Complexity kills

In the aftermath of the past two substantial crises the European banking industry has encountered massive interventions on part of the regulatory authorities – and further impending initiatives cast their shadows ahead. In addition, low interest rate environments still abide profits under pressure. It turns out that the impact on and response capacity of banks strongly depends upon their complexity. For instance, regulatory initiatives differ across geographical regions, hence, affecting globally active banks more than locally active banks. Quintessentially, globally active banks tend to be more complex than locally active banks. Furthermore, the recovery and resolution plan put forward by the European Banking Authority (EBA) distinguishes, amongst others, according to balance sheet size. The larger the balance sheet, the more impact by the resolution plan – hence, the larger the balance sheet, the more complex the bank.

This year’s European Banking Study sheds light on the complexity issue within banks and examines the impact of ongoing regulatory burden in combination with low interest rate environments. A subsequent article derives appropriate management actions and shows what extreme measures have to be taken in order to respond effectively.

Double Trouble continues

zeb’s European Banking Study 2014 revealed severe profitability and capital issues for Europe’s top 50 banks. The main drivers were identified to be ever-expanding regulatory requirements and a persisting low interest rate environment – inspiring the designation “double trouble”.

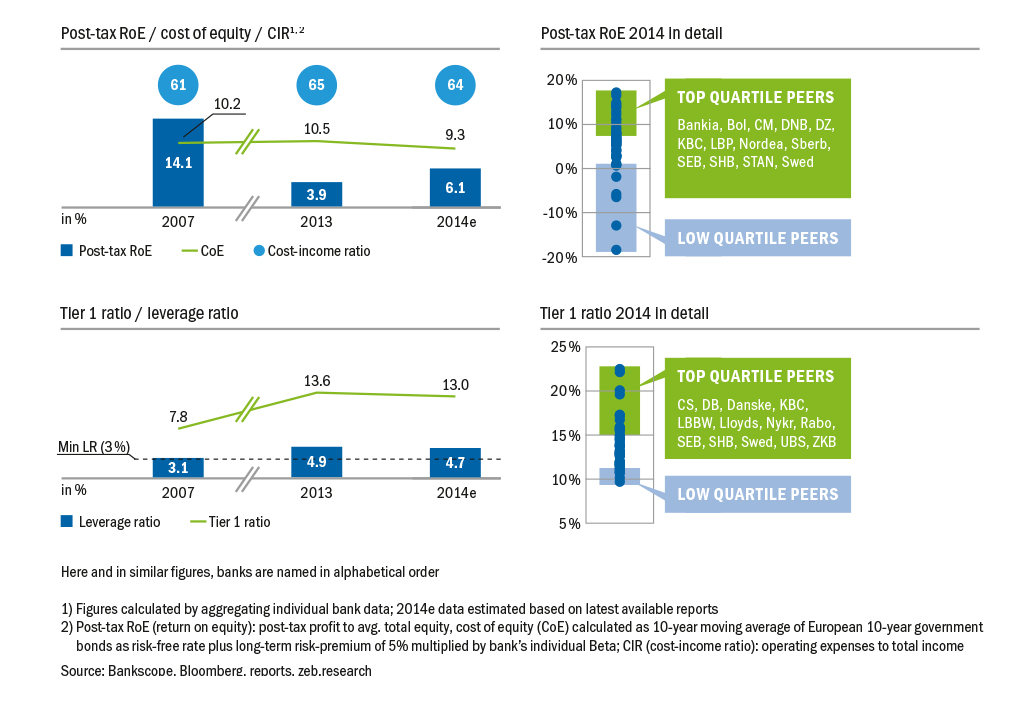

Today, one year later, the picture hasn’t changed too much. Despite of massive capital injections yielding an improved capital base (in particular, CET1 Ratio and Leverage Ratio), European bank’s overall profitability is still disastrous: Return-on-Equity (RoE) is again by far below Cost of Equity (CoE). Additionally, only four out of fifty banks feature a good capital base and adequate profitability – vice versa, eleven institutions lack even both, sufficient capital and profits. Hence again, big is still not beautiful in Europe. Figure 1 underlines this by providing an overview over profitability and capitalization of our European banks in the last years.

