What is the current status of the tokenization business in Germany?

At the latest since several major German banks were granted crypto custody licenses and a number of banks started to offer cryptocurrencies for purchase, it has become clear that cryptocurrencies are now ready for the mass market. But what about the tokenization of assets such as securities and tangible assets, postulated as one of the main use cases of distributed ledger technology (DLT)?

Tokenization describes the process of digitally representing rights to an asset as a fungible token, usually a security token or crypto security. Depending on the chosen form, securities such as (bearer) bonds and fund units as well as tangible assets such as real estate and art can be tokenized. We have described the tokenization process in detail in this article.

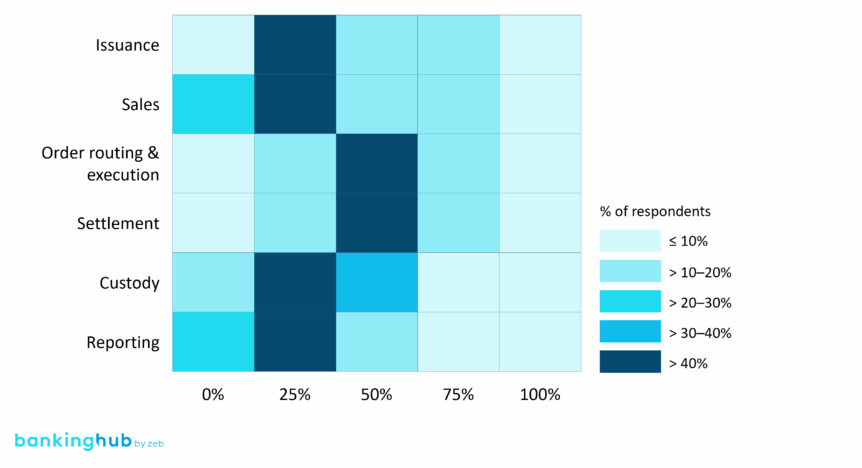

In addition to making previously illiquid assets such as collectibles tradeable, experts see especially cost savings as a relevant advantage of tokenization. Our latest Digital Assets Study shows that over 40% of the institutions surveyed expect cost savings of 25% when issuing tokenized assets. In downstream processes such as trading and back office, savings of up to 50% are even estimated to be possible.

In order to be able to operate a tokenization business, the foundations for the tokenization of assets in terms of technology and processes need to be laid first. To this end, technical infrastructures and skills for tokenization, custody and the transfer of tokenized assets must either be developed in-house or purchased externally. Most financial institutions have focused on this preparatory step in the past few years, as can be seen in the granting of numerous licenses to manage crypto securities registers and to provide crypto custody, among other things.

In the development of specific use cases in tokenization, providers in Germany have so far focused primarily on tokenized liquid assets in the form of securities. This is because liquid markets for securities already exist and numerous processes for tokenization are similar to previous issuance processes. Several pilot transactions with well-known institutional clients have been carried out to great media effect.

However, tokenized securities have not yet been offered on a mass market. Numerous market participants are currently examining how such an offering, e.g. in the form of crypto fund units, can be established.

When it comes to the tokenization of real assets, we can observe highly dynamic developments in the market, too. For instance, several banks are piloting the tokenization of real estate assets. In addition, some fintech companies offer the tokenization of collectibles such as art, watches and sneakers. Due to the need to set up new processes and the so far rather low liquidity for such real assets, traditional financial institutions in particular are relatively reluctant to enter this subsegment.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What are currently the main challenges in tokenization?

Although, as described above, there is a great deal of momentum in the market regarding tokenization, the big breakthrough has not yet been achieved. At present, we see three challenges that banks are facing.

High investment and conversion costs

Setting up a DLT-based market infrastructure requires considerable initial investment. Traditional financial institutions also face the challenge of operating two parallel infrastructures: the existing one and a DLT-based one. While fintech companies with a native tokenization strategy can pursue a greenfield approach, established institutions are confronted with a complex transformation process.

Fragmentation of the DLT landscape

Different market participants rely on different DLT systems for tokenization, including both private (permissioned) and public networks. This leads to technological fragmentation and makes interoperability between systems and market participants more difficult. DLT was originally intended to simplify existing financial market infrastructures – instead, there are examples of isolated solutions with new complexities.

Established, traditional capital markets as an impediment to innovation

Capital markets are based on centralized accounting systems and manual processes that have proven themselves over decades. These traditional structures enable high liquidity but exclude tokenized assets from existing liquidity pools. As the traditional capital market system currently functions reliably, many financial institutions still see too little incentive to invest in a new DLT-based infrastructure.

What conditions must be met for a mass-market tokenization offering?

