Transformation of collaboration and leadership

The right strategy and structure are undoubtedly necessary and form the basis for success. One question, however, that still too few organizations are asking themselves in the context of structural and strategic adjustments is this: HOW does the organization intend to achieve the desired adjustments? A regular review of strategy and structure is common practice in companies. But the question of “HOW do we achieve these goals?” is asked far too rarely.

New structures and strategies require new forms of collaboration and leadership. In this context, we are not only talking about adaptability in structural and systemic terms, but also with regard to implementing the strategy (or structure) quickly, smoothly and efficiently. This involves employees, teams and managers.

The reason is clear: only those who adapt their strategy with foresight and then manage to implement it quickly will be successful in the long term.

The key to successful implementation undoubtedly lies in corporate culture. It affects whether employees participate actively, think outside the box and are willing to change. However, it also affects whether resistance will slow down – or even block – the implementation process. The way in which employees collaborate and interact determines the success or survival of the company in the long term.

The best strategy is therefore only worth as much as the culture which serves as the foundation of its implementation.

If a company succeeds in turning employees and teams into fans of the strategy, they will achieve the full potential of their performance core. If it fails or does not fully succeed, performance blockers will hinder implementation. But how do you recognize potential and the performance core, but also performance blockers?

The latter often do not arise in systems (e.g. target systems), but rather because of the way in which people collaborate, i.e. how they interact. What is therefore required is a scientifically sound measurement model that identifies performance blockers in the culture and, based on this, a tried-and-tested transformation concept that reliably aligns different cultures within the overall organization with the success-critical components of the target culture.

Strategy as a guideline for culture

The corporate strategy sets out how the bank intends to move towards the goals it has set itself. Culture – and thus collaboration – is the lubricant in the strategic gears of the company, the importance of which is still frequently underestimated.

Customer orientation and centricity, for example, will be a permanent goal in almost all banks. To achieve it, the strategy provides guidance regarding the characteristics of customer contact. Obviously, the efficiency, simplicity and speed of processes are particularly relevant. However, many years of zeb project experience also show, especially in the dimension of customer orientation, that – both from the customer’s perspective and in terms of results – teams can achieve higher and better performance together than if everyone “goes it alone”. Customers were more satisfied and actively sought contact with customer advisors more often when teams jointly set specific goals in line with the strategy and when they reported positive collaboration. The culture of a bank is therefore not just a “soft” aspect, but a decisive factor that affects the implementation of the strategy.

A culture that encourages innovation, flexibility and risk-taking can respond better to changing market conditions, which in turn is consistent with a strategic focus on growth or diversification.

Controlling culture is therefore not an esoteric option, but systematic, targeted management.

The performance core: psychological safety

Psychological safety refers to employees “daring” to express their opinions and asking questions without fear of negative consequences. Particularly in an industry that is heavily influenced by risk assessment and decision-making, psychological safety plays a crucial role and has a significant impact on employee behavior and performance. For example, if a culture promotes transparency and collaboration, employees are more likely to share information and work together more effectively.

Measuring psychological safety regularly based on scientific findings and ideally comparing it with relevant benchmarks is therefore a logical consequence.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

The correlation between psychological safety and performance

In banks, the ability to generate innovative ideas, manage risks and communicate effectively is of fundamental importance. Psychological safety creates a space in which employees can make full use of their expertise without fear of negative consequences. This not only promotes individual performance, but also strengthens team dynamics and collaboration.

Banks are also particularly sensitive to risks. The risk culture, which influences the perception and communication of risks and how they are handled, must be in line with the bank’s strategic orientation. A culture that promotes an open discussion about risks helps to ensure that employees learn more actively from mistakes and that they implement the risk strategy more effectively.

The three layers of the zeb measurement model

The zeb.culture model makes it possible to measure whether a culture supports and promotes strategy implementation. Overall, a measurable culture helps to ensure that the implementation of the strategy is not just an abstract concept but becomes visible in concrete actions and results. By integrating measurable elements into a bank’s culture, the organization becomes more resilient, agile and better equipped to achieve its strategic goals.

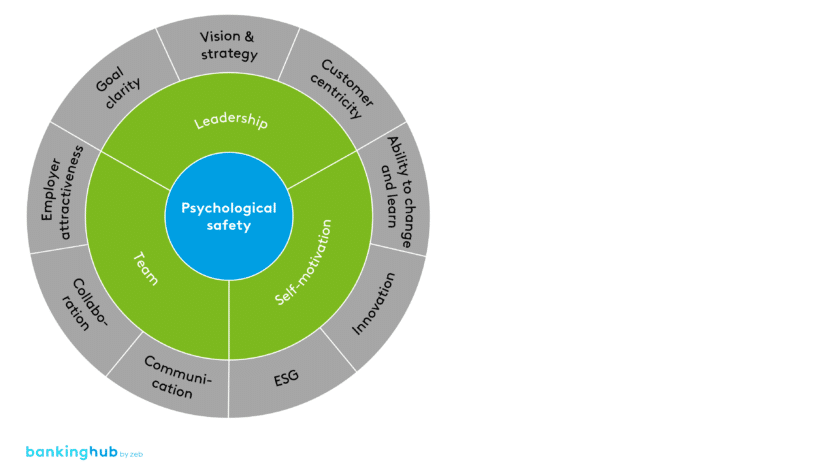

The zeb measurement model is based on three relevant layers, the content of which is adapted to the strategy as required. However, the structure of the three layers is always the same.

