Telecommunication market development in Poland

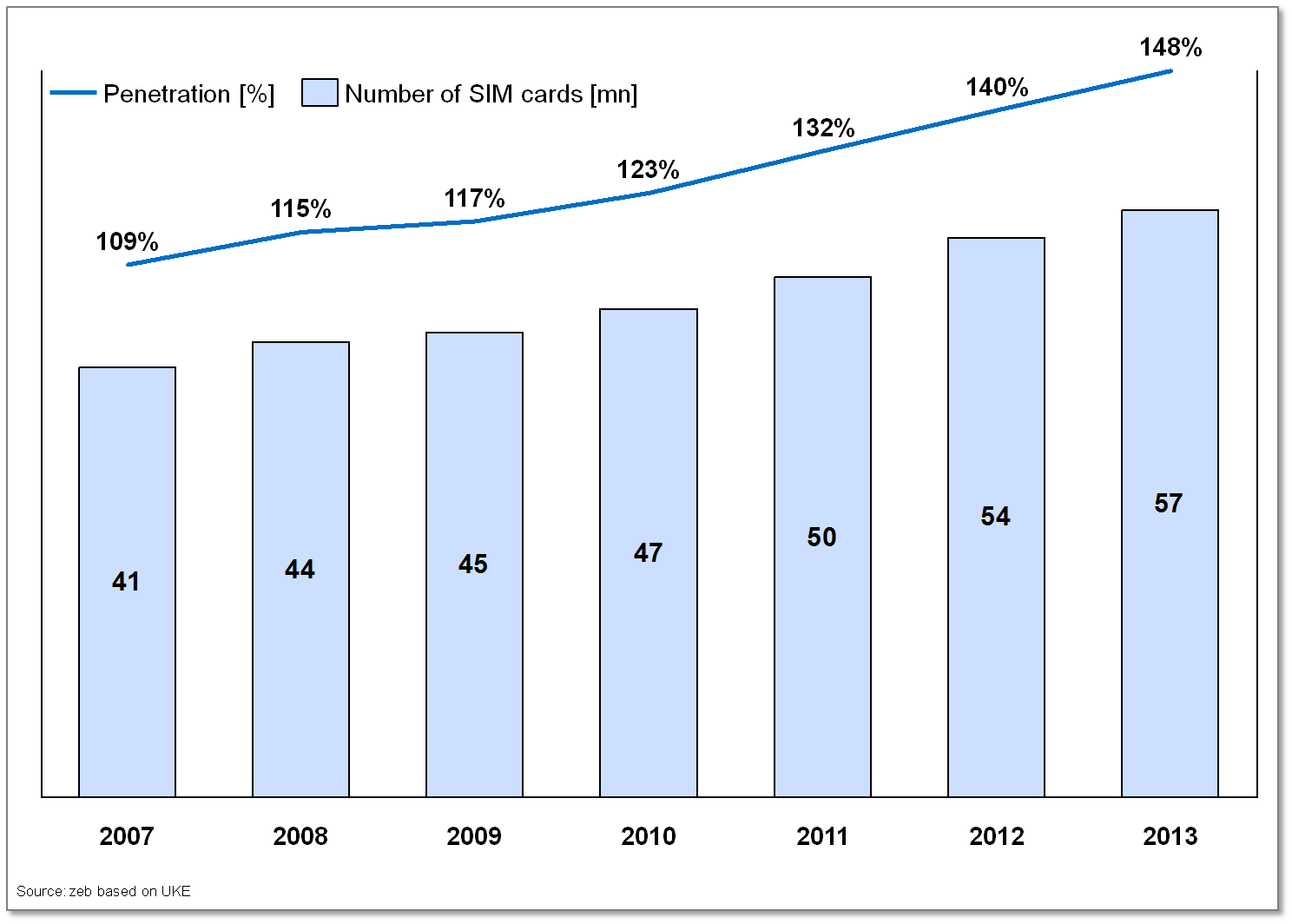

The mobile telecommunication market in Poland has been dynamically increasing in terms of users reaching almost 57 m SIM cards in 2013 with penetration exceeding the European Union average (see fig. 1). Although the market volume is on the increase, its future growth is limited due to already high penetration of almost 150%. Moreover, growing price pressure negatively affected ARPU (Average revenue per user) which has fallen in the last six years from approx. EUR 14 to EUR 8 in 2013 resulting in diminishing profits of telecom companies. On top of that, the mobile telephony market consists of 4 major players holding 97.5% market share in more or less equal parts preventing – due to regulatory reasons – any inorganic growth opportunities. From a technological point of view, the speed of new technologies and innovation adoption has never been faster and this trend is likely to continue. The share of smartphones in all mobile handsets in CEE accounts for approximately 30% and will reach 75% by 2019. The average speed of an internet connection is gradually increasing and mobile internet penetration reached 77% in Poland in 2013 (7th position in UE, average of 58%, AT 63%, CZ 51%, DE 43%).[1]

The struggle for new revenue sources led telecom companies in Poland to enter alliances with banks, while well-adopted mobile and internet technologies might contribute positively to customer acquisition for newly launched telecom banks.

