Key Topics

I. State of the banking industry

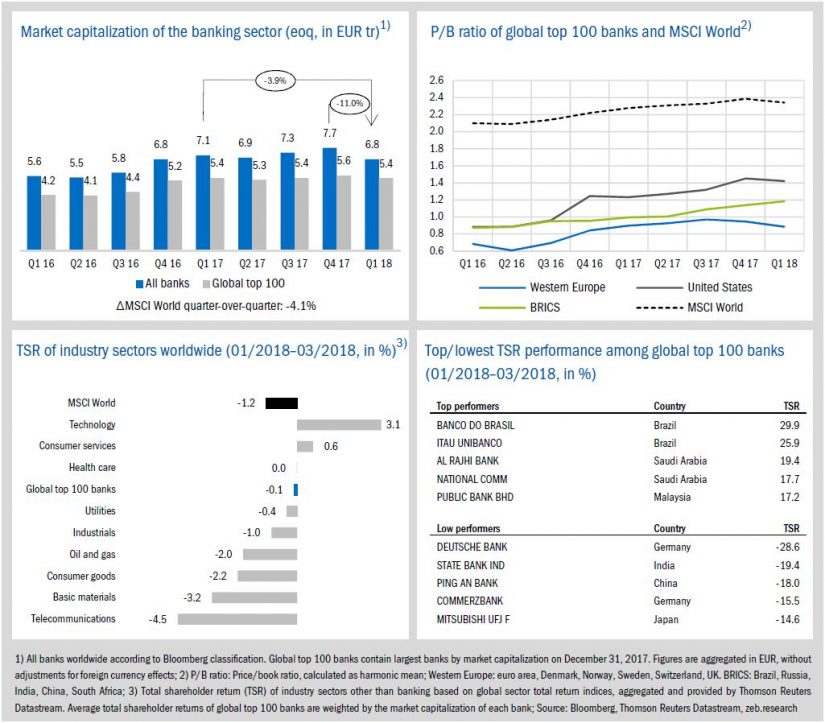

- Stock market corrections during the first quarter of 2018 stopped the trend of increasing market capitalization—in Q1, the market cap of all banks declined by -11.0%.

- European banks suffered large TSR losses (-4.7% on average), two German banks (Deutsche Bank and Commerzbank) are among the TSR low performers.

II. Economic environment and key banking drivers

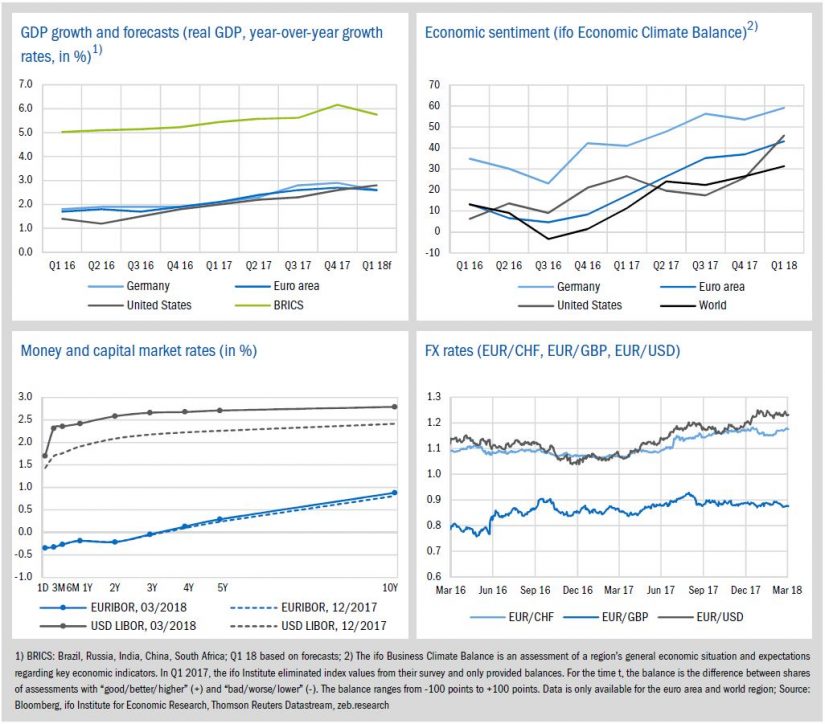

- Economic growth in the euro area is expected to remain robust, while U.S. growth is expected to further accelerate. The economic sentiment improved significantly across all regions, without reflecting the controversial U.S. trade policy so far.

