ESG compliance: why comprehensive data collection is indispensable

Regulatory initiatives focus in particular on the financial services industry, which is expected to play a central role in the sustainable management of investments and financial flows. In this context, various regulatory requirements obligate banks to collect and report certain ESG data. The following figure shows the most important regulatory requirements in Europe:

In order to meet these and other regulatory requirements and to be able to derive political, societal and institutional impulses for a sustainable economy in the future, corresponding data must be collected and made usable for the entire lending process. This entails the development of data request concepts, suitable data management tools, and a significant expansion of ESG data storage.

The concrete implementation of the extensive requirements poses functional, processual and technical challenges for financial institutions. One of the main tasks will be to make corresponding adjustments to the lending process and to anchor them in the respective core banking systems. In the following sections, we are taking a closer look at the specific impact of ESG data requirements on operational lending:

- Which ESG-specific data is relevant and how can it be collected?

- What data pools can be identified along the lending process and how do they impact the individual organizational units?

- What technical and process-related adjustments need to be made in the operational lending business?

Setup of an ESG data repository

In order for institutions to assess the scope of requirements for their operational lending business, they need to know what data needs to be collected and how this can be accomplished. However, the type and level of detail of ESG data that institutions need to collect from their customers depends on a number of factors, such as the type of lending transaction or the size and specific ESG risks of the borrower. For example, much more detailed information needs to be collected for complex corporate exposures than for “simpler” retail loans.

In general, the data infrastructure should have as high a level of detail as possible so that specific information on individual borrowers, loans and collateral can be recorded and subsequently processed. The data must also reflect the fact that ESG factors are highly future-oriented. This is evident, for example, in the case of physical climate risks. Assessing those requires scenario data for the next few decades.

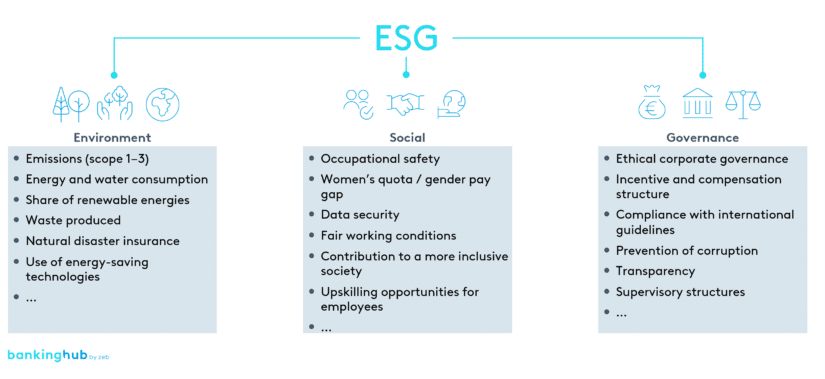

Current regulation focuses primarily on environmental and climate issues (The E part of ESG).[1] In this context, banks must collect information on a customer’s environmental footprint and what measures they take to minimize this impact. Figure 2 provides insight into some of the ESG data related to corporate customers.

In addition, further macroeconomic or scientific data such as climate scenarios and trajectories are required, particularly for risk management/controlling analyses, in order to generate effective steering impulses.

At least for large corporate customers, some data is already available publicly or through links to external databases/providers. In the case of medium-sized and smaller customers, however, institutions are faced with the task of collecting this information in the highest possible quality and yet efficiently through customer surveys or other instruments. Upcoming regulatory initiatives, in particular the CSRD[2], are expected to gradually improve the data situation (in terms of quantity and quality).

On the whole, institutions should embrace the opportunity of collecting customer-related ESG data and, especially at the outset, view it as a differentiating factor and a way to provide more targeted support to their customers.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

ESG data pools along the lending process

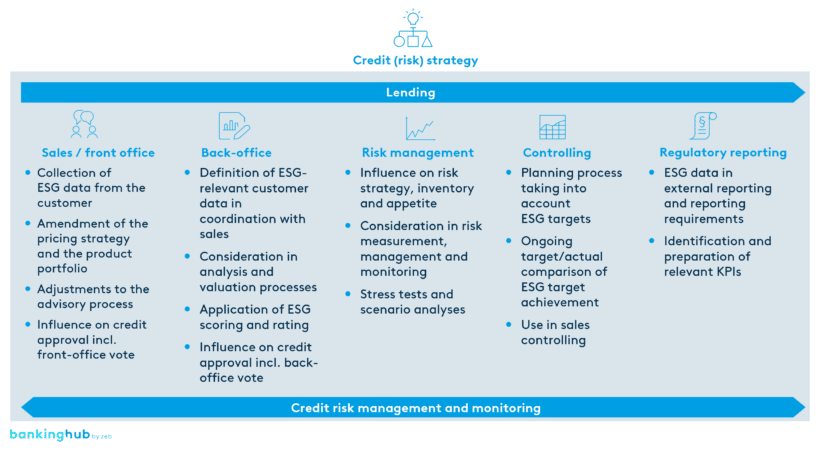

Various data pools are created in in line with regulatory requirements within the different organizational units of the operational lending business, which need to be populated with ESG-specific data.

Basically, ESG data must be anchored in the underlying credit (risk) strategy and integrated along the entire lending process. This ranges from the initial collection of data in the front office by sales staff, through analysis and approval processes in the back-office, to risk management. In addition, the data collected must be incorporated into controlling and processed for reporting purposes. In this context, it must be continuously taken into account in the credit risk management and monitoring processes.

Sales / front office

As the direct point of contact for customers , the sales staff will be facing new challenges in the future but will also be afforded new opportunities. They must explain the necessary background to customers in an appropriate manner, collect the data and then feed it into the institution’s data infrastructure. The front office can then use this data in the lending process to draw conclusions about the sustainability risks of borrowers or investments.

The new ESG data requirements also open up additional opportunities for discussion topics and occasions and generate new sales impulses. For example, ESG-specific information can be used to make adjustments to the product portfolio and pricing, and ideally, to discuss with the customer the necessary adjustment and transformation paths. In principle, we can expect the transformation of the economy and society to generate enormous financing potential.

Sustainability changes banking for good

Customers, highly ready to change banks, are pushing the transformation: consumers are becoming more and more aware of sustainability, and this is increasingly influencing their consumption behavior.

Sustainability changes banking for good

Sustainability is increasingly influencing consumer behavior and is also turning into a key driver for the transformation of the banking industry.

Back-office

The back-office is responsible for reviewing the credit application and monitoring compliance with the ESG policies and criteria, which should be integrated into the institutions’ strategic and operational guidelines and requirements.

Basically, this means that ESG data must be consistently incorporated into various analysis and assessment processes, such as credit scoring or collateral valuation. In addition, the data can be used to derive specific ESG scores or ratings. The data is then incorporated into the voting and the final credit decision.

Risk management

The core of the EBA guidelines and the 7th MaRisk amendment is the holistic integration of sustainability risks into the risk framework. ESG data forms the basis for risk identification and must be taken into account in both risk strategy and risk inventory. Risk appetite must also be redefined. In addition, new procedures for risk measurement, management and monitoring must be developed and existing procedures revised.

Typically, ESG-specific information is used at a granular level in the context of ESG scorings as well as stress tests and scenario analyses to map medium to long-term risks. A high-quality and comprehensive database is required to ensure valid and relevant risk management.

Controlling

ESG data must also be taken into account when monitoring loans and contracts over their entire term. For example, if data on individual ESG factors change for the worse, appropriate measures can be identified and implemented. The data can also be used to draw conclusions for planning and managing corporate objectives. It is possible to make forecasts about the development of assets and thereby avoid stranded assets, for example.

The consistent integration of ESG data ensures that deviations from defined strategies can be tracked. ESG data can also be used in the context of sales controlling.

Regulatory reporting

In the future, regulatory requirements will lead to increased reporting obligations, such as green asset ratios. Relevant KPIs must therefore be identified from the data collected and prepared for reporting. The external reports must be complete and up-to-date, and they must be delivered to the relevant authorities reliably, promptly, and, if possible, without manual intervention.

Process-related and technical adjustments in the operational lending business

Meeting ESG data requirements necessitates specific adjustments to the bank’s organization:

Governance

In order to establish a valid basis for ESG data management, institutions need to define guidelines and general standards for handling ESG-specific data. This should include a specification of the data to be collected and processed, as well as the desired data quality. In addition, strategic and operational responsibilities should be clearly defined within each organizational unit and across divisions, and the necessary resources be made available.

Processes

In order to be able to anchor and process the required data throughout the entire lending business, it is necessary to change the procedural approach in the operational process. Existing processes must be adapted to meet the new data requirements or expanded to include individual process steps.

In addition, it is necessary to check whether existing organizational and work instructions as well as process descriptions need to be adapted or newly created. The additional collection and processing of data can lead to increased administrative work for employees. This is often associated with longer process times, which in turn result in higher production costs. In particular, the collection of data during customer meetings or requirements analyses is likely to require significant adjustments, as ESG data may need to be discussed in detail with the customer and then queried.

Various optimization and automation approaches (e.g. an AI-supported, web-based data collection and advisory tool) should be used to keep the additional effort to a minimum while maximizing the user experience and the benefits for customers and bank advisors. In this context, zeb is currently developing a tool that will significantly support banks in their taxonomy audits.

Taxonomy audit for banks

To facilitate the taxonomy audit for banks, zeb has developed the zeb.taxonomy tool to support banks in the audit process.

Taxonomy audit for banks

In order to simplify the taxonomy audit for banks, zeb has developed the zeb.taxonomy tool to support banks in the audit process.

IT systems

In addition to process-related changes, institutions will also need to make technical adjustments. For example, they may need to create additional data entry fields in the core banking system or provide custom reporting forms. In order to minimize additional processing time, an automated supply of the required forms with the data should be developed.

We also expect the numerous requirements to massively increase the size of the institutions’ data repository. In this context, it is essential to maintain a functional and responsive IT infrastructure.

All in all, the increasing demands on IT investments will result in additional costs for the individual institutions.

Expertise of the employees

As described above, the regulatory requirements will lead to a large number of procedural and technical changes in the operational lending business. Employees will need to implement these changes in their operations. Accordingly, training and education play a crucial role in providing them with the necessary expertise.

To be able to competently advise their customers, employees need to have a thorough understanding of the legal and regulatory framework, while supporting their institution’s ESG (credit) strategy. In addition, they should be trained on what data can be obtained, how it can be collected, what it is needed for, and how further advisory approaches can be derived from this information.

It is crucial that banks recognize ESG requirements as an opportunity for new financing options. In this context, they need to educate their employees about alternative financial products, such as green loans or sustainability loans, and demonstrate how they can support their customers’ transformation towards sustainability.

Conclusion: holistic integration of ESG-specific data into the operational lending business

In summary, ESG data requirements raise a number of issues that banks and other financial institutions need to address in order to meet regulatory requirements and contribute to the EU’s net zero emissions target. Institutions need to develop a holistic approach that takes into account ESG data in all organizational units along the lending process. In addition, banks will be confronted with functional challenges and the necessity to make extensive procedural and technical adjustments.

We expect regulatory and ESG data requirements to continue to expand, while at the same time the amount of relevant ESG information to grow exponentially.