State of the banking industry

- Global top 100 bank shares are among the winners of the Q1 market rally, as increasing inflation expectations spread from the U.S. and raise hopes for higher interest rates.

- The TSR of the global top 100 banks outperformed the market again with +16.8% QoQ – especially U.S. banks showed a strong performance of +22.6% YoY (Western Europe: +18.2%, BRICS: +10.9%).

On the back of an improving economic outlook and ongoing expansive monetary policies around the world, global capital markets continued their year-end rally and are taking off to new heights. Global top 100 banks are among the winners of the first quarter of 2021, as increasing inflation expectations spread from the U.S. and raised the hope for higher interest rates. The TSR of global top 100 banks outperformed the market again with +16.8% QoQ and achieved the best TSR across all industry sectors. Especially U.S. banks showed a strong performance of +22.6% QoQ (Western Europe: +18.2%, BRICS: +10.9%).

- Global banks’ market capitalization has almost fully recovered and reached pre-pandemic heights. The market cap of global top 100 banks is up by +18.7% QoQ (+43.6% YoY). The market as a whole (MSCI World), however, grew by just +9.0% QoQ (+43.4% YoY) but reached a new all-time high.

- Average P/B ratios of the global banking sector continued their positive trend. U.S. banks’ valuation showed the strongest improvement of +0.26x to 1.41x, the highest value in the last three years. Western European banks’ as well as BRICS banks’ ratios increased slightly by 0.9x respectively, ending Q1 still below pre-pandemic levels.

- In Q1 21, global bank shares made up for the 2020 losses – TSR of global top 100 banks is +10.1% compared to Q4 19. However, European banks’ TSR is slightly behind with -5.0% while U.S. and BRICS banks show values of +16.5% and +7.9% respectively.

- Credit Suisse is the only bank among Western European banks to show a negative TSR. Although the Swiss bank surpassed analysts’ expectations in 2020, bad news hit the banks’ shares massively: after painful losses in the Greensill scandal, the bank announced a CHF 4.4 bn charge related to the insolvent American hedge fund Archegos.

Economic environment and key banking drivers

- After a historic year 2020, the global economic recovery from the COVID-19 pandemic seems to accelerate in the first half of 2021.

- The overall improving economic outlook raised fears of higher inflation in most major regions – in the U.S., inflation is expected to pick up strongly in 2021, reaching levels close to 3.0%.

- Global banks’ Q4 results are still defined by the impact of the COVID-19 pandemic, which, however, differs across regions. In Q4, U.S banks’ average quarterly RoE improved to 13.0% while European banks’ RoE dropped again to 2.6%.

After a historic year 2020, the global economic recovery from the COVID-19 pandemic seems to accelerate in the first half of 2021. Especially in the U.S. and China, GDP growth is expected to improve significantly while a slow vaccine rollout and the intensification of a third coronavirus wave is expected to inhibit Western European GDP growth in Q1 2021. The overall improving economic outlook raised fears of higher inflation in most major regions. In the U.S., inflation is expected to pick up strongly in 2021, reaching levels close to 3.0%, which has also pushed up the long end of the U.S. yield curve.

- On the back of the massive stimulus program by the new U.S. government as well as the vaccination turbo, U.S. GDP is expected to grow by +4.7% in Q1 and around +7.0% in Q2 and Q3. The Western European economy will have to wait another quarter for a recovery, but double-digit growth is expected for Q2 2021 (+13.9%).

- The Western European deflationary trend is expected to end with the year 2020. Inflation is accelerating in 2021 and may reach 2% by the end of the year – inflation in Germany might even approach the 3.0% mark.

- The U.S. yield curve steepened remarkably in Q1 and the 10Y-LIBOR rate jumped up by 83 BP, as inflation fears spread into the market and the Fed decided to leave interest rates untouched. The long end of the euro area yield curve also increased but the 10Y-EURIBOR still lingers at 0.01% as the ECB announced that it would fight rising rates with “whatever it takes”.

- In Q1 2021, the GBP gained further ground against the EUR (+5.7% QoQ), mainly driven by the hope that the good vaccination progress will quickly kick-start the British economic recovery. With the beginning of 2021, EUR ended its upward trend against USD but remained at the high level of 1.18.

Global banks’ Q4 results are still defined by the impact of the COVID-19 pandemic, which, however, differs across regions. U.S. banks benefited from an improving health situation due to a fast vaccine rollout and thus brighter economic outlook while European banks operated in an environment of continuing uncertainty. These differences are also reflected in banks’ profitability figures – the average quarterly RoE of U.S. banks improved further in Q4 and reached 13.0% (+2.0%p QoQ) but European banks’ RoE dropped again by -4.9%p QoQ to 2.6%.

