What is agility? Emerging dynamic factors

The advent of digitalization owes much to the exponential growth in computing power. “Moore’s Law” describes the phenomenon that the number of transistors on a computer chip has doubled roughly every two years since 1970. The enormous computing power available today – millions of times greater than it was then – enables applications such as big data and artificial intelligence on an unprecedented scale.

Here is a thought experiment to illustrate the concept of exponential growth: Imagine taking 30 steps. Typically, each step covers about 1.5 meters. However, let’s consider a scenario where your stride length doubles with each step. So, the second step becomes 3 meters, the third step 6 meters, and so on. Where do you think you will end up after these 30 steps? Will you still be in the same city? In the same country? Still on the same continent?

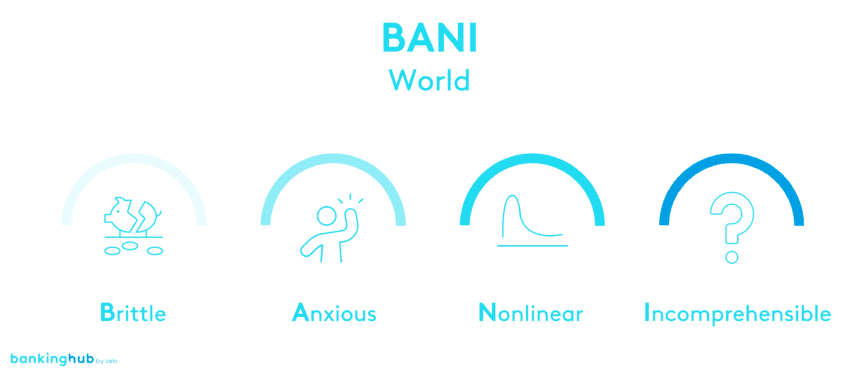

BANI model

Coupled with their exponentially increased performance capacity, the interconnection of computers via the Internet ensures a global network that links people, processes and economies. This brings forth new opportunities and challenges for companies. These challenges are intricately tied to dimensions such as brittleness, anxiety, nonlinearity and incomprehensibility – summarized by the acronym “BANI”.

VUCA model

This concept has supplanted the “VUCA” model from the 2000s, which referred primarily to digital advancements. Since then, the pandemic, supply chain disruptions and political uncertainties, along with changes driven by climate change, have exerted an equally profound impact. Against this backdrop, acting entrepreneurs are well-advised to adapt their business and operating models to the many innovations in an agile manner. And where conventional predictability and planning no longer suffice, the traditional hierarchical organizational structure prevalent in the “analog world” also becomes obsolete. Instead, companies must foster overall organizational agility to effectively navigate the evolving dynamic environment

Because – to break down the thought experiment – in 30 steps you have walked to the moon and back and then circled almost the entire globe. Have you misjudged? No wonder: our brains are not designed to comprehend exponential growth. Which makes it all the more clear that long-term business planning as an indicator of a successful strategy has had its day.

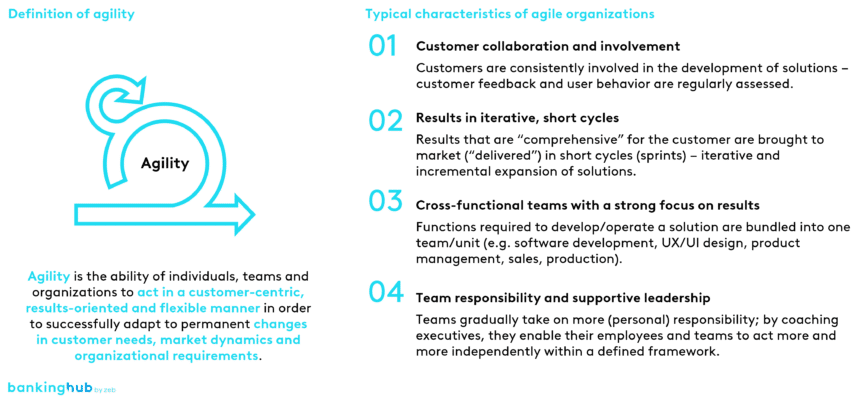

The right definition of agility

Agility as a response to increased demands: The combination of new technologies and their interactions with the business and operating model described above makes it clear that agility is more than just the application of agile methodologies.

It is a comprehensive approach aimed at enhancing the adaptability of individuals, teams and organizations as a whole.

The characteristics of the agile approach are as follows:

- Customer focus: Organizational agility begins with close collaboration and involvement with customers to respond quickly and accurately to their changing needs and expectations. The first step is to identify and understand customer needs and then test initial prototypes. Incorporating customer feedback forms an integral part of agile, complex project management.

