Client acquisition slower than expected, however, still relatively fast compared to other banks

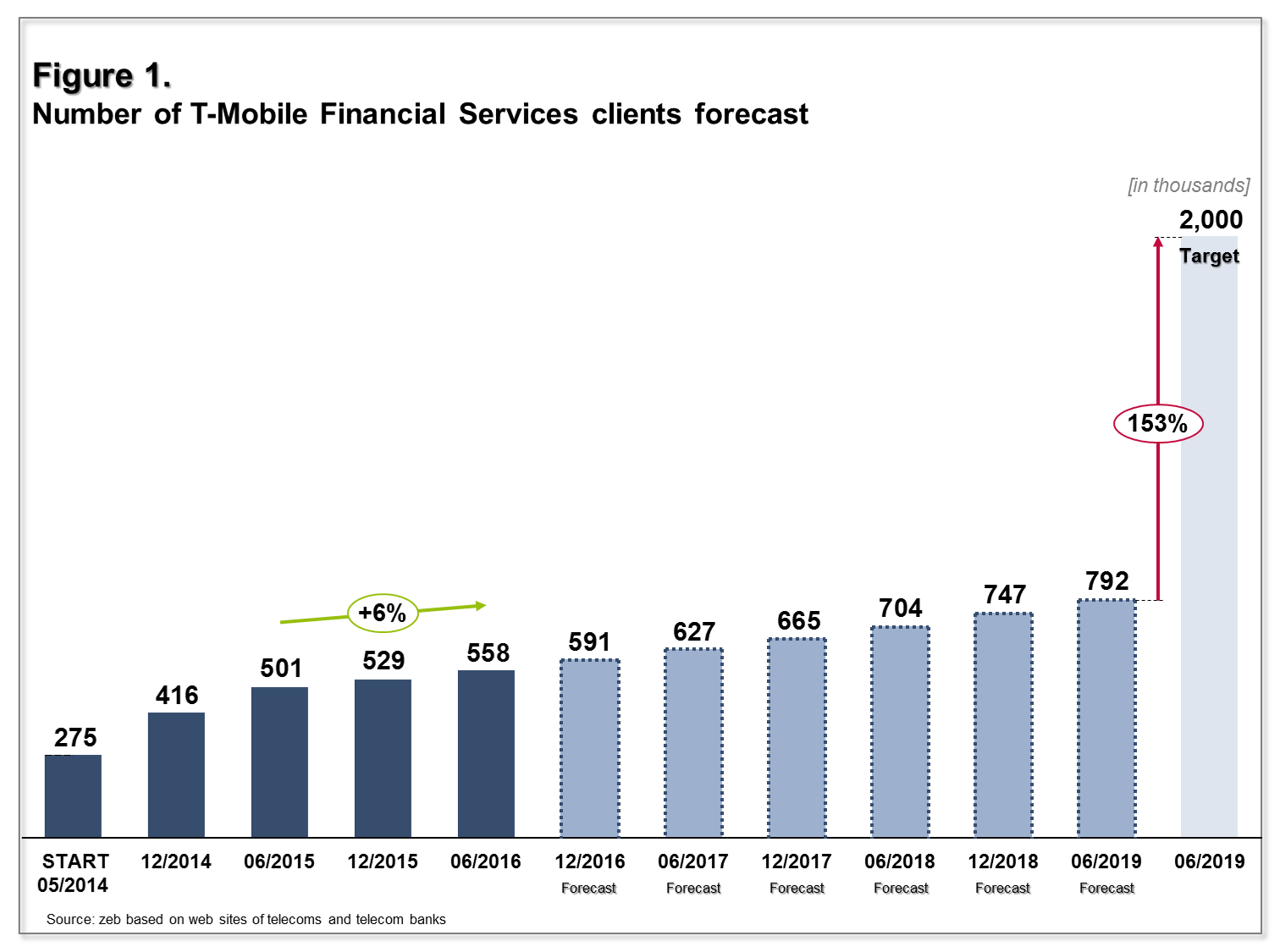

One of the alliances between telecoms and banks is the strategic cooperation between Alior Bank (a Polish local innovative player) and the global telecommunications company T-Mobile. The joint T-Mobile Financial Services project was formed on the basis of Alior Sync Internet bank belonging to Alior Bank with over 250,000 clients at that time. The T-Mobile Financial Services project, which runs under a brand associated with T-Mobile and booked as well as managed by Alior Bank as a virtual branch, was expected to attract 2 million clients within five years.

