Despite thinning air – new heights in private banking?

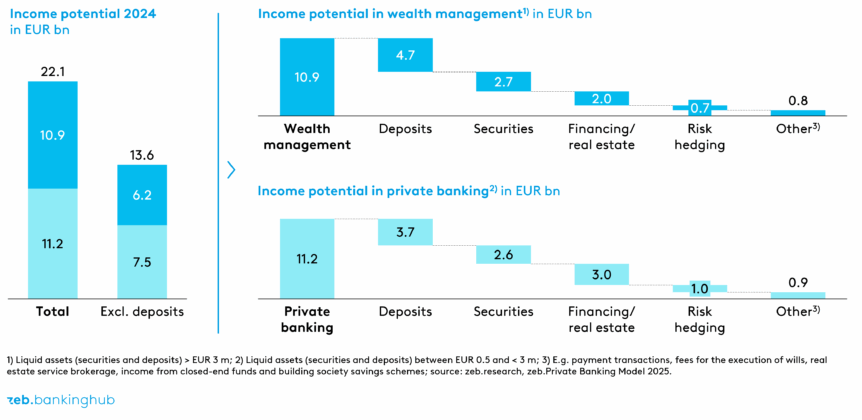

The market is buoyant, but the environment is becoming more challenging. In 2024, the income potential in German private banking and wealth management amounted to EUR 22.1 billion. By 2030, we anticipate income potential of EUR 26.7 billion coupled with growth of 3.2% p.a. (CAGR). At the same time, we expect the pressure on profitability to rise again if interest rates fall. For the first time in a long while, we saw commission-driven income dynamics in 2024.

We are keeping a particularly close eye on developments in the US. The political power struggle surrounding the Fed and the forceful calls for significant interest rate cuts are exacerbating the external economic uncertainties.

Even if the ECB is not expected to make any major interest rate moves in the euro area in the short term, the question remains as to how profits will develop if interest rates deteriorate. After all, it was not only income that increased over the past three years – costs did, too.

Which direction is the German private banking market heading in?

The German private banking market is in flux – and the momentum is increasing. While regional banks are expanding their position in private banking by means of dedicated initiatives, international providers are forcing their way into the market.

The strategic map shows that regional banks hold around 26% of the market, large banks around 25% and traditional private banks 22%. Foreign private banks have already reached a market share of 14% and are sending clear signals with acquisitions such as the integration of the HSBC Trinkaus business by BNP Paribas or the Bethmann HAL launch by ABN AMRO. At the same time, players such as LGT and J.P. Morgan are expanding specifically in Germany. Digital asset management companies are also gaining visibility, albeit at a low level (≈ 3%).

The message is clear: competition for wealthy clients is intensifying – and it ranges from traditional private banking to family offices and NextGen offerings.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Where does income stem from – and where is the greatest potential?

The addressable income potential in German private banking currently stands at around EUR 22.1 billion – with expected annual growth of 3.2% up to 2030. While the deposit business has made a significant contribution to income dynamics in recent years, it is losing traction due to currently constant interest rates. This makes it all the more important to boost income sources that do not depend on interest rates: even today, 38% of addressable income stems from areas beyond deposits and securities – primarily from mandate business, real estate solutions, financing and other services. This development underscores a key insight: the future of private banking lies in diversifying the income base.

At the same time, the income potential is highly concentrated regionally: over 70% of private banking households live in urban areas, 51% of the income potential/wallet is accounted for by the ten largest metropolitan regions – above all Munich, Hamburg and Frankfurt/Rhine-Main.

However, there is also attractive potential outside these metropolitan areas, for example in regions such as Western Lower Saxony / East Westphalia or the Lake Constance region. For institutions with a regional focus, there are specific opportunities here – provided that they systematically align their coverage models and resources with hot spots of income potential.

What challenges are holding back traditional private banks compared to the market as a whole?

In terms of assets, traditional private banks are growing less strongly than the rest of the market. Our bank sample shows asset growth of around 3.0% p.a., while the market as a whole recently stood at around 9.5% p.a. over the last five years. Although income has increased, the basic problem has not been solved. Costs are gradually being brought under control: in 2024, the rise is more moderate than in previous years, but the overall level remains high.

Efficiency is a priority, especially when it comes to personnel and IT costs. International firms from Switzerland, Liechtenstein and the US have noticeably increased salaries in the market, especially for advisors. The trend is positive, but work remains to be done.

Competition is also increasing: international providers are specifically addressing the wealth management and (U)HNWI segments. At the same time, independent asset managers are professionalizing their offer and gaining reach. This clearly puts traditional models under pressure.

What strategic levers does the 2025 Private Banking Study focus on?

