Economic turmoil and soaring interest rates cause markets to slump

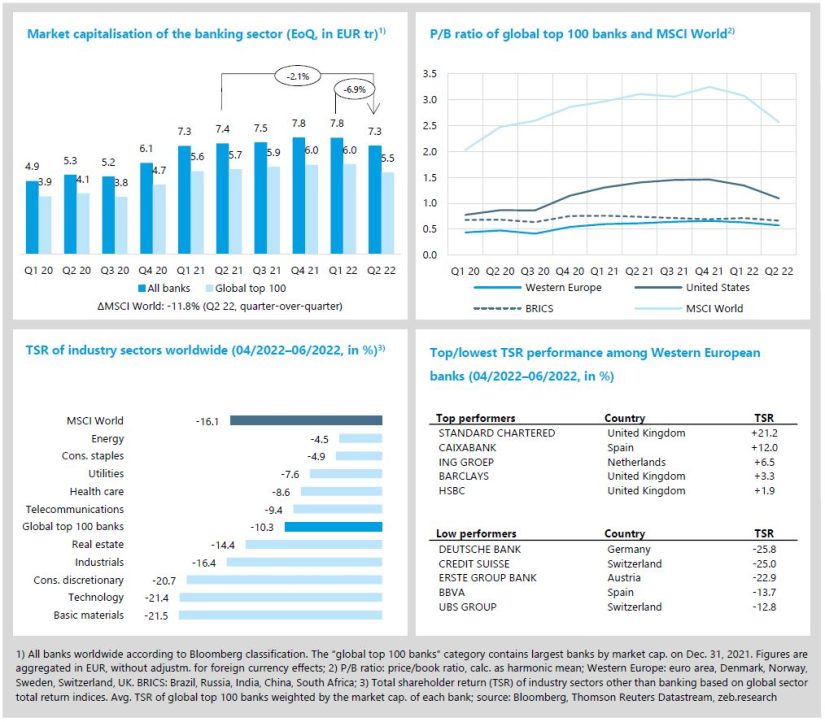

-10.3% QoQ TSR performance of the global top 100 banks

- Correction mode on global capital markets intensified in Q2 2022 as ongoing economic uncertainty and soaring interest rates weigh heavily on share prices.

- Global top 100 banks TSR reduction was mainly driven by U.S. banks with ‑17.5% QoQ while Western European banks’ TSR decreased by -4.9%.

Correction mode on global capital markets intensified in the second quarter of 2022 as ongoing economic uncertainty and soaring interest rates weigh heavily on share prices (MSCI World TSR -16.1% QoQ, market capitalisation -11.8% QoQ). The global top 100 banks’ TSR decreased by only -10.3% QoQ (market capitalisation -9.3% QoQ) and was driven primarily by U.S. banks (-17.5% QoQ) as corrections of Western European banks (-4.9% QoQ) and BRICS banks (-4.6%) were less harsh in this quarter.

- In the first half of 2022, global top 100 banks experienced comparably modest TSR declines of -8.5% (market capitalisation -8.7%) compared to the overall market (MSCI World TSR -20.3%, market capitalisation -15.0%). While Western European banks lost only -5.6% shareholder value, U.S. banks’ average TSR slumped by remarkable -23.9 (BRICS banks: -0.7).

- Average P/B ratios showed a corresponding downward trend in Q2 (MSCI World -0.51x QoQ to 2.56x). European banks’ average valuation declined by just -0.06x QoQ and remained around the low level of 0.60x. U.S. banks’ average P/B ratio dropped from -0.25x QoQ to 1.09x and thus approaches the important 1.0x line (BRICS banks: -0.05x QoQ, 0.66x).

- Among the Western European top performers of Q2 2022 are three UK banks with less significant Russian exposure and an overall stronger focus on Asia – Standard Chartered and HSBC made the top 5 for the second time in a row (+15.3% and +20.5% in Q1 2022, respectively).