- The U.S. Federal Reserve decided the first interest rate hike in 2018, leading to a further flattening of the USD LIBOR curve.

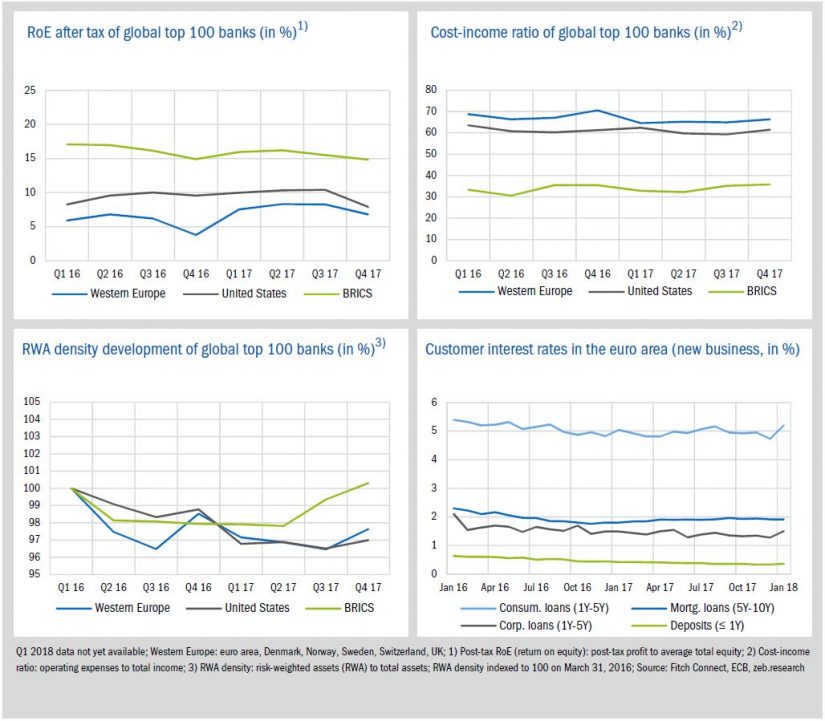

- The global top 100 banks’ profitability declined in Q4 2017. Especially, the full year results of some large U.S. but also of some European banks are clouded by negative one-time effects due to the new U.S. tax law.

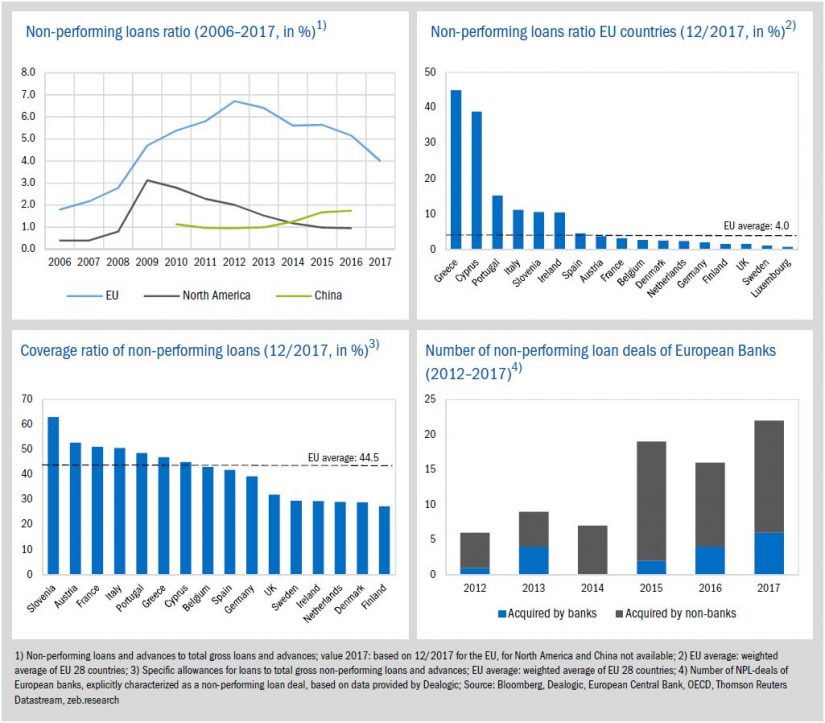

III. Special topic: Resolution of European banks’ NPL burden—behind the scenes

- Although EU banks have been able to reduce the volume of non-performing loans over the last years, the still large amount remains a European issue and ECB supervisors push banks to tackle this problem.