For banks to position themselves successfully in the German private banking market, we believe that four specific levers are of great strategic importance. These range from a visible presumption of competence to the brand image in private banking right through to the acquisition and retention of the next generation (see Figure 3). A concise insight into these four levers is provided below.

Lever 1: Brand image – how does the brand communicate competence before a conversation even begins?

Affluent and highly affluent clients will only entrust their money to a bank with a consistent brand, image and value proposition. The decisive factor is the so-called presumption of competence: even before the first meeting, clients need to get the impression that the bank understands their specific needs and can meet these in a professional manner. This impression is not generated by chance but is based on a visible and definable value proposition along four dimensions.

- Location – an exclusive advisory environment with a clear distinction from the traditional branch, emphasizing the exceptionality of the services provided both physically and in the reception and advisory process

- Pricing – a value-based concept that adequately takes the expectations of wealthy clients into account and deliberately sets itself apart from retail pricing

- Brand – a distinct private banking brand image that is clearly differentiated from the retail brand in digital and stationary terms and ensures that the bank is perceived as a competent provider in a competitive environment

- Service processes – with a dedicated service line, personal support even outside traditional opening hours and concierge offerings for additional services

Institutions that optimize these four dimensions increase visibility, strengthen differentiation and create an emotional bond at an early stage – long before the first asset allocation is discussed.

Lever 2: How can digitally supported, efficient client engagement be achieved?

Many private banking providers are not sufficiently prepared for their clients’ digital expectations. Cross-channel support is often patchy, and digital services appear fragmented and poorly integrated. Especially younger target groups expect a consistent, intuitive and personalized experience – across all touchpoints.

In order to transform digital engagement into a genuine advisory experience, you need well thought-out tool support along three aspects:

- Front-end perspective – market trends and client needs must be identified, for instance by means of data-based triggers, segment logic or life events.

- User interface – this is about designing intuitive digital services, mapping relevant use cases and activating users, for example through simple onboarding processes or personalized content.

- Back-end infrastructure – a stable infrastructure, clean data models and a 360-degree view of clients are crucial to ensure that both clients and advisors remain able to take action at all times.

Tool support should be based on four key qualities:

- Accessible – usable for all target clients and (at the very least) legally compliant

- User-friendly – including all relevant use cases

- Engaging – through attractive interfaces and positive user experiences beyond the pure range of functionalities

- Likable – engendering genuine loyalty and self-created barriers to migration

This turns digital engagement into an advisory experience that activates clients, closes deals and leads to long-term client retention.

Lever 3: AI-based private banking – managing assets and client relationships holistically

Artificial intelligence will massively change private banking in terms of both operations and sales. Completely new customer experiences and efficiency gains can be expected.

These changes occur primarily in three areas:

- In customer experience through more personalized service with advisors acting as personal anchors and an optimized customer journey, in which service processes and tools are supported by artificial intelligence

- In performance optimization and customization through the recognition of patterns in complex and large amounts of data as well as through more personalized portfolio strategies, which can also be modeled more easily for smaller asset dimensions (especially in the affluent segment)

- In process efficiency and regulatory compliance and in the areas of AI screening and fraud detection

The use of AI complements the offering in private banking and enables banks to provide a more personalized product and service portfolio, more efficient advisory and service projects and a client-oriented deployment of existing specialists. Banks should use AI to combine (regional) proximity with digital excellence.

Lever 4: NextGen management – engaging the next generation

Most private banking offerings are geared towards older target groups – the generation of heirs and new wealthy clients are often left out of the picture. The reasons for this are demographic trends, regionally distributed places of residence and increasing competition from digital providers.

The development of NextGen management aims to sustainably increase visibility and loyalty among young clients. This includes the early involvement of clients’ children, whereby banks can establish themselves as partners for financial matters of the family, and low-threshold access to advisory services – relatable and barrier-free.

Furthermore, banks must present themselves as an attractive brand to the younger target group and create a presumption of competence. Modern banks should therefore position themselves as “enablers” of valuable connections and experiences in order to meet client needs. An exemplary approach here lies in organizing exclusive and regional networking events that are geared towards the community spirit of these clients. The bank thus becomes a common anchor for the next generation – rather than just an asset manager.

Conclusion: are there signs of an upturn in German private banking?

The signs are indicating a tailwind – but the direction is not guaranteed. Asset development and the earnings mix give cause for optimism, as does the increasing resilience to interest rate changes. At the same time, competitive pressure remains high, the cost base tight and retaining younger target groups challenging. The crucial question is therefore: are the institutions actively using the current tailwind – or are they letting it pass them by?

Providers that strategically combine brand image, digital engagement, AI support and NextGen retention can not only navigate through volatile phases but also reach new heights. 2026 offers the opportunity to reposition private banking – as an exclusive, relevant and future-proof advisory service for discerning clients.