Inflation brings back interest rates

+7.6% YoY expected Western European inflation rate in Q2

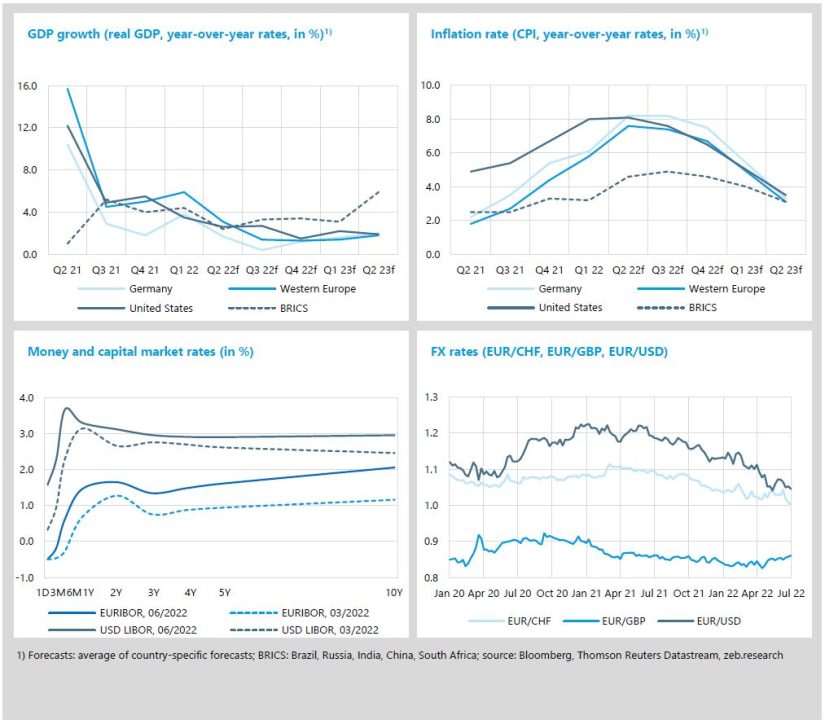

- Global economic development is markedly affected by the Russia-Ukraine war, China’s “Zero-Covid-Strategy” as well as a more restrictive monetary policy.

- Record-high inflation rates continued to drive medium- to long-term interest rates upward and force central banks to act decisively.

Global economic development is markedly affected by the Russia-Ukraine war, China’s economic dampening “Zero-Covid-Strategy” as well as a significantly more restrictive monetary policy (especially in the U.S.). These are impeding the economic recovery from the Covid-19 crisis. Record-high inflation rates expected in Q2 2022 (Germany +8.2% YoY; Western Europe +7.6% YoY; U.S. +8.1% YoY; BRICS +4.6% YoY) and expectations of a rather slow recovery to lower levels continued to drive medium- to long-term interest rates upward and force central banks to act decisively.

- The GDP forecast for Europe and the U.S. remains low for the upcoming quarters. For Germany, the lowest upcoming GDP growth rate is expected to be in Q3 2022 (+0.4% YoY), with a slow recovery by Q2 2023 to +2.0% YoY, surpassing the average GDP growth of Western Europe (+1.8% YoY) as well as of the U.S. (+1.9% YoY).

- In Q2 2022, inflation is expected to reach new highs in Western Europe and the U.S. before steadily decreasing to a still elevated and above target level (Western Europe +3.1% and U.S. +3.5% YoY in Q2 2023). The record-high inflation rates have led to significant action by the central banks. On July 21, the ECB decided on the first, unexpectedly strong, rate hike of +50bp while the U.S. Fed will decide on its fourth on July 27, 2022 (again +75bp). The USD and EUR yield curves shifted upwards, and the still inverted U.S. yield curve (6M: 3.7%; 10Y: 3.0%) reinforces fears of a recession.

