Data integration: current background

When a company makes strategic decisions, an analysis of its own macro-environment is an integral part of the decision-making process regarding future corporate development. As a basis for decision-making, companies often use tools and models which, among other things, describe market developments and their effects on the company, thus providing a solid foundation for strategic management.

In this article we focus on credit institutions and especially on their business intelligence (BI) strategy. In view of the increasingly challenging conditions in the banking environment, regulatory and technological aspects as well as competitive factors are becoming ever more important for management teams in developing future BI strategies.

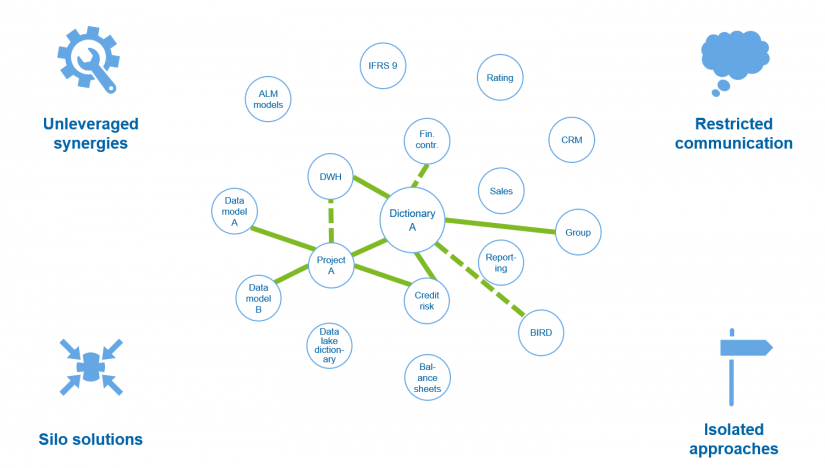

First and foremost, banks have faced enormous regulatory challenges in recent years. BCBS 239, AnaCredit and IFRS 9 are among the more complex and costly frameworks that have had to be—and are still being—implemented.

Data availability is a key success factor in the implementation process, which has made achieving regulatory efficiency one of the most important management issues for almost every bank concerned. The future initiatives of the regulators will not make things easy for the banks in the years to come either: with BIRD, SDD, ERF or SHS, among others, the requirements for granular and harmonized data are further tightened.

Moreover, rapid technological development and digital transformation are forcing credit institutions to pay particular attention to technological aspects and competitive factors in their strategic management. The leading players in and outside the financial sector therefore rely heavily on gaining information from the available data for both the economic and risk-oriented management of their company.[1]

This trend in the banking industry is easy to explain: new competitors such as Apple Pay et al. represent a latent threat to the banks, as they can already evaluate and use the data more effectively and generate a competitive advantage from it. The tech giants have long been aware that banks are sitting on a huge treasure trove of data, and they are therefore trying to gain access to this data by using innovative measures.

Figure 1: Current challenges due to constantly increasing regulatory requirements and new players in the banking environment

Figure 1: Current challenges due to constantly increasing regulatory requirements and new players in the banking environmentStatus quo of data integration: at many credit institutions, data is inconsistent and not integrated

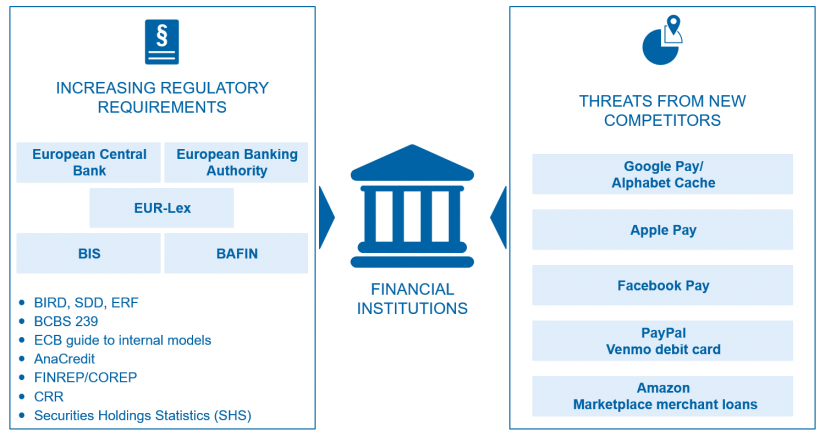

The challenges described above are adding to the importance of bank-wide data consistency and transparency. However, most credit institutions still have a large number of data silos that have been created as a result of different processing streams. They generally refer to the same data basis, but due to different formats, filters or definitions of the dimensions at report level, the data can only be compared or reconciled with a great deal of effort.[2] Such data silos within the banks cause unnecessarily high costs for IT as well as internal and additional external resources.

