What clients expect from digital solutions

Clients are familiar with digital solutions and their integration with the physical world. In the financial sector, it is worth mentioning the various neobanks, of which Revolut is one of the best known and most widely used worldwide. However, the transformation towards digital solutions extends beyond retail banking to higher asset classes and related offerings, as exemplified by asset management firm LIQUID in Germany. This is because clients increasingly demand digital offerings, which in turn creates competitive advantages for providers with more mature digital solutions.

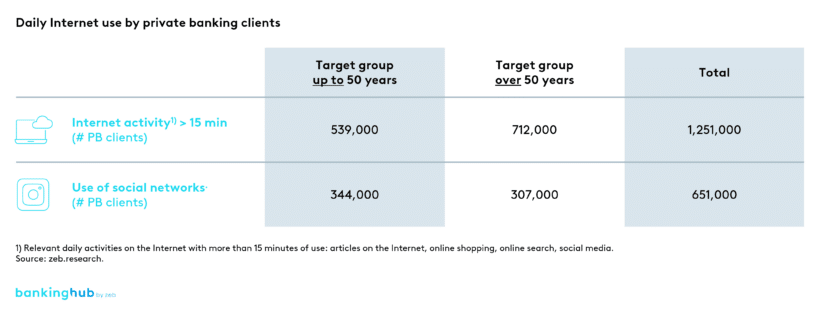

It is important to note that this transformation is not limited to the younger generation. The online study of the German broadcasting corporations ARD and ZDF reveals that, in 2022, 80% of individuals over the age of 14 in Germany use the internet daily, and even for people over the age of 70, this figure remains at a good 50%. Applied to the private banking target group, this translates to approximately 1.25 million daily internet users (see Figure 1). Consequently, private banking providers, often characterized by older client structures, should not just rest on their laurels, as their clientele also seeks the benefits of constant availability, simplicity, speed and efficiency offered by digital solutions.

Private banking providers must actively plan and shape their digital development, recognizing that digitalization is not a passing trend. On the contrary, those who fail to embrace it today risk being left behind tomorrow. For the transformation to be successful, however, the narrative should focus not on the imminent danger, but rather on the opportunities it presents, such as increased business volumes, optimized pricing and thus improved margins, enhanced organizational efficiency, higher client satisfaction, and deepened client-bank interaction.

Sales digitalization in existing business

Implementing digital transformation, however, is easier said than done, as it requires addressing a wide range of topics within a bank. It is therefore worthwhile to first gain an overview of the fields of action and to structure them.

Such a possible structure is divided into the three topics “client interaction,” “use of data,” and “digital offering”, as shown in Figure 2. The emphasis is placed on topics directly relevant to sales, while “purely operational” digitalization topics, such as process digitalization and automation, require separate consideration (see more on this in our article here).

Client touchpoints: client interaction

The first topic – client interaction – focuses on the client interface. It includes both client-initiated and bank-initiated contacts. The key is to ensure that clients perceive digital communication and physical interaction as equally valuable. If the client does not feel that the bank is taking digital communication channels seriously – whether with a human component or fully automated – they are unlikely to build trust in those channels.

This has several implications, e.g.:

- Communication should be two-way, not just a push of information towards clients

- Communication should be personalized in order to promote client involvement

- The channels clients use (e.g. chat, app, social media, e‑banking) should be covered

- The content of the digital interaction must be relevant and meaningful to them

These implications primarily affect the role of client advisors, who have traditionally acted as intermediaries between banks and clients. In the future, a triangular dynamic may emerge between clients, the bank and advisors. It is therefore conceivable that the bank’s direct presence in client interactions, without the intervention of advisors, could be strengthened. This could include personalized investment and product recommendations, as well as answering client questions or receiving and routing more complex client requests.

However, it is important that communication between the bank as the central organization and individual advisors is consistently coordinated, as the advisor is likely to remain the primary point of contact for the majority of clients. This ensures that the client experience is improved by providing them with a “one-stop shop” experience and by approaching them more consistently with relevant offerings on their preferred channels, which is made possible by enhanced centralized management.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Evaluating data by means of data analytics and AI

The buzzwords “data analytics” and “artificial intelligence” have long been associated with the promise of fundamental transformation – even beyond the financial sector. While the potential is huge, practical implementation in banks is still in its early stages. Particularly when it comes to filling digitally controlled client communications with individually relevant content and offerings, as mentioned earlier, these tools can be highly beneficial. On the sales side, three main fields of action emerge.