International overview of telecom alliances

So far, most of the cooperations and alliances between banks and telecom companies have focused on enhancing mobile payments and increasing usability of payment-related technology. While the scope of offered services is gradually increasing, it is still far from a complete product portfolio of a typical retail bank.

An alliance worth noticing comes from Spain, where Santander, CaixaBank and Telefónica created a joint venture aiming at developing business opportunities related to mobile technologies and creating an online community of merchants and customers seeking offers, discounts and promotions in the second quarter of 2013. All this was supported by the digital wallet payment service. This joint venture is claimed to be the first European strategic alliance between banks and telecom companies.

Another example is the US subsidiary of T-mobile which launched Mobile Money in the beginning of 2014, however, without any bank participation. The offered solution is a prepaid account wired to a mobile banking application and debit card allowing customers to make transfers, payments and use ATMs.

Poland – closer look at telecom banks

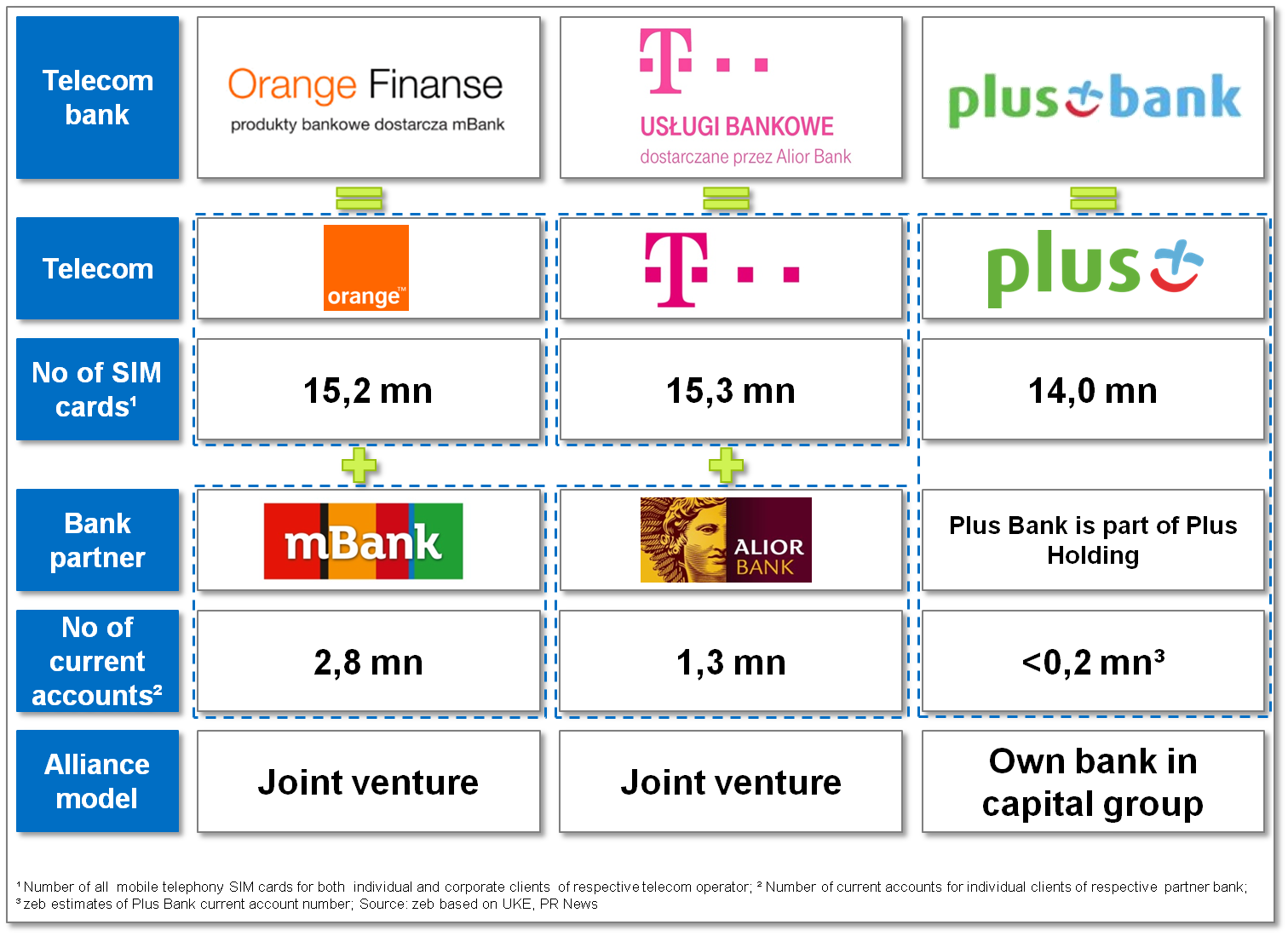

In the meantime, alliances in Poland have gone one step further. Two of major Polish telecom companies belonging to global telecommunication groups– Orange and T-mobile – decided to launch alliances with banks – accordingly mBank (subsidiary of CommerzBank) and Alior Bank (a local innovative and relatively new player) – in form of a co-branding initiative: the bank delivers the banking license, products and operations and the telecom company is responsible for marketing and client acquisition. The third operator, Polish owned, Plus (multimedia group consisting of telecom, radio and TV operators) decided to utilize its smaller niche bank from its capital group and launched a fully-fledged bank after rebranding under the name of Plus Bank (see fig. 2).

