The world is unfair to banks

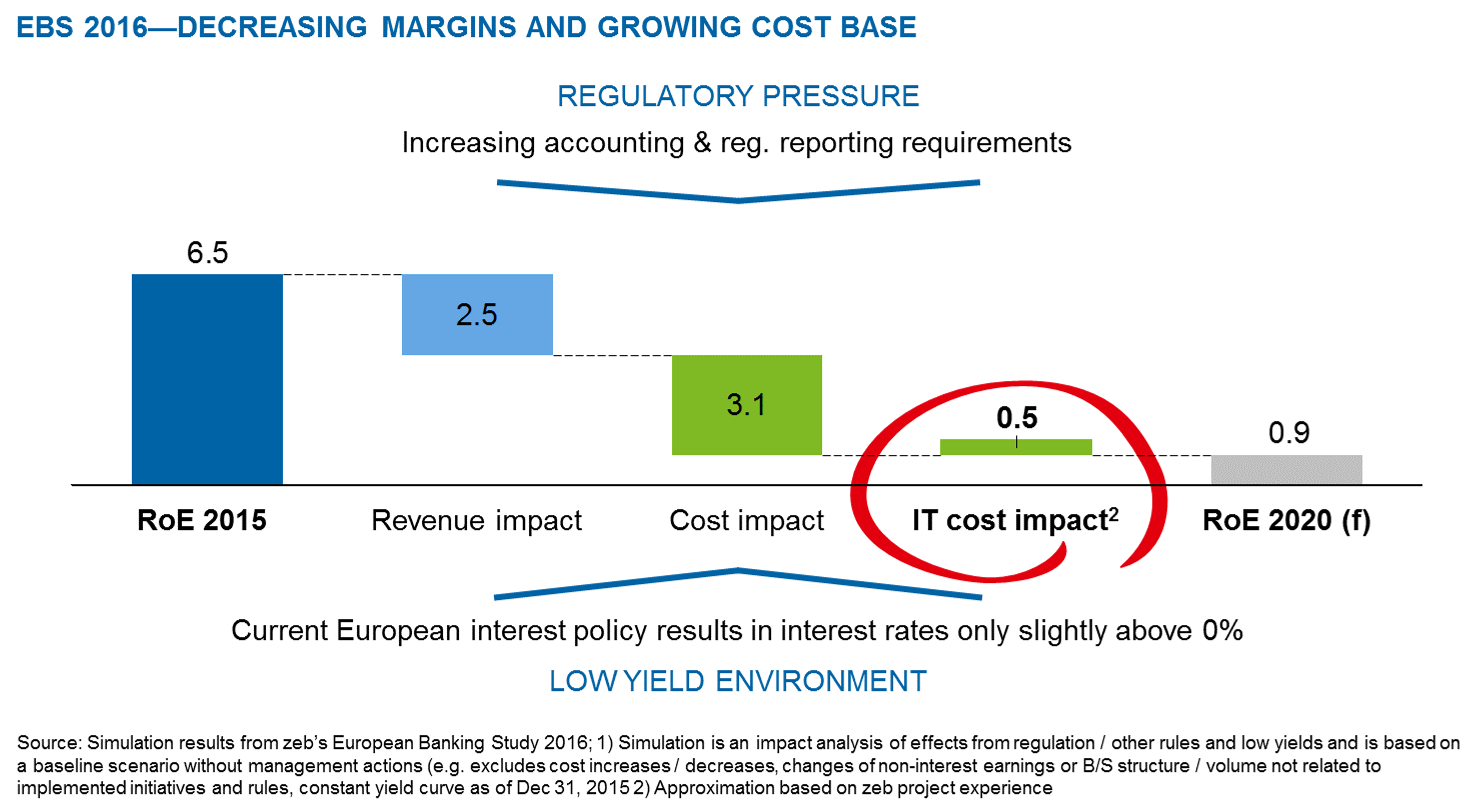

The story has been told often enough. The banking industry is undergoing profound changes all of which add pressure to the bottom line. Traditional revenue pools are shrinking in a low yield market environment and the increasing regulatory pressure adds the costs of running daily business. To adequately address a threat posed by the market entrants—fintechs—e.g. digital natives with no legacy and “light” regulatory requirements—banks will suffer a meltdown of their profits. In a “do nothing” scenario, an average top 50 European bank will lose 5.4 points of its return on equity ending up at a mere 0.9% in 2020 according to a recent zeb study. But where does IT come into play?

