Real estate business: new focus area of special audits

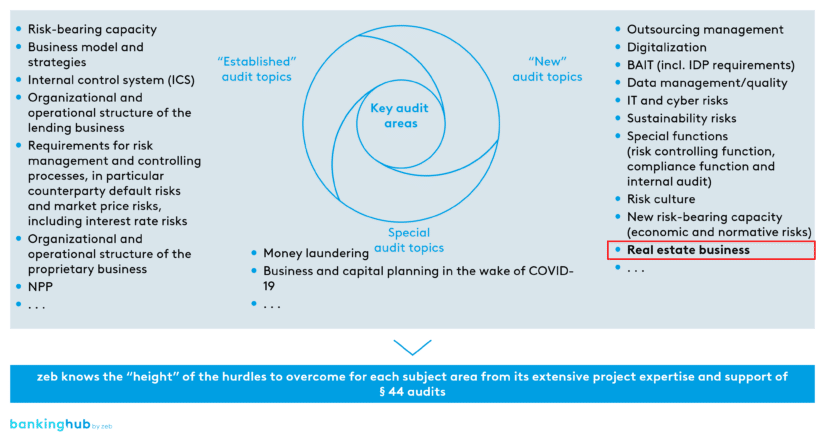

“Yet another § 44 focus review.” Comments along these lines were uttered quite frequently over the last few months. Since mid-2022, the supervisory authority has been establishing a new topic that had not previously been in the focus of regulatory audits. BaFin has been examining the real estate holdings of credit institutions for a year now and announced at the end of January 2023 that it would expand the audits – due to the findings obtained to date. zeb has supported a large number of institutions in preparing for, undergoing, or revising audits pursuant to Section 44 of the German Banking Act (KWG) and was thus able to gain some initial first-hand experience with the new “real estate business” audit type.

Less significant institutions (Less Significant Institutions – LSIs) usually undergo a special audit every eight to twelve years, as stipulated by Section 44 (1) of the KWG. In these audits, the banking supervisory authority reviews whether the institutions comply with the regulatory requirements. The audits may focus on various aspects. However, they are always based on the minimum requirements for risk management (MaRisk), so that typically the lending business and/or risk management in particular undergo extensive checks by the auditors.

The supervisory authority has now established real estate business as a further key audit area, although there are differences to its previous approach. Special audits are mandated by BaFin and generally conducted operationally by the Deutsche Bundesbank. BaFin derives the final result of the special audit from the Bundesbank’s report. In the context of the SREP, the results may affect the institution’s risk profile score and thus lead to capital surcharges.

As of today, BaFin has been conducting its audits of real estate holdings on its own. The audits are carried out by various BaFin units, including the savings banks and cooperative banks units as well as another unit specializing in accounting and valuation practices. Moreover, the “rule of thumb”, according to which a special audit is mandated every eight to twelve years, does not necessarily always apply – at least when it comes to real estate business. Initial experience shows that institutions which, for example, underwent a special audit of the credit and risk management areas at the beginning of 2022, had to undergo another special audit of their real estate holdings no later than in fall of the same year.

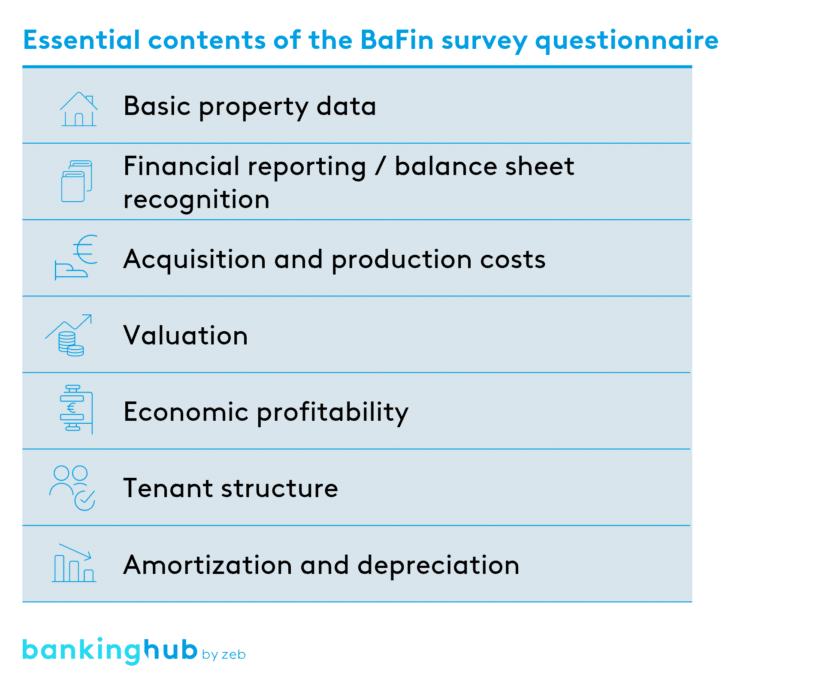

In April 2022, BaFin sent a questionnaire to selected institutions asking them to provide detailed information on their real estate holdings. The questions pertained to the following aspects regarding properties and buildings held by the institutions themselves or by their subsidiaries as of December 31, 2021:

After evaluating the feedback, BaFin made a risk-oriented selection of the institutions to be audited. One of the key selection criteria was the ratio of real estate held by an institution compared to its total capital resources. The first announcements of audits based on the April 2022 data collection were sent out as early as September 2022.

