Why is it relevant?

On the one hand, banks are forced to manage increasing regulatory requirements like Comprehensive Assessment (CA), AnaCredit or BCBS #239 and their implementation. These projects tie up financial and human resources that are needed to trigger strategic projects addressing issues that are related to cost efficiency or complexity reduction. In addition, current studies reveal that banks’ traditional challenges like industrialization and operational excellence still haven’t been realized to a satisfying degree. To gain a proper operational proficiency, it is necessary to monitor and control banks’ process efficiency and to avoid a sole focus on financial figures since they “[…] are the consequences of yesterday’s decisions and not the indicators of tomorrow’s performance,”[1].

You cannot control what you cannot measure—Process Mining as Enabler

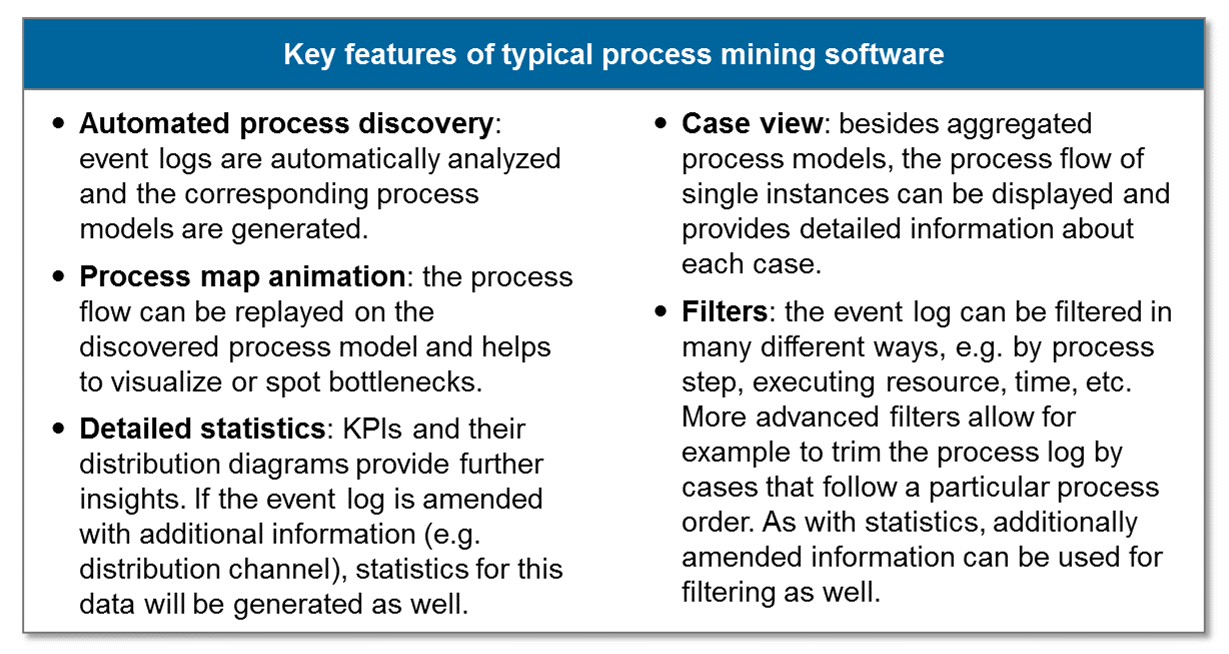

Getting insights in processes was usually directly connected to huge business process management (BPM) or reengineering (BPR) projects. Additionally, it was often argued that banks’ heterogeneous and complex IT landscapes do not allow for a proper tracking of process-related KPIs[2] or only at significant costs. For example, a manual measurement was often necessary to gather process-related KPIs. Hence, process-related KPIs were only collected and reported during BPM / BPR projects in a one-off fashion. But today, technological advances allow for a continuous tracking and analysis of banks’ processes by means of process mining. The main idea behind process mining is to reconstruct and analyze business processes based on the actual traces in IT systems. Based on this data, process models are automatically generated and provide a visual representation of the process. This feat is only possible due to the fact that most of today´s information systems are process aware – i.e. typically store a minimum set of information necessary to perform process mining: case ID, task name and timestamp. Each time a user or a second system interacts with these kinds of application, event data is generated. Examples of these systems are SAP, various core banking systems and even ticketing systems like Jira.

