2020 was a roller coaster – for us and for banking KPIs!

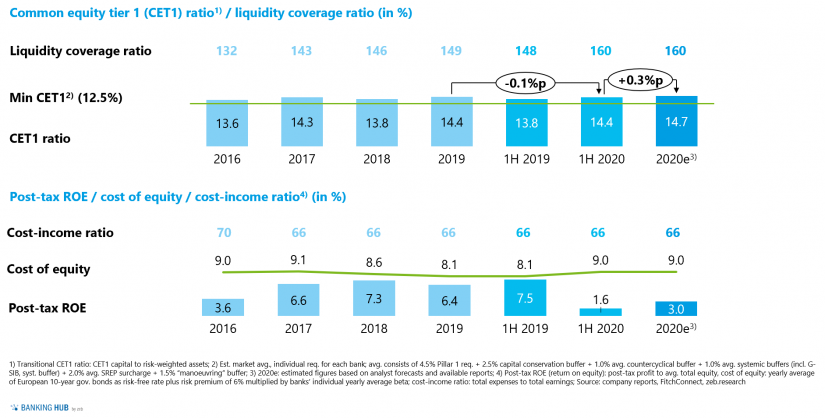

Beginning with some good news, even after all the ups and downs of the previous year, European banks’ capitalization remains strong. For the financial year 2020, we expect the average CET1 ratio of Europe’s top 50 banks to improve by around 30bp yoy to 14.7%. Slight negative effects on capital ratios initially seen at the onset of the COVID-19 pandemic – due to new loans granted especially to corporates (and to a limited degree retail customers) as well as drawn credit lines – were later entirely reversed by lower RWAs, especially from trading activities, and capital generation. Although regulators provided breathing room through eased capital requirements in response to the crisis, most banks did not apply these in order to preclude negative market reactions and even increased their capital ratios over the year. The situation is similar for the average leverage ratio (LR) and average liquidity coverage ratio (LCR) of the top 50 banks. LCR increased significantly and is expected to reach a new peak value of ~160% by the end of the year (FY 2019: 149%) as many banks counteracted greater uncertainty with larger liquidity buffers.

Turning to profitability figures, the picture begins to worsen as COVID-19-related effects on banks’ P&L statements are clearly deleterious. Following a positive trend in recent years and an average post-tax ROE of 6.4% in 2019, the FY 2020 figure is expected to be more than halved, falling to around 3.0%. Especially in the first quarters of 2020, profitability collapsed dramatically with many banks even reporting negative results. In the second half of 2020, profitability is expected to have recovered some, but to remain on the lowest level for more than 5 years, far from covering the cost of equity. Zooming in however, P&L impacts were very heterogenous. We expect 10–15 banks (out of 50) to report (significant) losses for the year 2020, whereas a handful of institutions should be able to muster results in the range of their 2019 profits. Most banks will report figures well below the level of 2019, but at least above zero.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Strongly increasing LLPs burden European banks’ profitability

What is the driver behind this profitability drop? In February and March 2020, there was a widespread expectation that banks’ earnings would decrease across the board during the pandemic, or that operating costs would rise. Ultimately, neither of these concerns ever manifested across the banking sector. In several business areas, banks were even able to increase their earnings. For example, asset and wealth management and especially investment banking – the long-time problem child in European banking – clearly benefited from higher uncertainties and therefore market volatilities. As a result, institutions with a large share of these segments reported good quarterly results. On the cost side, many institutions stepped on the brakes by reducing external variable costs or postponing projects to 2021.