- After a strong Q3 across all regions, only U.S. banks were able to continue the positive RoE trend in Q4 2020. U.S. banks had yet another strong quarter with slight earnings growth (+1% QoQ) but also boosted profits with very low LLPs, thus surpassing pre-pandemic profitability levels (+5.5%p YoY).

- European banks have to cope with overall decreasing earnings (-5.0% QoQ) and a disproportionally higher cost base as some seasonal HR expenses or additional costs in line with ongoing restructuring plans (especially of some large European banks like Santander) were posted in the final quarter of 2020. In Q4, cost-income ratios of European banks jumped up by +25.4%p QoQ to 85%, a level far above that of any other regions.

- After massive postings of LLPs in the first half of 2020, U.S. banks significantly reduced and even released risk provisions in Q4 and ended 2020 at 0.03%. Most of the European banks, however, remained cautious and LLPs rose by +3.0%p Q0Q due to rising infection rates and further lockdowns across Europe since December 2020.

- Peaking euro area corporate loan rates in Q3 came down again, ending at -10bp YoY. Rates for consumer and mortgage loans, as well as deposits, were also below previous years’ levels, with mortgage loan rates even decreasing by -16bp.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic: Inflation and increasing interest rates

Big comeback or just a dream?

- Inflation and “normal” interest rates almost seemed like a phenomenon of the past and banks had already resigned themselves to Japanese conditions.

- One year into the pandemic, inflation expectations are now rising again and government bond yields have increased – a realistic glimmer of hope for the banking sector?

- At least in the near term, inflation is likely to come back while rate hikes or a significantly steepening yield curve – at least in Europe – seem rather unlikely.

Inflation and “normal” interest rates almost seemed like a phenomenon of the past. As COVID-19 hit the whole world, most of the economists and bankers agreed: the pandemic has cemented the low yield environment for the years to come and the financial sector should adapt to Japanese conditions – especially in the euro area. One year into the pandemic, inflation expectations are now rising again and government bond yields have increased. Are these recent events a realistic glimmer of hope for the banking sector or just a short-lived movement?

For many years now, economic policies and financial markets have had to deal with low inflation rates, especially in Europe. Despite economic growth, central banks had great difficulty meeting their self-imposed inflation targets and even pushed interest rates into the negative. Classical macro-economic theories, explaining increasing inflation by decreasing unemployment (Phillips curve) or excess money supply (monetarism) seem to have lost their validity. Instead, other reasons for the absence of inflation have come into focus. Firstly, as life expectancy increased significantly, the preference for high living standards in retirement has become more important and saving rates are much higher than those of previous generations.

As a result, inflation has been visible in asset prices rather than consumer prices. Secondly, the growth of the supply side for goods and services has predominated demand. Globalization, and especially outsourcing, kept prices low, as did increased efficiency due to automatization and digitalization. The term of “Japanification” – describing permanently low economic growth, low inflation and lower forever interest rates – established itself in the market. A bleak outlook for the banking industry.