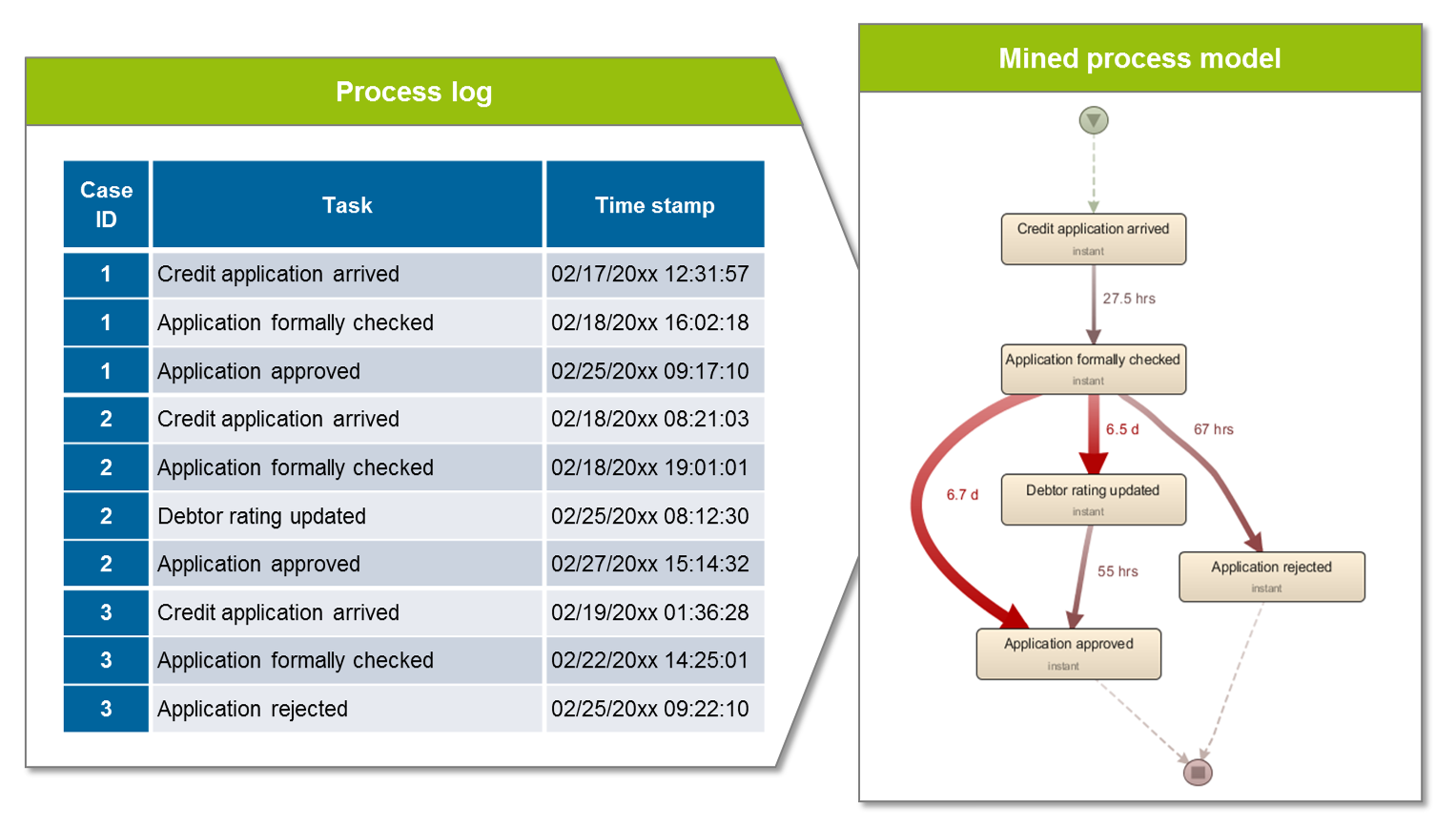

A brief illustration of the idea behind process mining is provided in Figure 1 [3] This example contains raw data of a simplified credit application process and the mined process model. The raw data consists of three cases with five tasks, respectively events. The mined process model shows the tasks and the process flow. The transitions are annotated with their mean duration. One can see that bottlenecks in the process occur when a formal check of the credit application is done. Hence, further investigations should focus on this task respectively upcoming steps to identify the reasons for this bottleneck.