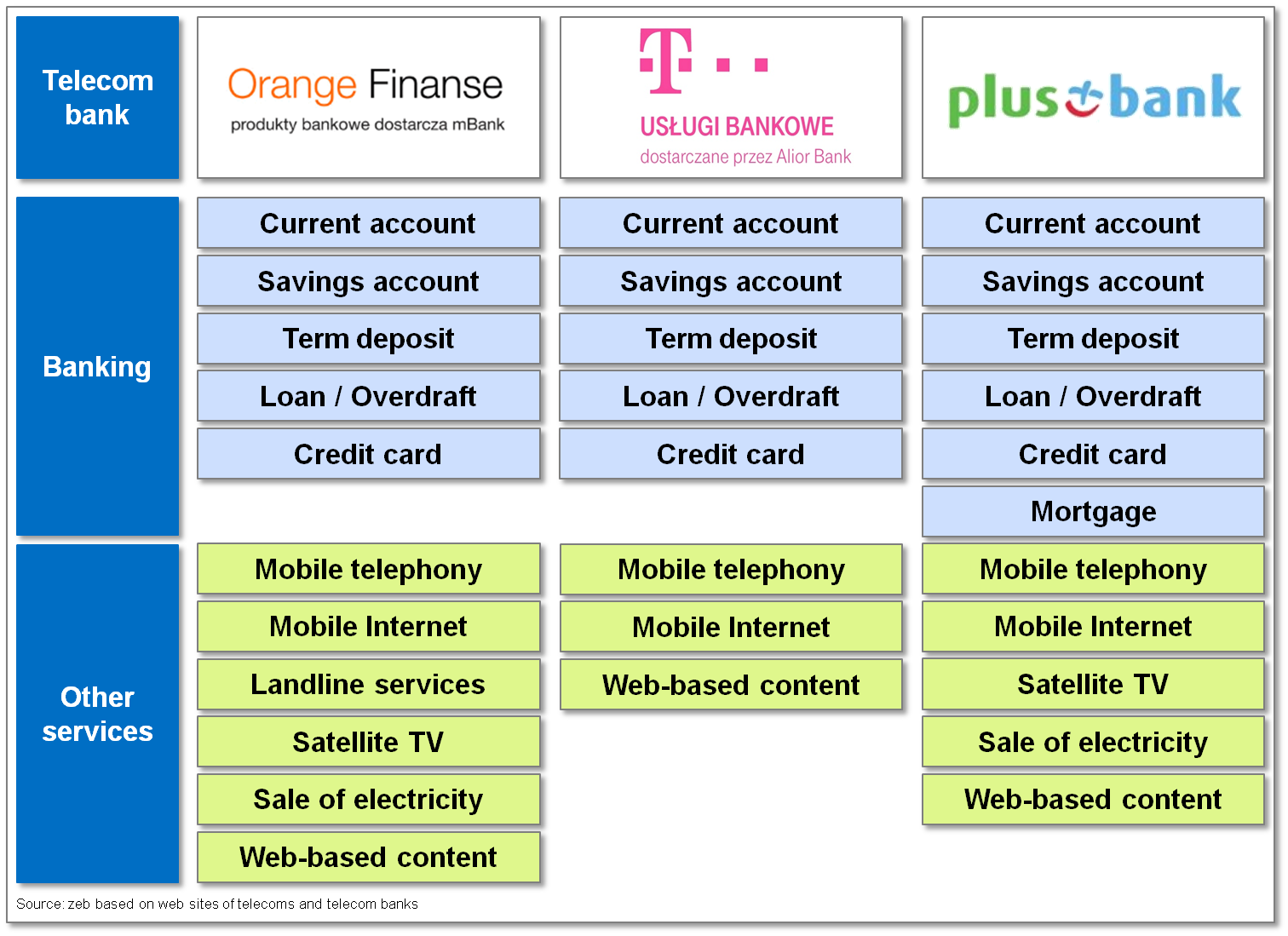

All telecom banks offer a comprehensive product portfolio ranging from current accounts and deposits to loans and credit cards in construction similar to products originally offered by cooperating banks (in case of Orange and T-mobile). Mobile payments are only the basis for other banking products. The crucial part are benefits for customers from a bundle offer (see fig. 3). Plus Bank offers discounts for every additional product in the portfolio of a client, e.g. the bank client will obtain % discount from a standard offer on a satellite TV within the group. Additionally, the higher customer expenses are on a debit card, the higher the discount is for a mobile postpaid contract. Plus also favors loyal mobile operator customers granting discounts for products for each year of being client. Orange mostly focuses on cashback features of current account and prepaid contracts bonus recharge for mobile payments and the timely payment of the contract fee. T-mobile offers easy to acquire overdraft for mobile operator clients and bonuses for every prepaid contract recharge for bank clients.

Offering novelty

In case of telecom banks, innovation does neither result from the specific characteristics of offered products nor from the technology enabling the usage of those products but rather from the comprehensive business and customer perspective. Both perspectives of the bank and telecom company merge in alliance where resources, people and knowledge are used in a more efficient way and managed more comprehensively creating substantial synergies. This completely new business model changes the way, in which financial services are delivered. Customers are offered a wider range of indispensible services for everyday use by only one provider. The big data utilization enables a composition of tailored products offered at the exact moment when a need occurs (e.g. geolocalization technology). The merger of banking and telecommunication will also influence payment services enhancing the use of technologies that allow purchasing goods by mobile phone which is already intensively promoted by banks.

Bringing value to the bank and telecom operator

Banks are able to use the resources, that have enabled them so far to serve their own clients to provide services to clients acquired by telecom banks, thus reducing the average costs of maintaining clients. Also the costs of acquiring new clients might be lower if acquisition is supported by a set of information provided by the telecom company from its client base.