In data processing departments and projects, parallel—sometimes new—heterogeneous data landscapes are often set up without a central data architecture due to isolated solution approaches. The data in the specialist areas is often defined specifically for each department, which greatly limits bank-wide communication and means that a technical interface can only be set up with a great deal of specialist and technical support.

Isolated data landscapes pose a great danger and severely impair the reaction time of banks’ management teams regarding many key strategic issues such as digitalization or the ability to respond to market changes ad hoc. For example, competitive pressure due to the negative trend of the low-interest phase and declining earnings in retail banking leave little scope for margin expansion. In order to enable sustainable growth of the banks, however, customer-centric sales development and customer loyalty are the keys to success. A modern and well organized business intelligence, which consistently guarantees data integrity and availability throughout the company, is one of the main success factors that should be focused on in the future.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

A vision of a fully integrated data world: corporate dictionary 2.0

With the principles defined in BCBS 239, the Basel Committee on Banking Supervision has already set the course to move away from historically grown, inefficient silo structures and towards the creation of a common language of data by means of a dictionary of all risk-relevant data.

However, the current market situation and the trend towards digitalization make it necessary to also deduce an economic aspect from the conclusions of the principles, in which the strategic orientation towards a uniform understanding of data throughout the company not only applies to risk management, but to the totality of all data in the company.

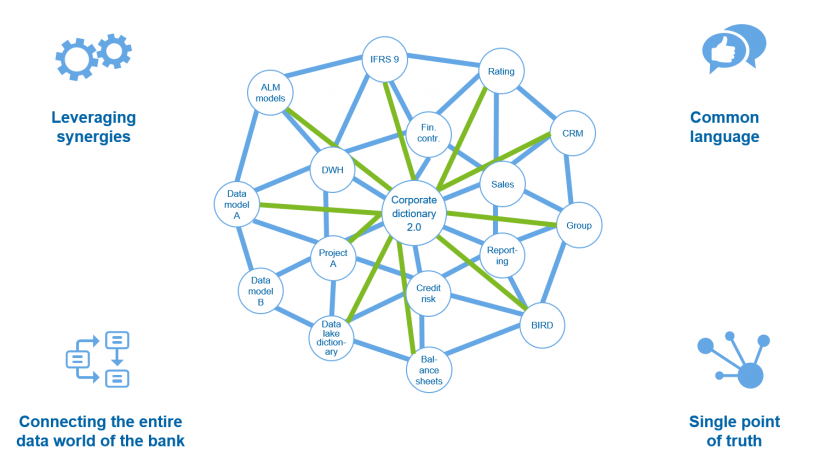

The goal is to integrate all information contained within the data of a bank (across all departments and topics) and to maintain it uniformly in a corporate dictionary 2.0. The main differences to the previous data models or data dictionaries are the bank-specific singularity and the embodiment of the “single point of truth” in the context of the definitions and correlations of data within the entire company. The company-wide consistent view of the data that is deliberately brought about in this way allows the individual data repositories of a company to be interconnected.

The simultaneous development of topic- and system-specific data models such as a CRM data model is still possible and even encouraged. The only condition is that the development of the models must be based on the corporate dictionary 2.0. This is the only way to ensure that the specialist descriptions and structures of the data are valid throughout the bank and to counteract the creation of data silos. For data structures and models that have historically grown, the challenge is to ensure their transferability to the corporate dictionary by means of retrospective harmonization.

Once the decision has been made to develop the data architecture in the direction of the corporate dictionary 2.0, a future-proof foundation has been laid for a holistic and responsive communication capability within the company as well as the ability to respond to changes in the macro environment ad hoc.