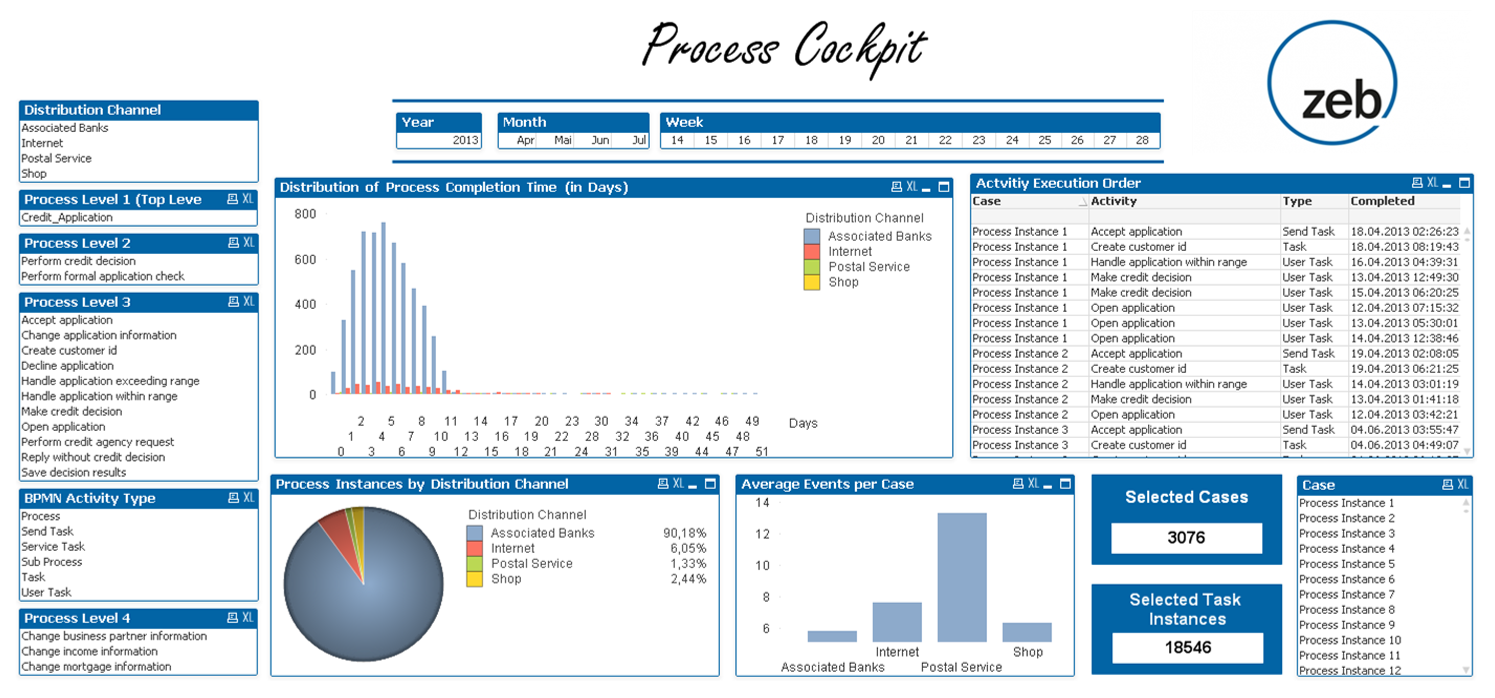

The advantage of process mining is that the manifold interfaces of banks’ IT applications are valuable data suppliers and can often be integrated with little effort. Process mining tools allow for an easy utilization of this additional data. For example, information about the sales channel could be used to identify process deviations with respect to the used channel. In addition, the gathered data can be used to serve as a supplier for a regular reporting by means of process cockpits, as you may call them. Typically, these cockpits report several KPIs with respect to several dimensions and across several processes at the same time. Figure 2 provides an example of a process cockpit and is based on real data.

Even though process mining and controlling provide important insights in the banks’ processes, two major issues have to be addressed in order to achieve a successful implementation. First, regulations of the work council as well as current laws should be considered and discussed at an early stage. This is due to the fact that a process performance measurement affects data protection / privacy concerns of the employees. But this article focuses on the second major issue and addresses data provisioning and the integration in the banks’ IT architecture.

