On March 19, 2015, the European Banking Authority (EBA) published a consultation paper on the “Guideline on limits on exposures to shadow banking entities which carry out banking activities outside a regulated framework”. Hereby EBA is progressing with its mandate specified in Art. 395 para. 2 CRR to “set appropriate aggregate limits to such exposures or tighter individual limits on exposures to shadow banking entities”.

The guideline aims at limiting exposures to shadow banks to avoid concentration risks.

The definition of “shadow banking entity” is not based on a legal definition, therefore, in its draft directive, EBA defines them as all entities which carry out bank-like activities involving maturity transformation, liquidity transformation, leverage, credit risk transfer or similar activities or those firms that are neither directly or indirectly subject to EU (or recognized third country) supervision or are exempt from supervision as defined in Art. 2 para. 5 CRD IV.

Basically, all exposures to shadow banks that exceed 0.25% of eligible capital have to be considered in limitation, similarly to the specifications in the Delegated Regulation 1187/2014. The requirements of Art. 392 CRR, according to which all exposures to a client or a group of connected clients that exceed 10% of eligible capital shall be considered as large exposures, and the large exposure limits laid down in Art. 395 CRR additionally apply. In its guideline, EBA proposes two different approaches for institutions to set appropriate limits particularly for exposures to shadow banks as part of their daily large exposure monitoring:

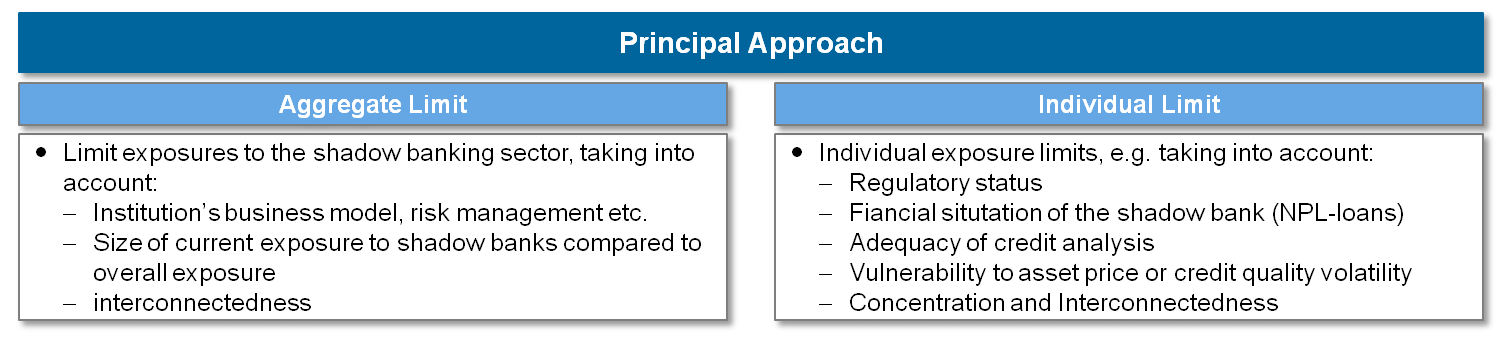

Principal approach

According to this approach, institutions set up and monitor either aggregate limits for aggregate exposures to shadow banks or, alternatively, individual limits for each individual borrower who has been identified as a shadow bank. To be able to apply this approach, information regarding the business model or the interconnectedness of entities, among others, have to be available.

The Principal approach requires the collection of quantitative as well as qualitative information on related activities and this information to be updated regularly. As a prerequisite, institutions have to develop appropriate processes and methods to identify the corresponding counterparties and transactions.

Fallback approach

Institutions that are not able to collect adequate information and thus to set up individual or aggregate limits can use the Fallback approach to aggregate all exposures to shadow banks and introduce an aggregate limit of 25% of eligible capital. In this case, institutions are still obliged to identify counterparties and transactions, but not to the same extent as with the Principal approach. In the Fallback approach, aggregating claims and treating them as exposures is similar to the procedure for “unknown clients”.

It is generally assumed that institutions hold sufficient information on clients and are able to identify corresponding exposures. In practice, large part of the relevant information turns out to be of qualitative value and also entails high (manual) efforts for collection and update.

Data collection by the EBA

To be able to better assess the basic necessity and effects of the described limits, the EBA has set up a data collection process for exposures to shadow banks in May 2015. Data collection performed at random by selected institutions and had to be submitted to the national supervisory authorities by July 22. The sample included large banks as well as so-called “Group 2” banks due to their different business models.

The data collection consisted of 2 tables. In the first table, institutions had to enter data on clients, exposure values and eligible collaterals as well as exemptions from the large exposure limit for each borrower as defined by the LE1 and LE2 templates. This data is complemented by information on company type, consolidated supervision and the legal basis for exemptions from the large exposure limit. Entities that are subject to consolidated supervision pursuant to CRR were exempted in the consultation paper, but not from the data collection.

In the second table, institutions were requested to provide data, if available, on average risk weighting and the profitability of the identified exposures to shadow banks. This information should be divided by the clients’ main activities, where possible.