Figure 3: Future vision of the data world/models in banks—interconnectedness of all data landscapes across departments and projects

Figure 3: Future vision of the data world/models in banks—interconnectedness of all data landscapes across departments and projectsA significant advantage of the architecturally created transparency is the optimal leveraging of synergies. The approach thus holds considerable savings potential for all future challenges. For instance, projects can utilize the definitions and structures (relations and dependencies) of the data in the corporate dictionary 2.0 and do not need to tie up permanent resources from the specialist departments. Especially new data landscapes, e.g. for digitalization and customer loyalty projects, benefit from all the advantages of the integrated data dictionary.

Data integration—data dictionary: a key medium in the BI environment

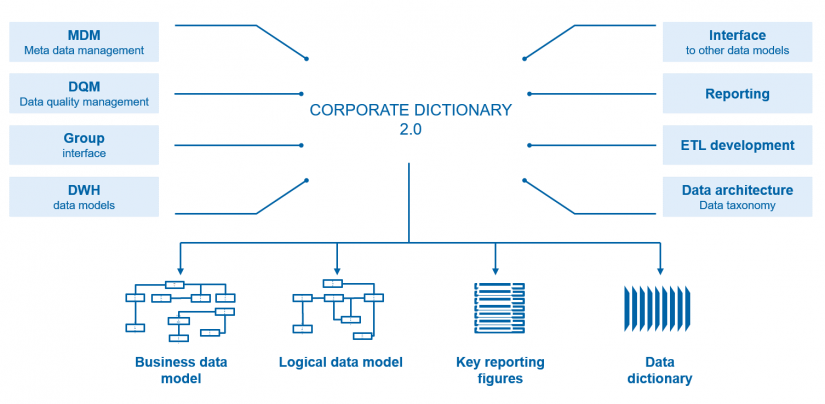

In a modern BI environment, the company-wide data dictionary is the foundation and provides important information on which, among other things, data management and group communication are based.

The completeness and integrity of the corporate dictionary 2.0 is ensured by the four components shown in Figure 4. The business data model (BDM) represents business information structures and business objects in the form of an entity relationship model independent of processes and systems. In addition, the BDM ensures compliance with relevant requirements and principles, including the integrated bank-wide data taxonomy, through the clear identification and definition of data elements to ensure a uniform understanding of the bank. The logical translation of the business view of the data is carried out in the logical data model (LDM) and also serves as a template for the physical implementation, for example of the DWH. Another form of presentation in addition to the granular basic data is the provision of bank-specific key reporting figures. The data dictionary consists of all relevant business attributes—derived from the FDM—that are required in particular for DQM and data ownership.

Added value of a corporate dictionary 2.0

With the corporate dictionary 2.0, banks are acting in a future-oriented manner and advancing data integration and the harmonization of data within their own company. In summary, the following added value is generated:

- Uniform understanding of all data among the relevant functional areas of the bank and elimination of silo architectures.

- Central point of reference for the use of technical terms in the bank; in case of ambiguities, the definition of the corporate dictionary applies across all departments.

- Basis for new technologies for data collection and analysis, such as big data.

- Greater innovative power and a quicker time-to-market response.

- Sound and consistent database for increasing current and future regulatory requirements.

- Basis of a modern BI organization.

- Apart from the initial roll-out effort, the interdisciplinary cooperation enables comparatively low (additional) running costs

Data integration: conclusion and outlook

A uniform, integrated language of data in a semantic data model is essential for efficient and future-oriented interdisciplinary communication within the bank and for responding to current and future challenges. A bank-wide corporate dictionary helps banks to understand their own data and use it as a basis for their own long-term development.

In a first step, the focus is on a bank-specific infrastructure or data architecture. As soon as the activities produce tangible results, the focus can be extended to group structures and a group dictionary implemented, in particular to strengthen ad-hoc capabilities within the group.

Against the current background of the key strategic issues, credit institutions should therefore analyze the status quo of their own data management and tackle the proactive and necessary measures for data integration to a reasonable and appropriate extent.