ESG reporting: Background and requirements

Germany, together with other EU countries, is aiming for maximum possible climate neutrality (more precisely: net zero emissions) by 2050 as part of the European Green Deal. In order to meet the ambitious (supra-)national targets, all sectors of the economy are required to act. The financial sector is seen as playing a special role in achieving social and political goals. In this context, regulators and associations/initiatives are requiring institutions to identify, manage and disclose sustainability risks both internally and externally.

The introduction of ESG risk reporting offers opportunities for more sustainable and transparent banking, but also poses particular challenges for institutions. For a targeted implementation, it is necessary to develop ESG data models that significantly expand the existing data repository to include ESG-specific information and subsequently integrate the ESG data into the existing IT.

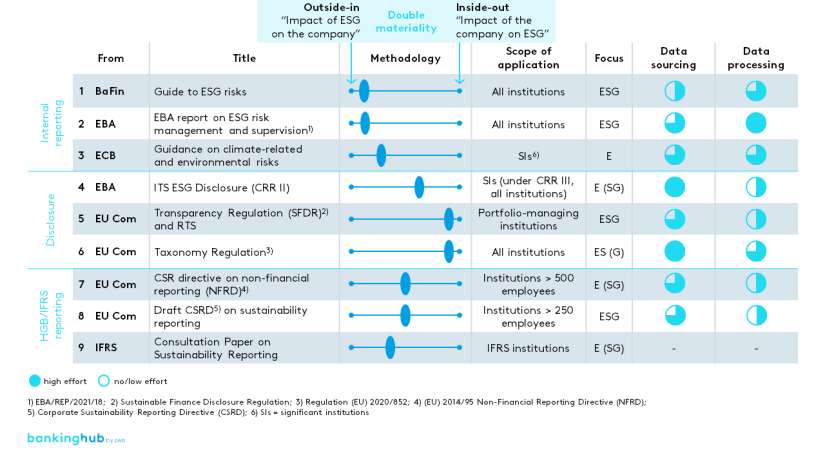

As already explained in the introduction ESG reporting is based on the concept of double materiality which takes two perspectives[2]:

- Outside-in perspective: impact of ESG factors on the performance, market position and development of institutions.

- Inside-out perspective: illustration of how institutions can have ESG-relevant effects on society or the environment.

Reporting initiatives can be categorized accordingly.

- First, initiatives focusing on the reporting of ESG aspects in banking operations (e.g. BaFin Guidance Notice, ECB Guidance and EBA Report) – these essentially take the outside-in perspective.

- Second, disclosure at the institution and product level, the majority of which takes the inside-out perspective and of which the EU Taxonomy is a well-known example. In addition, there are requirements, e.g. from the EU Commission in the context of non-financial HGB/IFRS reporting, which work towards a balanced presentation of both perspectives.[3]

Figure 1 provides an overview of relevant initiatives with an assessment of double materiality. The initiatives are sorted according to the above-mentioned groups “Internal reporting”, “Disclosure” and non-financial “HGB/IFRS reporting”. In addition, indicative assessments of the effort required for data sourcing and processing both in implementation and in operation are provided.

Above all, the initiatives listed mean one thing for institutions: requirements for additional sourcing and processing of ESG data. Thus, for the Green Asset Ratio, the compliance coefficients are to be collected from the respective counterparties from the management reports – if available there – or bilaterally.

For example, energy efficiency classes for real estate or motor vehicle financing are to be obtained from the borrowers. For disclosure and internal reporting purposes, data on greenhouse gas emissions from financed customers (in emission scopes 1, 2 and 3) and on physical risks such as flooding in certain regions must also be identified at the customer and individual contract level.

The data collected must also be integrated into stress tests, where it must subsequently be aggregated once again and processed for reporting.

Challenges in setting up ESG data repositories

To implement the new requirements, institutions have to consider additional specific challenges with regard to ESG reporting besides the fundamental issues of data sourcing and processing:

- Lack of a universally applicable ESG reporting standard, so that institutions have to consider different standards with different data requirements

- Definition of targeted ESG reporting performance indicators (KPIs) while taking into account their steering effect

- ESG data collection – in order to master ESG reporting, including the integration of relevant KPIs, appropriate, high-quality data is needed that is also at the right level of granularity and covers the required industries and region

The three challenges mentioned above are outlined below.

