Change management processes: where do the challenges lie?

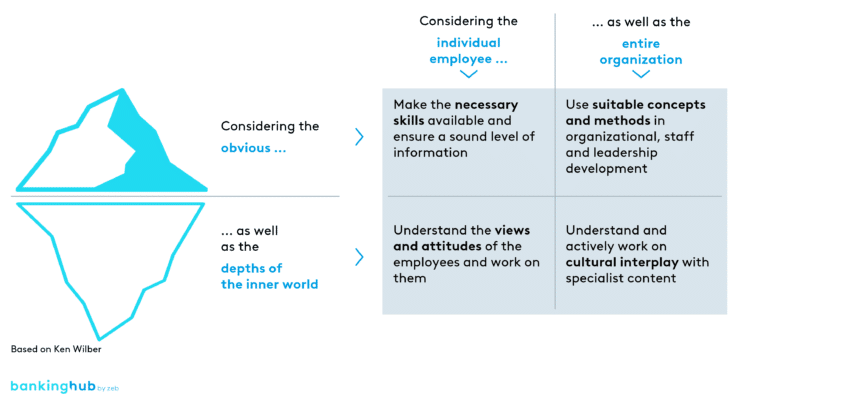

Financial institutions and insurance companies today face the challenge of adapting to a rapidly changing environment. It quickly becomes clear, however, that considering the technological perspective alone is not enough. The conversion of IT infrastructure leads to far-reaching changes in the operating model and in processes.

Lengthy transformation projects require intensive collaboration between specialist departments and IT employees. A purely technologically driven transformation without empowering the people involved will leave the organization overwhelmed. Therefore, holistic change management is indispensable.

The basic principle that everyone involved in the project is implicitly a change manager is crucial. The project stakeholders know the general conditions best and directly influence the perception of the IT transformation. Change management must therefore be integrated as a key element of the transformation in order to actively involve and support employees.

Change management: methods and phases

In organizations with little change and project experience, project staff are quickly overwhelmed by the demands of an IT transformation project. Time and quality are crucial for success; employees should therefore be brought on board and supported.

It is important to work on motivation, attitude and mindset in order to strengthen the sense of responsibility and achieve speed. The impact of IT projects on the organizational and operational structure must also be monitored. Change management helps to communicate into the organizational levels at an early stage and to operationalize the changes together with those affected.

Embedded change management

Impersonal communication can lead to resistance and negative messages on the office grapevine. Organizational units must therefore be informed and empowered separately.

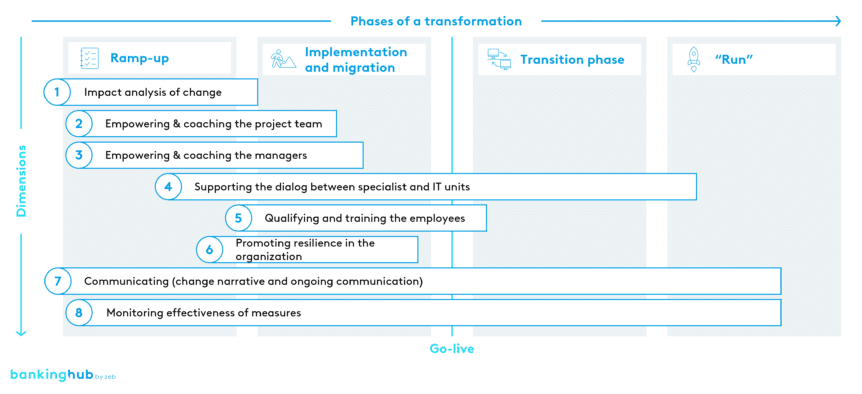

Accordingly, our zeb framework for embedded change management considers all relevant dimensions in the various phases of an IT transformation:

Conclusion on change management

Change management is absolutely indispensable for every IT transformation. It is a necessary component that makes a decisive contribution to success. Those responsible for transformation should therefore consider the required skills and their responsibilities at an early stage, even in the ramp-up phases.

Only by taking a holistic view and actively involving employees can insurance companies meet the challenges of IT transformation and make themselves fit for the future in the long term.