The audits covered the real estate held by the institutions as part of their proprietary investments with a particular focus on the following two aspects:

- Reviewing, from a supervisory perspective, the recognition and measurement of real estate held by the institution or recognized in the balance sheet of subsidiaries owned by the institution, taking into account its allocation to fixed or current assets.

- as well as any related processes.

Previous audits have not yet covered the new requirements for handling proprietary investments, which are currently still at the draft stage as part of the 7th MaRisk amendment. The survey of the underlying organizational principles was necessary for the assessment of the properties and was therefore examined in great detail by BaFin.

The first audits were part of a risk-oriented auditing campaign by BaFin, which was intended to give the supervisory authority an in-depth look into the real estate portfolios held by selected credit institutions, including a detailed review of their subsidiaries’ real estate portfolios as well as their recoverability.

As a result of these reviews, BaFin decided to intensify its examinations. It can be assumed that the new MaRisk requirements for the real estate business will be an integral part of future audits.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Changes in the 7th MaRisk amendment require extensive procedural, technical and organizational adjustments to the institutions’ real estate business

BaFin published the 7th MaRisk amendment for consultation in September 2023 and is currently working on the next stage in the further development of risk management requirements. For an overview of the many new features of the 7th amendment.

Previously, there was no regulations with regard to the real estate business, which led to uncertainties in supervisory and auditing practice. In addition, the importance of real estate holdings for institutions has increased – in some cases significantly – during the period of low interest rates. For this reason, BaFin introduced minimum requirements for the real estate business as part of the 7th MaRisk amendment.

Real estate transactions as defined in AT 2.3 para. 5 MaRisk are real estate transactions carried out by an institution for its own account with one of the following intentions:

- Acquisition or construction of real estate for the purpose of generating income through rental/leasing,

- Acquisition or construction of real estate for resale (e.g., real estate development)

- Existing real estate for the purpose of generating income through rental/leasing or resale

In addition to direct real estate transactions, real estate transactions conducted on the institution’s own account by the institution’s subsidiaries are also considered real estate transactions of the institution, provided that the subsidiary’s assets are derived exclusively or predominantly from real estate transactions or interests in real estate transactions. Real estate transactions which are predominantly used for the bank’s own business operations, or which are part of managed investment assets as defined by section 1(1) of the German Investment Code (KAGB) are not considered to be real estate transactions within the meaning of MaRisk.

Due to the low thresholds set by the supervisory authority, most institutions fall within the scope of the new requirements. They are obliged to implement the new requirements, unless the investment volume of all their real estate transactions exceeds neither EUR 30 million nor 2% of their total assets – this, however, applies to rather few institutions.

The newly imposed procedural requirements are largely identical to those of the lending business, including, for example, a strict separation of functions, economic risk analyses and assessments prior to the acquisition or construction of real estate, a value review at least once a year or on an ad hoc basis, and integration into the risk management process (including monitoring and reporting). This will entail significant adjustments of the current practice.

Conclusion: BaFin turns up the heat with special audits and new requirements

BaFin is taking account of the rapidly growing importance of real estate business holdings and is examining whether this could give rise to stability risks for the institutions. On this basis, it has already carried out initial special audits. In 2023, the audit activities will be continued – and intensified – as indicated by BaFin’s findings so far. At the same time, BaFin has regulated the real estate business with the 7th MaRisk amendment and introduced new procedural requirements. The supervisory authority expects these to be implemented by January 1, 2024, at the latest. In view of the expected effort and the tight implementation deadlines as well as BaFin’s current focus on the real estate business, all institutions that haven’t started an adequate and consistent implementation project yet, are well-advised to do so as soon as possible.

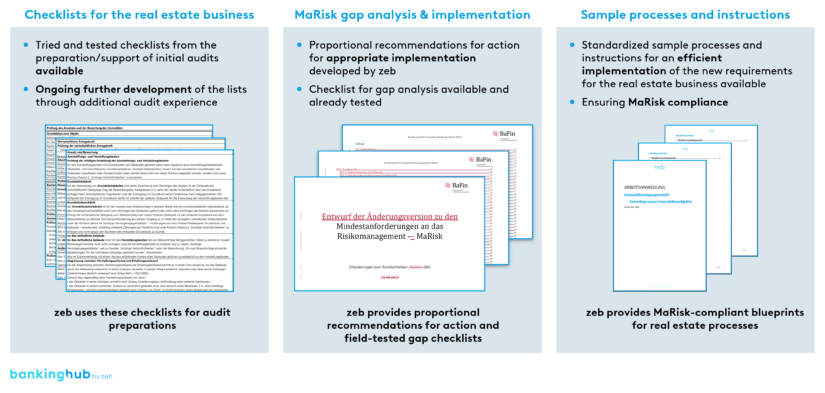

To support the implementation process in regional banks, zeb has prepared a set of tried and tested documents – including, among other things, checklists, a MaRisk gap analysis, sample processes and instructions (see Fig. 3).