Introduction

In the challenging environment, the most striking trend seems to be digitalization. Even though digital banking is nothing new—banks have been trying to digitalize their processes for the last decade—there is still no consensus on how this can be realized in order to exploit its full potential. Multiple banks have tried and failed to become digital leaders over the past few years; others have been more successful and achieved small successes. However, none of the banks seems to have really mastered the art of digitalization, which could eventually allow an organization to develop a real competitive advantage.

From a traditional banking business model to an ecosystem approach – a possible solution

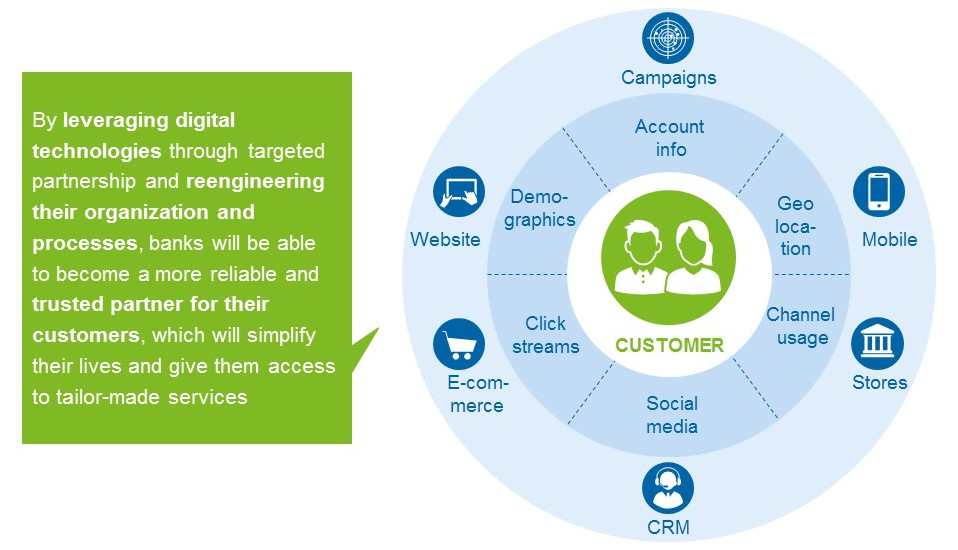

The current banking business model often has a product-based approach and operates through a series of overarching processes, which increase the level of complexity and inflexibility. This leads most likely to a large number of labor forces to make the banks work smoothly and creates an organization which can only react slowly to change and struggles to innovate. In order to move from a traditional banking business model to an ecosystem approach, a possible solution for a complete change in strategy is being elaborated, where the focus will be on the customers rather than on the products. Therefore, banks will need to change their way of operating to become more flexible, accessible and transparent for their customers. This journey towards customer centricity can be started by leveraging digital technologies through targeted partnerships and reengineering the bank’s current organization and processes.

What is a digital banking ecosystem and why could it be a solution?

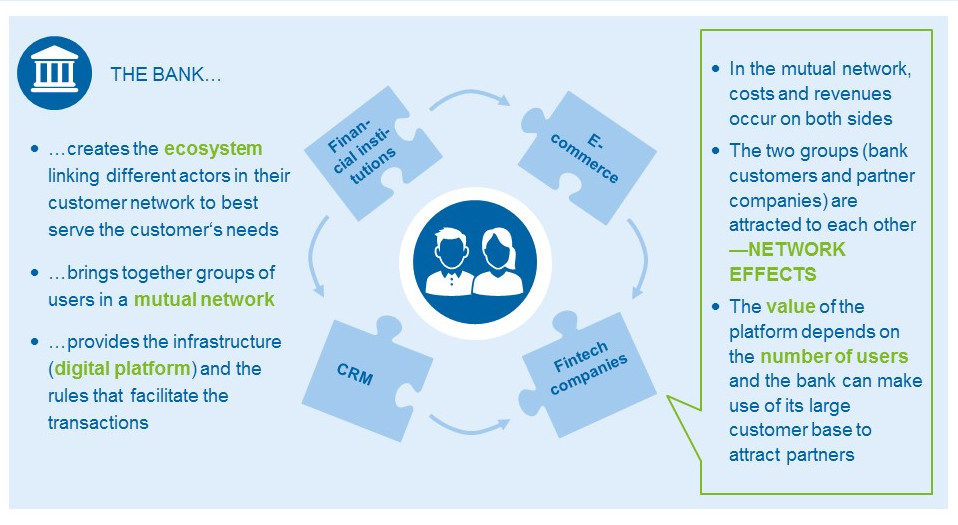

Multiple avenues have been explored to take advantage of the digitalization opportunity which retail banks are facing today. One of them is to create a banking ecosystem which besides offering core banking products to their customers also connects the customers to third-party service providers. In other words, banks become a platform where customers and service providers can interact for the benefits of all parties.