As a consequence of this pressure and a need to invest in technology, IT has shifted from being a pure operations agenda to that of the CEO. As the second largest cost block (after staff costs) with 10 – 20% of the overall banking operating expenditures, IT significantly contributes to the overall projected cost increase in the banking sector. In terms of RoE, IT will cost an average top 50 bank in Europe 0.5 percentage points. This reflects that IT is still at the heart of delivering the increased level of automation—be it in the processing of regulatory or client needs. Delivering in a fire-fighting mode will not make a successful CIO case.

In order to reduce IT costs and improve the bottom line, CIOs have to manage demands put forward to IT more effectively. Most fail either in the setup or execution of a solid business case. Even if the technology is tempting, banks should still only execute large IT investments if there is an outlook of lower operational costs in the medium term. In turn, building the business case depends on cutting the architectural scope of every IT investment right.

In the struggle with demands, scope definition and execution, conventional cost optimization approaches fall short of the requirement. Major decisions on costs are rather about which one-off investments to commit to (in order to arrive at a lower cost baseline in the medium term) than squeezing the last potentials out of the existing baseline. This calls for a new approach to reduce and manage IT costs.

How to tame the animal

The starting point of the new look on IT is a comprehensive overview of the IT (related) costs and their drivers. System, operations and business costs should be mapped to a common architecture model and the associated drivers of these costs should be made transparent and evaluated against the benefits. IT-related costs are often scattered across the organization. For example, complying with new regulation often rests on expensive systems and operations in multiple areas, e.g. from advisory support tools on the retails sales frontline to back end systems in operations. Thus, associated costs can be easily overlooked!