Telecom companies are able to reach to their current client base and extend the existing portfolio of products by financial services, which leads to additional profit and an increased average ARPU. Customers bound by more products are less likely to change the provider causing a reduced average churn rate. From the CRM point of view, telecom companies have customer data, that allows for a more accurate target and risk profile (e.g. pre-scoring) of potential bank clients. What is more: clients already acquired for a telecom bank contribute additional, valuable information (e.g. spending habits) that might be useful while offering telecommunication-related products. Telecom companies are also using current distribution resources in form of a POS network for increasing its efficiency.

Bringing value to the customer

From the customer perspective, the main advantage is a reduced financial burden. Telecom banks have made an effort to revamp their offer in order to attract as many customers as possible soon after the launch: free current accounts, a high interest rate on savings accounts (especially valuable in a low interest rates environment), cashback features for mobile payments or transfer from another bank. Some of the mentioned deals are only accessible for telecom clients, but on the other hand telecom banks clients are able to benefit from discounts and bundle offers for telecommunication-related products as well. The offer might be really attractive if the customer is willing to commit to a comprehensive product portfolio.

Convenience is another key word when it comes to the perceived value of customers. Telecom companies have already offered multiple products and services such as mobile telephony, internet services and satellite television. Adding banking products allows customers to purchase, manage and track payments for everyday use products in one place. The group holding owning Plus Bank and Orange goes even one step further with the recently introduced offer of electricity sale.

Outlook

Although cooperations between banks and telecom companies have a long history with different scopes and aims, the market starts to be mature enough for major, strategic alliances. There are three signs confirming this believe: the involvement of market leaders on both banking and telecommunication side, full commitment to the venture instead of developing single ideas supporting current activities and, finally, the introduction of a comprehensive product portfolio as opposed to focusing on payments only. Time will tell how those alliances will develop in terms of product portfolio (possibly wider range of mass market products from new industries), cooperation model adjustments (resumption of negotiations on revenue sharing or telecom attempts to become independent) and banking transformation (potential introduction of subscription banking in exchange for a fixed fee). Telecom banks might change the retail services market. Thus, it is worth following the future evolution of this service portfolio in Poland.