Asset Management before COVID-19

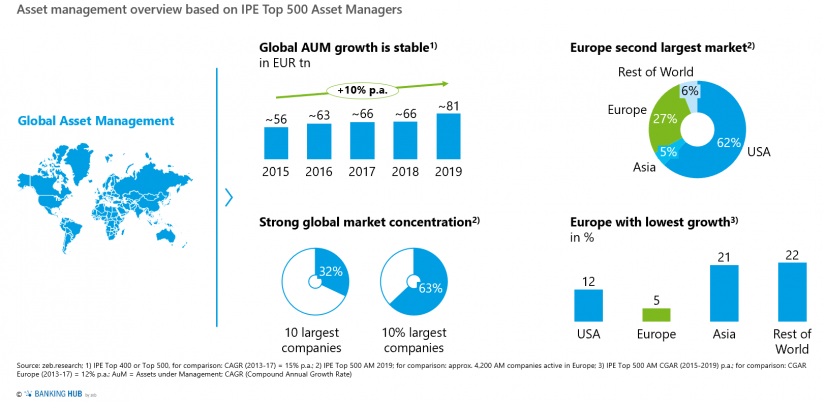

Asset management expanded globally at a rate of around ten percent a year in the period from 2015 to 2019, continuing a trend seen in 2013–17 (14 percent). Total assets under management were around EUR 81 trillion in 2019, considerably up on their level in 2017 and 2018. The degree of concentration in the global asset management industry is now even higher than in our 2019 study, with the ten largest companies accounting for around one third of the market and the forty largest players for almost two thirds. Europe continues to represent the second-largest market in the world, home to 27 percent of total assets under management, second to the United States, which represents 62 percent of the market. However, Europe also shows the lowest rate of growth, with a five percent CAGR in 2015–19, down still further on 2013–17 (12 percent).

Underlying global megatrends – the expanding middle class, the rising number of high net worth individuals (HNWIs), the ongoing shift from deposits to financial assets, increases in life expectancy, longer pension terms – look set to drive assets and flows long term, despite the current crisis. These trends are supported by other worldwide developments such as increasing urbanization, growth in non-residential and infrastructure investment, and recent economic stimulus and public investment programs, which have significant private financing requirements, providing investment opportunities for asset managers.

So much for the “good news”, but what about the “bad news”? The biggest issue facing the industry remains the pressure on profitability. This has a number of causes, many of them already observed in our previous studies and likely to remain a factor for the foreseeable future. Fees are under pressure as a result of poor performance, increased transparency and the continued success of passive investments. Costs are still too high and are even rising in order to keep pace with regulation and digitalization, as well as burgeoning customer demands. Competition in the industry remains fierce as concentration continues, and broad access to distribution platforms is vital, plus the ability to carve out a distinctive profile on those platforms. New players, especially Big Tech companies, are expected to enter the asset management arena, as they have done for banking. As we saw in previous studies, simply expanding in segments offering higher revenue margins is no guarantee of increased profitability, as having a larger share of segments such as retail or alternatives is often associated with higher operating costs.

The results of this year’s industry analysis can be summarized as follows:

- The cost trap is still the key issue; with simultaneous pressure on fees, this leads to shrinking profit margins even with increasing AuM

- “Winner takes it all”: The top five asset managers in our study with 40% of the assets under management in the study sample collected approximately three quarters of net new money

- Passive investment strategies continue to drive growth in net new money, COVID-19 has not changed that

- ESG is becoming the new standard and the new growth driver for net new money, but the level of ambition that asset managers have set themselves in terms of a holistic integration of ESG is largely not yet achieved

Read more in our detailed Asset Management Study 2020:

zeb European Asset Management Study—request now

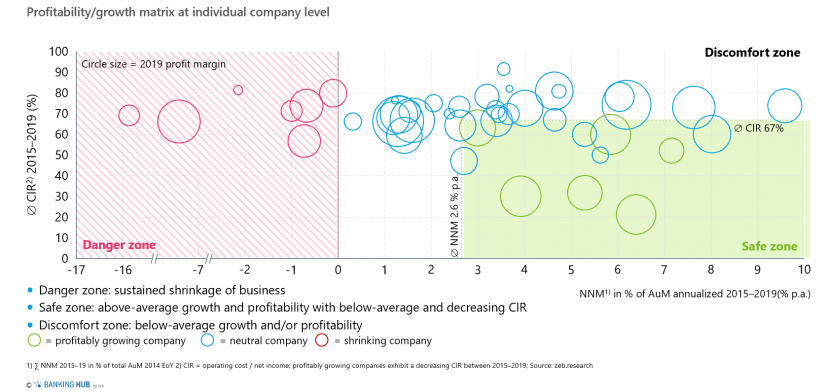

The zeb European Asset Management Study 2020 is again based on an individual company level, enabling zeb to offer its clients company-specific KPI benchmarking. Of the 44 market participants surveyed, only a few are experiencing profitable growth characterized by above-average net new money inflows while at the same time the CIR has been below average and ideally falling in the last 5 years. These are located in the “Safe Zone”, in the lower right quadrant of the chart. In contrast, the majority of the asset managers surveyed are at an above-average CIR level and/or a below-average growth level, while 15 percent of the market participants surveyed have continuously shrunk in the last few years.

Asset Management after Covid-19

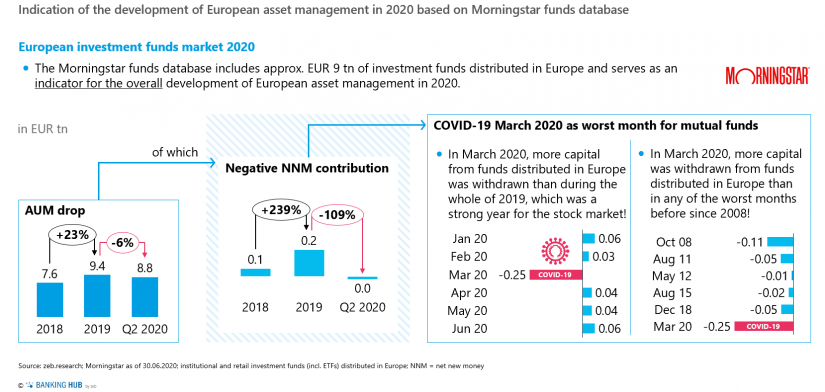

How will asset management fare in 2020? The COVID-19 crisis caused the assets under management of mutual funds distributed in Europe to shrink by around six percent in the first six months of 2020, and NNM by as much as 109 percent. March 2020 was the worst month for mutual funds, with more capital from funds distributed in Europe withdrawn than in any of the worst months since 2008. – Assets managed via segregated accounts for institutional investors are not covered by this data provided by Morningstar, but partly also recorded strong outflows. However, this dramatic impact did not last long. The markets rebounded quickly, some reaching all-time highs as little as three months later. This development was driven especially by sectors profiting from the crisis, such as companies in the tech and health.

Figure 3: Indication of the development of European asset management in 2020 based on Morningstar funds database

Figure 3: Indication of the development of European asset management in 2020 based on Morningstar funds databaseThe long-term picture is not yet clear, particularly as financial markets have to a large extent decoupled from the real economy due to the introduction of economic support programs and corresponding measures by central banks around the globe. The COVID-19 crisis has prompted a range of negative economic forecasts, however, the consensus being that interest rates will remain very low or negative, credit risks will increase substantially, and the future development of financial markets is uncertain. These factors will have a major impact on the asset management industry. The question is, really, when the recently even stronger decoupling of financial markets from the real economy will end – and the economic effects of COVID-19 on the real economy will increasingly be reflected in the asset prices.

To investigate what the future may hold for asset management as the global economy starts out on its tentative path to recovery, we carried out a simulation for a period of five years, based on data by the end of 2019. Below, we describe potential scenarios for the future of the market and discuss their impact on different types of players and business models over the next five years. The scenarios are based on varying assumptions about the development of assets under management, inflows of NNM, revenue development, and changes in cost margins.

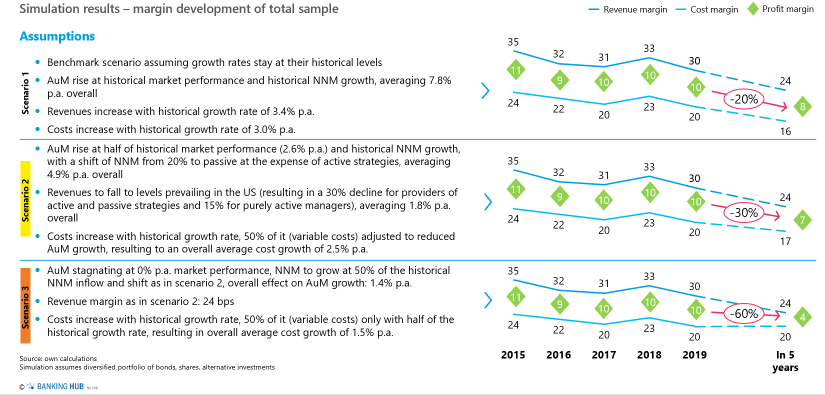

We simulated three different scenarios for the next five years, each reflecting different views on the extent and speed of the global economic recovery and its effect on financial markets:

- In Scenario 1, everything will stay as it was, i.e. the historical growth rates for assets under management (7.8% p.a.), revenues (3.4% p.a.) and costs (3% p.a.) from 2015 to 2019 continue. With asset prices already at or above pre-crisis levels after the markets were hit in March and new money from governments and central banks steadily flooding the markets, this obviously very optimistic scenario assumes that the financial markets continue to be rather decoupled from the real economy over the next five years. It also assumes that the development of benefitting business sectors like Tech & Digitals, Health, etc. may more than offset the adverse effect on traditional industries.