- However, a quick market-based reduction of the NPL volume is not in sight and European banks as well as ECB supervisors need to work on a common solution.

I. State of the banking industry

In the first quarter of 2018, stock market corrections stopped the latest strong TSR performance of global top 100 banks (2017: +22.2% p.a.). However, compared to the market, global top 100 banks only had to absorb slight losses in Q1 (-0.1%). European banks suffered larger losses (-4.7%, U.S. banks: -1.3%), whereas BRICS banks showed a positive TSR (+4.7%).

- After reaching the highest value in three years, the market capitalization of all banks plummeted by -11.0% in Q1 2018 (-3.9% yoy). In the global top 100 banks, the correction is much more moderate (-3.3% qoq, -0.1% yoy) and even lower compared to the global market (MSCI World: -4.1% qoq, -3.1% yoy).

- Apart from BRICS banks, average P/B ratios also decreased in Q1 2018. European banks showed a significant decrease by -0.06x, pushing the P/B ratio down to 0.88x, the lowest value since Q4 2016.

- Two German banks are among the Q1 TSR low performers: Deutsche Bank lost -28.6% and Commerzbank -15.5%. Two Brazilian banks are among the Q1 top performers, reflecting a stabilizing political environment and optimism about an economic rebound.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

II. Economic environment and key banking drivers

After renewed economic growth across all considered regions in Q4 2017, growth for Q1 2018 is expected to decrease slightly in Germany (-0.3pp), the euro area (-0.1pp) and in BRICs countries (-0.4pp) but still remains at robust levels. Only the U.S. economy is expected to further accelerate its year-over-year growth in Q1 and to continue at full throttle (2.8%, +0.2pp qoq). Effects from changes regarding the U.S. trade policy remain to be seen.

- The economic sentiment improved considerably in Q1 across all regions, as the current economic situation and expectations were rated significantly better than in Q4 2017, especially in the U.S. with +20.2 balance points.

- At the end of March, the Fed decided to increase U.S. interest rates by 25bp, which marks the first step of three planned rate hikes for 2018. Although the long-term US yields rose, the spread between the 1- and 10-year yields shrank by 13.4bp, indicating a further flattening of the USD LIBOR curve.

- The exchange rate of the euro against the USD reached a new 3-year high in Q1 2018.

The global top 100 banks’ profitability declined in the final quarter of 2017. Especially the full year results of some U.S. as well as of some European banks are clouded by the new U.S. tax law.

- Based on full year figures, the profitability of global banks decreased in the final quarter of 2017. However, compared to previous year’s results, European banks were able to increase their profitability (+3pp yoy), reaching a post-tax RoE of 6.8% on average for 2017. A closer look at the RoE before tax, by contrast, reveals that the distance in terms of profitability between European banks and their U.S. competitors persists.

- As expected, the full year results of some large U.S. banks as well as European banks were negatively affected in the final quarter of 2017 by the new U.S. tax law. For the European Banks HSBC, Barclays, UBS, Credit Suisse and Deutsche Bank, for instance, the valuation adjustments of U.S. deferred tax assets lead to a negative one-time effect of in total EUR 7.9 bn.

- In Q4 2017, all global banks showed higher cost-income ratios on average. However, the European banks’ CIR fell by -4.2pp compared to Q4 2016, while the CIR of US and BRICs banks slightly increased (U.S.: +0.1pp, BRICS: +0.4pp).

- Following a continued decline over 2017, European banks’ RWA density increased in Q4 by 1.2pp. The RWA density of BRICS banks continued to rise, exceeding 100% in Q4.

- Consumer and corporate loan rates in the euro area increased at the beginning of 2018. Especially rates for consumer loans jumped by 0.48pp, reaching the highest value since August 2016.

III. Special topic

Resolution of European banks’ NPL burden—behind the scenes

Despite progress in the reduction of non-performing loans over the last years, a huge amount of legacies is still slumbering in the balance sheets of European banks. The structure of the NPL volume is very heterogeneous across European countries, and the banks’ treatment of NPLs is not standardized. Although European banks have been able to reduce the amount over the last years, ECB supervisors are pushing banks to tackle the problem more quickly.

NPLs consume a significant amount of capital, squeeze banks’ profitability and consequently demand a high level of management attention. They have a negative impact on the overall resilience of the banking industry which can lead to higher funding costs, a lower credit supply of banks to the real economy and, consequently, to lower economic growth.

