Do you know the phenomenon of “rational inattention”?

Every day we are flooded with information and therefore focus our attention on the things that are relevant to us. In a speech to the European Parliament, Fabio Panetta, member of the ECB Executive Board, quoted this theory to open his plea for introducing the digital euro.

The digital euro would ensure that citizens continued to have secure access to central bank money. Unfortunately, only few citizens (and Members of Parliament) were able to name the difference between central bank money and private money as it did not make any difference to them at the moment.

What is money today?

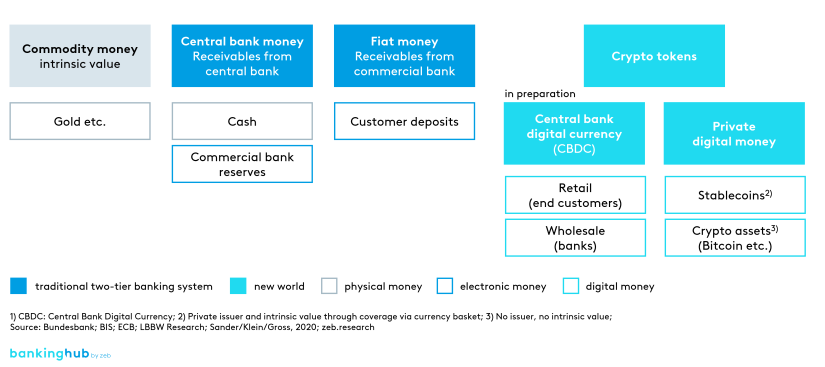

Central bank money is special: it is backed by the strength and credibility of the state and is considered the safest form of money. Unlike commodity money (e.g. gold), however, central bank money has no intrinsic value. This is to be distinguished from the variety of private money, such as fiat money (bank deposits, credit cards) in the conventional two-tier system of central bank and commercial banks, or modern cryptocurrencies such as Bitcoin and stablecoins.

Today’s fiat money also has no intrinsic value of its own: central and commercial banks create it from scratch. Cryptocurrencies, however, stick out: they are independent of central banks or issuers. Anyone can directly issue or receive cryptocurrencies at any place. Moreover, their quantity is limited, for example, in the case of Bitcoin. Stablecoins, such as Diem (Facebook), are covered by established hard currencies.

Central bank money is increasingly competing with private digital money (see figure 1). Central banks are catching up and responding by developing central bank digital currencies (CBDC).

What is a digital euro

This question can only be fully answered after the two-year investigation phase. However, the main features are already clear from previous ECB publications.

The ECB’s considerations to date can be summarized as the general idea of “digital cash”. In addition to physical cash and electronic fiat money, the ECB wants to introduce a digital euro with payment functions for everyday use via smartphone as central bank money.

For the banking industry, the most relevant question is whether it will remain a player in the system or whether the ECB prefers a direct model where the digital euro is directly accessible to end customers. The ECB prefers the two-tier system, i.e. end customers should generally have access via commercial banks only. This means, the ECB issues the digital euro and the holder of the digital euro has a payment claim against the ECB.

To replicate cash properties, the digital euro must meet the following requirements:

- Bearer instrument, i.e. possession authorizes transaction

- Without interest, i.e. means of payment and no investment

- Anonymous transaction, i.e. no traceability

The scope of application discussed is essentially limited to retail customers. According to the current state of consultation, this digital retail euro will fit into the existing payment transaction infrastructure. The ECB is responsible for the governance and control of the money circulation. Purist, fully decentralized distributed ledger technology (DLT) solutions are therefore not in the scope of the investigation.

Rather, the characteristics of a central digital euro system are:

- Centralized intermediaries (ECB, commercial banks) ensure integrity and security

- Preference for account- or identification-based access to the digital euro

(instead of token-based solutions) - Less functionality compared to a decentralized DLT solution

Banks will take over the operational management of the digital euro. A digital euro will be held in a type of wallet managed by banks. In order to ensure the monetary stability of the system and to be able to take precautions against a possible digital bank run, measures such as maximum amounts and, if necessary, withdrawal fees and interest income fees are being discussed.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What are the ECB’s objectives?

“Our work aims to ensure that in the digital age citizens and firms continue to have access to the safest form of money, central bank money.” This claim by Christine Lagarde demonstrates the ECB’s position. Cash, i.e. central bank money circulating among consumers, has become less significant over time. A trend that the coronavirus pandemic has even exacerbated.

The announcement of introducing digital versions of other currencies as well as the initiative surrounding Facebook’s Diem are also likely to have increased the pressure on the ECB to act. It therefore wants to position the digital euro as an addition to cash and offer another payment method for digital payments. Last but not least, it is also about controlling the currencies in circulation and thus about the ECB’s relevance as an institution.

What are the benefits of the digital euro? What is it ued for?

In the retail sector, the digital euro is often argued to be stable. In this context, stability means value stability (as an advantage compared to the often highly fluctuating cryptocurrencies) and thus stable payment processing. Further benefits might include the possibility of fast and cost-efficient international transactions as well as free real-time transactions or inexpensive small-volume transactions. What’s more, increased data security is also considered a benefit. Interestingly, a volume cap of EUR 3,000 is being discussed for wallets held by retail customers.

This leads to the question of the benefit of such an offer. Retail customers already have access to a wide range of payment options both online and offline that also offer the aforementioned advantages of a digital euro. They are relatively theft-proof (cash excluded) and stable in value. In our view, it is misleading to compare the digital euro with cryptocurrencies, which are generally not stable in value. After all, they are less a means of payment than an asset class. Our payment system as a whole is also very stable. Retail customers rarely have to pay for transactions, or only indirectly via account management fees. And there is no volume cap either (again, with the exception of cash).

It is not yet clear who can and may offer the wallets. This may be limited to commercial banks or made available to non-banks through a licensing process. The interest of a player, be it a commercial bank or another company, in offering wallets will heavily depend on the extent to which it can generate income. It is also unclear how the previous top dogs in digital payments, first and foremost MasterCard, Visa, PayPal, etc., will react.

Conclusion

The ECB wants to defend its position in the competition among different forms of money and has launched the digital euro project. At the current stage of discussion, there is no clear and precise answer to the question of the benefits for retail end users compared with existing electronic fiat money solutions. The offer could therefore fall victim to the “rational inattention” phenomenon among citizens described by Fabio Panetta.

On the other hand, the business community is calling for the digital blockchain euro for the industry 4.0. These are DLT-based solutions that enable transparent and secure automated payment transactions between machines in connection with smart contracts. Perhaps the ECB will have to go one step further.