Action plan of the ECB

According to the EU Commission, the European states and thus also the companies within the EU will be forced to fundamentally restructure their economies and their business.

New, ambitious standards can similarly be expected from monetary policy makers and banking regulators. For example, the ECB only recently presented an action plan to take account of climate protection aspects in its monetary policy strategy, underlining the seriousness of its intentions with an ambitious roadmap.

The financial services sector is ascribed a crucial role in the sustainable transformation of the economy. The first institutions have already positioned themselves clearly. Especially corporate banking will witness a fundamental transformation in the coming years.

In the following, we will outline initial answers to the three most important questions that corporate banking managers will not be able to ignore.

Why is ESG relevant in corporate banking?

To answer this first question, four hypotheses need to be tested:

- The customer requires it

- The regulator demands it

- The ESG-induced earnings potential makes it attractive

- The competition is already on the move

Customer: Well over 90 percent of medium-sized businesses consider sustainability to be a particularly relevant issue, and according to the latest studies[1], two thirds have either already developed a concrete sustainability strategy or are currently working on one. What these companies expect of themselves they also expect of their credit institutions.

Almost 70 percent of the companies surveyed require their bank both to offer sustainable financing products and to operate in a sustainable manner itself. In times when banks are vying for customers and not vice versa, a bank’s sustainable operations can be the decisive differentiating factor from the customer perspective.

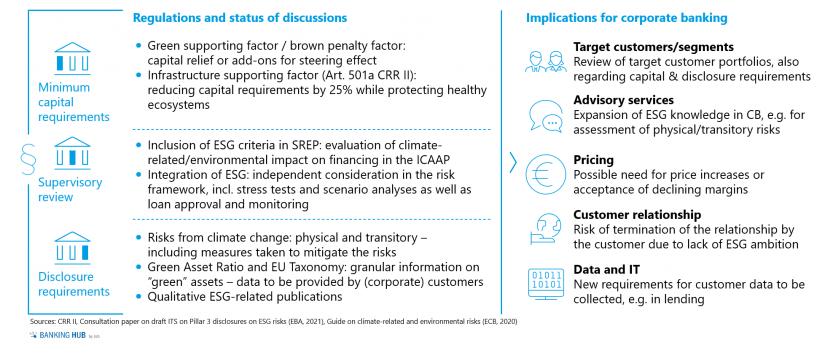

Regulator: Various regulatory authorities are pushing credit institutions to address the issue of sustainability. There are already regulatory initiatives in all three pillars which, once introduced, will have an impact on corporate banking in the short to medium term. For example, in the area of minimum capital requirements (Pillar 1), capital relief for particularly sustainable financing projects and capital add-ons for harmful financing projects are being discussed, which will have a steering effect on lending. The fact that regulators have so far only considered financing for “green” customers and not so much for those who want to become green (transformation financing) must be viewed critically.

In the area of supervisory review (Pillar 2), ESG criteria, among other things, are included in the SREP, and ESG is taken into account independently in the risk framework (cf., for example, BaFin leaflet on dealing with sustainability risks). At the same time, more stringent requirements will have to be met in the area of disclosure obligations (Pillar 3), for example regarding the scope of physical and transitory risks in the portfolio and regarding granular information on green assets (“green asset ratio”). From this alone, far-reaching disciplinary effects are to be expected.

In addition to the implications already described, further effects are to be expected, such as increased demands regarding the ESG expertise of corporate client advisors as well as the comprehensive and timely availability of customer data.

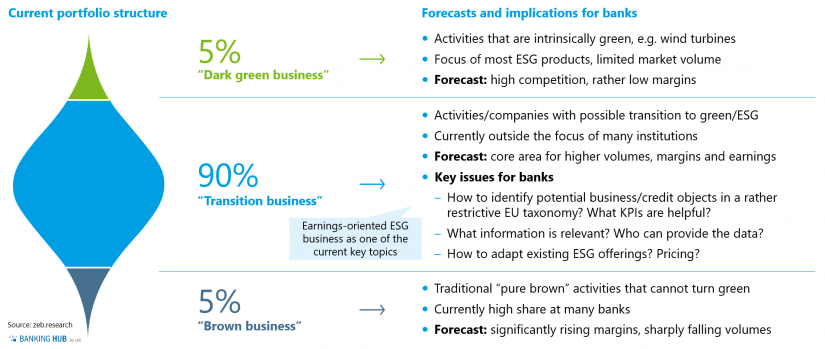

Earnings potential: To classify earnings potential, it is important to distinguish between “dark green business” (intrinsically ESG-compliant), “transition business” (where the aim of the business is to achieve ESG compliance) and “brown business” (fundamentally not transformable).

The initial focus of many institutions is obviously on “dark green” activities such as the financing of wind power plants, where, in addition to a limited market volume, there is now a high level of competition.

