Why is a compliance maturity assessment (CMA) worthwhile?

A CMA enables an organization to evaluate the effectiveness and maturity of its compliance scheme with respect to regulatory requirements, industry-specific standards and internal policies as well as its overall strategic direction.

By highlighting strengths and weaknesses, opportunities for improvement are identified. The CMA explains how banks can develop sustainable business models with a sophisticated compliance framework.

More than just regulations – beyond regulatory requirements?

Banks face a multitude of regulatory requirements such as MiFID II, Basel IV and ESG reporting. However, compliance should be seen not only as a cost factor and an operational hurdle, but also as a strategic lever to mitigate risk and increase efficiency. Sophisticated compliance management can …

- … mitigate operational and reputational risks arising from existing or potential conduct, thereby preventing loss of customer trust and strengthening customer confidence.

- … optimize processes, such as business or internal control processes, to integrate regulatory requirements into the existing or desired business model in an efficient and cost-effective manner.

- … create competitive advantages by emphasizing the effectiveness of compliance in the external image and using it as a quality feature when addressing customers.

What does an E2E view – a holistic perspective – of compliance look like?

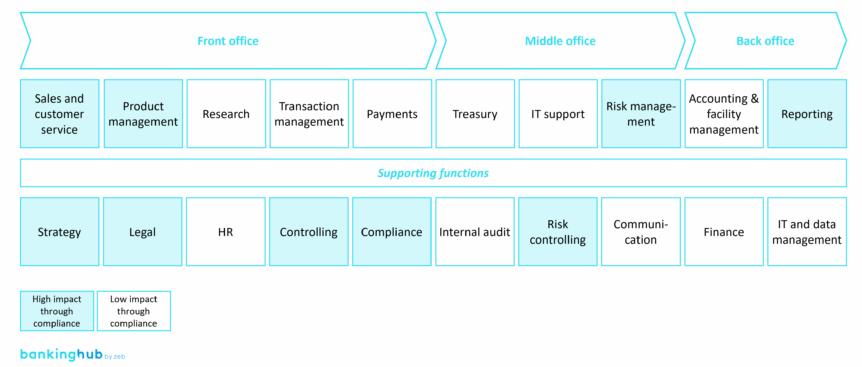

An end-to-end (E2E) approach ensures that compliance is not viewed in isolation but is integrated along the entire value chain. Within the value chain, there is a varying impact of compliance. Figure 1 shows in which parts of the value chain compliance can have a particular impact.

- Product management: early consideration of regulatory requirements prevents higher adjustment costs later on.

- Risk management: collaboration with the compliance department and a consistent and coordinated risk assessment increase the efficiency of (non-financial risk) management.

- Sales and customer service: transparent and compliant advice builds trust and reduces liability risks.

- Reporting: automated, well-designed and continuously improved compliance processes increase the accuracy and efficiency of reporting and controlling.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Compliance maturity assessment – where does the bank stand?

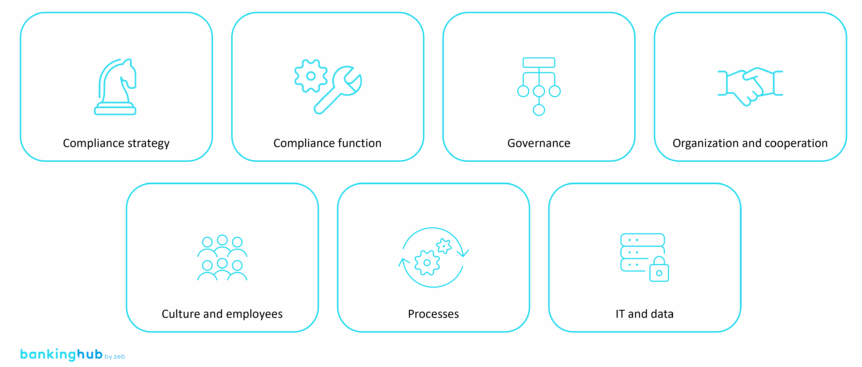

The CMA helps banks to assess their current level of maturity in various dimensions and to improve it in a targeted manner. Key dimensions include, for example:

- Governance and organization: management, the board of directors and executives are not only responsible for implementing the compliance program but must also set an example (tone from the top).

