About Raiffeisen OÖ Ventures

Hello Mr. Sancar, what prompted you to launch Raiffeisen OÖ Ventures, and what are your goals?

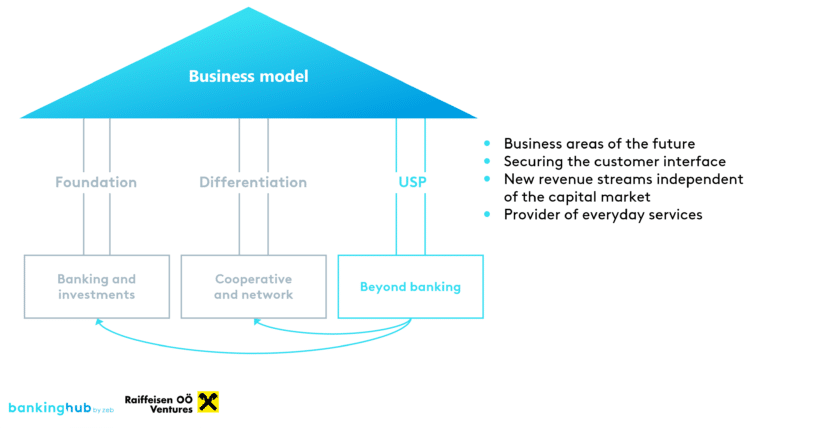

Raiffeisen OÖ Ventures emerged from the strategy project of the Raiffeisen Banking Group Oberösterreich. The goal was to develop innovative, future-proof business models and make the values of a cooperative tangible. This gave rise to the idea of a regional ecosystem.

The motto of our strategy project “Vom Kunden her denken” (editor’s note: “Thinking from the customer’s perspective” in English) laid the foundation for a radical customer orientation that is transforming us from a financial to an everyday service provider. This creates a new brand experience and opens up new revenue streams. We promote our cooperative mission by supporting regional value creation.

Venture building at the interface of start-ups

In your view, what is the essence of successful venture building at the interface of start-ups and an established company?

Successful venture building requires a clear vision and the best of both worlds. The agility of our start-up and the stability of the Raiffeisen Group create a fertile environment for growth. Innovation requires quick decisions and the management’s commitment to implement change. The foresight of our owners has helped us pioneer the operationalization of a beyond-banking ecosystem.

Cultural compatibility is important to mobilize our decentralized Raiffeisen banks as sales partners. In addition to thorough communication, understanding our overall structure as well as the banking systems and processes helps. Successful venture building also requires the creation of appropriate legal frameworks – complex assessment and implementation play a central role in this and need to be considered as part of technology development.

What challenges do you face and how do you overcome them?

Our project was initially marked by extensive research, planning, legal challenges and an immense technological effort. When implementing innovation projects, change within the company represents a major uncertainty factor. In addition to extending the business model, quite often the structural integrity of the corporate culture and the self-image of the employees are interfered with. This results in big communication tasks that tie up a lot of resources. For us, it was a kind of organizational development with a change in the DNA of colleagues who suddenly found additional topics on their desks.

In the marketplace sector, there is also the chicken-and-egg problem: which is created first, supply or demand? Here we benefit from the Raiffeisen structure, which enables us to address both categories through a network of existing contacts. Other potential ecosystem operators would have to invest large sums of money to even gain access to the companies that we serve as long-standing bank customers who trust us.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Idea management and development of start-ups

How do you select promising ideas in the beyond-banking space?

Beyond banking is to become a further pillar of the business model alongside the core banking business and investments. The idea must be based on a business case that has been fully thought through; presenting indirect returns as profitable is not enough.

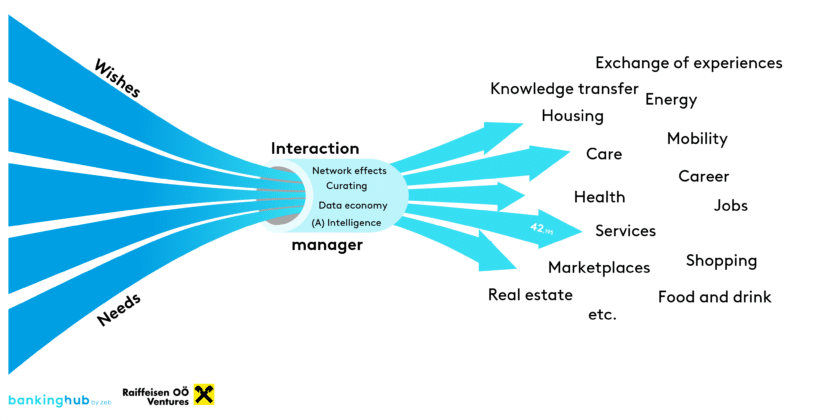

With our network, we connect stakeholders and activate the communal spirit. In doing so, we are very much guided by Raiffeisen’s cooperative values. Every idea must create everyday relevance and support people in their actual lives (both digitally and physically). New solutions must be integrable into the digital ecosystem and scalable. Our strength lies in digitally mapping all life realms in one integrative solution, conveniently and easily in a “super app”.