In world-wide comparison it is even worse. When compared to the US, China, and Australia, the largest international peers reach high profitability figures. For instance, the top 5 banks in Australia performed successfully with 15.4% post-tax RoE in 2014, while top 50 European banks yielded poor 5.3% on average. In contrast to top 10 banks in China, CIR of European banks is even twice as bad with more than 60% CIR. Both examples reveal bluntly that European banks face both a serious income and cost problem!

Lastly, from a capital market perspective, the European banking sector is the only industry that has been destroying shareholder value for almost a decade by now. In fact, we see a decrease of 6.1% of total shareholder return (TSR) per year from 2007 to 2014. In the meantime, other industries like healtcare, consumer goods or telecommunications have generated an increase in TSR of up to 10% p.a. Furthermore, banks’ TSR is extremely volatile with yearly differences of up to 116pp. All together, these are neither reliable nor attractive facts for potential investors in the banking sector.

Complexity of European banks – extended scope of simulation

As the vast amount of regulatory initiatives continues to expand it is reasonable to introduce an additional dimension into our simulation: Complexity of banking organizations. This will facilitate a more detailed analysis of the impact of regulatory initiatives and ongoing low interest rate environment, because some initiatives take effect depending on the “complexity” of the bank (in fact, some initiatives aim at reducing complexity).

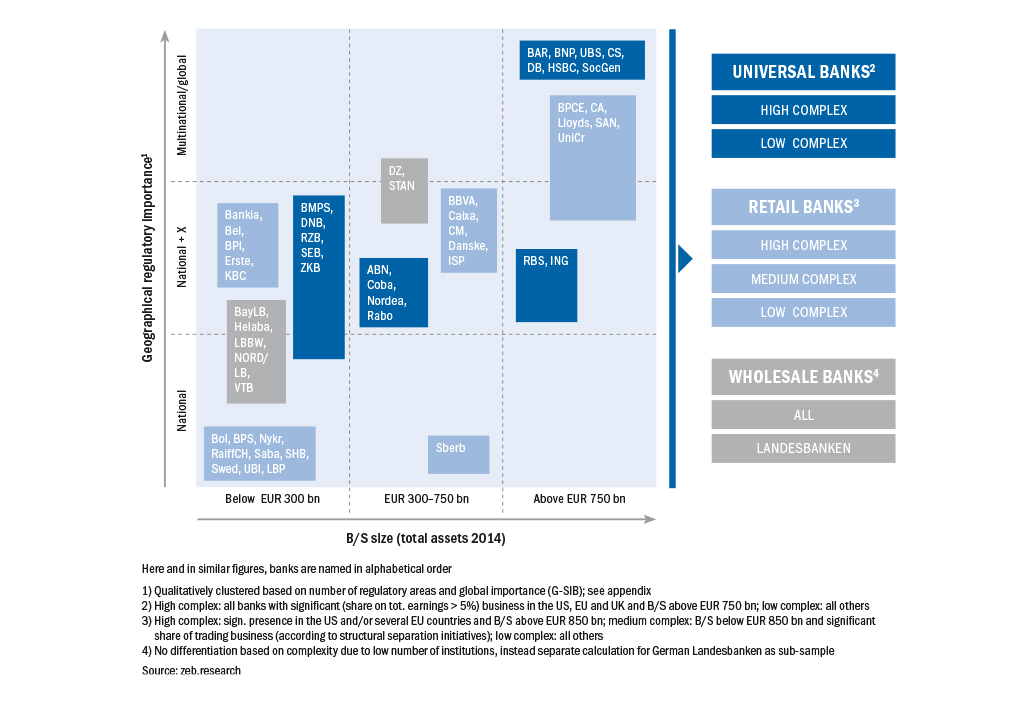

First, in order to incorporate complexity three main drivers have been identified: (1) geographical regulatory importance, (2) balance sheet size, and (3) business model. The first driver considers the number of relevant regulatory areas in which a bank is present. The second driver clusters banks according to their balance sheet size, and the third according to their business model. The later is based on the individual segment results of our top 50 sample. Overall, we distinguish three major types of business models: (a) retail banks, i.e. institutions with a clear focus on private customer segments, (b) wholesale commercial banks with a focus on corporate finance, project financing, investment banking and related areas as well as (c) universal banks that follow a balanced approach with a mix of retail, wealth management, wholesale and investment banking. For instance, Deutsche Bank is categorized as a highly complex universal bank, Commerzbank as a low complex universal bank, Sberbank of Russia as low complex retail, and DZ Bank Gruppe as a wholesale bank. The clustering results according to the complexity dimensions are depicted in the following figure.

Second, the extent of (new) regulatory initiatives (besides Basel III) has to be analyzed. Here, three main initiatives have been identified to be most striking: Structural separation, recovery & resolution plan, and the financial instruments regulation (MiFID II).

Structural separation regulation targets at raising robustness of banks. Therefore, proprietary trading and hedge-fund investments within banking groups are banned. In addition, duplication of organizational structures in the (retail) banking and the trading entity is required. Both effects result in lower profit margin as trading income is reduced on the one hand and additional cost are provoked on the other hand.

The BRRD (Bank Recovery and Resolution Directive) standardizes bank recovery and resolution plans in the European Union since the beginning of 2015. Furthermore, authorities in charge receive powerful tools and rights to interfere early in banks with financially threatening conditions. As a last resort, authorities are even in power to initiate a bank clearing, e.g. by starting with partial sales.

Last but not least, financial instruments regulation (MiFID II) primarily aims at increasing transparency of the trading and sales of financial instruments. Nevertheless, it affects both a decrease in retail revenues and trading revenues and an increase in cost to fulfill given requirements.

As developed for the last year’s EBS, the holistic simulation approach is extended by incorporating latest figures as initial values, the latest regulatory initiatives, and the according impact in dependence of the business model, balance sheet size and geographical presence (i.e. complexity level) of each bank. The results are analyzed with respect to balance sheet, profit, capital, and risk and provide a robust outlook until 2019.

A look into the future – simulation results

The results of this year’s European Banking Study are threefold:

- (Much) Higher profits and additional capital needed

- Capital and income gap too large to be closed by simple mitigation actions

- Global universal banks are hit hardest

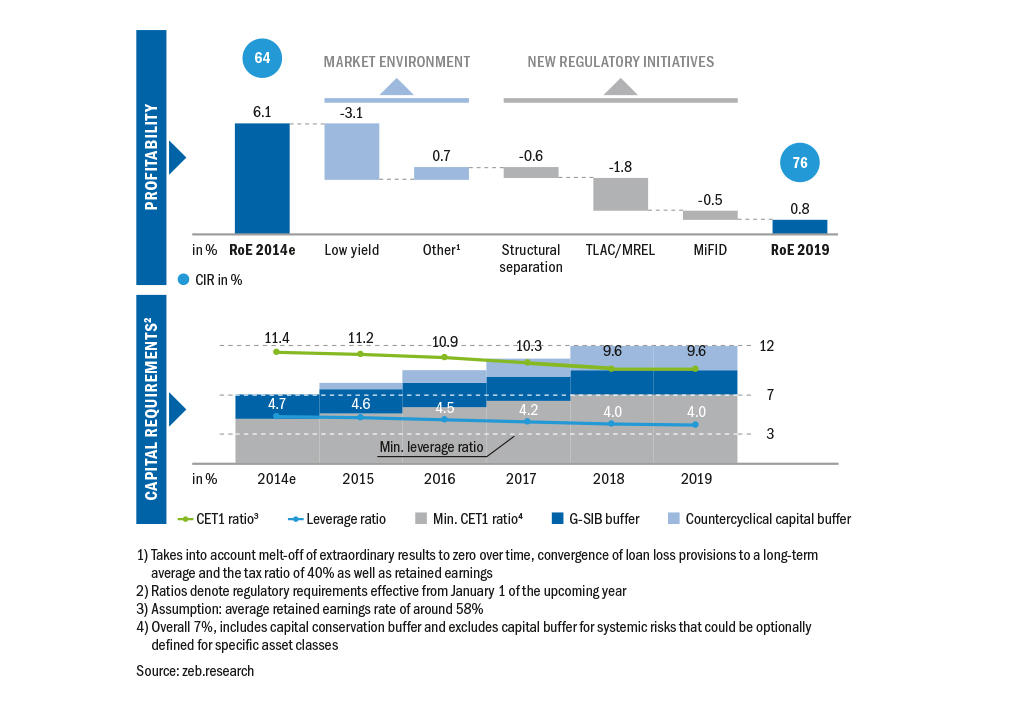

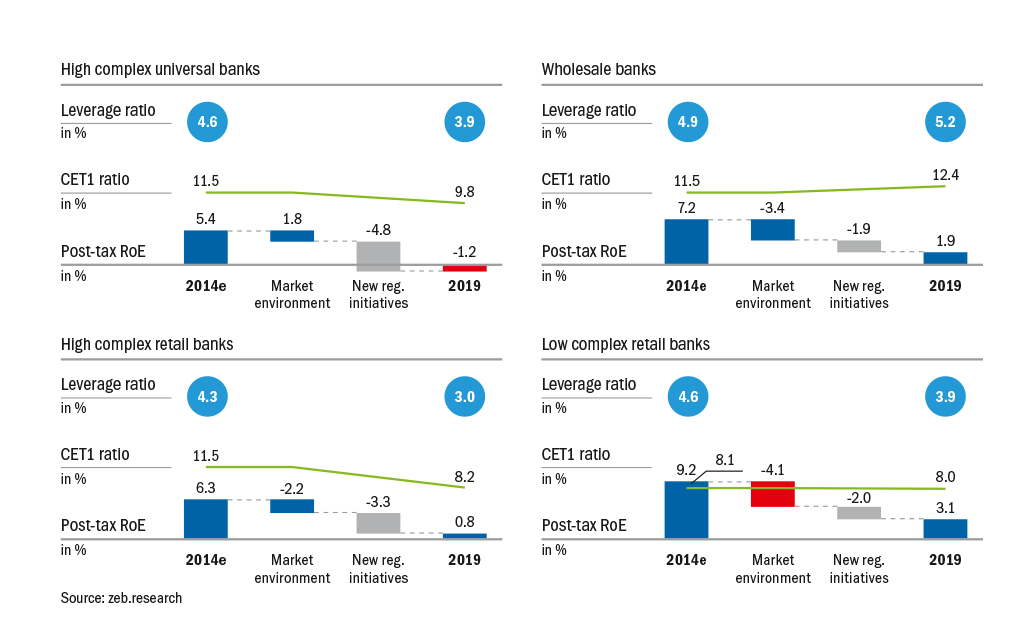

The results of zeb’s holistic baseline scenario (without any management actions, e.g. balance sheet growth, changes to the balance sheet structures or cost reductions) until 2019 demonstrate tremendous consequences (Figure 3): Massive slump in profitability on the one hand and poor capital bases on the other hand. The 2014 post-tax RoE of 6.1% falls below 1%, equally entailed by the weak market environment and massive regulatory disruptions. Capital requirements, primarily CET1 Ratio and Leverage Ratio are continuously decreasing, however, up to a decent level. Leverage Ratio in particular remains above minimum requirements as well as CET1 Ratio – at least as long as the countercyclical capital buffer are disregarded and the minimum required ratio will not be increased.