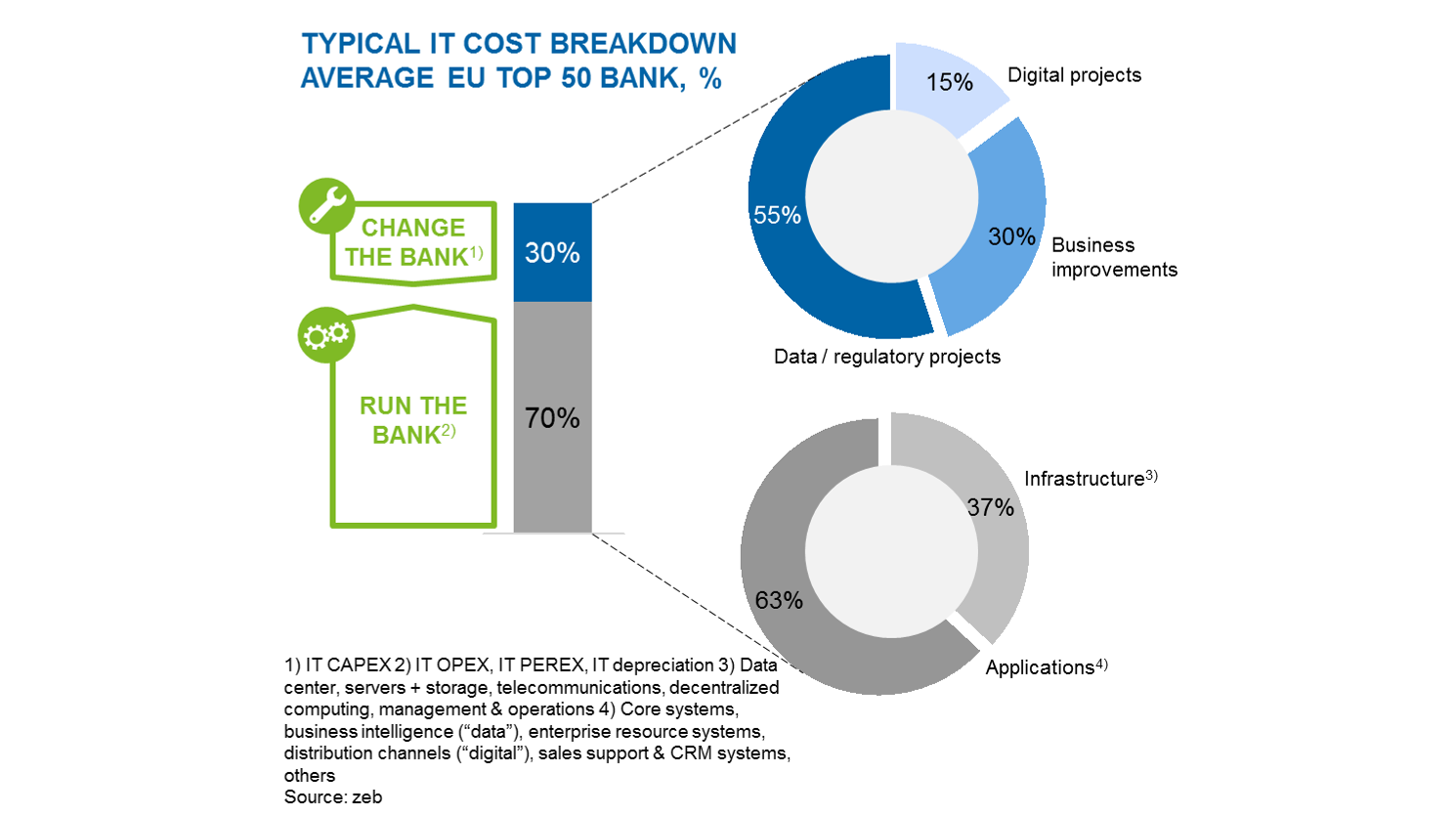

What is more alarming is that a typical bank spends approx. three euros for maintaining its legacy systems for every euro invested in innovation (new products, digitalization of a customer journey or enhanced analytics capabilities, etc.). IT bank executives across Europe clearly focus on projects that hardly add value to clients.

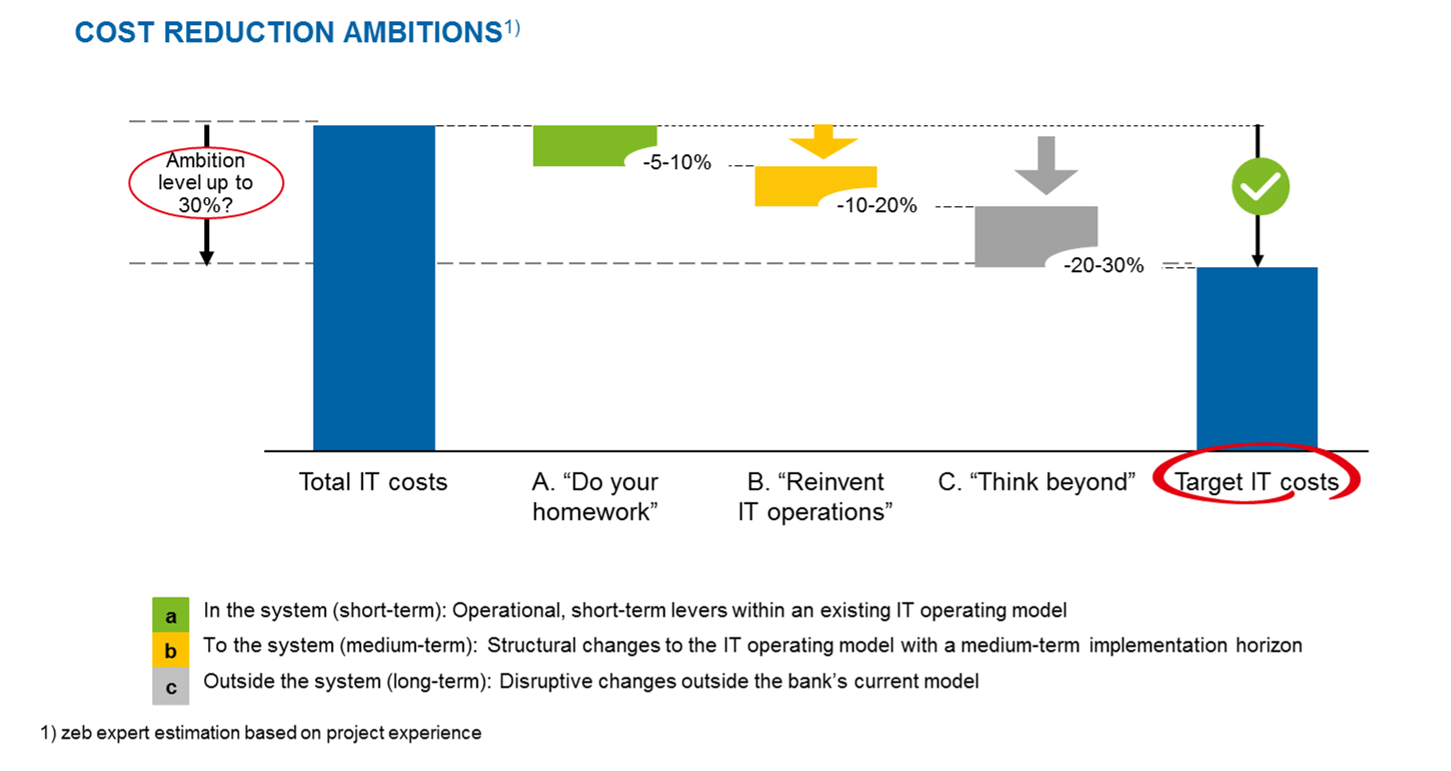

The real room for improvement lies in shifting management attention and budgets to the “change the bank” area, while reducing overall spending. Clearly, banks need to determine what it means for them in terms of the broadness and depth of the enterprise i.e. to set the right level of ambition to achieve this shift upfront (see Figure 3).

