Evaluation of impact on existing strategy and adjustment of product management

Back in 1987, the United Nations World Commission for Environment and Development defined sustainability as meeting the needs of people living today without restricting future generations in their ability to meet their own needs. While this definition of sustainability is still valid, ESG takes a more economical perspective in that it represents an approach of integrating sustainability aspects into a company’s strategy.

To help facilitate this, the German Banking Industry Committee (GBIC – DE: Deutsche Kreditwirtschaft (DK)), the German Derivatives Association (DE: Deutscher Derivate Verband (DDV)) and the German Investment Funds Association (DE: Bundesverband Investment und Asset Management (BVI)) jointly developed a cross-product concept, which enables product developers and issuers to classify their own products under ESG aspects.

According to their concept, products are to be assigned to one of four categories:

- Non-ESG,

- Basic,

- ESG

- and ESG-Impact.

“Non-ESG” products are either declared as being unsustainable or do not specify their impact on ESG factors. Products that are part of the “Basic” category consider their impact on ESG aspects, yet, they are not explicitly marketed as sustainable products. On the other hand, products in the “ESG” and “ESG-Impact” categories are explicitly marketed as sustainable products and hence have to follow stricter requirements, such as complying with the United Nations Global Compact (“ESG” products) or following a dedicated ESG strategy (“ESG-Impact” products), e.g. green and social bonds.

In contrast, the sustainability finance advisory council of the German government proposes a classification system which is designed to transparently present sustainability opportunities and risks on a simple scale of 1 to 5 in their final report in February 2021. The scale should reflect the extent to which sustainability criteria are implemented with a financial market product. These two approaches indicate that the implementation of ESG criteria into financial market products is still a moving target and active lobbying by market participants is necessary.

Before diving right into product management, however, the first step to successfully handling ESG is a thorough evaluation of its impact on the asset manager’s existing strategy and to define an overall ambition level. Ideally, this definition should enable the company to implement a holistic approach for the upcoming integration of ESG requirements by taking into account the effects on performance, culture and public image.

As to performance, a continuous repositioning could provide the asset manager with an opportunity to yield more revenue, thus gaining more volume and boosting overall performance.

In terms of culture, decision makers will need to ensure readiness for any change a repositioning could trigger while making sure the company remains authentic. Both institutional and retail investors are likely to appreciate a repositioning towards ESG, thus giving asset managers the opportunity to further polish their public image.

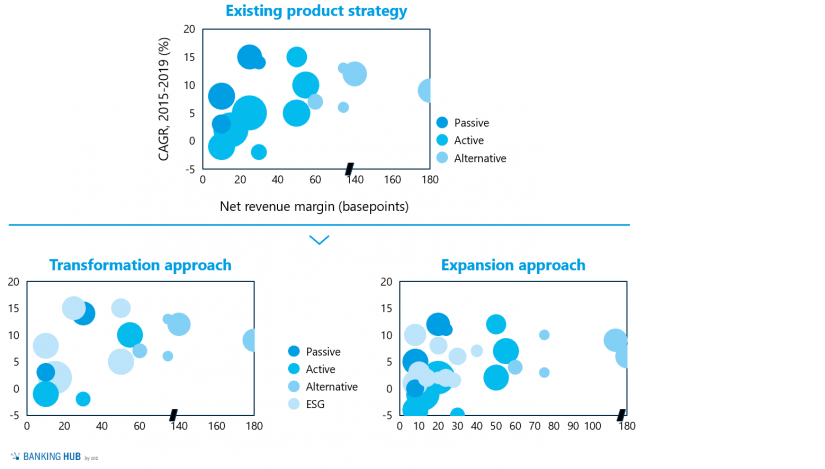

Asset managers’ overall product portfolio is very broad, entailing active, passive, and alternative funds with the respective Assets under Management (AuM) being very heterogeneous across the different categories.

In order to accommodate the recent trend towards ESG investments, asset managers will need to follow one of two approaches to adjusting their product portfolio:

the transformation approach (figure 2) aims at transforming existing products to fulfil ESG criteria. Thereby, potential needs for specific ESG products can be met, allowing funds to gain significant volume, thus preventing any further fragmentation of the portfolio.

In contrast, asset managers following the expansion approach (figure 2) will set up new products and funds according to existing investment strategies, leading to volumes being split into ESG and non-ESG products.

