Security, trust and pricing ahead of design in banking

In the entertainment and car industry or even in the production of intangible goods (e.g. streaming services), design has long been an integral part of the product itself.

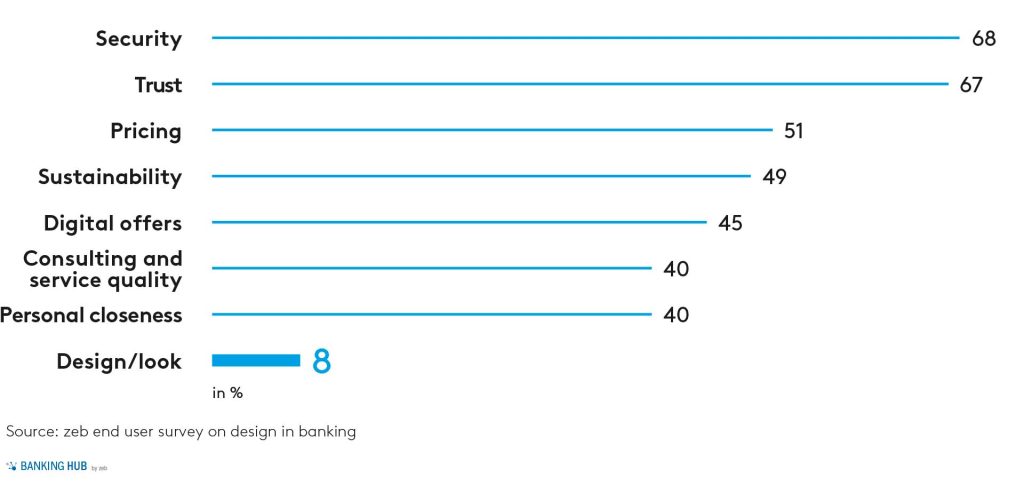

But is this also a success factor for traditional players in the financial sector? By comparison with other industries, the design of solutions or services still appears to play a secondary role here. Just think of the look of some online banking solutions, of the tedious onboarding process of opening an account or the design of the documents that come with it. This impression is confirmed by a representative zeb survey among end customers: from their point of view, design seems to play a comparatively minor role in finance. Aspects such as security, trust or pricing are rated as much more relevant by end customers.

Is design a unique selling point that has not yet been exploited?

In terms of banks’ design, is everything hunky-dory? Not at all – our survey also revealed: every fifth respondent stated that it is very or rather likely that they would change their bank due to considerations of design. Since there were roughly 110 million current accounts in Germany at the end of 2020[1], we are talking about a whopping 22 million bank accounts. In light of these facts, can banks still afford to ignore design issues?

The aspects that are important for customers in choosing a bank, i.e. trust, security and pricing, only provide little scope for differentiation from the competition. Moreover, their potential for optimization has largely been exhausted.

Design, however, offers a vast area of action for banks. It involves aesthetic aspects such as the design of the logo, of credit or debit cards and of the branch. Aside from these examples, it also encompasses the user experience of processes and personal interaction, the function of products and services. It is, therefore, probably only a matter of time before greater importance will be attached to design issues.

In addition, the target group is changing: for digital natives, physical touchpoints are less and less important; instead, good user navigation and interface design, shaped by influencers such as Apple and Google, are expected of all products. The design of credit cards or branches is becoming increasingly irrelevant for this (still) young target group as they prefer to pay with their smartphones or wearables.

Are banks responding to significant changes in customer needs?

The often cited customer needs have changed significantly over the last decade. Customers already appreciate real-time tracking of parcel deliveries or attach importance to aesthetically appealing and multi-functional smartphones. Their purchasing decisions are determined by the look and feel of products.

This raises questions such as whether established requirements from other industries will become compelling for banks in general – and if so, when? And how can banks benefit from a consistent design approach?

Ensuring future viability by means of design?

How can the discrepancy in customer perception be explained, and how does “good design” help create a distinctive feature in the financial services sector? The vague definition of design which leaves much room for interpretation, the lack of responsibility for design issues at management level and the focus on functions and high-performance systems in banking demonstrate the potential that design offers. Management teams should realize that design issues are not mere cost factors, but serve as an investment and as a driving force for economic growth, added value and innovation.

Our project experience shows five key success factors for optimizing design perception within banks:

