Digital assets represent a profitable investment opportunity

Digital assets can represent an alternative and, above all, a profitable investment opportunity. But are institutional investors really that interested in this kind of investment? And what specific expectations do institutional investors have with respect to the product offer related to digital assets?

A survey on “Investments in Digital Assets” gives insights into these issues. In this survey, the financial market participants – including asset managers, insurers, and credit institutions – were asked to assess the importance of digital assets as an asset class. The aim of the survey was to examine the current climate in the digital assets market based on a broad spectrum of institutional investors. Three key conclusions can be derived from the market survey.

1st conclusion: institutional investors are greatly interested in investments in digital assets

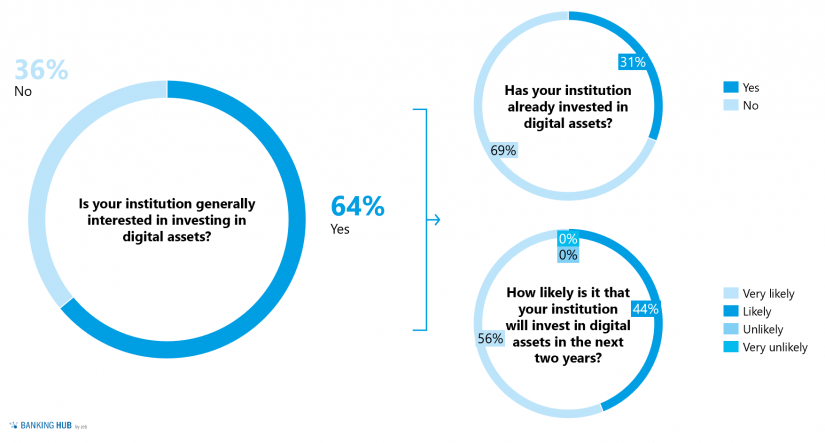

The survey shows that around 65% of institutional investors are interested in investing in digital assets. Only around 30% of this group have gained initial experience in the digital assets market or have made initial investments. Strikingly, all of the interested investors, who have not yet invested in digital assets, consider it likely or very likely that they will invest in this market within the next two years.

After having been very popular mainly with private investors, digital assets seem to have attracted the attention of institutional investors.

The trend is certainly also driven by the continuous development of the market infrastructure and of the regulatory framework. This could mean that investment in security tokens and crypto securities will continue to grow too. With regard to crypto securities, the Electronic Securities Act came into force on June 10, 2021, c.f. our BankingHub article “Crypto securities – disruptive innovation in the capital market” (only available in german language). With the proposal on “Markets in Crypto Assets” (MiCA) and the DLT pilot regime, the regulatory framework for digital assets is also being developed further at EU level.

2nd conclusion: institutional investors are interested in the entire range of digital assets, however, direct investments and investments as fund vehicles are preferred

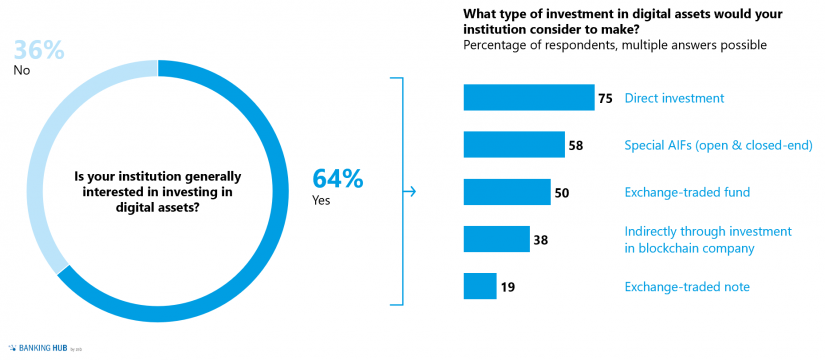

The market survey illustrates that institutional investors do not have a preference for a specific type of digital asset but are open to the entire range of digital assets (crypto currencies, security tokens, and crypto securities).

As for the type of investment, taking into account multiple answers, direct investments (75%), fund vehicles in the form of special AIFs (~60%), and ETFs (50%) are preferred. Concerning direct investments, the result reflects market practice, for example in the traditional securities sector where individual institutions hold more than 80% of assets via a direct investment.

The direct investment ratio in digital assets is thus slightly lower than in traditional asset classes. This again demonstrates that the willingness to invest via vehicles is higher for digital assets than for established asset classes.

Institutional investors seem to be especially interested in investing in special AIFs, both open and closed-end. The regulatory and technical framework for the launch of special AIFs already exists. In the near future, the first capital management companies are likely to enter the “playing field” of digital assets and will enable the launch/management of special AIFs.

A large proportion of respondents have stated that they intend to invest in digital assets via ETFs (~50%, multiple answers possible). The legal framework for UCITS does not yet allow digital asset ETFs. But, owing to the strong market demand, the launch of ETFs – taking into account dynamic and regulatory developments – seems likely in the future.

Regulated investment vehicles offer the opportunity to build trust in addition to spreading risk across the various types of digital assets. Institutional investors operate differently from private investors. They are usually subject to a complex regulatory framework and a regulated financial infrastructure (e.g. in connection with custody) when investing in digital assets. For this reason, fund vehicles that are governed by comprehensive regulation and are tried-and-tested as investments for institutional investors can greatly contribute to wider acceptance and expansion of the potential investor base in the institutional investment sector.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

3rd conclusion: compliance and security concerns are preventing the remaining third of institutional investors from investing in digital assets

Around one third of institutional investors are still reluctant to invest in digital assets in the current market environment. The majority of survey participants have stated that both compliance and security concerns are deterring them from investing in digital assets. The reason for this is certainly that despite the increasing acceptance and popularity, there is no uniform and comprehensive regulation of digital assets.

In addition, digital assets are still new on the market and do not (yet) enjoy the full confidence of regulators and institutions as regards anti-money laundering and terrorist financing. About half of the respondents have indicated that the lack of regulation creates uncertainty and is an obstacle to building a sustained interest in digital assets.

This moderate restraint is understandable at first glance. At the same time, it should be kept in mind that the reasons for non-investment are addressed by regulatory initiatives and the ongoing development of the market infrastructure.

Digital assets on the rise – early positioning of market participants paves the way for exploitation of first mover advantage

The market survey clearly reveals that digital assets are becoming more and more interesting as an asset class for institutional investors. This development is very probably going to accelerate in the next few years.

zeb and lindenpartners have identified four key propositions:

- Digital assets have established themselves in the market for institutional investors. Concerns about investing in digital assets are becoming less relevant owing to a progressively regulated market environment. Investment interest will grow significantly over the next few years.

- The service and product portfolio of institutional investors will increasingly include digital assets. Fast action in this new asset class provides a competitive advantage.

- Direct investment is the preferred choice but holds challenges for institutional investors (e.g. as regards custody). The special AIF offers investment opportunities within well-known structures and will play a greater role in the area of digital assets in the short or medium term.

- Consideration of the asset class “digital assets” and an appropriate positioning at an early stage present a competitive advantage to all relevant market participants (including institutional investors, fund initiators and managers, fund administrators, and custodians).