This data collection represents a considerable challenge for the institutions involved, since the previous large exposure reporting did not require such detailed information on the client’s business activities and consolidated group. Banks might therefore face problems with the current data base when trying to derive data regarding the client’s business activities, divided by fund types, financial undertakings, broker-dealer companies, credit insurers, securitizations or banks/insurance companies in third countries.

Outlook

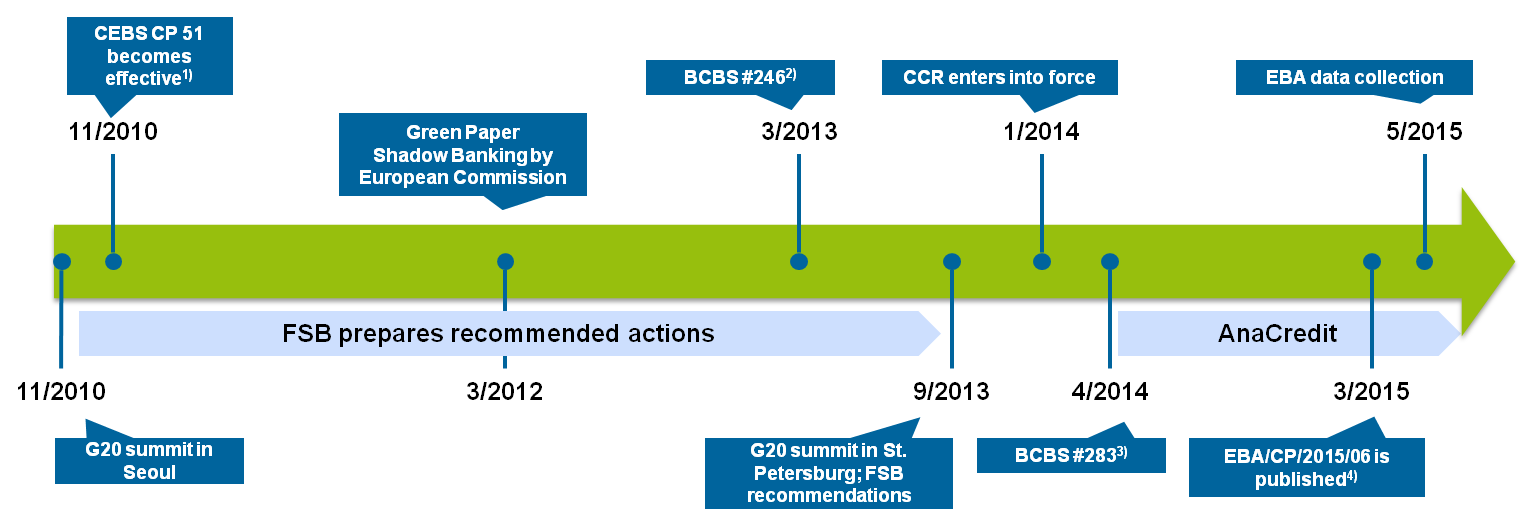

The latest consultation on identifying concentration risks towards shadow banks should not be regarded in isolation, but in the context of the various regulatory initiatives for limiting concentration risks and the efforts for protecting the financial system from the shadow banks’ risks.

To avoid concentration risks, the FSB’s post-financial-crisis efforts to regulate shadow banks more strictly have been complemented by the efforts of the Committee of European Banking Supervisors (CEBS)— predecessor of the EBA—as part of CP 51 and the European Commission’s regulations CRD II and CRR for harmonizing the requirements. In addition, the Basel Committee set up supervisory framework for measuring and controlling large exposures in 2014, which is currently waiting to be translated into EU law. This framework describes changes in determining eligible capital for large exposures and in recognizing selected risk positions (e.g. covered bonds, off-balance sheet items, derivatives) as well as a tighter limit for large exposures among G-SIBs and a possible limitation of exposures to central counterparties.

Recommended actions

To date, an exact timeline for the entry into force of the guidelines or, if available, of other limits for exposures to shadow banks has not been defined. Art 395 para. 2 CRR only indicates that “by 31 December 2015, the Commission shall assess the appropriateness and the impact of imposing limits on exposures to shadow banking entities”. Nevertheless, institutions should soon implement a regulated process to have the data required for identifying relevant exposures on hand. The experiences made during data collection may be helpful to identify and close data supply gaps as early as possible. This process should ensure timely availability of data and at the same time feature an efficient design, e.g. by setting up a data base that contains, at least, those clients that have already been identified as shadow banks together with related information. It may also be useful to introduce a separate business and client level flagging in the reporting systems to reduce manual interventions and evaluations to a minimum.

Finally it may be stated, that large exposure reporting as such exhibits a high stability and that no fundamental changes are currently expected to emerge. However, the above-mentioned global initiatives make clear that institutions will also be compelled to make adjustments in the future. Since the effects on institutions differ based on the applied business model, we recommend to analyze the expected changes and impact early on.