MiCAR overview

The Markets in Crypto-Assets Regulation (MiCAR) is the first EU-wide regulation addressing crypto assets and services. The European Commission has defined a “grandfathering” period from June 29, 2023, to July 1, 2026, but MiCAR will apply in full starting from 2025 already.

The regulation creates legal certainty around crypto assets and services, while simultaneously dismantling regulatory obstacles within the disjointed regulatory frameworks across the EU. As such, the MiCAR expands the utilization of transformative technologies in the financial sector, particularly regarding distributed ledger technology (DLT). Additionally, it aims to enhance consumer and investor protection, as well as market integrity for crypto assets in Europe.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Overview of crypto assets according to MiCAR

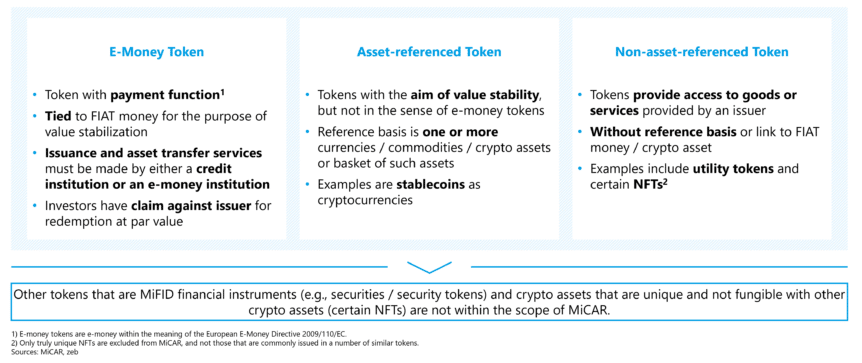

MiCAR distinguishes between three categories of tokens that are not currently included in existing regulatory frameworks: e-money tokens, asset-referenced tokens, and non-asset-referenced tokens. Not covered by MiCAR are, for instance, security tokens and unique non-fungible tokens (NFTs). As outlined in Figure 1, the regulation defines specific attributes and requirements that lead to stricter supervisory control.

Overview of crypto and security services according to MiCAR and MiFID II

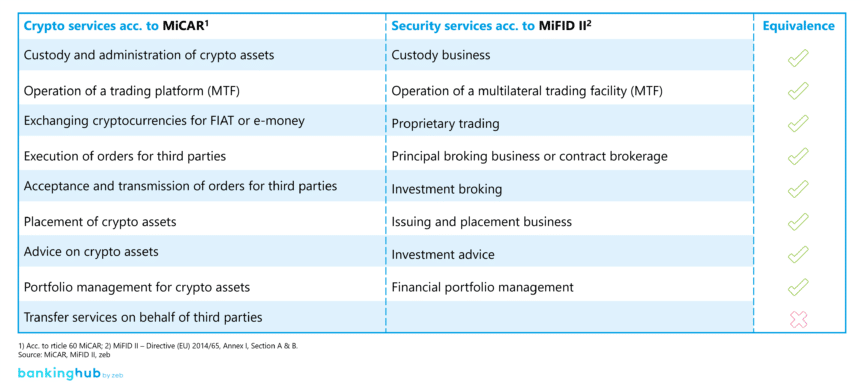

Apart from the classification of crypto assets, the MiCAR also deals with services, such as digital asset custody, brokerage, and issuance (see Figure 2). Alongside these regulatory measures, the MiCAR outlines organizational obligations that must be met by providers of these services. The obligations can be clustered into general crypto asset service requirements and service-specific requirements. Furthermore, market players can benefit from MiCAR passporting, which allows companies to operate throughout the EU with a single license.

MiFID II regulates securities services across Europe since 2018. As the following figure shows, most MiCAR-regulated crypto asset services[1] will be treated as equivalent to MiFID II securities services. The equivalence classification will help already MiFID II-licensed financial institutions to obtain a simpler authorization procedure for their MiCAR-regulated crypto services.

Authorization procedures

MiCAR crypto services are subject to the following authorization procedures:

- Notification procedure: Provision of selected information to the national supervisory authority is sufficient for obtaining authorization in case the MiFID II-equivalent service is licensed.

- Simplified licensing procedure: Less information is required for obtaining authorization if crypto services are licensed under national law.

- Standard licensing procedure: Usual licensing procedures with extensive information requirements are mandatory for obtaining a license.

In Germany, crypto custody requires a distinction between the authorization of crypto services under MiCAR (EU regulation) and the German Banking Act (KWG). To engage in the custody of payment, utility, and security tokens, a separate crypto custody license issued by the German financial authority BaFin is required.

Germany was the first jurisdiction with regulated crypto custody services and is therefore a regulatory pioneer in Europe that introduced a specific crypto custody license. Nevertheless, institutions that currently offer crypto custody under the German Banking Act (KWG) will have to ensure MiCAR compliance in their daily operations from 2025 onwards.

Crypto custodians already licensed under the KWG will soon be able to obtain a MiCAR license through the simplified MiCAR authorization procedure. Obtaining a MiCAR license is highly dependent on the specific requirements that BaFin in Germany will require for the authorization procedure. The concrete requirements are not yet known. In comparison, the Austrian Financial Market Authority (FMA) has not yet regulated crypto custody services and is expected to handle admission applications from providers of crypto asset services (crypto-asset service providers or CASPs) and reports from certain financial companies providing crypto asset services in accordance with the national accompanying legislation to the MiCAR from October 2024.

For further information on the obligations for CASPs and licensing procedures, stay tuned for our upcoming MiCAR articles!

You can find an overview of our series here: