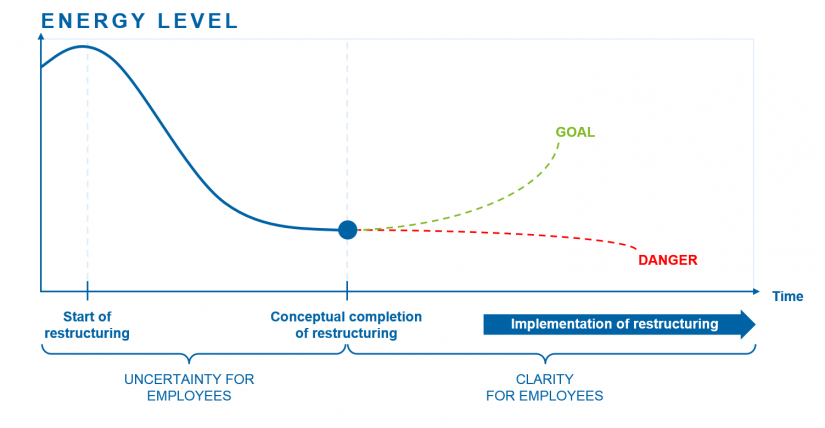

Development of the energy level of employees over the course of restructuring

During ongoing restructuring measures, banks’ market activities proportionally decrease. Employees are usually directly or indirectly involved in the measures, which means additional time invest. Yet, it is difficult for employees to estimate the medium-term and long-term consequences of these measures – uncertainty and a lack of confidence become part of their day-to-day work. The longer the phase of general and individual uncertainty, the more internal, personal topics dominate employees’ daily lives. Customer needs are no longer the sole focus of employee activities, but slowly and unconsciously recede out of focus; in combination with severe cost saving measures, the bank is literally paralyzed – customers rarely perceive any drive on the part of the bank to actively serve them.

In an ideal world, the management could limit the uncertainty factor during the concept stage of restructuring through targeted bilateral communication with important staff members. On the other hand, this model could be used in individual cases and on the other, confidentiality agreements with the works council that are in place for the duration of negotiations usually forbid this procedure.

Even after completion of the restructuring concept and the corresponding partial elimination of the uncertainty factor, there is still a danger that the employees’ energy level might drop even lower due to a lack of or unclear communication (see figure 1). Although the paralyzing uncertainty is no longer omnipresent, employees are still facing the strenuous task of implementing the measures that have been decided. If the bank loses touch with its customers during this stage, the result could be a permanent loss of income – the cost saving measures initially decided will then become insufficient. This could potentially be the beginning of a “shrinking-to-glory process” in which one cost measure follows the other until – to put it drastically – even the last customer has jumped ship.

Jointly initiating growth stimulating measures

In order to prevent the initiated restructuring measures from failing, it should be the bank’s primary goal to place the focus also on the customers, the market and thus on sufficient performance. To make sure that the turnaround toward a higher level of market activity can succeed, the bank has to restart initiating growth stimulating measures at an early stage and prevent remaining in restructuring stasis. In this context, sustained employee activation is crucial as soon as the restructuring concept has been completed.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Effective employee activation however goes beyond the traditional definition of change management which usually just puts the emphasis on the mere acceptance of the measures taken. By contrast, activation should be understood in the literal sense. Employees play an active part in fleshing out the growth measures. This does not only lead to commitment to the decisions taken and an enhanced feeling of being appreciated, but also to a positive get-up-and-go attitude in the entire organization in which employees do not “have to” implement things, but “want to” put things in motion.

It is not necessary to closely involve all employees of an organization along the way, as those employees who are involved can work as multipliers across all hierarchical levels of the organization. The management team is also of particular importance. Addressing employees with a united, positive and constructive attitude is indispensable in order to provide orientation towards a positive vision of the future and new structures. On the whole, by developing a growth strategy that is supported by all, the bank can once again focus on its successful future.

Using interactive formats for employee activation

If employee involvement and a focus on the customer perspective are regarded as required conditions, agile collaboration formats are particularly suitable. Small interdisciplinary teams work on specific issues directly from the customer’s perspective in short iterative slots. In the first instance, the aim is not to come up with a comprehensive in-depth concept, but to switch to the customer’s perspective in order to gain an understanding and develop growth stimulating measures. In this context, detailed interviews with selected “real-life” customers and employees from various hierarchical levels and areas can, for instance, form the basis for a series of workshops. As a result, transparency about the bank’s status quo is gained first hand and emphases for future strategic alignment are identified.

