Establishment of a new standard

In 2014, the ECB in cooperation with the EBA conducted an EU-wide stress test at about 130 financial institutions. This test was part of the “comprehensive assessment” and directly followed the “asset quality review”. Even at that time, the intended purpose was to generate insights that could be used in SREP (Supervisory Review and Evaluation Process). It was also possible for authorities to prescribe capital add-ons based directly on the stress test results.

In July 2015, the EBA announced that it would conduct a new stress test following a similar methodology in 2016. The objective of this current stress test was to achieve an even closer integration with SREP and to move the issue of bank-specific individual capital requirements completely into SREP. The EBA stress test initially focused directly on the significant financial institutions in the sense of the Single Supervisory Mechanism (SSM) mentioned in the EBA sample list.[1] For the significant financial institutions not on the EBA sample list however, the ECB conducted a so-called SSM SREP stress test which essentially uses the same methodology including the spreadsheet templates. Thus, a consistent treatment of all SSM institutions in SREP was ensured.

With the EBA / SREP stress test, the ECB now has an established instrument that feeds into SREP and which the ECB can use to fulfill its duty laid down explicitly by the SSM to review relevant financial institutions by means of stress testing. Therefore, it has to be assumed that the 2016 run will not be the last and that the EBA stress test is developing into a fixture of regulatory review.

The EBA stress test is methodologically sophisticated, places high demands on data availability and reconciliation, is conducted under tight time constraints, ties down important expert resources and, at the end of the day, impacts the regulatory capital requirements.

Thus, every bank will have to find an answer to the following question: How can we adequately prepare for the next stress test—are we stress test ready?

Anticipating stress test requirements

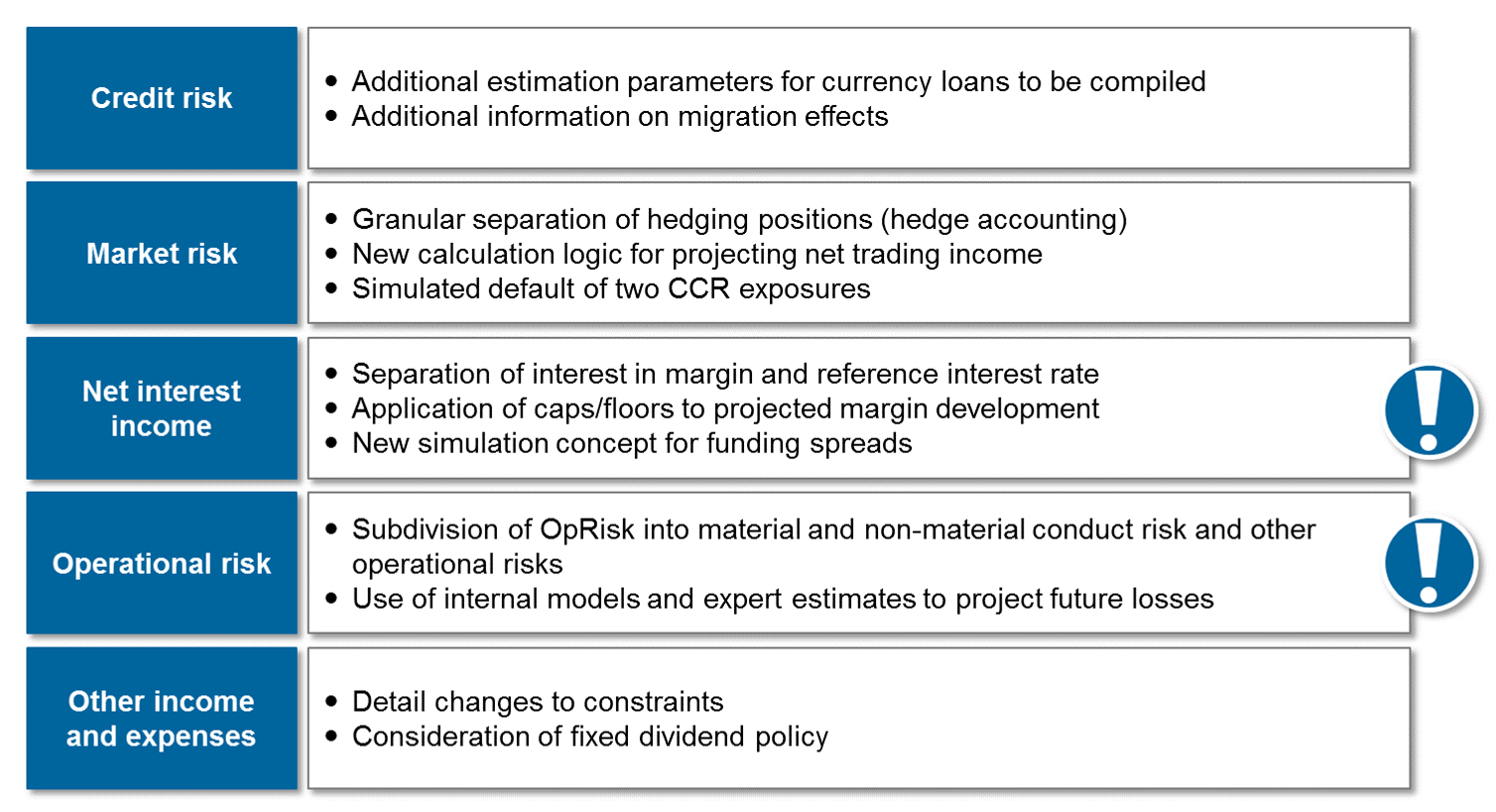

Compared to 2014, numerous methodological changes were introduced for the 2016 stress test[2], although the basic logic of the procedure remained in place. The target parameter is still the regulatory capital ratio (current focus on CET1 ratio) which is indirectly impacted by a macroeconomic shock via RWA and income effects. In this context, the following risk and income types are differentiated:

- Credit risk (impact on RWA and P&L)

- Market risk (impact on P&L)

- Operational risks incl. conduct risks (actual impact only on P&L)

- Net interest income (impact on P&L)

- Other income and expenses as well as changes in equity (impact on P&L or directly on equity)

Figure 1 lists some of the important methodological changes in the 2016 stress test. In this context, two changes are particularly noteworthy: Firstly, the most complex template of the stress test in 2014—the template for net interest income (NII)—is now even more detailed. A major effort driver was the requirement to split the interest rates of all positions into margin and reference interest rate. Secondly, the operational risk—so far treated as more of a formality—was divided into conduct risks and other operational risks and given a stronger methodological foundation. Amounts of loss had to be projected based on internal models and expert estimates. As a consequence, the number of subject-matter experts involved in the stress test as well as the volume of basic data will have increased in most banks.

It can be expected that details of the methodology will also change in future; in zeb’s view however, there are good reasons why the main methodological cornerstones and effort drivers should remain constant:

- In order to provide meaningful results for SREP module 3 “assessment of risks to capital”, the stress test will continue to focus on the regulatory capital ratio as a target parameter. This means that the periodic, IFRS-based calculation logic will remain in place also in the future and that the templates will be closely aligned with FinRep/CoRep.

- Considering SREP module 2 “Governance and risk management assessment” it can be assumed that the stress test will have to be conducted under considerable time pressure also in future and that a wide range of risk types will have to be taken into account. This would at least be in alignment with the direction of other regulatory initiatives, such as BCBS #239, which put the focus on the reconciliation of key figures as well as the short-term reporting and analyzing ability.

- For the supervisory authority as well, the stress test represents a considerable burden in terms of resources and a huge requirement with regard to data availability. To safeguard the efficiency of the entire process it is therefore to be expected that the basic template structure, the interdependency between the various types of risk and result tables reflected in it as well as the major target parameters will not change significantly. Of course, this also applies to the superordinate setting of multiple-period stress with baseline and adverse scenario. A high methodological consistency over time would also have the advantage that the supervisory authority could fall back not just on peer groups, but also on historical result parameters for its benchmarking analyses.

Even if details of methodological changes and future focal points of stress tests cannot be anticipated, it still becomes obvious that core challenges will remain. These include the ability to transfer figures from regulatory reporting, risk controlling, treasury and other functional areas. Tight deadlines, but also methodological aspects such as dependencies between calculation steps (e.g. NII requires information on defaulted exposures that result from the credit risk models) will lead to time pressure. The burden on resources will be correspondingly high during the acute stress test phase and, if required, measures for quality assurance and internal documentation will have to be postponed in favor of punctual deliveries. At the same time, the supervisory authority will expect a learning effect from institutions, also with regard to quality, which means that the pressure will increase even further.

Establishing stress test readiness means identifying and addressing fields of action

After the current stress test, it would be highly advisable to take stock. In the sense of “lessons learned”, this should include the identification of technical, process-related, methodological and organizational potentials for improvement. In many cases it will be possible to implement the measures derived from this even before the announcement of a new stress test as they address the above-mentioned long-term challenges of the stress test. As a constraint, during the conceptual design of solutions, flexibility or extendability should be taken into account and a fixed alignment with the current template structure should be avoided.

Potential technical / process-related fields of action:

- The templates that require the most effort relate to credit risk and NII. As there is a dependency in terms of content, a “clean” technical implementation of the reconciliation logic is particularly urgent. As a rule, two disparate system landscapes have to be interlinked. Typically the key challenge will be to represent drill-downs in CoRep/FinRep logic also in interest rate risk controlling. A corresponding conceptual design requires a lot of effort and should be engaged in at an early stage.

- To generate results, stress test-specific methods, internal models, data queries and the given template logic must be aligned. This constellation offers plenty of opportunity for system disruptions with corresponding risks to result quality and the traceability of the results. For instance in credit risk, satellite models for the influence of macroeconomic parameters on point-in-time PDs and LGDs must be estimated. These results must be transferred to the corresponding regulatory credit risk parameters. Based on this, stress scenarios can be simulated. Then the results can be transferred to the templates and default information can be delivered to NII.

- The complexity of the simulation requirements regarding net interest income exceeds the functional scope of a lot of common management / modeling software. Therefore it is recommended to implement lessons learned from previous stress tests at an early stage and to expand the functions of the relevant systems or—often the cheaper alternative—to purchase an appropriate solution. In its minimum scope, such software offers the possibility to create market scenarios for interest rates (separated into margin and reference rate), funding spreads and credit spreads as well as exchange rates. In addition, it should be possible to create reports for various portfolio structures and various views (e.g. new business volume, separation according to currencies). Another important requirement is the creation of alternative developments for loss ratios and their integration into the interest income simulation. With adequate software support, EBA/ECB reports can be created in a standardized manner and comprehensive analysis functions regarding risk drivers of interest income can be used.

Potential organizational / methodological fields of action:

- In principle, many activities can be started before the ECB and EBA give the official go. For instance, the estimation of the satellite models and the provision of historical data for the advance data collection can be started as soon as the balance sheet data / reporting data for the previous year-end are available. At this point, a draft of the future stress test methodology should also be available so that it can be evaluated what advance activities might be worthwhile.

- In this context, it can be useful to have a process model or a project plan already at hand. Depending on new methodological drafts and other announcements made by the supervisory authority, the plan can be detailed further. Relevant human and technical resource requirements and possible resource bottlenecks can thus be identified early on.

- Apart from publications directly relating to stress testing, additional regulatory changes with indirect impact on methodology should be monitored. For instance, it can be assumed that changes to existing FinRep and CoRep reports will be reflected in correspondingly adjusted templates.

- Overall, a mechanism should be found which makes sure that stress test preparation responds not just to regulatory changes, but also to IT-related changes. Interdependencies with other IT implementation projects, e.g. in the context of BCBS #239, must also be considered. For this purpose, a central responsible person could be named and escalation/information processes could be defined or regular informatory meetings of relevant stakeholders could be organized.

The improvement measures mentioned lead to higher quality results as process steps can be automated and tested. Correspondingly, the burden on resources is alleviated and more room for quality assurance is created. In particular, the capacity load during the acute stress test phase can be lightened. The costs for implementing measures are thus directly offset by future savings in internal and external resources. Indirectly, there is of course also a chance to score positive points for SREP by performing well in the stress test and to qualify for a reduced capital add-on.

Conclusion—taking the stress out of the stress test

In future, the EBA/SREP stress test will be repeated on a regular basis in similar form. Although adjustments to the methodology and changes in emphasis are likely, fundamental “building blocks” of the stress test will remain the same. Technical and organizational measures which significantly strengthen stress test readiness can be derived from the experiences made in 2014 and 2016. In this context, stress test readiness should be seen as a continuous process; measures can and should be taken at an early stage and not be driven by regulatory deadlines. Structured stock-taking, an internal and external exchange of experiences and a determined implementation of stress test readiness offers enormous potential: Standardization and automation can help reduce costs in the medium term and the improved performance / higher data quality will have a positive impact on possible capital add-ons. Most of all, capacity bottlenecks during the stress test process can be reduced and resources saved—taking the stress out of the stress test.

[1] Details can be found in the EBA Methodological Note (2016 EU‐WIDE STRESS TEST – METHODOLOGICAL NOTE) and the ECB Guidance (2016 Supervisory Review and Evaluation Process, ECB guidance on stress testing for banks).

[2] See Annex I of the EBA Methodological Note (2016 EU‐WIDE STRESS TEST – METHODOLOGICAL NOTE)