Sunny times in private banking?

For years, private banking and wealth management have been the only segments in the private customer market to record significant growth. According to our calculations, this trend will continue with a growth rate of 5–7% at least until 2028.

In 2023, the income wallet for banks in private banking and wealth management amounted to around EUR 21.6 billion. At EUR 9.2 billion, the share attributable to deposits is higher than ever before. However, this figure should be regarded with caution, as the increase in income in the last two years is mainly due to the above-average growth in net interest income and can therefore by no means be described as sustainable.

Is the German private banking market in flux?

What’s more, the German private banking market is in flux. Regional banks such as savings and cooperative banks have a broad customer base with long-standing relationships in both retail and business banking. This strong position enables them to successfully expand their services in private banking as well.

In contrast, traditional private banks are continuing to lose ground – they are finding it difficult to achieve organic growth beyond consolidation. At the same time, foreign providers from Switzerland and Liechtenstein are stepping up their activities, thereby noticeably increasing competitive pressure.

From 2019 to the end of 2022, the 13 representative, Germany-based private banking providers that we analyzed for this study recorded steady growth in assets under management. The additional, disproportionately strong income growth is mainly a result of the above-average growth in net interest income in the “peak interest rate years” of 2022 and 2023. While net interest income rose by 44%, net commission income fell by 3%.

What does a look at net interest income reveal?

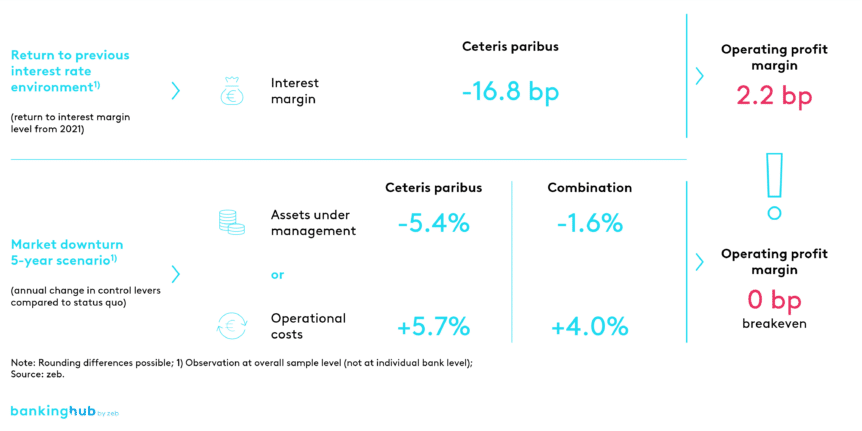

A detailed look at net interest income shows that, according to our calculations, a return to the interest rate environment of 2021 would almost completely erode overall profits. The current profit margin of around 18 bp in the sample would drop to 2.2 bp in this scenario (see Figure 1).

Looking at our bank sample over a period of five years, it is also evident that the increase in costs is above the average inflation level. Between 2019 and 2023, costs rose by an impressive 4.7% p.a. – driven by both personnel and non-personnel costs.

What are the challenges in the private banking market?

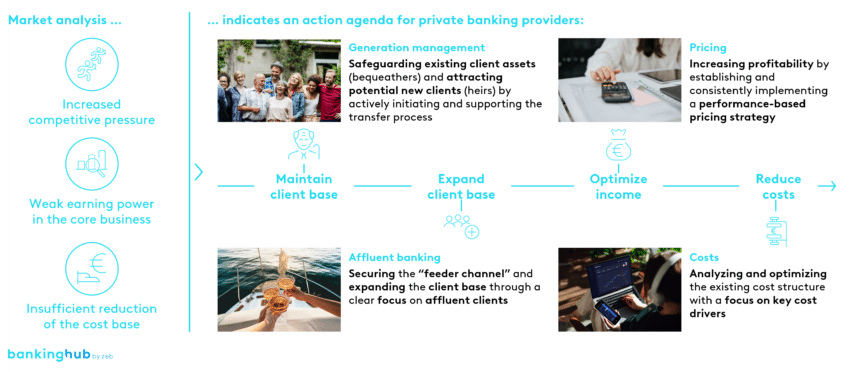

Those who recognize and correctly address the challenges of increased competitive pressure, weak profitability in the core business and insufficient reduction of the cost base can set sail for successful business development – we have defined real-life-oriented focus topics for this.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Which focus topics were relevant for our Private Banking Study 2024?

To set the course for successful business development, we believe that four fields of action are particularly relevant. They range from generation management and affluent banking to pricing and cost efficiency (see Figure 2).

Below, we would like to provide a brief insight into each of our four focus topics.

How can generation management succeed in private banking?

In private banking, there is a risk that significant asset volumes will be transferred to other banks by heirs, at the latest when clients die. This topic is often a taboo and therefore in many cases not easy to broach with clients. However, given its high relevance in terms of long-term client retention, it is essential to develop suitable strategies to address it.

A successful strategy requires involving the next generation at an early stage, maintaining contact and presenting these prospective clients with attractive offers. At the same time, the outgoing generation can serve as a valuable testimonial highlighting the benefits of a long-term relationship with the bank. In our experience, patience and tact are the most important factors for a successful transfer between the generations.

What is affluent banking and how can it be implemented successfully?

The aim here is to exploit the – according to our calculations – significant potential of affluent clients who are just below the private banking wealth threshold. Our experience shows that a tailored and, above all, digitally conveyed value proposition is a key factor in client appeal – also in terms of standing out from the competition.

Affluent clients go through different life stages, such as house purchase. inheritance or retirement, which banks can address specifically. Understanding their needs and recognizing gaps in the service portfolio are crucial for developing suitable products and services.

To accompany these profitable clients into private banking, not only active management, but also special “wow effects” are sometimes necessary: for instance, additional services that go beyond what is expected. These allow a bank to stand out and leave a lasting, positive impression. The focus here is on a hybrid advisory approach that masters the combination of “digital” and “personal”.

What are the challenges and opportunities in the area of pricing in private banking?

Pricing in private banking is often a mystery – for both clients and banks. Preferential terms dominate, especially for high-volume clients, which means that the bank’s valuable services provided at considerable cost are often not adequately remunerated. Banks usually lack the necessary information about the market and its price sensitivities, which is why they frequently set their prices too low.

At the same time, clients’ expectations regarding the quality of advice and services are rising, which leads to more effort without additional income. Once terms have been agreed, they are rarely renegotiated – for fear of losing clients.

The good news is that banks have various levers at their disposal to increase their profitability. These should be reviewed holistically and regularly. They include an increased focus on AM mandates and performance-based pricing models.

What role do cost increases play in private banking?

As mentioned above, the cost increases in our bank sample have consistently exceeded the average inflation level over the last five years. What’s more, managing the same AUM basis has become more expensive. However, this is not so much due to investments in technology, as was the case in previous years. This large cost block has now largely “normalized” and the IT investments that have been made should now contribute significantly to cost stability.

Simply saying “These costs have to come down!” does not take account of the bigger picture. A closer look reveals the various challenges faced by the individual institutions. High-growth private banking providers need to find out how they can harmonize their expected income growth and their cost growth. Companies with less growth, on the other hand, should analyze typical complexity problems in the context of their business model. Striving for efficiency and scalability should always remain in focus.

Conclusion: Is the private banking market at a new turning point?

One thing is clear: the private banking market is at a new turning point. Leaning back is not an option. When the wind shifts, clever maneuvers are needed to keep the boat on course or reach new destinations – in sailing as well as in business. That’s what makes it so exciting!