Interactive and agile implementation of the growth strategy

Although the joint development of the growth agenda has a positive impact on employee motivation and the bank’s energy level, it is important to ensure in an early implementation stage that the momentum that has been built up is maintained over a sustained period of time and ideally even increased. Therefore, sticking to the interactive and agile approach also during the development of the implementation concept is recommended. Specifically, this means that the fields of action that were iteratively developed should not be comprehensively bundled into one big growth agenda, detailed centrally and then rolled out across the entire organization, as is frequently the case. Instead, individual, concrete measures should be implemented within very short periods of time in the form of “speedboats”. This requires the initial limitation to a clearly defined application area and the willingness to start off with an “80 percent solution” which can be successively improved and expanded. On the whole, using an interactive and agile approach offers four major advantages:

- Celebrate small successes early on

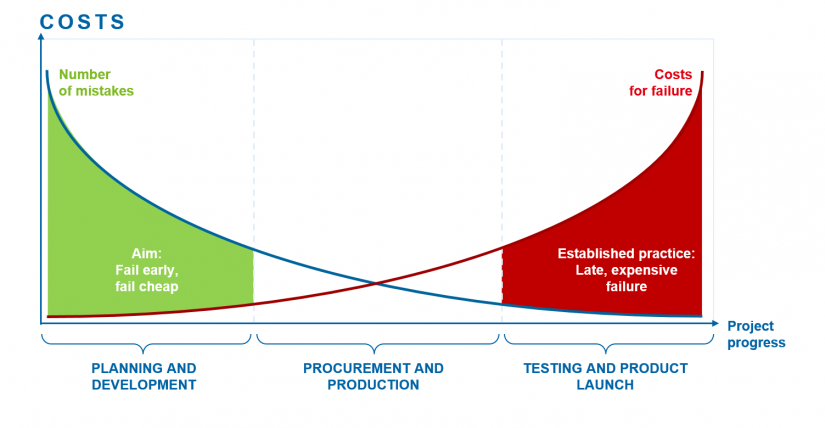

By necessity, small “speedboats” will lead to initial results after just a short period of time. If employees realize that the measures of the jointly developed growth agenda are starting to take effect, this creates an incentive to continue to engage with the evolution of the bank intensively and actively. Achieving short-term goals and acknowledging small improvements thus have a positive effect on the motivation of everybody involved that should not be underestimated. In addition, employees will identify closely with the measures they themselves have driven forward, which at the end of the day can also contribute to a renewed identification with the entire institution. - “Fail early, fail cheap

”Even if the dynamically developed “speedboats” do not prove successful, then from the bank’s perspective there is the chance to initiate suitable and affordable countermeasures at this relatively early stage of implementation (see figure 2).

Even abandoning entire bundles of measures in response to initial internal or external feedback seems bearable after just a few weeks as opposed to a failure after months of planning. The prerequisite for this however is the organization’s willingness to regard mistakes not as the failure of the employees involved, but as a “natural” result of the “speedboat approach” and to consciously accept it as such. - Customized use of available resources

Dividing a large growth agenda into small “bite-sized” pieces makes it possible to adapt the number of measures simultaneously worked on to the current energy level as well as the organization’s available resources – a fact that, especially against the background of the restructuring measures also being or about to be implemented, should not be underestimated. If the scope and number of measures to be implemented are systematically aligned with the bank’s available resources, both the overburdening of the organization and the overutilization of its employees can be prevented. - Involving the management

Some board members or executives regard the idea of agile and interdisciplinary ways of working as a chance to conveniently delegate large chunks of “work” and operational responsibility for measures and results to employees on lower hierarchical levels. While it is true that assigning tasks and team members taking on responsibilities is crucial for the success of the approach described above, the involvement of executives is a strong signal with great impact. Instead of staying out and “laying back”, the management team should participate in measures “on an equal footing” with employees and show engagement. The important thing is to set a good example—both in terms of accepting and implementing agile work approaches or in terms of the practical collaboration in projects and measures.

Ideally, by the interactive and agile implementation of a defined growth agenda, the bank will succeed in establishing a closed, self-reinforcing process which leads to a higher level of engagement, an increase in productivity and a growing number of implemented measures. The desired profitability boost will materialize and the turnaround will be jointly achieved – a success story.