- EUR lost strongly against USD and CHF. End of Q2 2022, the EUR/USD dropped to 1.04 and even fell below parity at times in mid-July – thus, the EUR/USD reached its lowest value in almost 20 years.

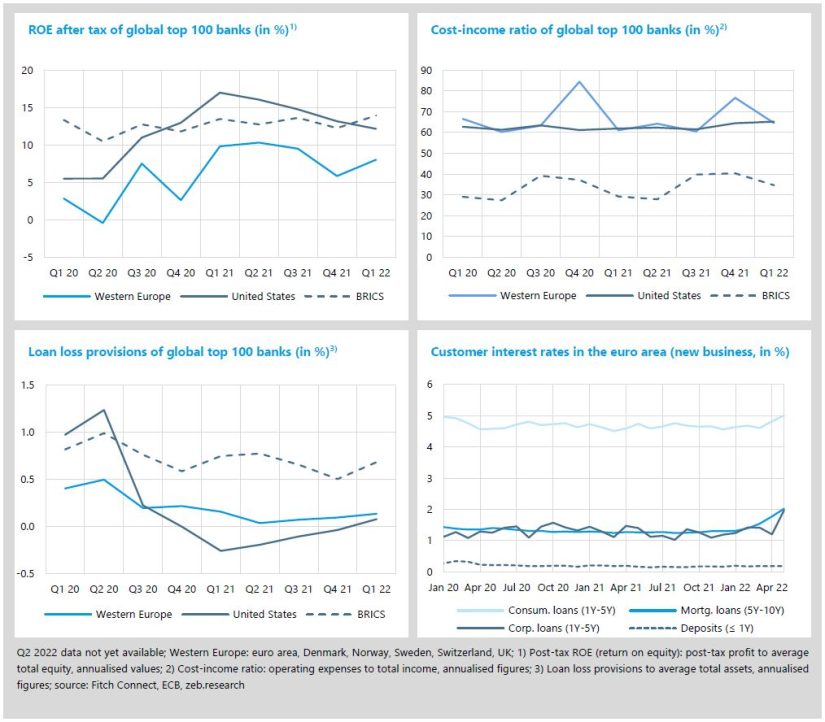

The economic slowdown, high inflation and increasing interest rates make for difficult banking environment at the moment. In Q1 2022, profitability of U.S. and European banks dropped YoY (-4.8%p and -1.8%p) against a very strong first quarter 2021, but remained on good levels of 12.2% and 8.0%, respectively. BRICS banks reported an average quarterly RoE of 12.3% (+0.5%p YoY) and surpassed U.S. banks once again. For the time being, the current economic developments are hardly visible in the banks’ KPIs, but they will materialise in the coming quarters (see our special topic for details).

- Western European banks’ average cost-income ratio is back at U.S. levels of around 65% and only increased moderately in Q1 compared to last year’s value (+3.5%p YoY). The increase is primarily driven by higher costs (+7.6% YoY), as revenues grew by only +1.8% YoY. U.S. banks’ CIR showed a similar development, with costs +8.3% YoY but revenues +2.7% YoY.

- In Q1 2022, U.S. as well as Western European banks further increased their loan loss provisions (LLPs) in anticipation of effects from the economic turmoil. U.S. banks’ risk provisions grew further by +0.11%p QoQ and are again positive (0.08%). Western European banks still hold some reserves, built up during the COVID-19 crisis, and thus increased LLPs by just +0.04%p QoQ to 0.13%.

- The impacts of euro area yield curve effects are increasingly reflected in elevated customer rates. Consumer loan rates came in at 5.01% at the end of May and are +0.37%p higher than at the start of 2022. For mortgage (May 2022: 2.02%) and corporate loans (1.97%) the increases are even stronger with +0.71%p and +0.73%p, respectively. Deposit rates are expected to slowly rise as well – as soon as the effects of ECB rate increases will (partially) be passed on to customers in Q3 and Q4 2022.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic: Soaring interest rates in turbulent times

Soaring interest rates in turbulent times

- It is official: The era of zero interest rate levels seems to be over, but banks are currently not dealing with an isolated and gradual rate increase.

