“The sustainability trend has taken off” – a snapshot of current market trends

Sustainable investment funds are no longer niche products. The study, which examined more than 30,000 open-end and exchange traded funds[3] domiciled in the EU-27 countries, Liechtenstein, Norway, Switzerland and the United Kingdom, paints a promising picture of the development of sustainable investment funds in Europe.

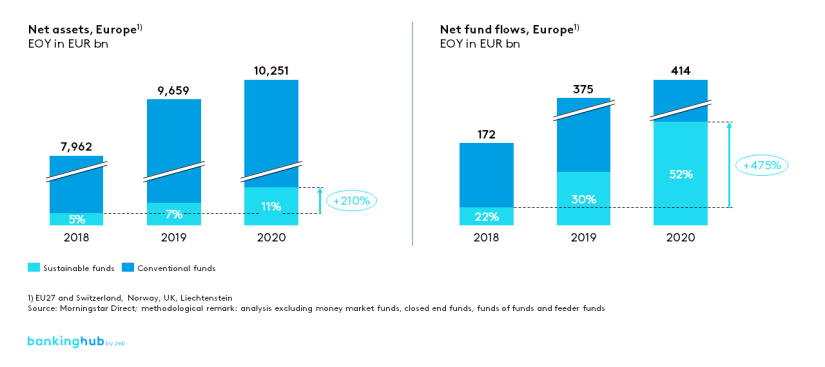

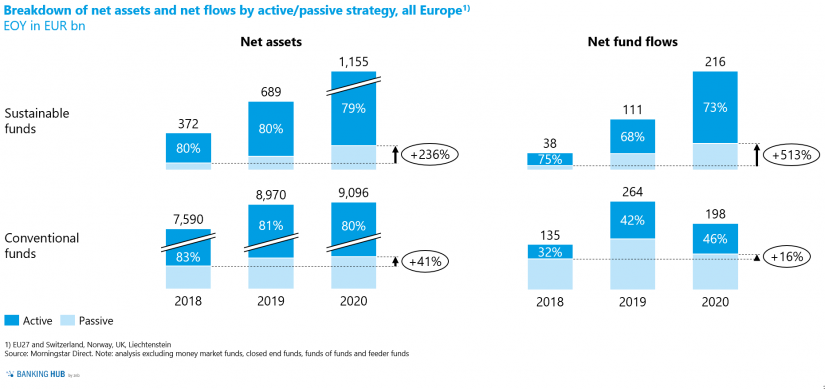

At the end of 2020, investment in sustainable funds accounted for 11% of all European net assets under management, up from 5% in 2018. This share will certainly increase in future given the growing interest in sustainable investment funds from both retail and institutional investors, reflected in the high share of net flows directed into respective funds (Figure 1).

This trend is even more significant when we consider that, at the beginning of 2020, Morningstar introduced a stricter definition of what is considered a sustainable strategy[4]. To qualify as a sustainable fund, ESG must be the core of its strategy, meaning that some generic form of ESG incorporation or negative screening will not suffice.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

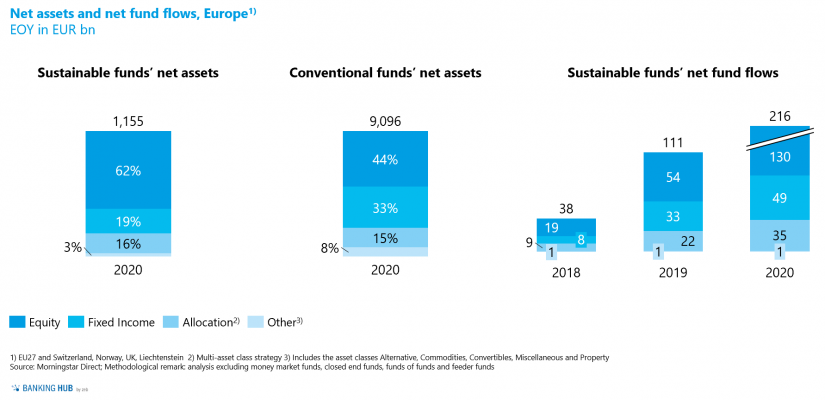

Equity is by far the most important asset class of sustainable funds…

with a share of more than 60% of net sustainable assets, compared to only 44% in conventional funds, supporting the general perception that equity investments allow asset managers to exert greater influence on the ESG efforts of companies. Nevertheless, the integration of ESG factors is becoming more important also in other asset classes, in particular in fixed income, with an approximate share of 20% of sustainable assets and strong inflows in the last three years (Figure 2).

