What are stablecoins?

Stablecoins are DLT-based tokens whose value is pegged to other assets. Looking back, the launch of the crypto stablecoins Tether in 2014 and USDC in 2017 marked the beginning of stablecoins. At that time, crypto investors faced volatility in the market prices of their investments. In addition, there was no way to quickly and cheaply convert crypto assets into fiat currencies. Tether and USDC were the first more stable investment alternatives in the DLT ecosystem.

Stablecoins have received increased attention from financial institutions since 2019. The Libra project of the Meta Group, which aimed to establish a global payment system based on a USD stablecoin in competition with the existing financial system, was one of the main reasons for the change in attitude. Even though Libra’s stablecoin project was thwarted by regulations, it nevertheless demonstrated the disruptive nature of stablecoins.

Central banks then recognized the relevance of stablecoins. In 2023, more than 100 central bank initiatives piloted CBDCs.[1] Their strategies diverge significantly. The EU/ECB, for example, is pursuing a CBDC initiative to launch a digital euro for retail customers, and announced in January 2024 that it plans to commit more than EUR 1.1 billion to this initiative. Meanwhile, a Swiss National Bank project is prioritizing wholesale banking by targeting interbank transactions.

Stablecoins, deposit tokens, CBDCs – definitions and differentiation

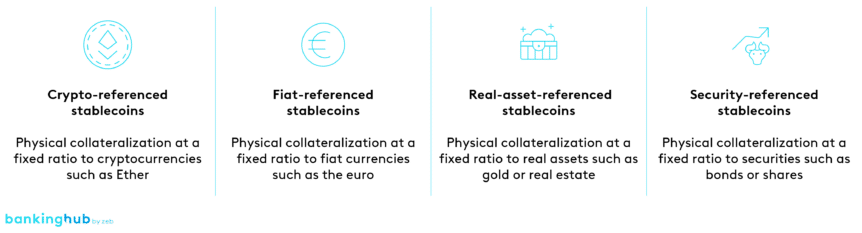

Basically, stablecoins can be differentiated based on the underlying asset.

As stablecoins are pegged to an underlying asset, they participate in the latter’s performance or stability. The collateralization of stablecoins need not be limited to physical assets; it can also be achieved algorithmically. Beyond the specified collateral amount, the type of underlying asset plays a pivotal role in the collateralization process. Crypto-backed stablecoins often demand a 100% collateralization level or more.

Algorithmically backed stablecoins employ mechanisms that automatically regulate their supply, for example by minting or burning the stablecoins based on target prices within the stablecoin protocol. In light of various scandals such as the Terra Luna crash in 2022, many countries have decided to play it safe and only accept physically backed stablecoins.

In addition to the underlying asset, stablecoins have the following characteristics:

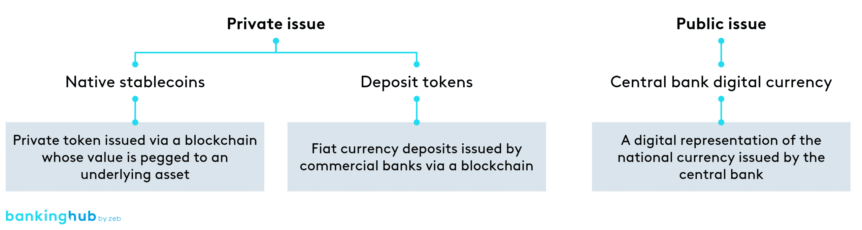

Both native stablecoins and deposit tokens emerge from private issuance. Native stablecoins such as Tether or USDC represent bearer bonds against their issuers. They are purchased on crypto exchanges, and a crypto asset or fiat currency is sold in return.

Deposit tokens represent a deposit claim against the issuing institution and are primarily intended as a means of payment (e.g. Swiss deposit tokens). Accordingly, they are settled through the commercial banks’ deposits with the central bank and are indirectly subject to the regulatory requirements for deposit money.

