By 2030, skilled workers will be in short supply in Germany

Assuming that the number of workers required remains the same between now and 2030, today’s 800,000 job openings will turn into around 2,900,000 vacancies.[2] This means that one in 14 positions will be unfilled in about seven years. Given the same productivity and often comparable fixed costs, this will reduce the achievable turnover proportionately and companies’ bottom lines even disproportionately.

So, skilled workers will be in short supply in Germany in the future. One reassuring piece of news in this context: fewer and fewer companies believe that this development will only affect “the others”.

However, there has been little analysis of what this shortage of skilled labor means for our banks and insurance companies.

Banks and insurance companies will lose more than 30% of their employees

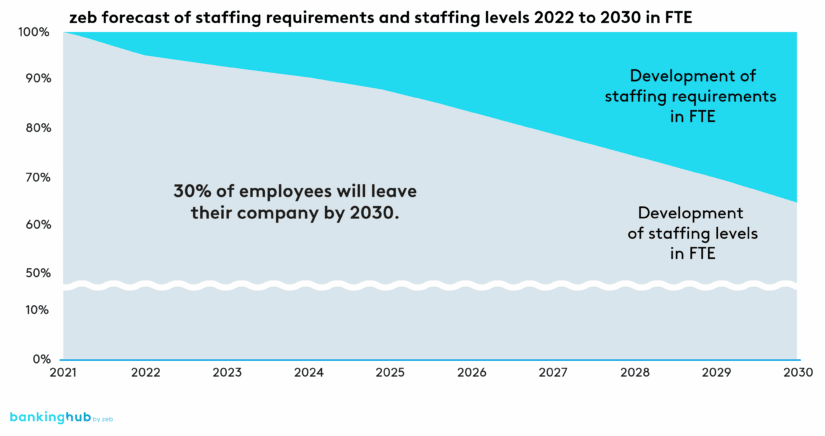

We have taken a look at the staff employed at established financial services providers. The average age of employees at most German banks and insurance companies is currently over 47. The shortage of skilled workers will therefore not develop in a linear fashion over the coming years but will accelerate from year to year. Through retirement alone, companies will on average lose well over 30% of their employees by 2030.

And capacity is not the only issue. Companies will also lose more than 30% of today’s expert knowledge. So how must knowledge be safeguarded? We are going to witness an exodus of executives, so strategic succession management will take on a whole new significance. At the same time, more than 30% of today’s personal customer relationships will also be lost and with them a critical element of customer loyalty.

These figures do not even take into account churn due to employee resignations. In the past, financial services companies have often perceived the low rate of employee turnover as a burden on their ability to change. But the tide is noticeably turning. At most companies, turnover (employee resignations) is already picking up. Instead of 1% to 2%, we are currently starting to see rates of 4% in some cases. Looking at the Gallup Engagement Index 2021[3], higher rates will at best stabilize, but tend to increase. Between 2018 and 2021, the number of employees who were actively looking for a job rose from 4% to about 14%. The statistics also clearly show a trend toward increasing willingness to change jobs in the short and medium term. And demographics lead to an additional and often underestimated risk.

If companies succeed in replacing retiring staff with young employees, this will have a significant impact on churn. That is because the turnover rate is around 1% in the final years of a career, compared to a turnover rate of almost 10% for employees in their first eight years of employment.

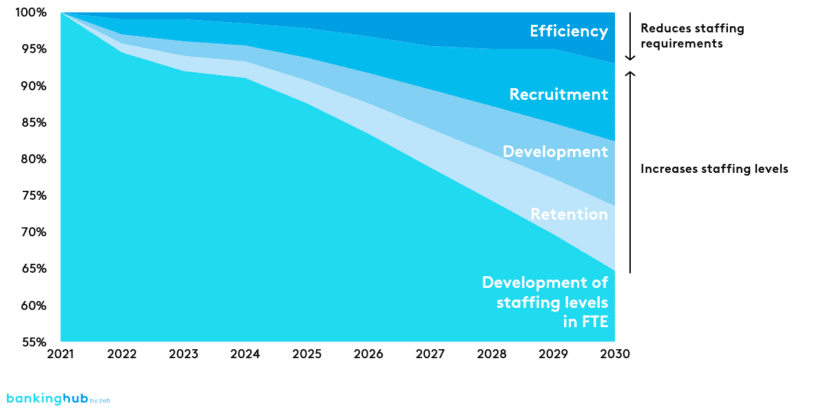

Recruiting is already foreseeably backed up against the wall given labor market developments. Increasing employee turnover can thus be the straw that breaks the camel’s back. Even an increase of just 2% makes it clear that the problem cannot be solved by recruiting alone. Instead, all levers must be pulled to counteract the development at an early stage and for the long term.

Of course, boosting productivity can initially be a lever against the shortage of skilled workers. But the past has shown that the forecasts about the effect of digitalization on productivity, which tended to be extremely optimistic, have not come true. Overall, productivity growth is therefore much less important than expected.

To counter the risk of a shortage of skilled workers, the focus is therefore on the levers of recruitment, retention and development of staff. But what are the concrete options (and needs!) for action in these areas?

Recruitment: success factors in combating the shortage of skilled workers

In recruitment, significant changes are already emerging that need to be taken into account. For example, it is becoming increasingly apparent that not only IT or expert functions, but also standard positions such as service staff in banks are becoming more and more difficult to fill. The bottleneck is thus spreading nearly across the entire spectrum of functions.

While headhunters are currently experiencing booming demand, this industry may be in for trouble in the foreseeable future. The effort required to find personnel is simply becoming too great, so assignments with little chance of success increasingly have to be turned down. Companies will therefore be less able to rely on established service providers in the future. Their own setup and performance in recruitment will determine their success.

