Need for Change!

Projects fail over and over again, as the various parties involved don’t work efficiently in the same direction or oppositions evolve. Here, two main reasons can be identified. First, complex implementation plans cannot be handled due to unclear structures and missing coordination. Second, the stakeholders often don’t back the project goals unanimously. This quickly leads to predetermined breaking points between different responsibility areas in the project (“Who is to be blamed?”) or between the project and the line. If the critical character of both aspects is known to the project managers, the problems can easily and sustainably be prevented by using carefully selected change management and communication methods.

Ideas on mind

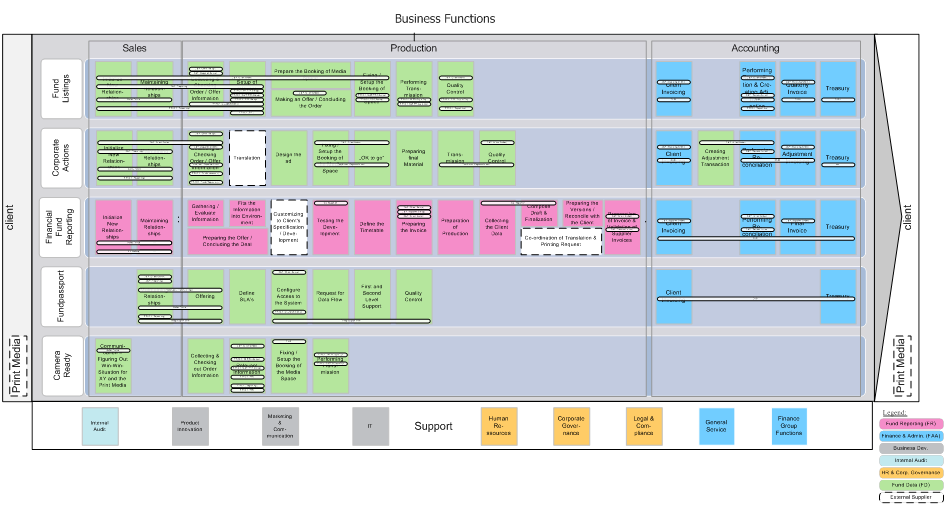

In particular IT implementations at financial services providers are difficult to grasp: Due to a missing standardized terminology and the abstract character of bank products, stakeholders quickly develop a different understanding of problems and solutions. Misunderstandings are inevitable when it comes to communication beyond gridlocked opinions and between specialized fields and IT. These lead in the end to expensive corrections of concepts and solutions or, in the worst case, even to a breach of confidence. Structured visualizations have proven to be a successful tool as a catalyst and common reference for describing solutions. If a problem is illustrated in an abstract way, which is comprehensible for all stakeholders and formal and granular enough to describe the solution, all stakeholders will quickly enter into a joint discussion. This will lead to a result, that is binding for everyone and has already been evaluated from all relevant perspectives and thus is of high quality. This “target image” can then be backed by all stakeholders. Here, the establishment of a standardized basic structure and of standardized illustration forms is decisive. Defining and using a “visual grammar” enables a quick orientation of the decision makers with the help of a similar preparation of decision papers. They don’t have to try to understand the illustration from scratch over and over again, but can immediately identify the affected departments of the bank and the consequences, that a change entails for the individual components of the organization.

Orientation towards benefits instead of methodical dogma

Finding an adequate visualization for the respective problem determines the broad acceptance of the illustrations and is thus a “catalyst” for success. The most important question is: “Which questions do I want to answer with my illustration?” Then, a basic structure is to be derived, which illustrates the necessary basic information in such a way that the desired answers can be found easily. The following rule always applies for a detailed illustration: rather show quick results with a focus on the context (“width”) than invest much effort for a detailed modeling (“depth”). This enables an early entry into discussion and enables an early identification of findings without investing much effort in already available results. If needed, a detailed modeling can follow in areas that are worth the effort. The illustration should be designed in a flexible way, which makes it easier to read. In doing so, the findings will be more comprehensible. Thus, e.g. simultaneous process elements can be illustrated one after another. This differentiates the semi-formal illustrations (use cases) from classic models, which are often used in IT.

Harmonizing the technical and IT perspective

Even if the design of the illustration depends on the respective problem, the same basic perspectives appear over and over again. It is decisive for functioning ORG / IT solutions to harmonize them consistently.

- What has to be done? —Business process: The business process should always be the starting point for the (further) development of solutions. Here, the necessary steps are to be defined in order to obtain the desired result. In comparison to other process modelings, such as EPC, the focus is on the subject and not on the method. This enables a good view on the process of value creation without dealing with various case differentiations. By limiting to the result of the service provision, quick modeling is enabled and prevents obsolescence which can easily occur in complex process models.

- Who does it? —Organizational unit: Based on the description of the value creation chain, the next step entails the issue of service provision. Here, the persons in charge and the executing organizational units have to be assigned. Value creation requires the involvement of people.

- With which system support? —Applications: IT plays an important role in service provision, in particular at financial services providers. Most processes in the organizational units are supported by applications—some parts of the processes are even fully automated and the function of the organizational unit is limited to supervision.

- Based on which information? —Data: The basis for value creation is information. Ensuring sufficient data quality and knowing which information is needed in which process steps is the prerequisite to provide the “raw material” for value creation.

Based on basic perspectives that show the relation between value creation and the required “raw materials”, specific problems can then be treated. Further information is added to the basic illustrations. Thus, information such as capacity needs or the amount of transactions can be integrated in order to identify bottlenecks of performance peaks. zeb has merged this specific kind of illustration and its applications into a method and calls it zeb.proGAM (professional business architectural management; German: professionelles Geschäftsarchitekturmanagement).

Joint design—Elaboration of a target business model and IT development with proGAM

Use at a leading service and software provider of the global investment fund industry is an example of successful application. It has lost the actual value creating activities and the holistic IT support of processes out of sight over the years of intense growth with several new business models. Various IT requirements have been solved ad hoc, comprehensive further requirements have been formulated, but an overview was missing. By applying zeb.proGAM, the current business models were first collected and visualized and afterwards supplemented by processes and applications. These illustrations served as a discussion basis with the management about value drivers, revenue streams and the future corporate strategy. The jointly generated findings were transferred into a target image for the future alignment of the company. This target image then served as a template for the business process, the target IT architecture and the necessary activities for reaching self-defined goals (development plan). The method supported both the discussion of the top management with the respective persons in charge and the holistic generation of findings and recommended actions. All in all, it was applied change management.

Just give it a try

Testing the approach in form of a pilot is quickly profitable, even it is seems unconventional at first. Previous experience of the application for different issues and different customer segments has proven to be successful. Thanks to focusing, there is only low initial effort, which is usually associated with an increase of transparency. Further steps for a detailed analysis can be derived later on, if needed.