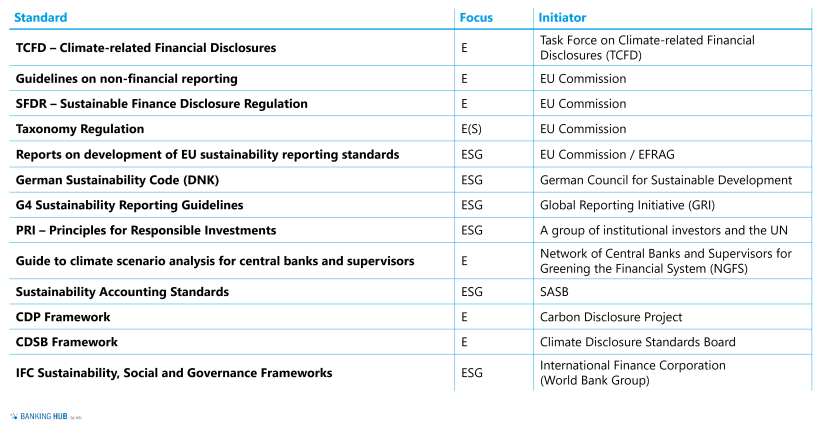

Lack of a universally applicable ESG reporting standard

Due to their high relevance, reporting standards on ESG are being developed by a wide variety of bodies. In recent years, a large number of frameworks, standards and metrics[4] have emerged in an estimated total number of over 600 individual publications.[5] Standards are issued by both government agencies and private initiatives – those with high relevance for German institutions are listed in Table 1.[6]

Overall, it should be noted that there is currently no generally applicable standard and that the regulatory initiatives refer to the various frameworks when defining requirements. As a result, institutions have to apply a variety of standards and, consequently, a variety of different data requirements.

In order for the addressees to be able to understand the reporting at all and to compare it across banks, a generally applicable standard should be in place. In light of this, the EU Commission has published the Delegated Regulation supplementing Article 8 of the Taxonomy Regulation.

In conjunction with the Corporate Sustainability Reporting Directive (CSRD)[7] the application of a uniform EU-wide reporting standard for non-financial information is implemented and extended to a much broader user base. This standard is to be developed by the European Financial Reporting Advisory Group (EFRAG) by mid-2022 and applied in companies and institutions from 2023. According to the EU Commission’s schedules, the first reporting is to take place in 2024.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Definition of targeted and relevant KPIs

In a first step, generally applicable KPIs without industry differentiation of existing standards such as the GRI[8] and EFFAS[9] should be adopted. The standards define the respective minimum content for reporting. In addition to universal standards, the German Sustainability Code (DNK) recommends the use of industry-specific KPIs. The NFRD, for example, lists Sustainable Development Key Performance Indicators (SDKPIs) for 68 industry sectors as non-financial performance indicators.[10]

The EBA proposes the following KPIs for institutions, for instance:[11]

- Environmental: greenhouse gas emissions in CO2 equivalents, energy consumption (in gigawatt hours) and water consumption (in metric tons)

- Social: business activities in rural, underdeveloped areas; women’s quota; employee training programs; data security measures

- Governance: compliance with OECD guidelines, availability of diversity strategies, adherence to reporting obligations

In a second step, the selected KPIs are to be reviewed with regard to their suitability and coherence. On the one hand, general ESG KPIs ensure comparability between different industries; on the other hand, the accuracy and validity of the results are not as precise as with industry-specific KPIs. For institutions, this initially results in the need for an institution-specific selection of suitable KPIs, which ultimately have to be adapted to external reporting requirements.

ESG data collection and integration into the credit process

Institutions can obtain data either from external data providers or by means of internal data collection.

Although a consolidation of ESG rating providers is already taking place in the market, there is still a multitude of different ESG ratings, scorings or rankings. Currently they tend to cover only listed companies or companies subject to NFRD as the external data providers usually only consider publicly available information such as sustainability reports.

Due to the high proportion of unlisted companies and SMEs in the portfolios of German institutions, the incumbent providers are therefore not entirely suitable for enriching the data repositories with the necessary ESG data[12].

Because of these limitations regarding external data providers, institutions face the challenge of collecting data internally, i.e. in-house, to validate external data and to fill gaps caused by missing or poor-quality data. Integrating data collection into the credit process poses the biggest challenges.

As already explained, institutions must, for example, provide information on the respective energy efficiency classes of real estate collateral, compliance of the use of funds with the Taxonomy Regulation or CO2 emissions of Scope 3 from their customers. Therefore, it is necessary to obtain the required data bilaterally – for example, through customer meetings or questionnaires sent to customer groups. Sales personnel must be trained for this purpose.

Furthermore, the subsequent steps in the credit process need to be adjusted. At the end of the day, the data repository must contain the relevant ESG data for risk management, financial controlling and reporting purposes. Therefore, the adaptation of the credit process is one of the main tasks. It should be planned as comprehensively as possible to avoid repeated interventions so that all relevant ESG data requirements are covered.

Success factors in implementing ESG reporting

In order to meet the various requirements of ESG risk reporting, a comprehensive integration of ESG information into the data already held by institutions is necessary. At the same time, they need to further develop their lending policies and processes to adequately address ESG risks.

For the institutions, the greatest challenge lies in fully coping with the myriad requirements for the different areas of the bank. Thus, for ESG reporting, the integration of risk management, accounting and reporting in particular must be driven forward continuously. Institutions should also reflect on appropriate governance, such as the preparation, collection and aggregation of ESG data, among other things.

Outlook ESG reporting

Developments in ESG reporting are dynamic, and universal standards as well as best practice approaches are gradually emerging. Institutions need to assess the relevance of the requirements for their business operations and estimate the urgency and importance of the initiatives based on the impact on their business model and the associated implementation costs. They can then use these assessments to develop an institution-specific implementation road map.