1. Transaction data, financial situation and personal characteristics of the client

For example, insights into potential unaddressed client needs and corresponding offerings can be drawn from transaction data, the financial situation and personal characteristics. Furthermore, it is conceivable to go even further by systematically, continuously and fully automatically analyzing publicly available unstructured information about clients. This could include social media profiles, blogs, other types of personal internet presence, and media reports.

2. Data on individual willingness to pay

Additionally, data can also assist in optimizing product pricing. In essence, the goal is to analyze clients’ individual willingness to pay and determine the optimal price as a recommendation for client advisors and their negotiations. This can be achieved by analyzing client-specific data and, in particular, by performing a comprehensive comparative analysis across all of the bank’s clients.

In this way, meaningful price ranges can be derived, and, for example, internal benchmarking can also be performed at individual client level. This information may serve as a tool for managing client advisors, providing insights into areas where preferential terms are out of line, but also where opportunities exist for price adjustments.

3. Client satisfaction data

Finally, data analysis can aid in the anticipation of client attrition, identification of underlying causes and formulation of effective countermeasures. This can lead to a reduction in client churn and the subsequent loss of revenue. To accomplish this, one possible approach is to analyze written client communications, such as e‑mails or messages. Furthermore, analyzing telephone conversations can offer valuable insights into client satisfaction and uncover underlying factors, both positive and negative.

It is, however, important to address the challenge of obtaining explicit client consent for analyzing personal data. Without such consent, the systematic analysis of personal client data would not be legally permissible. Therefore, it is crucial to consistently make the case among clients for giving their consent. Emphasizing the benefits clients can gain from providing consent is essential, and the process of granting consent should be easy and user-friendly, preferably through an effective digital solution.

Development areas for the digital offering

As banks strive to enhance client interactions, it becomes imperative to consider not only communication but also the product offering from the client’s perspective. Clients place significant value on factors such as comprehensibility, ease of use, seamless channel switching, and direct transaction completion without analog or time-delayed steps. These requirements should be incorporated into three key areas of product and service development.

1st development area: existing offering

The first development area involves transitioning the existing offering to the digital realm, which marks the first and fundamental step in the digitalization process. It is expected that the option of digital completion alone will lead to more transactions – provided that this option is presented to clients in a way that attracts their interest (see also topic 1).

Removing barriers that hinder clients’ impulse to buy, such as delays due to limited opening hours or the need to switch channels, can have a significant impact. Additionally, enabling clients to independently test products without direct involvement of advisors can be a decisive factor, particularly in acquiring new clients.

2nd development area: creating new digital offerings

The second development area focuses on the creation of entirely new digital offerings. Examples include digital assets, such as tokenized art alongside cryptocurrencies, automated portfolio recommendations and live simulations. Minimizing entry barriers is crucial to counter client uncertainty and capitalize on opportunities.

Allowing clients to try new offerings without incurring significant costs or making long-term commitments is an important way to address this uncertainty and build trust. This approach opens up additional revenue streams for private banking providers.

3rd development area: establishing digital private banking ecosystems

The third development area involves establishing digital private banking ecosystems that seamlessly integrate with the physical world. For private banking providers, value-added services have long been established as a complementary offering to their clients, designed to create an additional lock-in effect. Now, the focus is on transferring these services to the digital realm and expanding them to include digital offerings.

For instance, a comprehensive private banking app can facilitate easy digital registration for the “usual” networking events, while also providing exclusive invitations to high-profile art auctions or opportunities for philanthropic engagement.

What do private banking providers need to do now?

For most institutions, the path is likely to be one of steady, evolutionary development, with only a few being able to pursue disruptive strategies. This makes it all the more important to effectively and efficiently utilize limited financial and human resources.

In light of the fields of action discussed in this article, it is essential to conduct a thorough assessment of the status quo. This should be complemented by a robust analysis of the digital requirements specific to the institution’s clientele, considering the anticipated evolution of client needs in the digital realm. Importantly, this effort should not be limited to a pure management process but should actively engage clients. Only by incorporating their input can a reliable digital roadmap be developed, because those who can comprehensively and reliably satisfy client needs also in the digital landscape will gain a distinct competitive advantage.