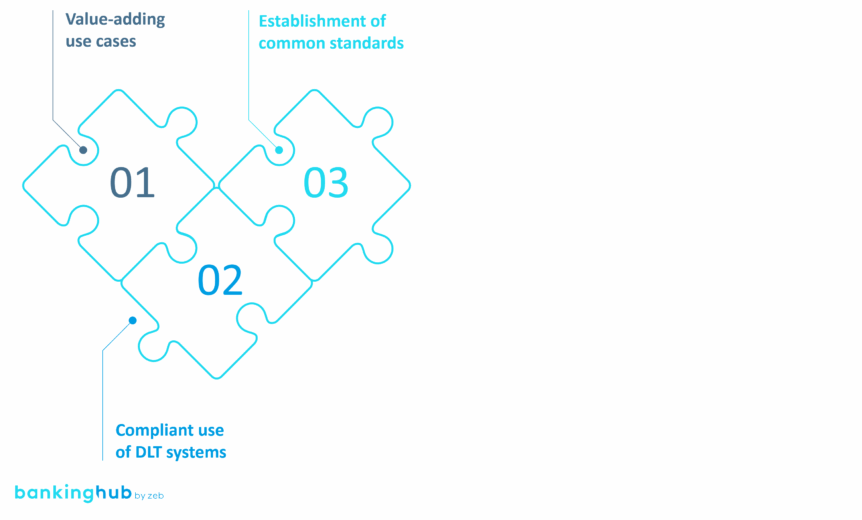

For tokenization to achieve broad market penetration, a stable regulatory basis is required. The Markets in Crypto-Assets Regulation (MiCAR) and the DLT pilot regime are important cornerstones in this regard. Nevertheless, it will take time for a critical mass of market participants to fully adapt to this regulatory framework and for the structures to become ingrained. However, to establish tokenization on a large scale, further vital conditions must be met. Only if these conditions are fulfilled can the technology not only gain traction operationally, but also have a lasting positive impact on the income statement.

1) Value-adding use cases

Use cases must be carefully developed in line with customer needs, existing capabilities, implementation complexities and the envisaged time-to-market. Key drivers for use case development are increasing liquidity – especially for illiquid assets (such as tokenized tangible assets) – and a significant efficiency boost. Another decisive factor is the ability to make tokenized assets tradable across different DLT structures without having to rely on a central securities depository.

2) Compliant use of DLT systems

Interoperable DLT systems are becoming increasingly important for financial institutions as they offer greater flexibility and future viability. By using open systems, institutions can move independently of proprietary solutions and avoid strong ties to individual, central providers. This should be seen as a prerequisite for cross-border interoperability.

At the same time, open DLT systems must consistently fulfill regulatory requirements and compliance rules. While closed systems can implement these requirements more easily by directly restricting network access, compliance in open systems requires a different approach. Here, the implementation of regulatory requirements shifts to the level of smart contracts or directly to the asset structure itself.

3) Establishment of common standards

For tokenization to become widespread, binding standards are essential. Only a harmonized language among all market participants can create the necessary interoperability and efficiency. For mass-market adoption, tokenization therefore requires a standardized data basis and smart contracts.

A groundbreaking example of a standardized framework is the “Project Guardian” of the Monetary Authority of Singapore, which is supported by leading banks such as Deutsche Bank, J.P. Morgan, UBS and Deutsche Bundesbank.

The project follows a two-stage approach:

- Development of a taxonomy for tokenized assets (e.g. bonds)

- Integration of this taxonomy into standardized smart contract frameworks to enable uniform token management

The aim is to harmonize data on assets, transactions and settlement as well as regulatory requirements both “on-chain” and “off-chain”. Only in this way can market participants interact, trade and transfer tokenized assets securely and efficiently based on data.

How will the tokenization business develop in the coming years?

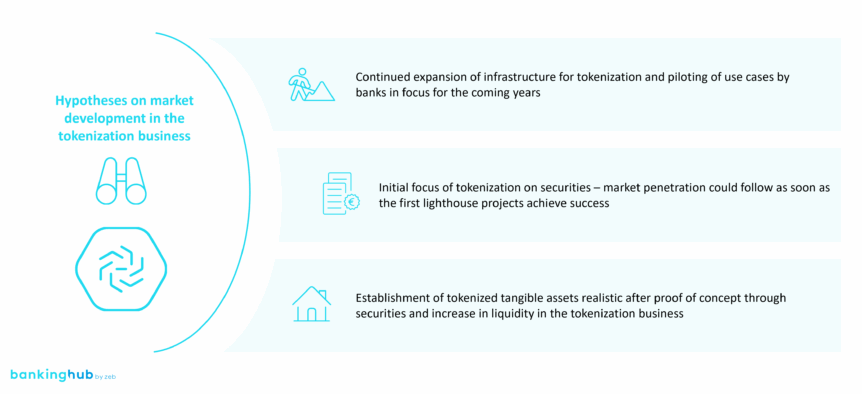

From zeb’s perspective, it will still take several years before the conditions for mass-market viability of the tokenization business described above are met. As soon as this happens, however, we expect to see a sharp increase in volumes in this type of business. Based on these thoughts, we expect three key developments in the tokenization business over the next few years.

- While the topic of tokenization will initially remain fairly quiet among the general public, the evolution of an interoperable infrastructure and the creation of use cases will continue. The development of frameworks for standardization in the tokenization business will also be driven forward until proper market standards are established in the coming years.

- The focus of tokenization will continue to be on securities over the next few years. As soon as B2C use cases reach market maturity and the integration of all systems and functions involved is ensured, the first providers will start to realize significant cost advantages. This lighthouse effect will lead to rapid imitation by competitors, which could result in tokenization volumes of up to EUR 1,500 billion.

- The establishment of tokenized securities will massively increase trust and thus also liquidity in the tokenization business. This will lay the foundation for the tokenization of tangible assets. In the following years, the adoption of tokenization in all asset classes will increase until it becomes the market standard.