- Iterative processes: The use of iterative cycles is a key element of agile organizations that aim to continuously learn, incorporate new information into project plans and quickly adapt to changing circumstances. Short development cycles deliver preliminary results quickly and allow for feedback. Relevant stakeholders and independent users provide this feedback to the team. This allows you to incrementally assess the needs of all parties involved without the risk of wasting a lot of resources by making the wrong decisions.

- Cross-functional teams: Agile organizations rely on cross-functional teams that cover a wide range of expertise, facilitate collaboration across different specialist areas and contribute to a holistic view. The end-to-end accountability fostered by this approach means that the responsibility for results and the process lies with the team from start to finish. External dependencies are thus minimized, and coordination processes are significantly accelerated, which leads to greater empowerment and motivation of team members.

- Personal responsibility: Within defined structures and processes, agile working goes hand in hand with an understanding of leadership that supports and empowers employees to make their own decisions and act independently. A high level of trust and courage, both in one’s own abilities and in the support from team members and executives, encourages creative thinking and innovative solutions.

Why is agility in companies so important?

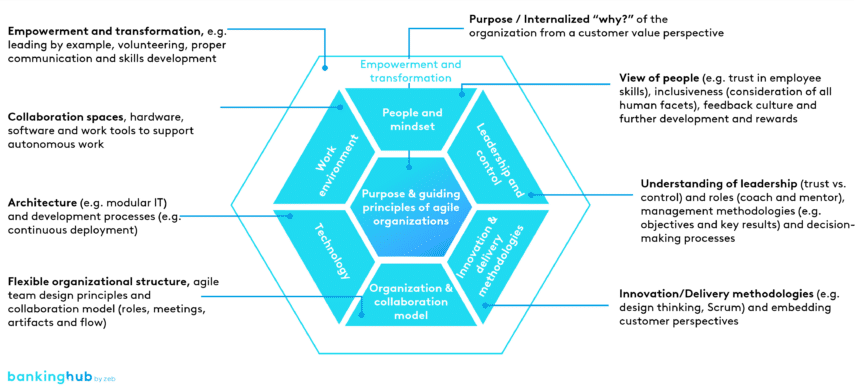

The characteristics outlined above underscore several critical mechanisms that must be considered when designing agile organizational structures.

In our experience, the following dimensions are important:

- People and mindset: This key aspect of understanding agility focuses on people and their mindset. Whether customers or employees: fostering a positive attitude toward change is paramount. Open communication and a culture of continuous learning serve as the bedrock for an agile collaboration model.

- Leadership and control: Leadership in agile organizations is fundamentally different from traditional approaches and is based on empowerment, coaching and support. Terms such as ‘servant leadership’ or ‘lateral leadership’ that emphasize promoting personal responsibility and self-organization within teams, are often used in this context. Control methodologies are used in an agile context to enhance transparency, efficiency and collaboration within the team and are therefore also designed and defined by the team itself. Common formats are elements of the Scrum framework, such as retrospectives and reviews, or objectives and key results (OKR).

- Innovation methodologies: In agile organizations, the strategic use of innovative methodologies, such as design thinking and Scrum, plays a pivotal role in fostering continuous improvement and creative problem-solving. These approaches serve as valuable gateways into the realm of agile work, offering low barriers to entry. Importantly, they can be applied selectively based on specific contexts, without requiring a comprehensive agile transformation up-front. But: they are by no means an end in themselves. Prior clarity is crucial: organizations must discern the nature of the problem at hand and evaluate how a particular methodology aligns with the desired solution.

- Flexible organizational structure: Agility manifests itself in a flexible organizational structure that adapts dynamically to requirements and changes and replaces traditional hierarchies with networked teams. This means, for example, thinking in terms of roles rather than positions and(re)defining an realigning meeting structures and collaboration models to optimize their impact.

- Technology: In agile organizations, technology drives innovation and efficiency, thereby contributing significantly to the implementation of agile ideas. Traditional industries should also adopt adaptable technology setups to enable quick responses.

- Open work environment: Creating spaces where teams can self-organize and move flexibly fosters new collaboration models. Architecture can also promote the exchange of ideas and the giving and receiving of feedback, helping to establish a transparent and collaborative culture in agile organizations.

- The core question is WHY. Agile organizations are united by a common purpose and well-defined guiding principles that ensure that employees are working toward the same goal. Moreover, these guidelines serve as reference points for focusing on what is important.

What is organizational agility?