- What is the total impact of these developments on European banks and how do capital markets assess the new, potential opportunities for the sector?

As of last week’s ECB meeting, it is official: The era of zero interest rate levels seems to be over. In general, soaring interest rate levels are perceived as an unambiguous upside case for the banking sector. However, banks are currently not dealing with an isolated and gradual rate increase. Instead, the overall global (capital) markets are in turmoil – inflation seems to be consolidating and economic growth is faltering. Therefore, we want to explore the total impact of these developments on European banks and how capital markets assess the new, potential opportunities for the sector.

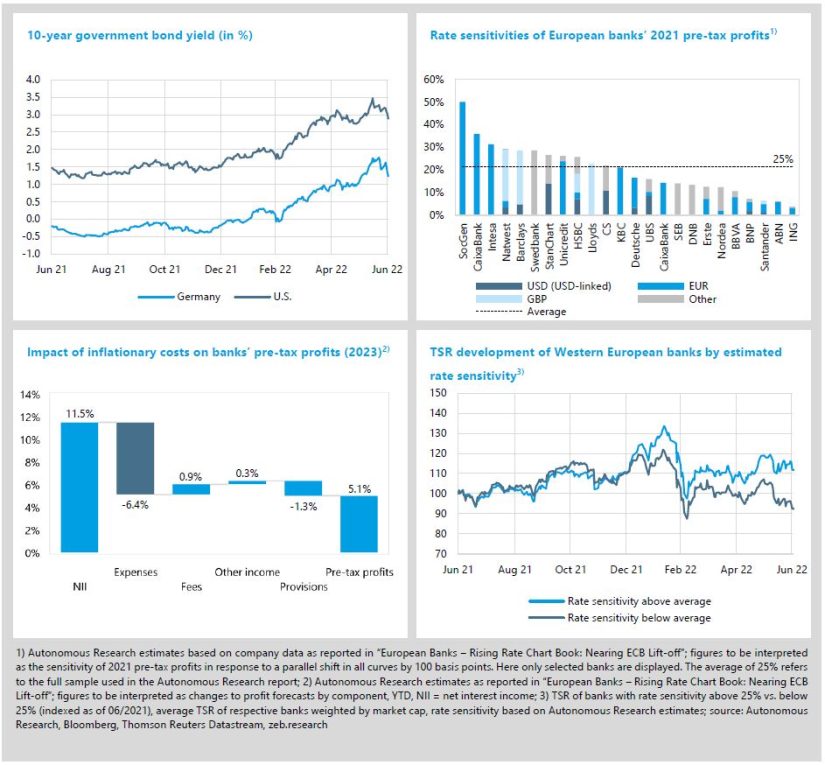

The interest rate environment had already gained massive momentum long before the U.S. Fed as well as the ECB decided to tackle the inflationary trends. Between mid-December 2021 and the end of June 2022 yields on euro area 10-year government bonds rose by around +170 bp (from -0.40% up to 1.3% end of June) and 10-year U.S. yields by around +150 bp. Especially with the beginning of the Russia-Ukraine war, those yields have increased significantly, accompanied by central banks’ rate hikes of 50 bp (ECB) to 75 bp (Fed) most recently. These rapid and strong increases in market rates over the past months have put instantaneous pressure on capital markets, both equity and bond markets, and thus have led to painful losses in the portfolios of the investors, including banks.

Consequently, banks with a high share of proprietary investments will experience noticeable cuts in their valuation results for 2022. For now, it is quite difficult to pin down the effect to an exact number. However, it will definitely be reflected in banks’ P&L and thus heavily weigh on banks’ full year results 2022.