The asset quality issue arose decisively in Europe during the financial crisis starting in 2007 and was compounded by the European sovereign debt crisis starting in 2010 and the weak economy in Southern Europe. During that time, the NPL ratio of European banks (as non-performing loans to gross loans) increased from around 2.0% in 2006 to a peak value of 6.7% in 2012. Since then, the NPL ratio in Europe has declined only slowly. In line with an improving economic environment and low interest rates, European banks have been able to reduce their volume of NPLs by around EUR 175 bn over the past 12 months. However, with a total NPL volume of EUR 813 bn at the end of 2017, the implicit NPL ratio of 4.0% is still well above the pre-crisis level. A comparison to other regions in the world reveals the particular problem of this European development. In North America, for instance, after a sharp increase in the wake of the global financial crisis, the NPL ratio has almost returned to normal. This is mainly due to the absence of a sovereign debt crisis in North America as well as to structural and regulatory reasons. Besides the pure level of the NPL ratio, a further issue in Europe is reflected in the heterogeneity across European countries. In particular, countries that were hit hard by the sovereign debt crisis, such as Greece (44.9%), Portugal (15.2%) or Italy (11.1%) have high values, whereas other countries have values far below the European average—like the UK (1.5%) or Germany (1.9%). Moreover, there is no single concept of NPLs in European countries. For example, different default classifications (according to IFRS, CRR etc.) lead to different definitions of a non-performing loan. These inconsistencies with respect to definition and accounting of NPLs lead to insufficient transparency between countries and institutions within the same country.

The coverage ratio of European banks (amount of allowances for loans to total gross non‐performing loans and advances) has also risen over time and averaged 44.5% at the end of 2017. Despite the structural differences across Europe, especially for countries with higher NPL ratios such as Greece, Cypress or Italy, coverage ratios are above average.

European banks should use the current good economic times to reduce the still large amount of bad loans. The decisive factor for a reduction of the NPL burden is an efficient, bank-internal NPL management. As a result, in March 2017, the ECB published comprehensive guidelines including expectations and best practices for banks to deal with NPLs. In addition to using a standardized NPL definition, the ECB’s guidance focuses on how to improve processes, governance and risk management within the banks to manage NPLs more efficiently and to provide more transparency. Furthermore, on March 2018, the ECB published a final addendum to this guidance that specifies quantitative supervisory expectations for minimum levels of prudential provisions for new NPLs. In order to promote faster provisioning practices for NPLs in the future, all significant institutions in the Eurozone are expected to provide full coverage for unsecured NPLs after 2 years at the latest, and for secured NPLs after 7 years at the latest. However, these expectations are not legally binding and only apply to all exposures that have been newly classified as non-performing from the beginning of April 2018 onwards.

Creating such best practices within a bank takes time. Apart from that, there are structural impediments in several European countries, such as inefficient, lengthy and costly legal debt recovery processes that hamper an effective and fast NPL resolution. In order to deliver quick results, especially regarding the existing NPL stock, the direct sale of NPLs is an option. In fact, the number of NPL deals of European banks increased significantly since 2015, from 7 deals p.a. on average between 2012 and 2014 to 22 deals in 2017.[1] The acquirers of these NPL portfolios are predominantly non-banking institutions such as asset managers, private equity firms or debt collection companies but also some banks specializing in the acquisition/sale and management of NPL portfolios, as well as investment banks. However, only approximately EUR 50 bn of NPLs of European banks in total were sold between 2015 and 2017, thereof EUR 37 bn alone from Italian banks and EUR 6.5 bn from Spanish banks. Unfortunately, many sources of asymmetric information prevent a faster removal of NPLs from European bank’s balance sheets via market transactions. Investor uncertainties regarding the quality of the NPL portfolio resulting from poor availability of data, the existence of collateral as well as the heterogeneous treatment of NPLs across Europe, prevent the formation of a liquid and efficient market for NPLs.

The high NPL burden, especially in certain European countries, creates a clear pan-European problem and a quick fix would be desirable. A rapid reduction of the NPL volume due to market-based options alone is not in sight. On the one hand, European banks have to work on a more efficient as well as consistent NPL management and need to focus on an overall NPL strategy and transparency rather than on an individual assessment of their NPL portfolios. On the other hand, ECB supervisors along with EU legislation, must support structural reforms in order to reduce obstacles to an orderly and rapid resolution of NPLs in the future.