The journey toward an agile organization is complex. It is important to realize that there is no one-size-fits-all template for all organizations. Instead, companies should tailor their transformation process and the characteristics of the various dimensions to their unique positioning, strategy and culture.

Employee participation, empowerment and effective communication are critical to achieving agility.

When transitioning from a traditional to an agile organization, there are several methods available, depending on the desired focus. In our experience, there are two approaches that differ in scope: team-wide agility and organization-wide agility.

- Team-wide agility: A focus on team-wide agility emphasizes autonomy and rapid response to change at the team level, using methodologies such as Kanban, Scrum or design sprints.

- Organization-wide agility: Organization-wide agility strives for coordinated and rapid adaptability at the organizational level, using methodologies such as OKR, SAFe/LeSS or Holacracy to facilitate this comprehensive transformation.

Challenges of agile transformation

Introducing agility to a team or an entire organization presents challenges that go beyond simply affecting the formal structural and procedural organization. It requires a profound cultural change.

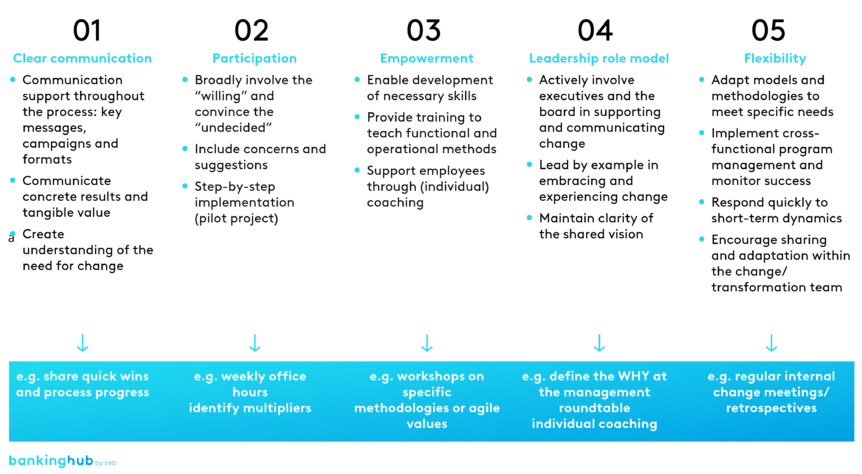

As you have probably already experienced yourself, the reorganization can cause uncertainty and resistance among employees that must be identified and overcome. Initiators should consider the following approaches to agile transformation:

- Clear communication:Effective communication is crucial during organizational changes, which are often associated with anxiety and fears. Clearly communicating goals, key messages and successes promotes understanding and breaks down barriers.

- Employee participation:Involving everyone in the change process fosters identification and acceptance. Leveraging employee experiences and ideas through participatory approaches is essential. A phased introduction through a pilot project can also be beneficial.

- Empowerment: Employees must be empowered to implement the new agile principles. This includes training, coaching and providing the necessary resources and tools.

- Leadership role model:Executives play a decisive role as role models. Their behavior and attitudes toward change have a significant impact on the acceptance and implementation of agility. Clarity about the common goal is essential to actively support and communicate change. This applies to all executives from group leaders to board members.

- Flexibility:The willingness to adapt flexibly to change is crucial. Avoid rigid adherence to old structures and ways of thinking, as this can hinder the success of the transformation. This applies both to existing structures and to the ability to adapt during the transformation process itself. Listening to feedback, evaluating progress and adjusting strategies ensure sustainable change.

Agility is not a rigid concept, but rather requires constant adaptation and evolution. Agile transformation is therefore an ongoing process that focuses on creating a dynamic, learning organization.

Conclusion: the need for agility in times of change

In a world of constant change and uncertainty, agility is becoming an indispensable tool for organizations to adapt to the outside world and remain successful.

Applying agile principles and methodologies not only allows faster responses to change but also fosters a collaborative, innovation-driven culture. It’s essential to recognize that there is no one-size-fits-all approach to successfully implementing change. Every organization is unique, shaped by the people who work within it, and the solutions and methodologies they choose should reflect this diversity.

While the path to an agile organization may be complex, the benefits – such as flexibility, customer focus and innovation – make it a necessary step in the digital revolution era. The most important thing, however, is to get started!

Do you want to contribute to your organization’s change processes but lack the necessary expertise? Click here for our Agile Guide training.

![Thede Küntzel, Manager Projects & Innovation at Sparkasse Bremen and Managing Director of ÜberseeHub GmbH.]](https://www.bankinghub.eu/wp-content/uploads/2023/04/thede-kuentzel-bankinghub-768x549.jpg)