CBDCs are issued by the central banks and represent a deposit claim against the central bank. A distinction can be made between wholesale CBDCs for use by commercial banks and retail CBDCs open to all economic agents. However, not all central banks pursue the same scope, target group and purpose with their respective CBDC projects (see above, SNB vs. ECB).

In the case of CBDCs (e.g. the digital euro), the underlying technology can be built on existing payment systems. This has implications for the use cases of CBDCs: without DLT-based technology they do not offer the benefits of programmable money and cannot bridge the gap between decentralized finance and traditional finance. In the following, we take a closer look at DLT-based CBDCs.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Regulation of stablecoins in the EU and Switzerland

The global regulatory landscape for stablecoins and their issuers is dynamic. Increasingly, regulations governing the issuance, custody and administration of stablecoins are coming into effect.

Starting in 2025, stablecoins will be subject to uniform regulation within the European Union (EU) when MiCAR enters into force. MiCAR will impose new requirements for issuers of stablecoins. These relate to e-money tokens, which possess payment functionality and are pegged to fiat currencies. In addition, there are asset-referenced tokens that provide stability in relation to an underlying asset.[2] For these stablecoins, a liquidity reserve equivalent to the pegged asset value must be maintained at a 1:1 ratio. MiCAR explicitly prohibits algorithm-based stablecoins and any interest payments or comparable benefits originating therefrom.

In Switzerland, stablecoins have been subject to regulation through circulars since 2019. Aligned with Switzerland’s principles-based and technology-neutral regulatory approach, further reinforced by the DLT Act in 2021, the regulatory requirements for stablecoins are contingent upon their economic function and purpose. Depending on their specific characteristics, fiat-backed stablecoins can fall under the purview of the Banking Act, the Capital Investment Act or the Financial Infrastructure Act.

Unlike the EU, the Swiss Financial Market Supervisory Authority (FINMA) does not currently differentiate between token types. Instead, it applies the “same risk, same rules” principle. Notably, there is no categorical exclusion of certain stablecoin types, including algorithm-based variants, in Switzerland. The regulatory focus in Switzerland is on stablecoin legislation, under which FINMA plans to introduce a licensing framework for stablecoin issuers this year.

Use cases and value proposition

From zeb’s perspective, stablecoins hold significant relevance for the future. Five specific use cases illustrate their impact on services and financial institutions:

- Capital market: DLT-based cash leg processing via deposit tokens and CBDCs enables large banks with capital market business, brokers and exchanges to achieve real-time clearing and settlement with a minimal number of intermediaries involved. In the highly automated capital market business, smart contracts can leverage additional automation potential within DLT-based transaction processing.

- Crypto trading: Investors and asset managers actively utilize native stablecoins as a safe-haven asset for their crypto investments. Native stablecoins offer a cost-effective and efficient solution for hedging currency risk in foreign exchange markets.

- FX/Treasury: International corporations and financial institutions can swiftly provide real-time liquidity using these stablecoins, regardless of the country where liquidity is required. This streamlined process enhances transparency and accelerates trade transactions and payment flows.

- DeFi apps (dApps): The integration of native stablecoins into traditional financial systems enables fintech companies and neobanks to grant their customers easier access to decentralized finance (DeFi) services such as crypto staking or lending and to differentiate themselves from established financial institutions by offering innovative products.

- E-commerce: Financial institutions engaged in e-commerce payment processing have a unique opportunity to enhance transaction efficiency while reducing costs by leveraging deposit tokens and CBDCs. The versatility of programmable money allows its effective use for managing targeted and transparent customer rewards programs, for example.

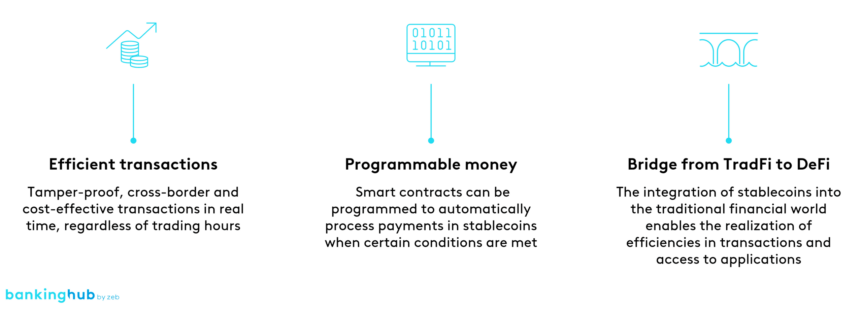

From the five use cases considered, the three value propositions shown in Figure 3 should be highlighted:

Reality check and outlook

Stablecoins have gained both in relevance and market capitalization over recent years. Progressive regulation is increasingly creating legal certainty and fostering trust within the DLT ecosystem, where stablecoins serve an ever more diverse array of use cases.

But what is the current status of the development of stablecoins? Due to the specific advantages of the different forms, each has its own use cases.

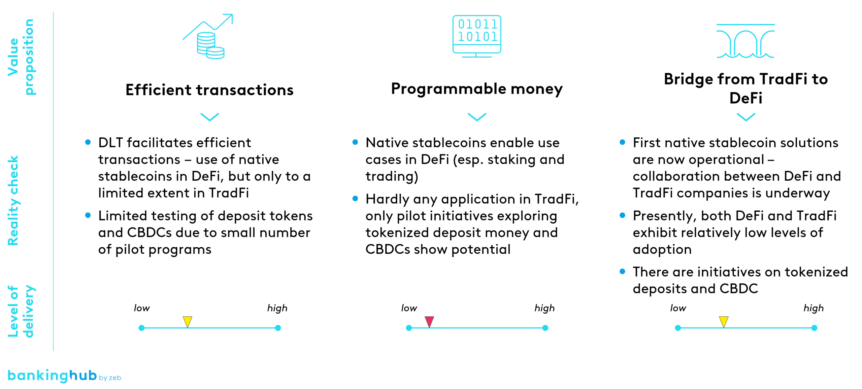

A reality check on stablecoins was conducted along the value proposition:

The reality check reveals that stablecoins do not quite live up to the value propositions described.

A survey conducted as part of zeb’s European DLT & Digital Assets Study 2024 indicates that only a select few financial institutions have currently initiated pilot projects and that a mere 11% of surveyed institutions in Europe actually intend to position themselves within the stablecoin landscape in the future. This cautious approach stems from the traditional division of roles between financial institutions and central banks. The prevailing assumption is that monetary policy and money creation will remain within the central banks’ purview.

While stablecoins are at the beginning of a long journey, they play an intrinsic role in the further development of the DLT ecosystem, particularly in the context of tokenized securities.

zeb anticipates that native stablecoins, deposit tokens and CBDCs will play an increasingly important role in the financial landscape and estimates that the market capitalization could reach up to EUR 800 billion in the EU and Switzerland. Achieving such a substantial figure necessitates the successful implementation of DLT-based CBDC projects, which hold the potential to revolutionize automation levels and redefine the mechanics of global payments in the near future.

The adoption curve for native stablecoins will continue to ascend rapidly. These digital currencies serve as essential building blocks for the establishment of tokenized securities within financial markets. Beyond their transactional utility, native stablecoins are increasingly sought after as a safe-haven asset to protect investors from the inflationary pressures of national currencies.

Financial institutions grapple with a critical question: How can they position themselves effectively today to navigate the future landscape of native stablecoins, deposit tokens and CBDCs? To address this challenge proactively, zeb recommends the following steps:

- Scenario development: developing scenarios that anticipate the future utilization of these digital assets and assessing the probabilities associated with each scenario

- Impact on the business model: analyzing how the developed scenarios will affect the existing business model across the entire value chain

- Prioritization of fields of action: deriving and prioritizing potential areas for action based on the impact analysis of the business model

- Operating model impact analysis: evaluating the impact on the existing operating model, taking into account compliance requirements and legal considerations

- IT systems gap analysis: identifying systemic adaptation requirements, with a specific focus on integrating and connecting DLT to the existing system landscape.