According to zeb assessments, however, the key to success lies primarily in the “transition business”, which accounts for about 90 percent of a bank’s loan portfolio on average. This business is the core area for additional earnings potential, driven by higher volumes and margins. Here, too, key questions have to be answered by the institutions, for example regarding the correct identification of suitable credit objects and the corresponding offer.

All in all, it can be assumed that the ambitious 2030 climate target will result in additional investment requirements, which in Germany alone will lead to additional earnings potential of up to EUR 3.2 billion or 10 percent p.a. in corporate banking.

Competition: Many credit institutions have already begun to systematically address the issue of sustainability in corporate banking and to launch their own initiatives. Looking at the 50 largest banks in Europe, 94 percent have already made a voluntary commitment to the Paris climate agreement. In addition, almost half already have a defined net zero target, i.e. a carbon footprint reduced to net zero across their entire lending and investment portfolios.

What’s more, various (regional) banks in Germany have also set out on this path. Volksbank Mittelhessen, for example, focuses explicitly on financing ESG sectors (e.g. renewable energies) and, as part of their ESG standards, BayernLB has essentially excluded the financing of the arms industry.

In summary, it is clear that an ESG-compliant positioning is necessary in corporate banking – not only to manage ESG risks, but also to seize new opportunities. In our estimation, there is still a 3–5 year window for the development and “sustainable” implementation of an individual positioning. After this period, regulatory standards and market developments will have ensured that ESG compliance is part of a bank’s standard repertoire in the corporate banking business.

What needs to be done in corporate banking?

From zeb’s point of view, there are three key measures to be taken for a successful ESG positioning:

- Adaptation of the advisory process based on customer needs and service offering

- Expansion of “beyond banking” services and use for differentiation

- Adjustment of credit risk management with regard to corporate banking and the bank as a whole

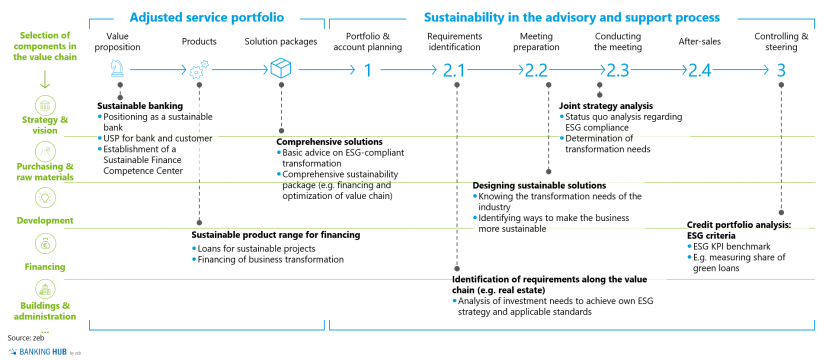

Advisory process: Companies need to consider sustainability-oriented optimization along their entire value chain. To name just two examples, this includes the active selection of raw materials and suppliers in purchasing, as well as investment requirements for plants and buildings, right through to logistics.

The financing and support of related projects and investments requires credit institutions that not only understand the current value chain of their customers, but whose service portfolio and advisory process are geared to the future parameters in their customers’ value chains. With regard to the service portfolio, it is conceivable, for example, to link loan terms to the achievement of sustainability targets (e.g. CO2 reduction targets) or to identify ESG-related investment needs at an early stage as part of the requirements identification process. A concrete client example of implications for the service portfolio and the advisory process is shown in Figure 3.

“Beyond banking” services: Banks can use these to offer corporate customers added value over and above traditional banking offerings, while at the same time differentiating themselves from the mainstream competition. They include, for example, the analysis of the customer’s individual CO2 footprint by means of a tool or ESG profile analyses including detailed peer group benchmarking. Arranging specialized energy advice or ESG investment analyses with recommendations on how to improve the company’s ESG profile could also be on the list of additional services.

Across Europe, a growing range of services can be observed, from traditional financial investments to specific advisory solutions. The zeb European Green Banking Database already comprises more than 300 “green” products and solutions from more than 100 institutions across Europe and covers the structural characteristics of different countries (e.g. strong fintech sector in Great Britain, government pressure towards sustainable products in Scandinavia). Against this backdrop, it is becoming increasingly important for institutions to develop an offering in the field of “beyond banking” that fits their own organization and creates added value for the customer.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