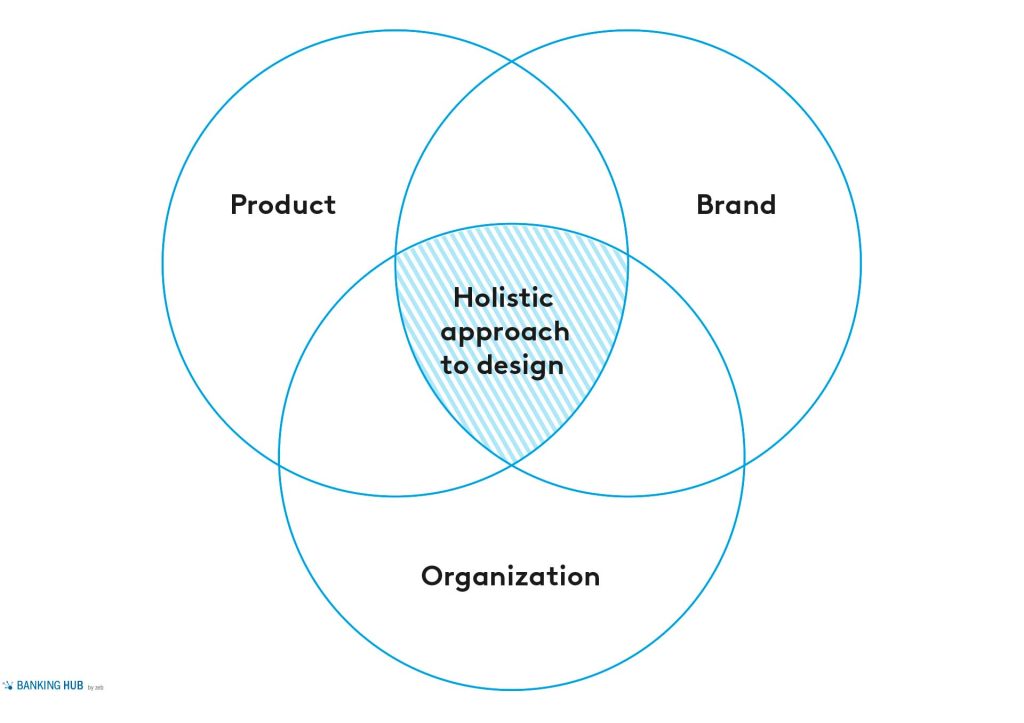

1. Take a holistic approach to design

Design must always be viewed holistically to create both a consistent brand identity and customer experience. A holistic approach to design therefore requires that a bank thinks far beyond the actual design project and synchronizes all business processes. To ensure a holistic user experience along the entire customer journey, a nice-looking user interface is not enough. What is needed is a holistic mindset. When we think design holistically, we understand the value that design has in its entirety.

A holistic design approach is a lengthy process that not only requires financial resources, but also time and the willingness to change business processes and even the corporate culture. Additionally, interdisciplinary know-how and a good understanding of the company, the brand world, the employees, products/services, the target market and business model are crucial.

2. Product design as a key element of the brand experience

What makes products successful today and what distinguishes physical from digital products? In the car industry, for instance, the development of physical products is an extremely complex topic that can consume vast amounts of resources. One example is the attention which is paid to detail in design elements. These are not only essential for the overall appearance of the (car) brand, but in many cases also have a specific function desired by users. Such an investment on the part of the company does not go unrewarded – car manufacturers have long realized that a brand experience always depends on the products and their actual characteristics. If a product has a wow effect, this user experience is a tremendous boon for the brand.

In the financial world, products like a mobile banking app, a bank branch or a credit card shape our brand experience of the bank every day. Consequently, a bank’s strategy should carefully consider how to achieve a good brand experience for users with the available products. To this end, the product must offer the right feature at the right time in the right context and be intuitive to use. One example from the financial industry which illustrates this perfectly is the eight-minute onboarding process of the German neobank N26. Owing to their user-oriented approach, they have enjoyed rapid growth in customer numbers.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

3. Create scope for creative solutions

The constant progress of technologies, complex customer requirements and competitive pressure from new market participants present major challenges to banks and their design teams. In order for these teams to be able to concentrate on the essential tasks, the organization must create scope for efficient work. We have worked on projects with design teams for many years. This extensive experience has allowed us to identify the following key takeaways:

- Design teams should be composed in such a way that they can work as self-organized and responsibly as possible and decisions can be made within the team – precisely where they are needed.

- Equip your design team with the right hardware and software. Design teams at large tech corporations definitely don’t work with an outdated laptop and Microsoft Office. That’s why you should talk to your team from the very beginning and listen to their needs.

- Networking with other people inside and outside the company is key to the development of creative solutions.

- A uniform platform to communicate with other teams and stakeholders is essential for your design team. The necessary tools and systems must be provided for remote working employees.

- Modern, agile methods, such as Design Thinking, Scrum, Design Sprints or Eigenland, have been on everyone’s lips for years – and not without reason. They are regularly used by leading companies for innovation processes. They can also be used within the design team to develop innovative ideas.

4. Use influences and best practices from other industries

It’s no secret that designers are inspired by everyday objects, products from competitors or video games. For financial products, looking at what other industries are doing is a good idea. Especially the retail and technology industries are drivers of innovation and set design trends. Anyone who has ever been involved in user interface design is familiar with Material Design, Google’s design system, or with Apple’s Human Interface Guidelines. Another example is the one click order of the online marketplace Amazon. Additional ideas, e.g. in order to develop an existing product further, can be derived from these inspirational examples.

5. Actively involve customers/users in design processes

Banking products are used by their target group every day. Instead of asking users about the structure, design and functionality of their products right from the start, companies focus on innovative technical options, their business goals and an appealing graphic implementation. Involving end users early in the design process allows the design team to address their needs, wishes and questions. Constructive user feedback can help identify at an early stage whether a website, app or other digital product has potential. Cost savings in development, support and training are an added benefit.

Identify and exploit untapped potential

The challengers in the financial world – whether fintech companies or neobanks – have one thing in common: a pleasing, functional design.

New banking deliberately places great emphasis on high design standards as a key differentiating feature. It thus appeals especially to the younger generation. At the same time, traditional values have not lost their relevance and are still central in customers’ perception.

Nevertheless, there is a need for action to remain competitive in the long term. Design plays a key role here. This change will only succeed if design is developed holistically and integrated into the strategic agenda as a success factor.

Industries such as retail and technology prove that such a paradigm shift guarantees success.

Design expertise at zeb

Together with its digitally-focused subsidiary zeb.applied, zeb has the experience and expertise to help you optimize your design.

We work closely with our clients to create solutions that cover all phases of the design process – from market research and user analysis to state-of-the-art design and prototyping, usability testing and further development.

Further information is available at zeb-consulting.com und zeb-applied.com.

Matthias Wald

Head of design at zeb

Hannes Tscharner

Head of design at zeb applied