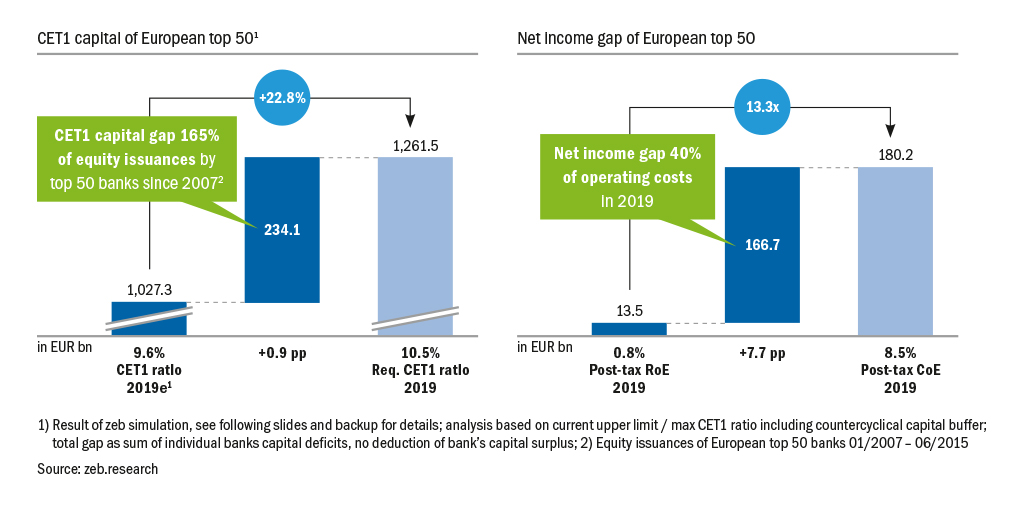

Fixing realistic targets for the CET1 Ratio and the RoE and comparing these figures to our simulation results gives a taste of how large the gap can be and how much capital and income might be needed to bridge the gap. Figure 4 underlines that there is a capital gap of approx. EUR 230 bn. (corresponds to 165% of equity issuances (Equity issuances of European top 50 banks 01/2007 – 06/2015) since 2007) and a net income gap of around EUR 170 bn. (corresponds to 40% of actual operating costs) in 2019.

Finally, the severity of impact varies depending on business model distinguished by level of complexity. Clearly, highly complex universal banks are hit hardest: 2019 post-tax RoE is negative and CET1 Ratio is below minimum requirement. On the other hand, Wholesale banks and low complex retail bank exhibit at least positive RoE’s – Wholesale banks are even properly capitalized. Clearly, the issue of complexity is crucial: complexity kills!

Market outlook and summary

The 2015 European Banking Study revealed ongoing profitability and capital issues for the top 50 European banks. In particular, highly complex banks – measured primarily through geographical regulatory exposure, balance sheet size, as well as business model – exhibit the worst outlook in 2019. While they might keep up with the pressure for the next years – thus surviving, there are clear signs that less complex banks fall prey to their bad profit situation. These effects will even be accelerated by ongoing regulatory pressure and will enforce continuous consolidation of the entire banking sector towards a more oligopolistic structure.

Our simulations showed that the future capital and income gap is too large for simple mitigation actions like equity issuance and cost cutting alone. For European top 50 banks, a further analysis shows that bringing low performers merely up to average income increase will not be sufficient enough to close the income gap. Hence, in order to respond to profitability gap and regulatory pressure appropriately, more substantial and interrelated actions are required, thereby regarding each bank and its peculiar organizational structure individually.

An appropriate response program will be discussed in the upcoming BankingHub article which will be published in mid-December, 2015.

One response to “Complexity kills – How European banking models have to change in a complex world”

William Fohrmann

To whom it may concern,

it is not the complexity that kills !!!! It is the inability of companies to cope with complexity. We all live in complex markets/environments so we have to train our companies to deal with it and not deney it’s existance.

Slice the elephant is NOT (and has never been) the proper solution to complex challenges!

kind regard William Fohrmann