Psychological safety is at the core (here the blue layer) – therefore it is also known as the performance core. Insufficient psychological safety is the biggest performance impediment for organizations, employees, teams and managers – it can put the brakes on collaboration and leadership quality. A lack of psychological safety means that mistakes are swept under the carpet. It creates a lot of negative atmosphere and energy in teams and the entire organization – rumors are spread, people talk more about each other than with each other. This can also lead to dysfunctional collaboration, i.e. infighting within the team. If the core is “out of kilter”, then this is always the first and most important field of action, as it stops teams from working in a targeted, i.e. strategy-oriented, manner.

Due to their different areas and fields of activity, banks also have different requirements in terms of, for example, innovation or the way mistakes or risk aspects are dealt with. However, the performance core, i.e. psychological safety, is relevant for any orientation.

Around the core there is another important layer (here depicted in green) to describe the “HOW” of an organization and to identify performance blockers. This layer describes what motivates people in organizations – including the motivation of individuals, the motivation and impact of leadership behavior and the motivation arising from teamwork. Psychological safety is closely interlinked with these aspects. Performance and impact arise from the interplay of individual motivation, the form of leadership and teamwork. At the same time, these components of the green layer are also relevant for the depth of psychological safety.

Most performance blockers are found precisely in these two layers. If these are “out of kilter”, targeted work is disrupted. A typical phenomenon can be observed time and again in projects: If a team is highly motivated but perceives little psychological safety, the team does not gain traction. Performance does not become visible. Only when psychological safety is positively influenced does the project team achieve its full potential.

The outer layer contains the strategic goals that the organization wants to achieve, such as customer orientation, ability to innovate and change, and results orientation. This outer layer must be developed in a very tailored manner, depending on the guiding strategy. It enables us to answer whether teams are really aligned with the strategy and can support it in a meaningful way or whether teams, employees and managers are focusing on the “wrong things”. We often identify blockers that lie at the core, i.e. that are rooted in leadership or motivation. This leads to working time being spent on resolving conflicts or finding “special solutions” to avoid conflicts. Ultimately, it is a waste of performance and efficiency that could otherwise be used in the targeted support and implementation of strategically relevant topics.

A transformation approach based on this model aims to eliminate the internal performance blockers – thinking from the inside out. In doing so, a positive culture and collaboration can be aligned with the strategic goals.

In addition to the three-layer structure shown above, the step of gaining insights from results is particularly challenging. What good is a value in a survey if it cannot be put next to the values of particularly successful companies? The zeb measurement model therefore not only provides a scientifically sound structure for greater success. It also provides a database of around 70,000 data records. Depending on the desired benchmark, a comparison can be made with regional banks, large banks, insurance companies, but also with industrial companies – and not only in relation to overall results, but also to each specific question. Only on this basis can a bank’s performance be systematically raised to the level of “the best”.

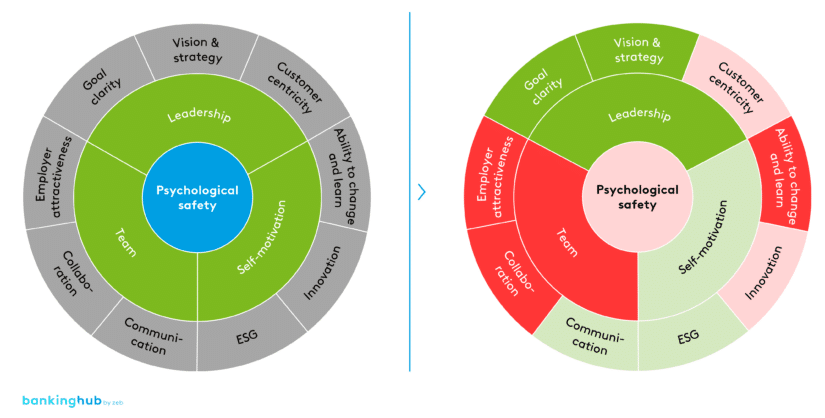

The measurement model can therefore provide clear implications as to where things are “out of kilter” and which cultural fields of action act as performance blockers, hindering strategy implementation. In the graphical example, we see a dysfunction at the core of the model. It is therefore important to solve precisely these problems so that activities and working time can once again be used in a targeted manner.

Conclusion: culture has strategic impact

If the corporate culture is seen as the lubricant of the company, as described above, common employee surveys regularly fall short. Attention is generated by both simple and elaborate means without having any impact in terms of strategy.

Effective support for the implementation of a strategy requires a scientifically sound approach instead. In this context, “sound” should be taken as a synonym for “well-founded”. After all, science lays the foundation on which a simple and attractive analysis platform is built for a company’s employees. Last but not least, benchmarks are a key success factor for working on the corporate culture in a targeted manner, i.e. in line with the strategy.