How it all began: the founding of the Novus World Ltd. neobank

Hi Marco, what was your idea for the start-up and how did you come up with it?

Our basic idea was simple – we asked ourselves: how can we use what we have learned in the financial world to make a positive contribution to society and the environment?

We saw that our customers were ready to deal with the sustainability hygiene factor. So we simply analyzed our ideas under consideration of the demand dynamics in the market and said to ourselves: this is exactly the right time. We had several business models in mind, and through our prior jobs for private equity funds, we also had insight into certain markets that looked promising to us.

Did you foresee the next hype in sustainability matters or why did you consider the topic important?

Besides our personal belief that a company should have a “purpose” beyond profitability, we saw very strong demand and growth dynamics in the digital banking segment: in 2020/2021, the customer base of many established players multiplied within a few months – with a clear trend towards further growth. In addition, another social trend has emerged: people want to live with a higher degree of awareness for environmental and sustainability topics.

We capitalized on both trends to launch a differentiated product that serves a niche and does not have to compete with the offerings of large and established players. Our goal was to become the market leader within the sustainability niche in the “conscious consumer” niche. Ultimately, this is how the NOVUS debit card came into being.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Sustainable neobanks: competition and USP

The debit card allowed NOVUS to become the first company in the sustainable neobanking niche to implement sustainability in such a consistent manner that it also became the first B Corp licensed company in the UK. How does NOVUS differentiate itself from the other market players?

In recent years, companies at all stages of development have increasingly embraced sustainability, and we appreciate this. In our market, we were the first start-up in the UK to be licensed as a B Corp. This has helped us tremendously in tapping into the market demand for a product like ours. Our customer base consisted primarily of affluent millennials (80%) and 20% of Generation Z members from the UK, but also with immigrant backgrounds.

“Every ‘card tap,’ i.e. every time you use your card, has a positive impact on the world – that’s what motivated us, and that’s what we put into practice.” – Marco Wolf, co-founder, NOVUS

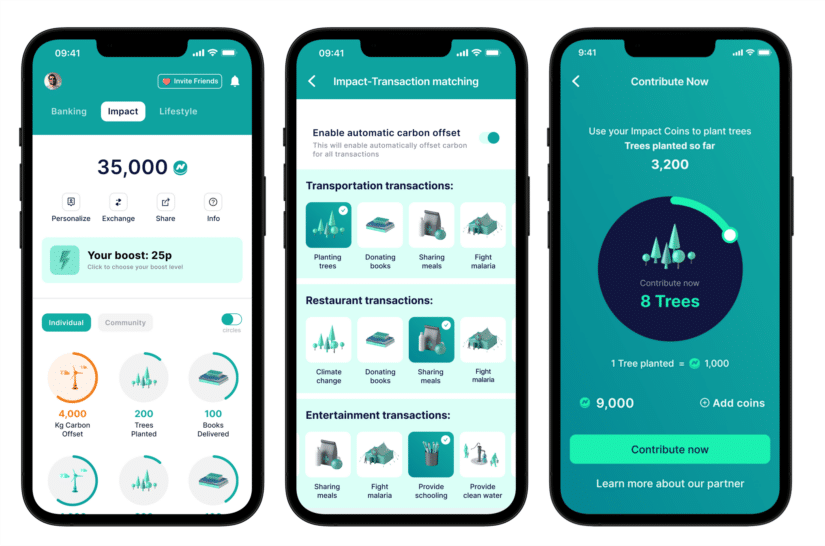

A key aspect in differentiating our product offering from the competition was our proprietary “thematic matching” technology, which runs in the background. With this technology, a portion of the interchange fee is donated to NGOs of the customer’s choice for every transaction made through the NOVUS debit account. Let me illustrate this with an example: when I pay at a restaurant with my NOVUS debit card, the algorithm allocates the credits received during the payment process to the category for donating a meal to a person in need.

In a next step, we expanded the product offering to the basic features of a lifestyle app and entered into partnerships, for example, with companies from the food and beverage, household products, and fashion, beauty and cosmetics sectors – all with a focus on sustainability. NOVUS customers have received special offers through our app. Each of our business partners or external service providers has been very carefully screened as part of our ESG due diligence.

What exactly do the principles in your manifesto and the principle of transparency mean to you?

At NOVUS, we treat every stakeholder according to the principles defined in our manifesto. In my opinion, there is no growth without consistent principles. Particularly with regard to employee motivation and leadership, they provide the necessary framework to jointly achieve the goal.

For the sake of clarity, let me give you an example to illustrate what this means in terms of transparency: our customers were able to see at any time what happened to the commissions they received from their trading partners. For example, out of a 15% commission, they received 13% from us as an impact cashback which helped support our NGO partners, and we used 2% to cover our operating costs. In addition, all customers could see on their dashboard how many credits were needed to, for example, share a meal, save a turtle, or plant a tree. NOVUS also showed them their pound-to-impact ratio so they could keep track of how much good they had already done.

Challenges in the venture capital community

In 2022, volatile capital markets and dried-up funding sources in the venture capital (VC) market put increased pressure on investors in the VC community in terms of returns and investment progress, and on startups in terms of profitability. The latter is causing problems for many neobanks as they lack the economies of scale common to large retail banks. What was your experience and how did NOVUS deal with the situation?

The market has changed fundamentally in the last few months with increased inflation and the central banks’ foreseeable response to this, namely to raise key interest rates. Expected cash flows for the next few years are currently valued at a lower amount than before the interest rate hike. As a result, companies are under increasing pressure to generate higher cash flows and justify their valuations. This trend has also reached the venture capital industry.

The digital banking business of neobanks only works through economies of scale, i.e. until sufficient economies of scale can be exploited, these startups make a loss. Venture capitalists tolerated this situation for many years, but today they are no longer willing to support a neobank for years and several rounds of financing without a positive P&L. As a result, I expect the market to consolidate, which would lead to many neobanks disappearing from the market or being bought out.

“I’m still incredibly impressed with how the whole team pulled it off.”– Marco Wolf, co-founder, NOVUS

In the case of NOVUS, the entire founding team closely monitored the situation and simulated possible future developments in our financial planning. In particular, we focused on how to position NOVUS in a capital market with changing requirements.

In doing so, we realized that we have an excellent understanding of the entire value chain (from POS provider to acquirer and from network to issuer), based on our in-depth knowledge of the core banking infrastructure and transaction systems that we gained while building our own core banking engine and all related services. We can now leverage this fundamental understanding to help other companies build their own payment infrastructure or develop payment-based products.

Under the new Greenfin brand, we primarily offer software and product development services, provide advisory services on payments and sustainability, and white label solutions to serve larger financial services companies, such as a Mobiliar Group subsidiary and an ecommerce marketplace platform with hundreds of B2B customers. After just a few projects, we were already breaking even with the new brand.

Do we need more neobanks?

Does it still make sense, i.e. is it still worthwhile to start a neobank? Do we need more sustainability-focused neobanks?

At present, I see rather moderate growth in this area due to the rising cost of living and the changing priorities of traditional neobank customers. I think that the market in the U.S. is still attractive due to higher interchange fees.

In our home market, the United Kingdom, or Europe in general, there are already a large number of players. Consolidation will reduce fragmentation over the next few years, but for now, founders should pay particular attention to the cash flow profile of their business model. In particular, they should move away from capital-intensive business models to make it easier to attract investors.

Thank you very much for the exciting interview and all the best, Marco!