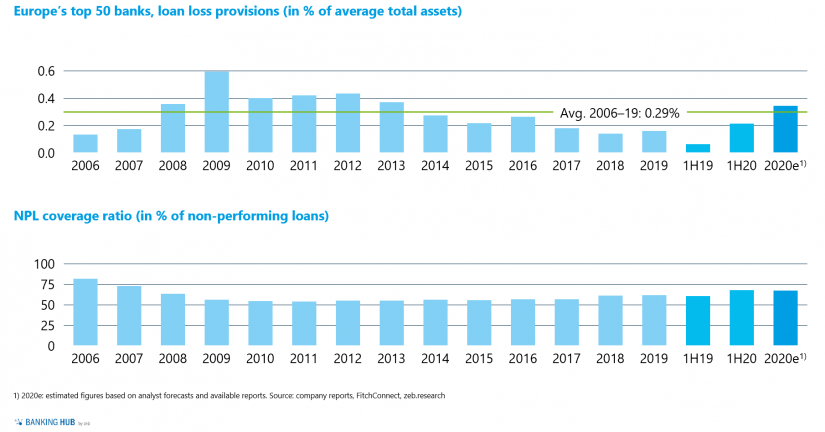

Instead, the key reason behind the profitability drop was the cost of risk. After economic outlook became historically gloomy throughout 2020, Europe’s top 50 banks massively increased their risk provisions. By the end of the second quarter, loan loss provisions (LLPs, in % of average total assets) had already exceeded the previous year’s value and correspondingly burdened banks’ bottom line results. Interestingly, most of these provisions came from stage 1 (or 2) rather than stage 3. In fact, due to state aid programs and other public measures, actual credit losses have not yet reached banks in full and accordingly, LLPs are expected to normalize for 2H 2020. Nevertheless, full-year risk provisions are expected to be more than double the FY 2019 value. Although they will remain below the dimensions of the global financial crisis, FY 2020 provisions will clearly exceed the long-term average 2006 to 2019.

Figure 2: Long-term development of loan loss provisions and NPL coverage ratio of Europe’s top 50 banks

Figure 2: Long-term development of loan loss provisions and NPL coverage ratio of Europe’s top 50 banksThe problem behind this development is that European banks benefited significantly from the benign credit environment in the past and many banks rely on these positive effects in their P&Ls. Loan loss provisions decreased continuously in recent years, reaching an historic low in 2018, and have been a key driver of banks’ latest ROE increases. Although European banks had some success in streamlining their operating model, i.e. reducing costs, these effects were almost completely neutralized by reductions in earnings and thus cost-income ratios remained relatively stable at 66%. As a result, the current crisis has caught many banks off guard and, again, reveals their operational weakness. The small operating profit cushions that did exist were not sufficient to offset significantly higher loan losses. Instead, several banks are now in a position where they must deal with rising non-performing loans in their portfolio and are simultaneously forced into operational action, most notably cost-cutting measures.

Are the real troubles still ahead of us?

Looking back at 2020, the good news is that at the end of a historically difficult year, Europe’s top 50 banks are still sufficiently capitalized. Even in terms of profitability, they have (more or less) withstood the crisis so far. These results are much better than initially expected at the beginning of the year. Furthermore, the availability of effective COVID-19 vaccines has buoyed hopes that the pandemic will be soon over and there are first signs that the impact on the whole economy might be lower than initially feared. In addition, several pivotal political questions (Brexit, US presidency) have finally been answered.

However, the real test for banks’ resilience will come in the second half of 2021. It is expected that after the end of the debt moratoria and state aid programs, the number of corporate/private insolvencies will increase, ultimately leading to non-performing loans and credit defaults at banks. This could require further significant LLPs starting in the second half of 2021 and lead to substantial losses in some banks’ P&L statements. Moreover, expected rating migrations in corporate business could lead to RWA inflation and therefore deteriorate capital ratios in 2H 2021 and beyond.

For additional insights on these issues, we highly recommend the two editions of our European Banking Study 2020:

- Outlook on the potential developments of loan loss provisions: European Banking Study 2020, 1. edition

- Impact on the capitalization/risk-weighted assets: European Banking Study 2020, 2. edition

Capital markets are aware of these risks, as banks’ current market valuations and share prices show. While most industries fully recovered over 2020, European banks are still trading at a significant discount.

We took a closer look at these developments in our latest zeb. market flash:

Overall, the outlook on upcoming 2020 results is two folded. Yes, there will be negative results at several banks, but, on average, at least one line of defense – capitalization – will still stand. As for profitability and credit losses, the real test will come in the second half of 2021 and beyond. Looking forward, one point is very clear: weak results in 2020 and to some degree in 2021 can easily (and justifiably) be explained by COVID-19, but beyond that, improving operational leverage is a must.

Contributors to this excerpt of the European Banking Study 2021:

Dr. Ekkehardt Bauer, Dr. Dirk Holländer, Dr. Frank Mrusek, Dr. Benedikt Rotermann, Heinz-Gerd Stickling, James Williams, Darius Wirtz