Employer brand and HR marketing

In the future, the employer brand and HR marketing will have to be much more target group-specific. This poses a question right at the start: what will be my target groups in the future? It holds considerable opportunity, because if companies are open to new target groups, their chances of success in recruitment improve considerably. Does a service employee in a bank really have to have completed an apprenticeship as a bank clerk? Or can a high level of service orientation also be found in completely different occupational groups?

Only transparency about function-based staffing requirements and rethought target groups create the conditions for investing sensibly in employer brand and HR marketing.

Recruitment

If headhunters are increasingly going to turn down assignments in the future, companies will have to build up the relevant expertise themselves. This is not just a question of additional capacity in recruitment. Completely new skills are required to actively search for and successfully address potential candidates. Active sourcing is making its way into companies.

Another success factor in combating the shortage of skilled workers is the employee net promoter score (ENPS), i.e. the willingness of employees to recommend their employer to friends and family members. No recruitment channel is as effective as the result of a high ENPS. Recruitment is thus becoming an entrepreneurial task for all executives, because the ENPS depends mainly on the perceived quality of leadership and collaboration.

Training

In addition to filling existing positions directly, the attractiveness of training is becoming increasingly relevant. In many companies, applications for apprenticeships have declined by around 70% in recent years. It is therefore necessary to make training programs much more attractive, to review the requirements for joining them and, if necessary, to redefine target groups, too.

Retention: levers to retain employees

A new StepStone study on employee retention has just been published. According to this study, salary continues to be the main trigger for resignations. However, it also shows that this is more of a hygiene factor. After all, in the assessment of what engenders loyalty toward an employer, salary is nowhere near the top. Leadership, collaboration and team orientation are significantly more important factors. Only when these points are judged negatively does a poor assessment of the remuneration received break the camel’s back.

The AVANTGARDE Experts Job Satisfaction Study 2022[4] highlights another critical aspect: around 41% of employees feel underchallenged by their tasks. In the age group up to 34, this figure is as high as 47% – possibly due to the increasing number of university graduates. Employee retention therefore also means achieving the best possible match between the requirements of a job and employees’ skills.

Culture and leadership

The aforementioned topics make it clear that culture and leadership are an important lever, if not the key lever, of employee retention. Only a culture and a leadership that allow employees to enjoy their tasks and work as part of a team will lead to the satisfaction needed to retain employees in the long term and counteract a shortage of skilled workers. So supposedly high investments in culture and leadership work clearly pay off, as they also contribute to increasing productivity.

Incentivization and performance management

To put it simply: those who set individual goals but want to achieve team orientation will fail in their endeavor. Hybrid work puts completely new demands on employees’ personal responsibility. In effect, responsibility is increasingly distributed within the team. Placing the team in the focus of targets is therefore only logical. And incentives for teams do not consist of euros or fruit baskets. Incentivization promotes cohesion among colleagues and thus creates added value both for employees and for the company.

Life phase orientation

Last but not least, the development of life-phase-oriented offerings is experiencing a revival. The turnover figures indicate where to start: with employees in their first ten or so years on the job. With the right offers, the high turnover rate at the beginning of working life can be counteracted and employees remain loyal to the company.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Personnel development: measures and planning horizon

Is personnel development becoming the new recruitment? Yes and no. In addition to establishing systematic succession management and attractive and flexible talent programs, the question of how to deal with identifiable staff surpluses will require completely new answers in the future. Reducing staff surpluses will be only the second-best solution. The best solution will be to offer employees longer-term personnel development measures and to think in terms of development paths for entire groups of employees. This adds a very important strategic aspect to personnel development and human resource planning.

Succession planning

In the past, the importance of succession management has often been misjudged. It not only offers relevant prospects for motivated employees, but it is also a key prerequisite for retaining as much knowledge and experience as possible in the company when more than 30% of employees will leave by 2030. So while systematic succession planning in the past had to close individual gaps, in the future it will take on a completely new breadth and thus relevance with regard to the shortage of skilled workers. After all, without succession management, companies will lose a significant part of their substance.

Talent management and career models

Many companies set up elaborate talent programs and yet, in the medium term, generate exactly the opposite of what they are trying to achieve. All too often, talents have to wait far too long for vacancies, so the talent program is perceived as a waiting room rather than a springboard. This demotivating effect should be avoided in the future.

Going forward, talent programs will no longer be self-contained. Particularly high-performing employees will be rewarded through special personnel development measures. The system will thus become open, rewarding performance without creating concrete expectations on a timeline. What’s more, it will remain flexible enough to respond to fluctuations in performance.

Qualification and development paths

Development paths offer the opportunity to build up skills where they will be needed in the future without reducing existing staff levels. The question is how systematically such paths can be designed or whether the solution lies in highly individual offers. Reducing staff surpluses is not an effective long-term measure for companies, as it only creates an even larger gap in the workforce.

At this point, it is particularly important to have a qualitative view and a planning horizon in addition to quantitative HR planning, and to assess and review these time and again in an iterative manner. This approach allows qualification gaps to be quickly identified and addressed. Basic qualification programs can also ensure at an early stage that selected groups of employees are trained and educated to develop specific skills.

Development programs will cost companies a lot of money in the future. However, this will be well invested if there is quality HR planning behind the program as well as close monitoring of the necessary qualifications. In addition, it is important to develop a balanced and well thought-out concept and to apply it consistently and purposefully within the company.

Conclusion regarding the shortage of skilled workers

The complexity of the issue and the question “Where do we start?” have become an essential part of most board meetings. This is a good thing, because without a strategic focus on recruitment, employee retention and personnel development, the shortage of skilled workers will become an existential risk. In any case, the changes in the labor market mean that HR management will take on even greater strategic importance and should be seen as a significant player in the company.