In fact, in several countries the trend towards third-party ecosystems can be observed. For instance, in China, Alipay and WeChat have already been successfully implemented. Furthermore, Facebook, Amazon, Apple and Google are all working on technologies that would allow themselves to become the gateway to every single purchase or transaction and thus an infinite data traffic. This does not mean that retail banks should engage themselves in a race against tech giants for controlling these ecosystems. Both operate in different businesses and have disparate goals. Nevertheless, if banks are not reacting to this new threat, they will risk losing contact with their customers and becoming only a bridge between their customers’ money and a digital platform where products and services can be purchased. If such a scenario happened, brand advocacy of banks would fall quite drastically, given that they would all be providing more or less the same service, hence giving no reason to customers to stay loyal to one institution.

Banking ecosystems have been the subject of many conversations over the past years. However, none have ever really been implemented. Still an omni-channel strategy offering several financial and non-financial services through a digital platform is a scenario that banks all over Europe should look at more closely. A platform allows the bank to create an ecosystem bringing customers and service providers together and enabling both groups to interact and create a mutual network. In this ecosystem, costs and revenues occur on both sides and each group is attracted to the other through network effects. The goal of this ecosystem is to provide a simple, time-saving and personalized experience that aims to change the existing perspective of the customer towards the traditional banking model.

How a digital banking ecosystem could worK – food for thought

Users are able to view specific products but also categories related to their key life events as well as their everyday routine, such as mobility, entertainment, travel, etc. The aim of this platform is to provide need-based solutions, which are proactive, anticipating and responsive to user behavior. This is all based on big data analytics linking partners and bank products through the platform. For example, if a user is searching for a car, through modern technology the bank will be able to recognize the situation and offer financing options, insurance, monthly expenses that show how this purchase is going to affect his financial situation. Furthermore, the platform adapts itself according to habits, preferences and user behavior and the client can customize the start page as well. Regarding the security concerns, the platform is only accessible through biometric identification methods and the bank can make their secure identification and verification process available also for their partners.

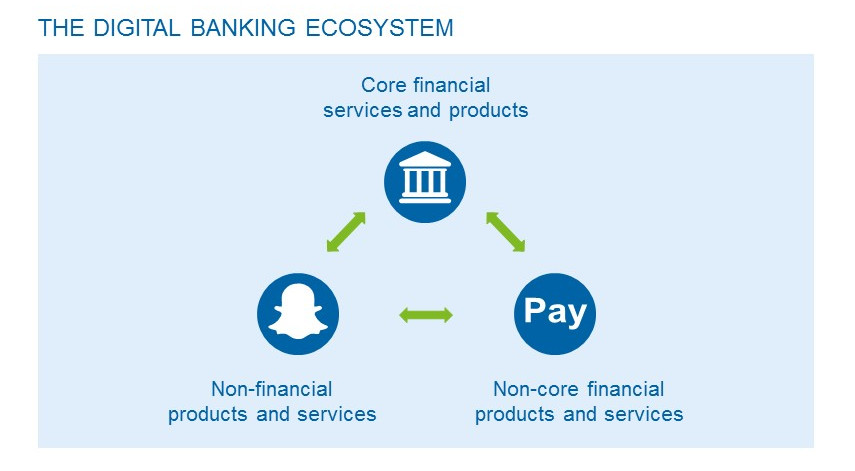

Three service categories are offered to the customers on the digital platform: core financial products, non-core financial products and non-financial products. Here is an overview of each category:

Core financial services and products: The online platform allows the customer to access his account information and have a direct overview of his balance sheet as well as an express access to any financial services offered by the bank: transactions, savings account, loans, investments, funds, mortgages, advisory service and others.

