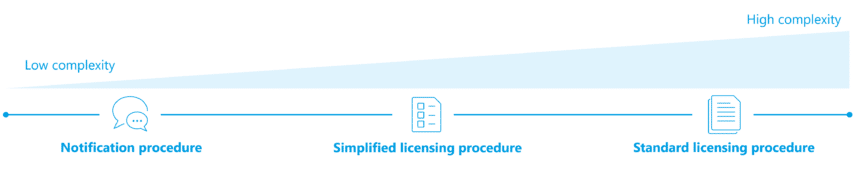

MiCAR’s licensing processes

Following the first articles in our blog series “MiCAR unveiled”, in which we presented the classification of crypto assets and services under MiCAR as well as requirements for the provision of crypto asset services, in this article we will focus on the licensing procedures under MiCAR.

The European Union has established three distinct approaches for securing a license under MiCAR, each of which is tailored to specific financial services providers based on their previous service provision. These approaches aim to minimize duplication of regulatory assessments, particularly in situations where EU regulations already apply to the institution, such as the regulation on security services under MiFID II.

I) Notification Procedure

The notification procedure (Article 60 MiCAR) is the least complex one and is characterized by the following:

- Targeted institutions: EU-regulated financial institutions providing investment services equivalent to those under MiFID II, including central securities depositories, investment firms and credit institutions.

- Need for action: Initiation of the application procedure involves submitting specific details to national authorities for licensing under MiCAR, except for MiFID II-equivalent investment services (e.g. business plan of the intended crypto asset service offering, description of custody and management policies, etc.).

- Timeline: The application window opens on December 30, 2024, allowing a 40-day lead time prior to service provision, and continues until the final deadline of July 1, 2026.

- Example: Central security depository regulated under EU law (MiFID II)

II) Simplified Licensing Procedure

The simplified licensing procedure (Art. 143 (6) MiCAR) necessitates additional information and may be requested during the “grandfathering” period:

- Targeted institutions: The procedure is tailored to crypto asset service providers that are currently offering crypto asset services but within the bounds of national legislation.

- Need for action: This approach necessitates a reduced amount of information compared to the standard process, with the specific details determined at national level by EU members.

- Timeline: The timeline for this procedure aligns with that of the notification process. Applications can be submitted from December 30, 2024, to July 1, 2026. Upon the expiration of this timeframe, the standard procedure will once again come into effect.

- Example: A fintech company providing crypto asset services according to the German Banking Act (KWG)

III) Standard Licensing Procedure

Finally, the standard licensing procedure (Art. 62, 63 MiCAR) is the most complex and applies to the remaining asset service providers not covered by the other two methods.

- Targeted service providers: The standard procedure is intended for all crypto asset services that do not meet the criteria for the above procedures.

- Need for action: As no prior information has been submitted to national or EU authorities, a comprehensive set of information is necessary.

- Timeline: This procedure will become effective on the same date as the other two methods, starting from December 30, 2024.

- Example: Legal persons or other undertakings intending to provide crypto asset services

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

MiCAR passporting

MiCAR passporting (Article 65 MiCAR) allows crypto asset service providers that are authorized and regulated in one European Union country to offer their licensed crypto asset services in other EU member states without having to apply for a separate crypto asset service license in each of these countries. Even without a physical presence, a crypto asset service provider can operate in other EU countries.

The goal of MiCAR passporting is to facilitate the integration and free trade of crypto services within the EU single market. Compared to non-EU countries such as Switzerland, MiCAR passporting has the advantage that crypto asset service providers can scale a license once acquired with low resources and quickly drive forward the internationalization of crypto asset services.

An important exception to the MiCAR licensing requirement is reverse solicitation. This applies when customers in the EU or EEA access crypto asset services on their own initiative, without active solicitation by the service provider. In such cases, no MiCAR license is required. The European Securities and Markets Authority (ESMA) will publish a guideline on reverse solicitation, providing further clarity on the framework for this exemption.

In Germany, MiCAR passporting for crypto services is similarly implemented and defined in the KWG regime (Section 24a (3) KWG) but has shorter deadlines and fewer requirements. For example, BaFin has only 15 days to review the notification. It is also possible to apply for several countries within one application.

Need for action

During the process of the license application for a crypto asset service or after obtaining the license for it, financial institutions are often faced with make-or-buy decisions regarding their crypto asset service, such as crypto asset custody. The development of crypto asset custody services can present significant challenges, such as the development of a MiCAR-compliant process design and the connection to the financial institutions’ custody systems.

The MiCAR, with its crypto asset and service-specific requirements for crypto assets as well as different licensing options will soon be applicable and further adopted by EU member states. As outlined in the “MiCAR unveiled” series, crypto asset service providers must carefully consider strategic positioning, product offerings, licensing procedures and compliance obligations to build a robust business and operating model in this evolving landscape.

Get in contact with our digital assets team to discuss further steps your institution can take.

You can find an overview of our “MiCAR unveiled” blog post series here: