What has happened?

Regulatory requirements and importance of BIRD as part of the ESCB’s long-term reporting strategy

The latest version 5.0 of the BIRD, published at the end of 2019, contains a revised input data layer, which enables the mapping of “CoRep Credit Risk” and “FinRep Non-Performing Loans and Securitization” via its expanded data scope. Thus, version 5.0 of the glossary contains the data requirements for the following regulatory requirements[1]:

However, the hoped-for expansion to include reports on the Liquidity Coverage Ratio (LCR) and the validation rules for CoRep and FinRep failed to materialize. Instead, the focus for 2020 was placed on revising the data model and testing the mappings from the input layer via the transformations to the non-reference output layer (output data layer for the export to reporting templates), which is to improve the stability and quality of the glossary[2]. However, after the promised release in summer 2020 also failed to materialize, it remains to be seen to what extent the coronavirus pandemic will further impact the project schedule. Thus, the plans of the BIRD Steering Group continue to provide for the inclusion of the LCR as well as further improvements in other areas.

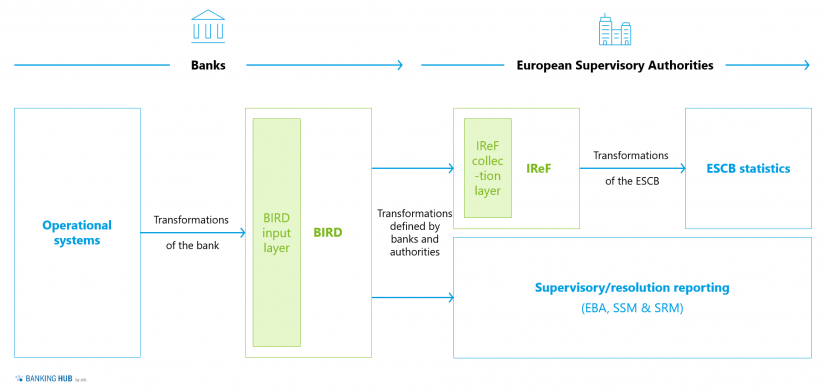

The importance of BIRD as part of the ESCB’s long-term reporting strategy was again highlighted in the September 2020 feasibility study conducted by the European Banking Authority (EBA) on behalf of the European Parliament and the Council[3]. In particular, the close integration of the Integrated Reporting Framework (IReF; formerly also: ERF) in the data collection target picture (see Figure 1) shows that an implementation of the IReF between 2024 and 2027, as currently planned by the supervisory authority, is feasible by connecting the operational systems of the individual banks to the BIRD input layer.

Figure 2: Illustration of the ESCB strategy for data collection from banks (adapted from the ECB Annual Report 2019)

Figure 2: Illustration of the ESCB strategy for data collection from banks (adapted from the ECB Annual Report 2019)Why is BIRD not being implemented now?

Target group of BIRD and onverting the in-house data model to the BIRD standard

In view of the many advantages of BIRD for banks and supervisors alike, which have already been highlighted in the previous articles, and its growing relevance in the near future, the legitimate question arises as to why BIRD has so far only been marginally considered by most institutions. To answer this question, it is first necessary to take another look at who the target group of BIRD actually is.

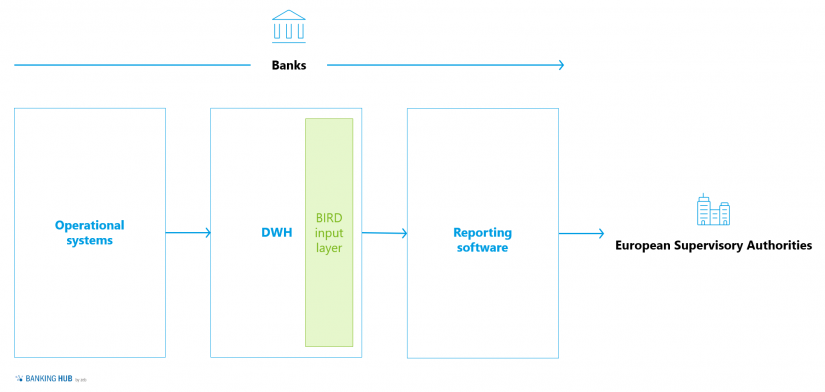

In principle, BIRD is aimed at all European banks as a complete solution for generating regulatory reports. It is thus to be understood as a blueprint for setting up a regulatory data warehouse (DWH) including automated transfer of the data into the required XBRL templates. However, while the input layer must be directly connected to the internal systems of the respective financial service provider, the later layers of the model, as well as the associated transformation and validation rules, fulfill functions that are currently more likely to be found in standard reporting solutions.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Since the regulatory requirements already had to be met before BIRD, each financial institution already has its own financial DWH with mostly individual data mappings or at least a proprietary data delivery from the operational systems into a specific data model of the reporting solution. Converting the in-house data model to the BIRD standard therefore offers no immediate monetary benefit for the institutions. For this reason, BIRD is currently treated mainly as a benchmark for the institutions’ own data models and is used as a template for restructuring measures that are necessary anyway. With a possible alignment of the solution providers’ data models with BIRD, this gradual harmonization would continue in the future.

BIRD as an opportunity for FinTech companies

Case study on the implementation possibilities at Revolut Ltd.

The situation is different when a completely new DWH or reporting data mart is about to be built, as is the case with some neobanks and FinTech companies that have recently acquired a banking license. Here, BIRD offers an interesting approach to building a complete reporting solution as cost-efficiently as possible.

For this purpose, a case study on the implementation possibilities at Revolut Ltd. was conducted as part of the master’s thesis “Building the BIRD’s nest”. Revolut Ltd., headquartered in London, has been offering financial services in the retail sector since 2015 by means of the self-developed app of the same name. Valued at $5.5 billion in 2020, the FinTech company received a European banking license in 2017 for its subsidiary Revolut Bank UAB, based in Vilnius, Lithuania.

Currently, Revolut Bank reports to the supervisory authority via a common reporting software, which is supplied with data from the upstream systems via XML upload. Against the background of the resulting complex supply of different data source systems, the bank has recognized the need for harmonization and central control of the data supply, which should be investigated in the context of the case study.

For this purpose, BIRD was used as the basis for determining the data requirements for reporting. In a first step, relevant BIRD data clusters for Revolut Ltd. were selected based on the products and reporting requirements. In order to determine the degree of coverage of the reporting requirements by BIRD, the BIRD input data layer was conceptually transferred to the reporting system in the second step. In the process, a high degree of coverage was identified. The transformations required for this are characterized by low complexity.

The results show that BIRD already covers a significantly larger scope than required by most FinTech companies, as they tend to offer a limited product portfolio compared to a wholesale bank. Furthermore, a first analysis showed a high compatibility between the BIRD input layer and the established reporting software. Out of 307 variables previously selected for analysis, 95% could be assigned to a counterpart in the reporting software data model. Thus, the approach, as simplified in Figure 2, would be a valid and cost-effective option for building a reporting solution for a (neo)bank.

The next step would be to build the DWH along the relevant data clusters of BIRD and successively convert the data delivery to the reporting system via the integrated data warehouse.

BIRD as an entry point to a modern integrated data platform

Data model requirements and achieving synergies when the data model is supplemented

The BIRD data model offers a suitable starting point for the development of a harmonized data provision for regulatory reporting as well as for financial controlling with a broad and still growing coverage of the requirements. Experience has shown that the attributes required by regulatory reporting in an integrated data warehouse already account for more than half of the existing data of a bank’s overall bank management, so considerable synergies can be achieved when the data model is supplemented by other disciplines such as (risk) controlling.

For the successful development of a DWH, however, further aspects in the basic design and procedure must be taken into account in order to prevent a more extensive need for adjustment at a later point in time.

MaRisk imposes requirements such as the technical and functional traceability of data movements, the documentation of changes to data, and the correctness of data.

In principle, this requires consideration of the development of a data lineage using suitable tools or documentation methods. Suitable data quality measuring points must be implemented along the supply chain and corresponding reporting control processes must be established.

In addition, it is recommended to provide for a consolidation of all metadata created in the process in a metadata repository in order to facilitate operational and business processes in connection with the DWH.

Current technological developments in the areas of big data and data analytics allow the establishment of a data warehouse in modern, scalable architectures and thus the expansion of traditional controlling and reporting by including analytical methods and use cases.

Many of the required components are available in the form of cloud-capable open-source solutions (e.g., based on the Hadoop ecosystem), for which a broad developer base with an active community exists in the market. The development of a DWH can thus be carried out cost-efficiently. Cloud-capability opens up the options for rapid prototyping from on-premise operation to a later transfer to the cloud, thus ensuring scalability and future viability.

Conclusion BIRD 5.0

Especially for banks that want to address the topic of integrated data management in a timely manner and with manageable effort, such as FinTechs or neobanks, BIRD represents a very good starting point for building a regulatory data management system. This was successfully demonstrated in an initial preliminary study at Revolut Ltd., showing that the current development status of BIRD has now reached a deployable maturity. With the further development of BIRD and the synchronization of the initiative with the IReF, it can be assumed that its applicability for data warehouses and reporting will steadily increase and the importance of BIRD in the reporting process will continue to grow.