The majority of sustainable investment funds are actively managed

It is argued that active management is in a stronger position to influence the ESG profile of companies as they can divest easily, putting pressure on their management to align its strategy towards more sustainable directions. Nevertheless, passive sustainable investment funds are also seeing increasing interest resulting in strong growth rates over the last three years. Meanwhile they represent 21% of the total sustainable funds sector – similar to the levels seen in the conventional funds sector (Figure 3). .

Figure 3: Breakdown of net assets of sustainable and conventional funds into active and passive investment strategies

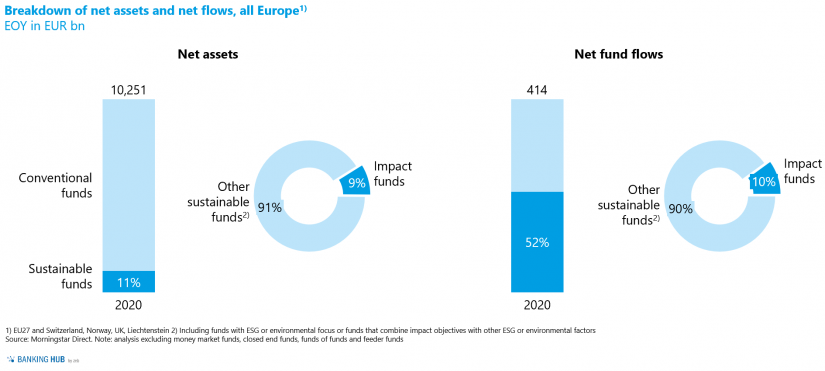

Figure 3: Breakdown of net assets of sustainable and conventional funds into active and passive investment strategiesThe share of net assets of more ambitious sustainability strategies, namely impact funds, is still limited

The share of assets in impact funds is in fact approximately 9% of total sustainable net assets or 1% of total net assets. However, the inflows in sustainable funds were directed to a slightly higher proportion towards impact funds meaning that investors across Europe are increasingly looking for more ambitious sustainable funds than simply incorporating ESG factors into their investment processes (Figure 4).

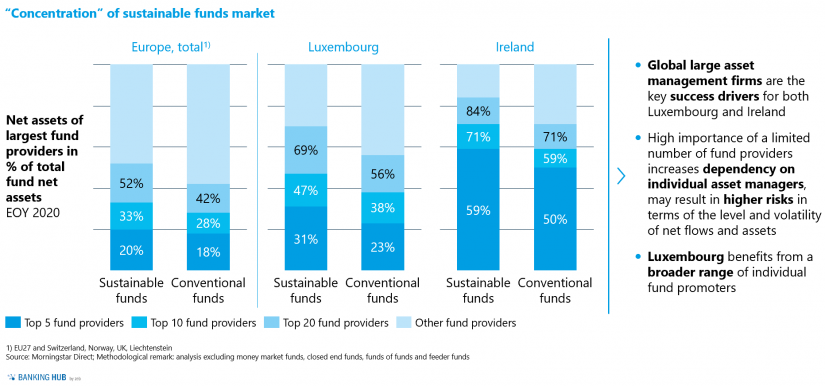

The traditionally high concentration in the fund industry where only few fund providers dominate the markets is even more prevalent in the sustainable sector…

where the top 10 fund providers manage a third of the European sustainable funds’ net assets (Figure 5). The concentration levels differ significantly between different domiciles with Ireland being specifically dependent on some major players, most likely due to its strong passive business. The higher the concentration level, the higher the risk for a domicile in terms of the level and volatility of net flows and assets.