- Processes and controls: a general assessment of the processes and controls in place to detect misconduct is part of every CMA.

- Data management and reporting: a standardized bank-wide data structure, which ensures data quality and data security, is a key element of compliance and contributes significantly to efficient and transparent reporting.

- Technology and digitalization: a digital compliance road map, including the use of automated processes and AI, is an important part of using innovative technology.

All seven dimensions of a zeb CMA – in addition to those explained above – are depicted in Figure 2.

A structured assessment enables banks to derive targeted measures to eliminate weaknesses and anchor compliance more firmly in their corporate strategy.

How do good market insights contribute to more effective compliance management?

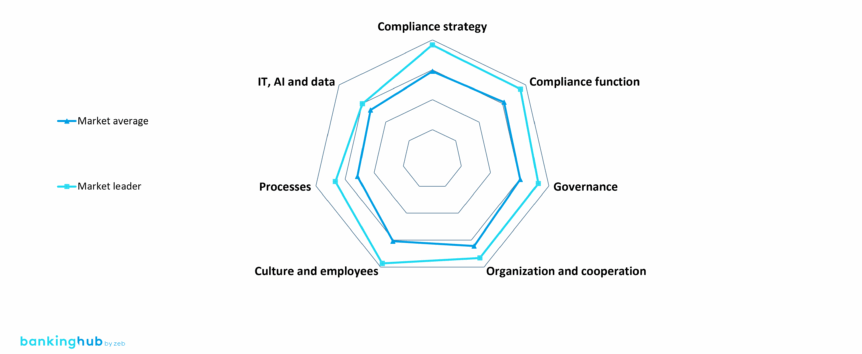

Effective compliance management requires continuous further development in line with regulatory requirements and best practices from market leaders to stand out from the market average (see Figure 3 ). Organizations are increasingly focusing on further automating compliance processes to reduce manual workflows and become more efficient. The use of AI is becoming increasingly important in AML monitoring, for example to optimize behavior-based detection models and minimize false positives.

At the same time, real-time monitoring of regulatory requirements is essential to respond quickly to new regulations. Additionally, better integrating compliance into first-line processes is a priority to ensure that business decisions are compliant from the start and risks are mitigated promptly.

With the expansion of compliance frameworks for cross-border activities, banks also need to efficiently manage country-specific regulatory differences. Closer collaboration with regulators is also required to proactively respond to new regulatory developments.

Ultimately, sustainable investments in compliance resources remain a key success factor to continuously strengthen technological, personnel and analytical skills and to keep pace in a competitive market environment.

What foundation does the CMA lay for a sustainable business model?

The CMA provides essential transparency about the current maturity level and pinpoints specific areas for improvement. This establishes the groundwork for modern compliance management, which not only meets regulatory requirements but also actively enhances the bank’s value creation.

- Efficiency gains through automation: reducing manual inspection processes with AI-supported compliance monitoring

- Increased customer loyalty: building trust through transparent and comprehensible processes

- Strategic differentiation: leveraging sustainability compliance (ESG) as a selling point

- Common goals and awareness: understanding compliance as a success factor rather than an obstacle

- Proactive compliance strategy: integrating compliance into business decisions

- Data-driven compliance: leveraging AI, golden source data pools and automation to boost efficiency

Why is it important to consider compliance strategically as a whole?

Banks must view compliance as an integral part of their business strategy. A structured compliance maturity assessment provides an opportunity to meet regulatory requirements more efficiently, minimize operational risks and leverage strategic potential.

- Automated digital compliance solutions can significantly increase the efficiency of processes and controls when used thoughtfully and in the appropriate context.

- With respect to the AI topics relevant to compliance, it will be worthwhile to integrate them more closely into the overall business strategy.

- A practiced compliance culture should go beyond the regulatory requirements themselves and consistently monitor their impact on business strategy implementation. The continuous development of such a compliance culture becomes at least an indirect competitive advantage for any bank that is positioned in this way, as it actively supports business decisions.

Achieving a high level of compliance maturity not only means greater security for banks but also long-term business success. Banks who pursue a strategic approach to compliance ensure their future viability.