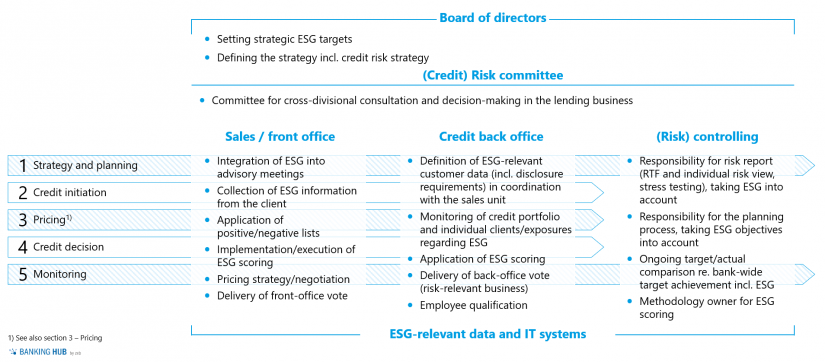

Credit risk management: From strategy and planning to monitoring, sustainability orientation is an issue that touches all aspects of the lending business. In view of this, the range of tasks and responsibilities must be systematically analyzed along the lines of all those involved in the lending process and expanded accordingly. While the board of directors has to define strategic ESG objectives in corporate banking and the resulting credit risk strategy and a (credit) risk committee needs to monitor these on an ongoing basis, both sales / front office as well as back office and (risk) controlling must be further developed operationally to include ESG aspects.

In sales, for example, ESG issues must not only be integrated into advisory discussions, but ESG information also needs to be collected from the customer and ESG scoring must be carried out. In addition to obvious examples such as the exclusion of financing coal-fired power stations in new business, this also includes initially less clear-cut cases such as financing battery cages for conventional poultry farming when the most important customers have already made a commitment to organic animal husbandry from 2030 onwards.

The credit back office also plays an important role in this context. Here, ESG-relevant customer disclosures must be defined, ESG exposures per customer and in the portfolio monitored and the defined ESG scoring applied. It is critical for success that sufficient expertise is available in the back office to be able to issue a qualified (ESG) vote, especially in risk-relevant business, and to identify critical transactions at an early stage.

Last but not least, in (risk) controlling, the risk report must be supplemented with ESG-related information (e.g. an ESG RTF), and a regular comparison of target and actual figures regarding target achievement must be carried out. In addition, the operational responsibility for the planning process, taking into account ESG objectives, as well as the methodological authority for ESG scoring lies here.

In summary, it is clear that there is much to be done in corporate banking to achieve a successful “sustainable transformation”. Even if the above-mentioned levers have been defined as individual components, zeb believes that, owing to significant overlaps, the isolated implementation of such components will not lead to success unless there is an appropriate superstructure.

What might a ESG focused approach look like?

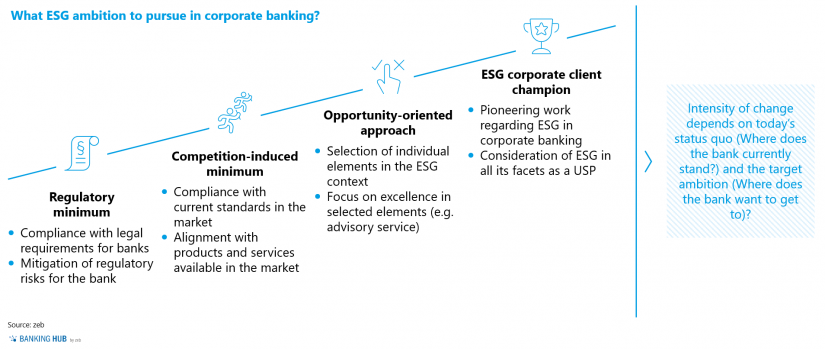

Against the backdrop of regulatory and market pressure, the company’s ambition or desired positioning must be formulated as a fundamental decision: Is it enough to meet legal or market-based hygiene requirements, which are difficult to avoid anyway? Does the bank additionally want to make its mark in selected areas, such as advisory services? Or could it make sense to differentiate oneself from direct competitors by means of a holistic ESG USP? There is a broad spectrum of options and after carefully weighing them up a strategic decision must be made.

To ensure a focused approach, it makes sense – especially if there is still uncertainty within the management team – to jointly clarify the concept of sustainability in a workshop format and perhaps even identify initial fields of action.

In order to develop a consistent and practicable sustainability strategy in corporate banking, it is recommended to follow up the workshop with a project-based approach in which, after a systematic status quo assessment, the bank’s individual ambition level is determined, measures are defined, calculated and prioritized, and these are then detailed and consolidated in a roadmap. In this context, it is important to harmonize the sustainability strategy in corporate banking with the other business segments and divisions in order to take account of relevant interfaces and ensure a common endeavor.

Conclusion about sustainability in corporate banking

Sustainability is a megatrend that affects all areas of our society and should be high on the agenda of credit institutions and other financial service providers. Particularly in corporate banking, not only the political and regulatory environment, but also the customers themselves have high expectations of the financial industry. Hence, it is indispensable for corporate banking managers to promptly review their action plans and define their own ambition in order to lay the foundation for “sustainable success” now. It’s sink or swim.