A still-evolving regulatory environment

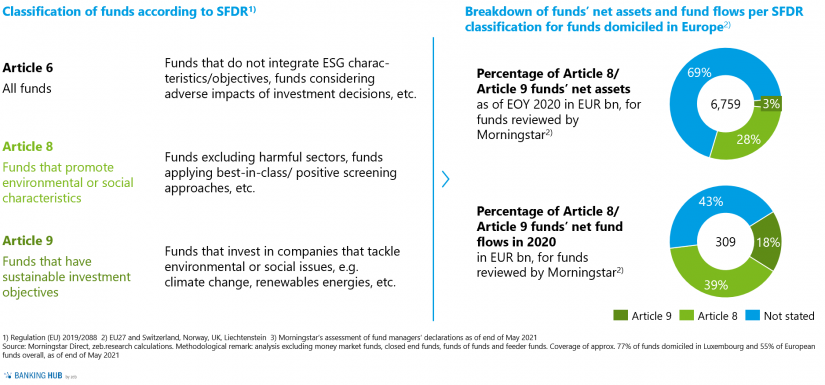

Numerous EU-wide regulatory initiatives launched in the last few years on the basis of the 2018 EU Action Plan for sustainable finance contribute to directing financial resources into sustainable investments and avoiding greenwashing – in particular the taxonomy regulation to define ESG criteria and the Sustainable Finance Disclosure Regulation (SFDR) to clarify the required standard ESG disclosures at product and company level.

While these new regulations will contribute to a more standardized and monitored sustainable finance marketplace, asset managers and investors will need to cope with a phase of transition until all legislations enter into force and are implemented over the coming years. Meanwhile, non-settled definitions and methodologies will be interpreted differently, and consequently ESG-related data may not be available homogeneously or used inconsistently, and classification or ratings of companies, financial instruments and funds may lead to inconsistent results from the perspective of the users.

In this phase of transition, the most important market breakthrough was the adoption of the first set of provisions of the new SFDR. As of March 2021, fund providers have begun to classify their funds according to specific sustainability parameters defined in particular in Article 8 and Article 9 of the Regulation which imply different disclosure requirements. Initial data shows that different approaches are used by fund providers, with some providers pursuing a more conservative approach with only a small portion of their funds marketed as Article 8/Article 9 funds, while others have already applied the new definitions to a larger share of their funds.

In general, the share of net assets in either Article 8 or Article 9 funds is 31%, with about 3% of net assets qualifying as Article 9 funds and 28% as less ambitious Article 8 funds. The criteria that qualify a fund as an Article 8 fund are specifically broad resulting in a vast variety of funds with very different sustainable strategies and ambition levels in this category (Figure 6). However, regulatory adoption is still incomplete, with approximately only 55% of European domiciled funds having received their SFDR designation as per end of May 2021.

Nevertheless, the figures contrast with the overall share of sustainable funds´ net assets in total net assets of funds domiciled in Europe of 11% based on the Morningstar classification. It shows the rather strict definition of sustainability applied by Morningstar where funds that solely exclude some controversial industries from their universe are not considered sustainable.

Figure 6: Sustainable funds classification according to SFDR and respective share of net assets and net fund flows

Figure 6: Sustainable funds classification according to SFDR and respective share of net assets and net fund flowsOutlook for financial firms and investors

As trends show, sustainability is becoming increasingly important in society in general and in the asset management and fund industry in particular. Pushed by increased public engagement and regulatory initiatives, investment solutions that convey capital to sustainable causes are rapidly becoming the norm rather than the exception.

However, while the offering for sustainability products will further enhance to meet the investors’ demand, the next two to three years will present severe challenges. On the one hand, companies need to follow the new ESG disclosure requirements. On the other hand, the investment firms must interpret the already available ESG data, align their offering with their clients’ needs, and ramp up their operating and governance framework (policies, procedures, applications, etc.) to manage sustainability-related matters as part of their daily business.

“European Sustainable Investment Funds Study 2021”

Would you like to read more on the new European sustainable funds study?</

Downloaded the full study here