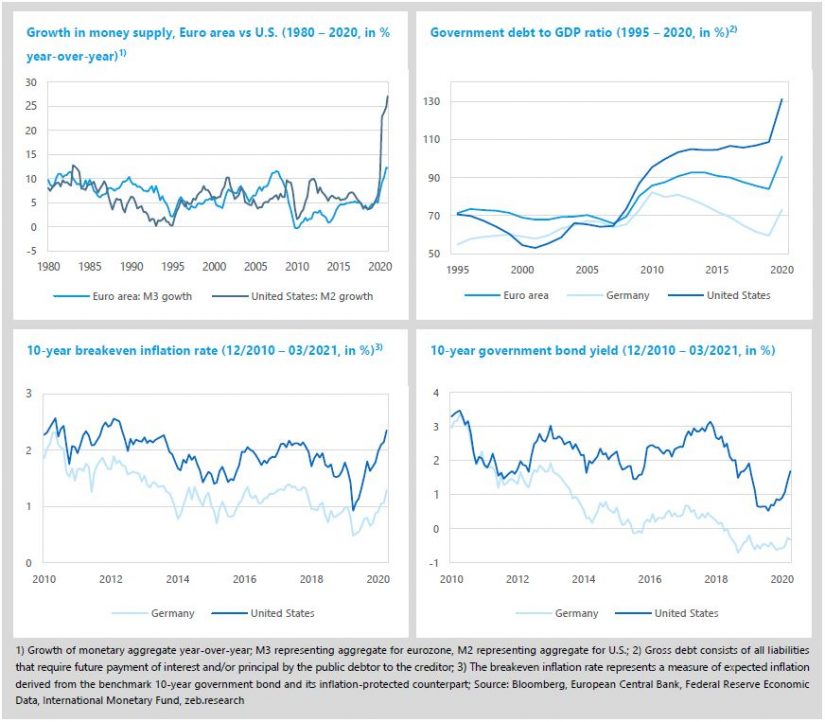

In the course of the COVID-19 crisis, however, the discussions about inflation came back on the agenda. Central banks around the world have eased their, in part already ultra-loose, monetary policy leading to significantly growing money supply. For instance, in the U.S., the representative money aggregate M2 grew by 27.1% YoY in March 2021, by far a record high for more than 50 years. The corresponding money supply in the eurozone (measured as M3) also reached a new peak value of +12.6% YoY. At the same time, the massive governmental aid programs pushed fiscal deficits to wartime levels. Gross public debt to GDP in the eurozone increased to an all-time high of 101% and U.S. figures jumped to 133%, the highest value in U.S. history – the latest $1.9 trillion stimulus package not even included.

The fear of inflation is spreading in the markets as a sharp economic recovery and rising demand but lasting reductions in supply due to still disrupted supply chains could substantially drive up price levels. A controversial discussion among economists has arisen as to whether those developments in line with a reversal trend of globalization and a decreasing working population due to an already aging society could lead in the medium to long term to a comeback of inflation, with potential rates we have not seen in a generation.

In fact, inflation expectations have increased continuously since September 2020. Especially in the U.S., the fundamental indicator of long-term inflation expectation – measured as the yield spread between nominal and inflation-linked bonds – reached the highest value in nearly 8 years. Moreover, with consolidating inflation expectations, interest rates have also climbed recently in anticipation that central banks will be forced to counteract. At the end of March, the 10-year U.S. Treasury yields rose to 1.69%, the highest value since December 2019. Those developments are also becoming visible in Europe, albeit to a lesser extent. For instance, the inflation indicator for Germany has also risen continuously and stands at the highest level since the end of 2018. The 10-year German government bond yields are still negative but have temporarily improved in Q1 2021.

Of course, the real inflation outcome is still uncertain, but the consensus view is that consumer prices will accelerate over 2021 and 2022 but slight overshoots will not be persistent (as described in the previous chapter). However, will inflation bring interest rates back and help European banks to substantially improve their profitability and further boost their market valuations? In a potential Goldilocks scenario of modest inflation accompanied by modest rate rises, Stuart Graham, one of the most renowned banking analysts in Europe, showed in his analyses that even a +100bps parallel shift could boost European banks’ profits by +20%[1]. Further good news for an ongoing positive development of banks’ share price performance.

Unfortunately, higher inflation does not automatically lead to higher interest rates and only the latter is a direct “profit booster” for banks. The impact of inflation on the banking industry will therefore mostly depend on central banks’ reactions to a potential rise in inflation. Central banks like the Fed or ECB with symmetrical inflation targets and an expanded toolbox for fixing the yield curve (yield curve control) could try to freeze money and capital market rates and thus lift negative real interest rates to historic highs. Both central banks already announced that a temporarily overshooting of inflation is possible without hiking rates.

Moreover, the very high level of governmental debt could force central banks to intervene at the long end of the yield curve. Especially the ECB has made it very clear that they will not only keep short-term rates at record lows for long but will also not tolerate any sharp increases in long-term yields. This was already noticeable at the end of March when the ECB increased the pandemic emergency bond purchase program (PEPP) in order to ensure favorable financing conditions across all economic sectors. As a result, yields on European government bonds fell significantly. However, a scenario of moderate inflation but without higher yields could continue to keep financial markets bullish – a development that could be beneficial at least for European banks’ share prices too.

Overall, Friedrich von Hayek’s much cited tiger of inflation has awakened from a deep sleep and the fear of higher inflation is not unfounded – a scenario that central banks need to be vigilant about. At least in the near term, inflation is likely to come back while rate hikes or a significantly steepening yield curve – at least in Europe – seem rather unlikely. For European banks such a scenario would only imply business as usual and dreaming of higher rates. Inflation will not be able to solve the fundamental problems of the European banking industry. Several banks are still in the middle of a restructuring process, which should be pursued – higher interest rates can only bring some relief here.