Non-core financial products and services: Users are able to benefit from other financial services and products that are not part of the bank’s core activities, through other financial service providers. These providers, mainly fintech companies, are directly connected to the user’s bank account using APIs. In doing so, banks focus on their core business and on the other side, fintech companies provide non-core financial services at lower costs. The creation of partnerships between banks and fintech companies allows banks to reduce inefficiencies in their operations, while at the same time delivering a differentiated offering, targeting a new customer segment and generating additional revenues through new streams. Fintech companies and banks both have a lot to gain working together. Here are some examples of services possibly offered by fintech companies through the bank channels: digital wallet operations, payments, peer-to-peer transfers, insurance, foreign exchange and others.

Non-financial products and services: On the same web space, users have access and contact to non-financial services in different service areas, such as transportation, energy, food and others. To make the platform attractive to this type of service providers, the bank has to give something in exchange. If not, there would be no added value for service providers to be partnered with banks, given that they can sell directly to the customers through their own sales channels. One way banks can achieve this is to systematically organize and sell purchasing behavior information of customers to their partner, of course, only with the consent of the customers. This allows non-financial service providers to create tailor-made advertisements to specific groups of customers and target customers who are known for using their products or services. Furthermore, to increase the customer loyalty for these service providers and the platform in general, a loyalty program can be established to reward regular and frequent platform users.

How will this change in the banking business model impact the bottom line?

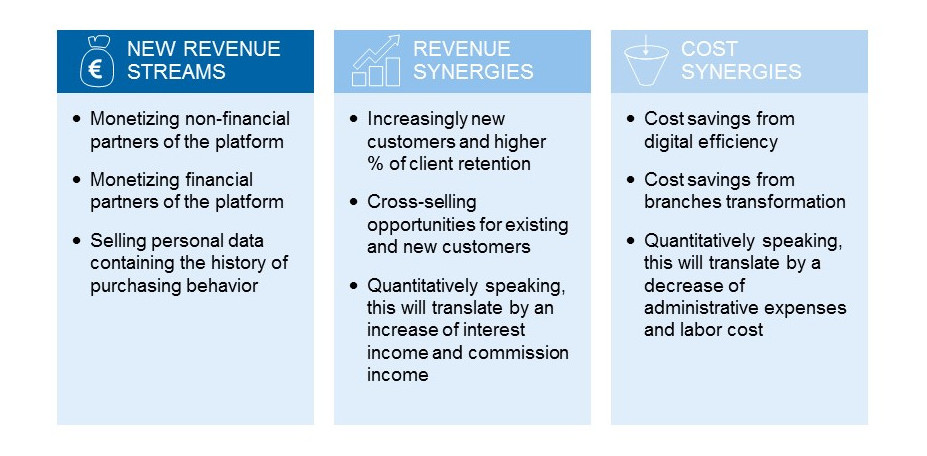

Such an ecosystem requires for sure a large investment in technology and moreover a significant desire to do things differently since major changes of culture, processes and hierarchical organization are needed. However, one can assume that such a project reshapes the banking business model by putting the customer in the center of it and presumably the benefits will be larger than the costs. For instance, such a digital banking platform certainly brings a fair share of new revenue streams. Banks have the opportunity to monetize the right to access the platform of financial and non-financial service providers. Another interesting source of revenue for banks is the possibility, given the consent of the users, to sell personal data of customer segments containing their purchasing behavior history.

Additionally, synergy effects are created through this new ecosystem. This digital platform redefines user experience leading to a high retention of current clients, but also an increase of new customers. Moreover, banks benefit from the presence of non-financial service providers on the platform by cross-selling products and services to online users. Besides that, retail banks are able to reduce the level of services offered in their branches, mainly because more basic operations can be done through the digital channel, hence reducing the amount of personnel needed in the middle and back offices of their branches.

Conclusion

Even though it is quite hard to predict what the future will look like for retail banks, one thing is certain: maintaining the status quo is not an option. The industry is currently under tremendous pressure to reinvent itself through technology and innovation. Is this new banking platform where customers and service providers can interact the answer to digitalization? It is hard to know for sure, however, we believe that it might be one possible concept. However this e-banking platform has the power to change the banking experience for customers and allows banks to build a sustainable competitive advantage by leveraging technology.

This article was prepared in cooperation with the CEMS master program of WU Vienna, so our special thanks for their creativity and their commitment goes to Bourdeau Philippe, Chang Torok Eve, Hintner Bettina, Radeczky Janos and Viera da Costa Joao.