“Homework” (“in the system”) measures will target IT run costs bringing minor, but quickly visible short-term cost reductions. This was the focus of the cost reductions in the single line management responsibility. Often CIOs and COOs would have to fight each year to prevent maintenance budgets from bouncing back as they come under pressure to improve legacy environments. At the same time, cost initiatives, which are implemented across multiple lines, are being diluted in the implementation. In the end, there is still little cash freed up for change projects.

Banks should address IT outside-in with “reinvent” measures (also referred to as “to the system”, as they still contribute to the current perimeter) and address both run and change the bank components through targeted transformation of selected business / IT clusters of the architecture. This implies a reallocation of the best IT and organizational resources from maintenance into project work. This shift should be accompanied by selected quick wins if this hasn’t been done before.

Ultimately, the biggest effect can be extracted when “thinking beyond” the IT / operations domain. Taking the CEO perspective, business heads should critically evaluate their own needs based on the bank’s business model and USP. They need to assess the profitability of segments and product offerings, which are supported by different system platforms or leverage them in other markets. Due to their fundamental nature, we also call these measures “outside the system”.

It needs the best the bank can provide

In order to rescue some of that shrinking RoE for the bank, most banks will have to run fundamental IT (cost) transformations aiming at reductions of up to 30% in the supporting functions of the bank (IT and/or operations). Clear signaling measures are required from the start to raise cost awareness and the cost component in the project goals. The business case should be secured by addressing the right architecture cluster. But, the last mile of the journey is execution, requiring the bank’s best people. Banks cannot afford to spare them for business tasks no longer. Only they will deliver the change, which is needed.

One response to “Cutting IT costs in a smart way—our swim aid for CIOs under pressure”

Lawrenc Dillon

Great article and very true.

For consideration, the challenge I have witnessed over 30 years is not the lack of an IT department’s passion and insight to improving performance while reducing costs. In fact, with a partnership from the CFO I have always achieved this outcome. However, without a CFO partner, finance organizations support funds for new features and functions without considering what or how they are added to within existing systems.

Imagine if this were true when a company has to invest in a new building driven by the current or future growth of a bank! Does the Finance organization approve a new, bigger and more efficient building with the plan of moving some or all the employees, furniture, etc. from other smaller and older building in the area? Or, do they approve adding a new “wing” to a 30 year old building 10 or 20 stories up in the air because they have no land to build on? Is an ROI for the first scenario the only one built because the second scenario would be rediculous? Does the ROI allow for the consolidation of several older, out of date, smaller building to be emptied out and closed?

If a new building is needed , is the budget terminated with the old building and employees in those buildings remaining in place? Does a group other than HR, operations and/or the real estate group(s) determine who uses that new building and when the migration of people actually occurs? Can leaders of other groups say “no” to the move without consequence? Do the HR, operations and real estate departments get a reduction in their operating budget now that they have a new building even when the old buildings were never shut down and nobody was required to move to the new building?

This may sound silly but IT lives this situation daily. The rules considered normal by other functional groups do not seem to apply to IT. Maybe this is because IT leaders are too technical and not business leaders. Maybe they have a difficult time explaining the longer-term impact of financial decisions? Maybe it is because other leaders are tired of hearing IT “complain” and don’t believe the IT leadership?. Regardless, the above example happens everyday in IT with other leaders believing that it is reasonable to expect IT to cut costs when they can refuse to standardize, move to new systems, turn off old systems and engage in the design and testing of new systems. These “IT” related activities require everyone to be engaged just like they would be if they had to create and move to a new building / location.

If all the executives understood the complexity already in place prior to approving additional funds to add more complexity, maybe there would be an effort, and investment, in reducing the complexity first. If IT leaders invested in simplification and all the executives forced P&L leaders to move off of old systems, reduce their “pet projects” (or reports), and create & accepted standards, this can easily reduce the cost of maintaining systems. Granted, this takes strategic and managerial courage but it would free up cash to allow for investments elsewhere.