ARCHITECTURAL FOUNDATION – HOW TO INTEGRATE IN EXISTING IT-LANDSCAPES

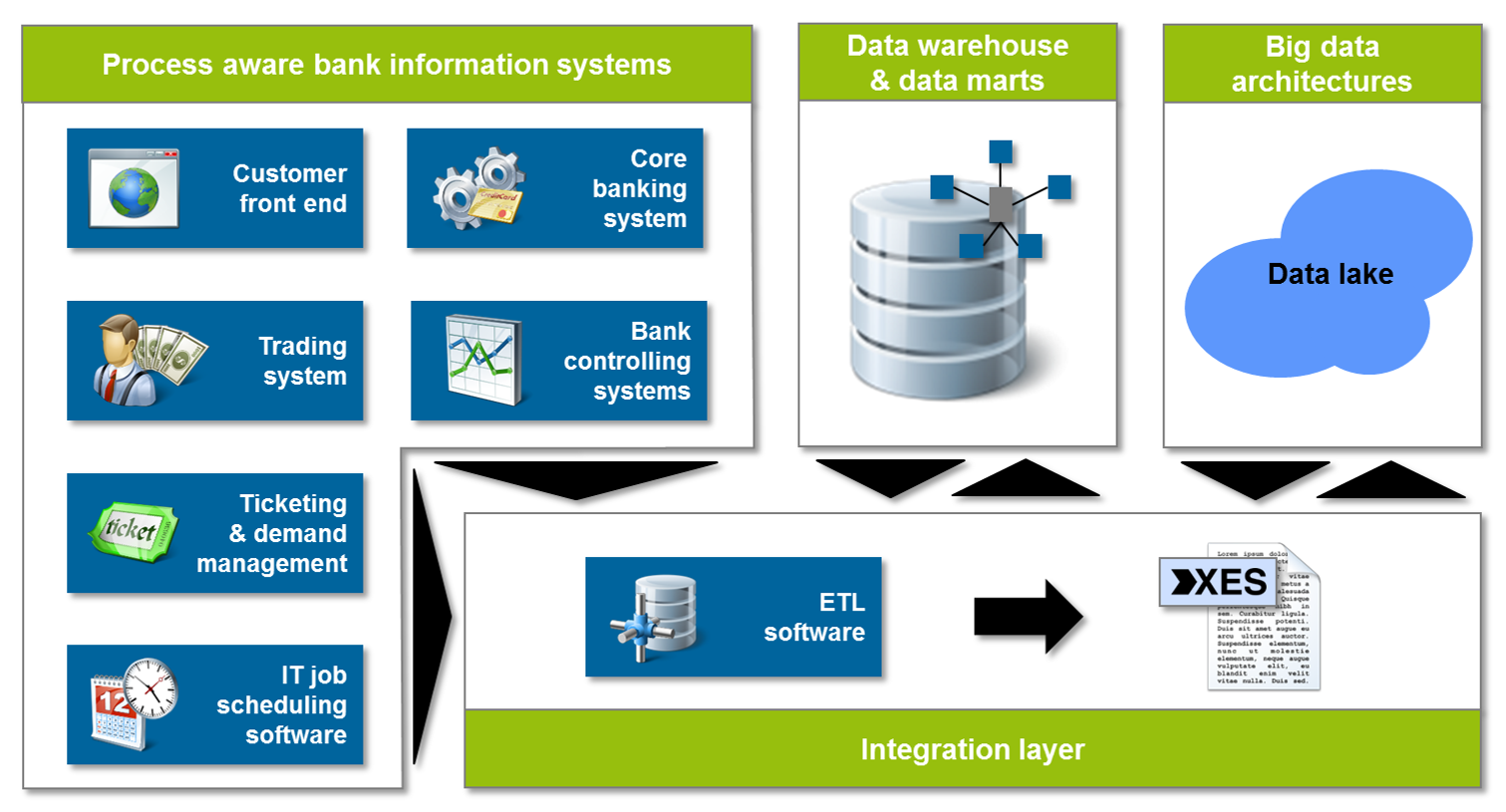

Initial event logs / data are usually gathered in a hands-on manner, but the reporting and analysis tools have to be automated for a proper controlling of business processes. Therefore, it is necessary to identify all IT systems that are involved in a business process and to get an understanding how process data is stored in each system. In order to allow for a detailed analysis, additional data sources like data warehouses should be considered to include information about costs, product or organizational structures, etc. Unfortunately, current data warehouses are often not suitable to serve as the single / main data supplier since they are missing process-relevant data like tasks and related time stamps. But establishing a mining-driven process controlling allows to integrate this process data in the data warehouse and to utilize the banks’ standard reporting capabilities, e.g. Business Intelligence (BI) tools. An example of what an integration scenario might look like is provided in Figure 3.

The input data from the relevant data sources need to be combined by using an ETL (extract, transform and load) application. The resulting data set should reflect the process structures and the amended information properly. In addition, the output should be generated in a standardized manner in order to provide and use defined interfaces. The most promising candidate is the eXtensible Event Stream (XES). The XES Working Group proposed an XML-based format that is right now on the way to become an IEEE standard. Finally, the output, i.e. the generated event log, has to be integrated in the existing reporting architecture.

Five Theses about How Advances in Process Mining will change Business Processes in Banks

Process mining is a rather new approach, but there is a strong professional and scientific community with ongoing initiatives for developing mature approaches and tools. We believe that due to advances in the area of process mining within the next years, the following five developments will become true:

- Process mining will become a common tool that is used as naturally as BI reporting solutions.

- The common usage of process mining will lead to standardization in terms of event log exchange.

- Based on standardized exchange formats, process audits will be performed by means of process mining.

- With an increasing amount of event data, process mining will become a scalable and cloud-based approach.

- Predictive analytics will be integrated in process mining and will significantly affect the banks’ (human) resource management.

However, process efficiency is an important requirement to address the current challenges in the financial industry. Even though the advances are not yet realized to a full extent, the time is right to gather hands-on experience in process mining techniques, as it can be used already with little effort. This allows to take first steps towards a better process transparency and represents a necessary foundation for a further optimization and digitalization of the bank’s processes.