- Scenario 2 assumes a decline in asset growth to 2.5 percent, half the rate of the last five years. The pattern is more or less V-shaped, reflecting a fast recovery of the economy. Individual growth rates for NNM continue as in the last five years, leading to an overall growth rate of 5.1 percent a year for assets under management. Reflecting ongoing demand for passive strategies, Scenario 2 assumes 20 percent growth of NNM for firms offering both active and passive products, at the expense of core active providers. The scenario also reflects the ongoing pressure on fees by assuming a drop in revenue growth to levels comparable with the big US asset managers, leading to a 30 percent decline for firms offering both active and passive strategies, and a 15 percent decline for core active managers. Acknowledging a certain amount of flexibility with regard to variable costs and cost-cutting efforts, 50 percent of the historically observed cost growth rate is adjusted down in line with the reduced growth rate for assets under management, resulting in average overall cost growth of 2.5 percent a year..

- In Scenario 3, assets under management stagnate, with a market performance of zero percent over the next five years. This is a U-shaped economic recovery. We assume that NNM grows at half its historical rate and apply the shifts from active to passive as in Scenario 2. Growth of assets under management is thus 1.3 percent a year, purely driven by NNM. The revenue margin is 24 bps, as in Scenario 2. In this scenario we assumed only half of the cost growth seen in the past assuming that the variable costs will not increase which results in an average overall rise in costs of 1.5 percent a year.

Applying the three scenarios to our sample of asset management firms reveals some of the challenges ahead. Overall, we see a decline in profit margins over the five-year simulation period, despite the fact that scenario 1 is based on historical parameters, namely a continuous asset growth as observed in the previous five years. Even in Scenario 1, the most optimistic scenario assuming no long term effects of COVID-19 on asset growth at all, profit margins fall by 20 percent over the next five years. Considering long term negative impacts of COVID-19 on the development of assets combined with more realistic assumptions on both the direction of net new money and fee level developments, the picture deteriorates – even though all of the respective scenarios also model in some cost-reduction efforts. In Scenario 2, profit margins fall by 30 percent over the next five years; in the more pessimistic Scenario 3, assuming no market performance at all, they fall by about 60 percent

The simulation paints a negative picture regarding the asset management industry’s performance indicators in the next five years. Even before COVID-19, margins were already depressed. Could the industry be slipping into a danger zone now? The pressure on earnings will persist no matter whether assets under management grow or shrink. Passive products will continue their success story whereas the performance of active managers will continue to be viewed critically. There is also not much leeway for asset managers regardless of their investment philosophies. The bulk of passive strategies is highly transparent and follows plain vanilla indices where the fees are the main differentiator. Bond managers face the already low interest rate levels which do not offer potential for price adjustments either. As pressure on the earnings side continues, cost reduction and cost discipline will be absolutely essential, now more than ever.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Recommendations and conclusions from the zeb.European Asset Management Study 2020

Based on the analysis presented above, five key recommendations can be derived:

- An adjustment of the business model in the direction of a clear strategic positioning with clearly recognizable USPs (this is in particular relevant for those companies that can realize little scaling effects with undifferentiated positioning and low AuM)

- Radical and disciplined cost reduction initiatives both in line with the adjustment of the business model and the resulting streamlining of product ranges and in individual areas with high cost reduction potential (e.g. data management)

- Development of a clear digital target picture

- Introduction of effective data governance in combination with the implementation of an efficient data management

- Implementation of a holistic approach to the integration of ESG to ensure long-term competitiveness – more as a necessary measure than as a distinguishing feature

More than ever before, tackling these measures appears to be indispensable to ensure a sustainable successful business in a highly competitive industry and enables asset managers to make the leap back into the comfort zone or even better into the save zone.

Curious? Then order your free copy of the zeb European Asset Management Study 2020 here or contact us for individual discussions.

More articles about Asset-Management

-

- Beginning of 2019

In our first Asset Management survey 2019, which analyzed the European asset management industry over the period of 2013–2017, we showed that the industry had been lulled into a false sense of security – a comfort zone in which asset managers no longer continuously reviewed their competitiveness and adjusted their business accordingly. - Early 2020

In our update on the industry in early 2020, and thus before Covid-19, we once again summed up: an industry in the cost trap.

- Beginning of 2019