Along with the changes in the product offering, pre-contractual and website disclosures will have to be updated as they will be required to follow new regulatory standards. The necessary adjustments bring about various challenges, such as identifying suitable data sources and obtaining said data.

Asset managers will not only have to develop an approach as to how ESG ratings should be incorporated into product documents but will also have to accurately categorize their products according to the aforementioned ESG-specific framework.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Development of a meaningful KPI set, data sourcing and ESG-compliant client reporting

In portfolio management, strategies based on measurable ESG criteria, the implementation of taxonomy-oriented KPIs and thorough risk analysis will be key. After implementing a sustainable investment strategy, asset managers will need to develop and implement measurable KPIs which also align with the forthcoming Level 2 Taxonomy.

To put this into action, asset managers will require significant amounts of data, for the sourcing of which they have two alternatives: first, they can internalize the sourcing and second, they may resort to an external supplier. When assessing which of the two alternatives is better suited, asset managers will need to conduct a thorough cost-benefit analysis, weighing the pros and cons for both options.

In case the provision of data from an external supplier turns out to be the favorable option, an adequate provider and sourcing strategy will need to be found, allowing for relevant ESG-related KPIs while keeping costs as low as possible. Moreover, due to the complexity of ESG-related data, quality checks will have to be performed continuously, while making sure there is only a single source of truth across the entire value chain.

Due to new regulatory requirements, asset managers will need to perform enhanced risk calculations, incorporating risks arising from ESG events into existing models and scenarios. Any actual or potential material negative impact on an investment’s value arising from an adverse sustainability impact will need to be considered, taking into account macro, sector, portfolio and unsystematic risks.

Equally for reporting, Level 2 RTS will require a comprehensive ESG client reporting, entailing a score rating within ESG categories, a comparison of investments against green benchmarks, transparency with regards to excluded companies and performance impacts as well as examples of direct impacts.

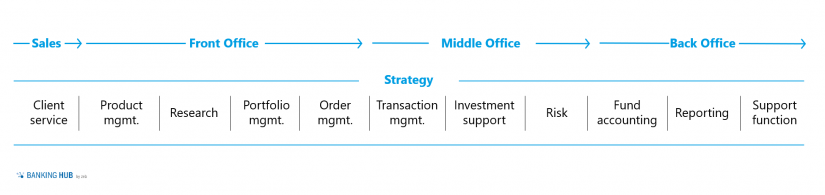

Summary: Impact of ESG on asset managers’ value chain

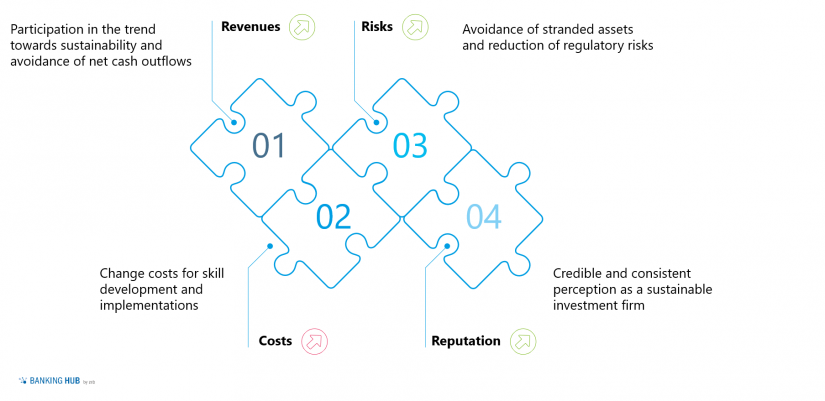

Having discussed some of the many implications that the transformation process will bring about, it becomes clear that the scale of its potential impact on an asset manager’s financials and reputation can become significant (figure 3).

By participating in the trend towards sustainability, revenues are likely to increase while reducing net cash outflow of customers who have a strong belief in sustainable products and would otherwise do business elsewhere. Closely connected to this, however, is the incurrence of change costs, e.g. to develop the skills and capabilities needed to effectively market specific ESG products.

In terms of risks, a repositioning towards ESG will likely reduce regulatory risks and lead to the avoidance of stranded assets. Finally, asset managers who leverage the trend towards ESG investing by adopting a consistent strategy will most likely be able to attain a reputation as a both credible and sustainable investment firm, further reinforcing the aforementioned benefits.