What is your approach to developing new ideas or start-ups?

It all starts with the vision and the strategic goals, taking into account trends, customer needs and markets. After validating and developing the ideas, we look at integrating them into the existing business in order to exploit synergies. Regular reviews and adjustments are necessary to respond to market changes. Above all, there needs to be a cultural change as well as a culture of learning and continuous improvement to learn from successes and failures. Every solution needs a responsible team with industry expertise.

In the past, banks often lagged behind other industries when it came to innovation. Now we are venturing into digital commerce, an industry that has always been extremely innovative. Therefore we work across disciplines to develop true beyond-banking solutions by deliberately starting with the “beyond” rather than the core banking business and aligning ourselves with the actual customer journey. Where the customer need arises, there we create the link to the core business.

Can you give examples of successful initiatives?

After several years of implementation, the planned ecosystem has turned into a digital commerce innovation called “finde-R”. The name stands for #findeRegionales (editor’s note: “find something regional” in English) and is a regional everyday companion that aims to connect all people and businesses in Upper Austria beyond the Raiffeisen network. “finde-R” informs, inspires and matches a demand with the best available offer.

By linking information, products, services, real-time communication and other features, value-added offerings are created. In this way, people and businesses benefit from regional solutions in a shared ecosystem and together invigorate the local economy. Information, interaction and transaction take place without linking to external sites, so that we keep the customer interface and data.

With “finde-R”, we combine platform economy and regionality into a holistic approach that clearly differentiates us from other solutions.

What advice would you offer other institutions in your situation?

Companies should develop strategies that go beyond their traditional business. In the past, technology followed strategy as an implementation tool. It is no different today. Today, however, technological knowledge can help develop innovative business models. First movers are rewarded, because customers repay the added value with loyalty.

We believe that with regard to the “regional ecosystem”, markets will be occupied for the long term. Currently, the markets are still distributed. From our point of view, this window of opportunity will soon close, and the infrastructure providers / ecosystem operators will walk away as the winners. So the main thing is to be fast.

The strategy is one thing, but the implementation is actually the biggest and most important challenge. For effective implementation, people in the company must be won over by an internal communication strategy and strong values. For example, an authentic regional ecosystem must not be dominated by centralized services from the capital.

The existing business case should allow for performance-based incentivization of sales with direct income opportunities. Monetization opportunities should be coordinated with the sales units, in our case the decentralized Raiffeisen banks.

Our proof of concept has shown that everyday relevance in the beyond-banking ecosystem can only be achieved by incorporating many life realms. We therefore do not recommend limiting the solution to selected industries (e.g. only construction and housing). In addition, a non-diversified solution is not immune to industry fluctuations and competes in a saturated market. A multi-life realm approach, by contrast, offers new opportunities for networking and thus a positioning with unique selling points.

The full power of an ecosystem will unfold only in the second or third step. That’s why stamina and an understanding of innovation projects are essential. It is important to set the right course. In order to be able to scale and to remain flexible, adaptable and expandable in the future, a technology architecture that is designed for the long term is crucial.

Future of Raiffeisen OÖ Ventures

What are the future developments at Raiffeisen OÖ Ventures?

We are constantly expanding and improving our ecosystem. We are always looking for innovative ideas and partnerships to expand our offering.

New business areas require additional infrastructures. Our regional proximity with comprehensive coverage is a strong basis. Raiffeisen makes an important contribution to an attractive and “livable” region. We are talking about initiatives, support, sponsorships of various clubs and associations as well as events in the areas of sports, art, culture and more. Raiffeisen is an enabler everywhere. In addition to the decentralized analog basis, we have now built a centralized digital solution that links all these real services on a common technology. In the next step, decentralized and centralized as well as analog and digital infrastructures must dovetail to create an economic cycle, i.e. an ecosystem (living and economic space). This is the circular economy and value creation in action. In the region for the region with real benefit for the people.

With “finde-R”, we have put in place a large and important piece of the puzzle in our beyond-banking strategy and thus laid the foundation. Our partners can benefit from our investment as well as the accumulated know-how and thus save time and avoid risky in-house developments. The possibilities of white-label solutions and the regionality principle in our business models avoid conflicts of interest. Together we can strengthen the communal spirit and shape the future.

Dear Mr. Sancar, thank you very much for this informative conversation. We wish you every success and lots of innovative strength for your next adventures!

Recommended reading On the Bank Blog, our interviewee Binjamin Sancar explores the question of whether business model innovation still matters or whether banks can rely on their core business alone.

Interest rate turnaround & relevance of regional beyond-banking ecosystems

![Thede Küntzel, Manager Projects & Innovation at Sparkasse Bremen and Managing Director of ÜberseeHub GmbH.]](https://www.bankinghub.eu/wp-content/uploads/2023/04/thede-kuentzel-bankinghub-scaled.jpg)