Of course, with higher interest rates, banks will be able to earn more money again in the longer term. This effect will obviously be influenced by the structure of banks’ balance sheets but also depends on the extent to which banks pass on higher rates to their customers. On the one hand, customers are looking to reap higher yields from their deposits, and banks should be inclined to grant higher interests on deposits. This competition for deposits might lead to an erosion of the potential profits. Autonomous Research, one of the leading global financial sector research firms, provides some interesting figures here. Historically, European banks have assumed an approximate 50% pass-through to their depositors.

Coming from a negative/near-zero interest rate level, though, it may be expected that banks will behave much more cautiously this time – especially those which rely on favourable refinancing via deposits. Empirical evidence from Czechia supports this notion: Policy rates there were recently increased by 550 bp resulting only in a 20% pass-through. How long such behaviour is possible certainly depends on customer inertia and competitive dynamics in the sector. On the other hand, some market participants, mainly investors, fear that increased competition on new loan pricing puts downward pressure on the positive effects from increasing interest rates.[1] Particularly smaller and non-shareholder-value-driven banks, such as cooperative and savings banks, might find themselves feeling the urge to pass on spreads to their members and customers. However, such economically irrational behaviour is currently not observable in the banking market.

Therefore, viewed in isolation, banks’ profits will benefit from the improving yield environment. According to a recent rate sensitivity analysis by Autonomous Research, a parallel shift of +100 bp in all curves could lead to an increase in pre-tax profits by 25% in major European banks (based on 2021 figures). The effect, however, is very heterogenous across European banks, ranging from ~50% for Société Générale to just ~0.5% for ING.[1] For the German Banking sector, previous stress scenario analyses by the German Bundesbank support these findings. They consider a +200 bp hike and see pre-tax profits rise by up to 38% within four years.[2]

However, with higher customer rates, borrowers are also faced with higher interest charges. These higher loads, together with a possible decline in real income as the economic environment deteriorates, could bring credit risk back on banks’ agenda. Analysts do not yet see a significant increase in loan losses as an urgent threat. Scenario analyses by Autonomous Research suggest that default numbers will not nearly be as high as in 2008/2009 or during COVID-19 peak times in 2020. Furthermore, early indicators do not show signs of a recession materialising any time soon – but this should not be ruled out entirely.

Finally, a further immediate and pressing threat to European banks’ P&L will emanate from inflationary costs. High energy prices, distressed global supply chains and a weak euro still drive inflationary trends. Autonomous Research, assume a 4% increase of bank-relevant costs even in 2022. Moreover, those cost increases are likely to absorb roughly 50% of policy rate induced revenue upgrades made by analysts.[1] Whether last week’s advance by the ECB to increase policy rates by 50 bp is sufficient to stabilise inflation rates in the euro zone is questionable. In any case, at least some additional cost increases are to be expected within the next years, which will counteract the cost-cutting programmes of many European banks.

At the bottom line of all these effects, banks seem to benefit from significant revenue potential – at least from 2023 onwards. For some European banks, this can also clearly be seen in current capital market valuations. Although the overall market valuation of the banking sector considers the current downside risks (i.e. negative impact on valuation results), looking at the TSR development of the 23 European banks within our top 100 sample, banks with an estimated rate sensitivity above average show stronger results. While the performance of the banks was very similar during the second half of 2021, rate sensitive banks’ TSR developed much better since the beginning of 2022. Compared to June 2021, more rate sensitive banks’ TSR improved by +12% YoY while less rate sensitive banks’ TSR fell by -8% YoY.

The banking sector is still facing challenging times and banks’ 2022 results will certainly be negatively impacted by the latest developments. In the medium to long term, however, the return of the interest rates will create new opportunities. Currently, it is not yet clear how much the banking sector will benefit from the rising yield environment – and not all banks will benefit equally. A key factor will be the capability of banks to absorb the negative but mainly short-term effects in their P&L from higher costs and higher depreciations.