What is a robo advice resp. a robo advisor?

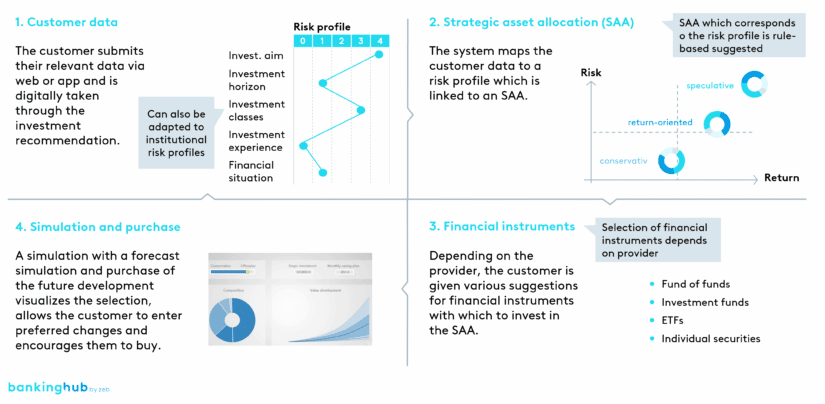

The widely accepted definition of robo advice as a digital and fully automated asset management solution actually goes too far, as robo advice in itself is merely the digital customer interface for identifying the most suitable risk profile for an investor. A web- and/or app-based input template gathers customer data, investment horizon, risk preference and other legally required investor information and, to put it simply, the risk profile is determined using an if-then logic.

The robo advice merely digitalizes the WpHG[1] classification and the MiFID II suitability and appropriateness assessment carried out by the client advisor in a traditional advisory meeting. A differentiation between robo advisors only takes place in the subsequent process of actual asset management where the risk profile is translated into a strategic asset allocation (SAA) and implemented by selecting specific investment products.

Robo Advisors: Development and status quo

Internationally, robo advisors manage approximately EUR 480 bn in assets under management (AUM), which corresponds to about half of the German market for mutual funds. With about EUR 110 bn, Vanguard Personal Advisor Services is the largest provider worldwide and has a global market share of around 20%. The top 5 robo advisors manage about EUR 170 bn, which corresponds to a market share of roughly 40%. The sector is estimated to grow to more than EUR 2,300 bn in AUM over the next five years.

Robo advisors in Europe

With a volume of about EUR 14 bn in AUM, the European market is relatively small and roughly equals the size of the third-largest robo advisor in the world, Betterment. In Europe, the United Kingdom is the largest market with AUM of EUR 5.5 bn, followed by Germany with AUM of about EUR 3.9 bn.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

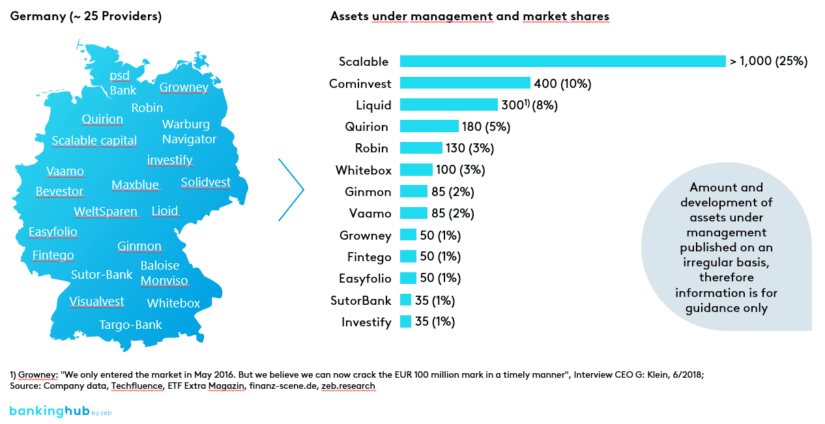

Robo advisors in Germany

In Germany, there are currently around 30 robo advisors; globally, there are about 350. From an international perspective, the number of German robo advisors is thus quite large. Only the USA, a much bigger market, offers more of them. A look at the ownership structure of German robo advisors reveals that only very few of them are independent start-ups (such as Liqid or Scalable). The majority of robo advisors are digital customer interfaces within the omnichannel offering of private banks (such as Warburg, Hauck & Aufhäuser or Quirin Privatbank), large-cap banks (Commerzbank or Deutsche Bank) or regional banks (Volksbanken and Sparkassen).

In spite of their large number, providers in Germany currently only manage relatively limited asset volumes compared to international standards—the size of the German market has remained below both expert forecasts and the expectations of providers themselves. With the exception of Scalable Capital competitors’ AUM are still in the tens or low hundreds of millions. Due to the lack of official reporting obligations, however, all figures are to be taken with a pinch of salt and may actually be considerably lower.

Robo advice—fit for the future?

Robo advice has taken root as a self-service in German asset management. Besides independent start-ups, established banks have integrated it into their offering. What’s missing, however, is satisfactory performance, i.e. the required product quality. Therefore, the market continues to be attractive to new players that not only promise customers such quality, but are actually able to deliver it.

Software providers, such as Aixigo, the company behind Investify’s robo advisor, allow independent asset managers to rent the robo advice functionality and thus offer their strategy online. As Germans are becoming more and more familiar with the offering due to the service portfolios of established banks and digitalization is progressing, a corresponding market and growth opportunity for all providers of asset management strategies is emerging.

More information about robo advice and robo advisors can be found in the following publications (in German language only)

-

- Bedrohung oder Chance? (Ausg. 3/2016): Beraten in Zukunft bloß noch Roboter? Grundlagen & Funktionsweise des neuen Megatrends.

- Ein Wettbewerbervergleich (Ausg. 4/2016): Verschaffen Sie sich einen Überblick über die Wettbewerber.

- Rechtliche Herausforderungen (Ausg. 5/2016): Juristische Herausforderungen, denen sich „Robo Advisors“ stellen müssen.

- Robo Advice – das erste Zwischenfazit enttäuscht (Ausg. 1/2019): Wie finden Robo Advisors ihren Weg zum Erfolg?