However, after one year, T-Mobile Financial Services acquired 226,000 clients and within the second year fewer than 60,000 (+6% from 2015 to 2016) (see Figure 1). As an overall trend, it is clear that the goal cannot be obtained at that growth rate and that the gap between the target and expected number of clients will not narrow in the next years.

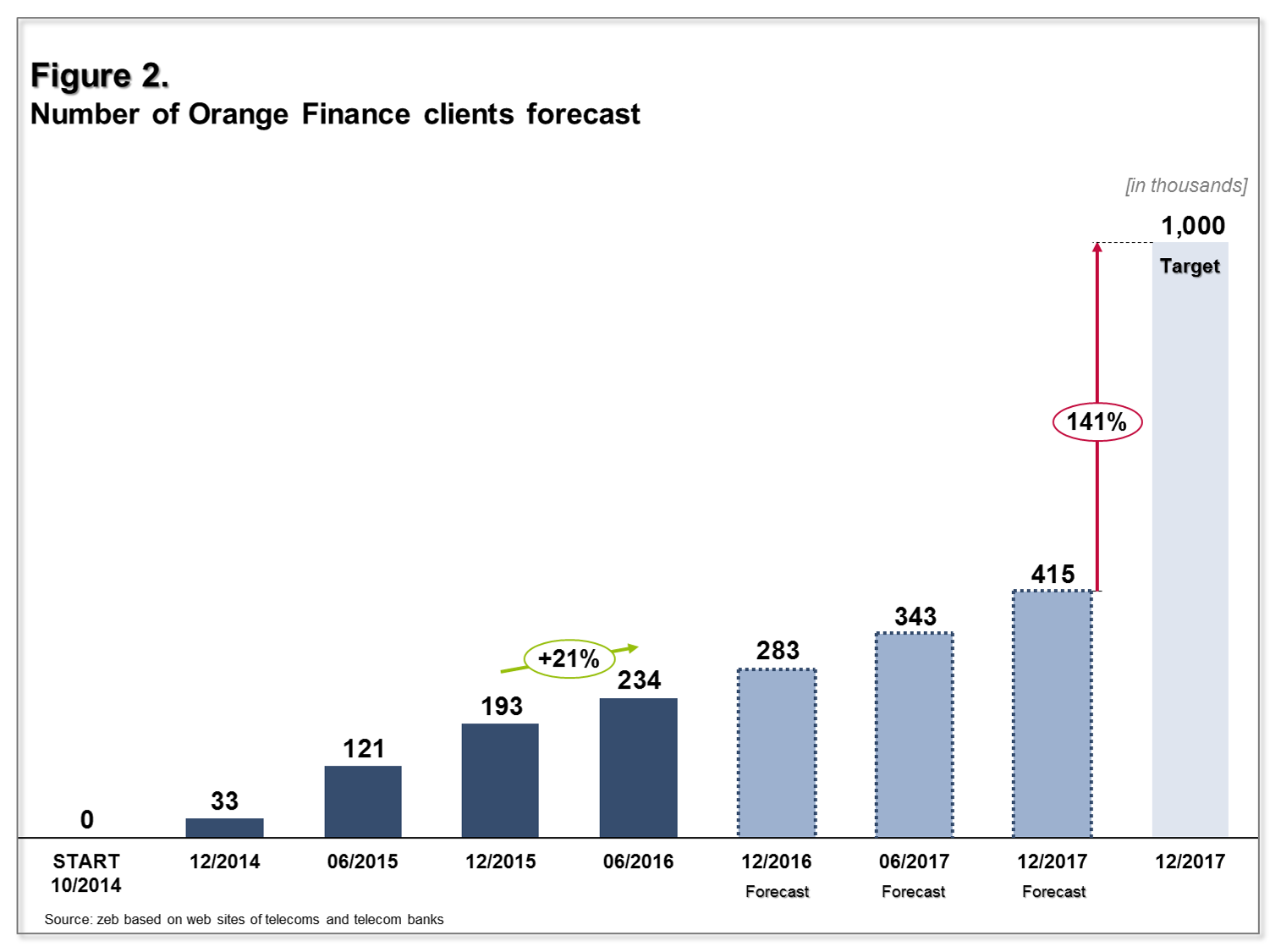

Another example was launched by Orange Poland (Poland’s largest telecoms operator) and mBank (subsidiary of CommerzBank). The joint mobile banking service Orange Finanse was estimated to reach around one million clients and generate 7% of the group’s revenues during three years.

After one year, Orange Finanse has reached fewer than 200,000 clients (see Figure 2). According to the forecast based on historical growth, the goal of acquiring one million clients within three years will be hardly reached at a growth rate of +21%, especially taking into consideration that the growth dynamic has fallen compared to the first months after launch.

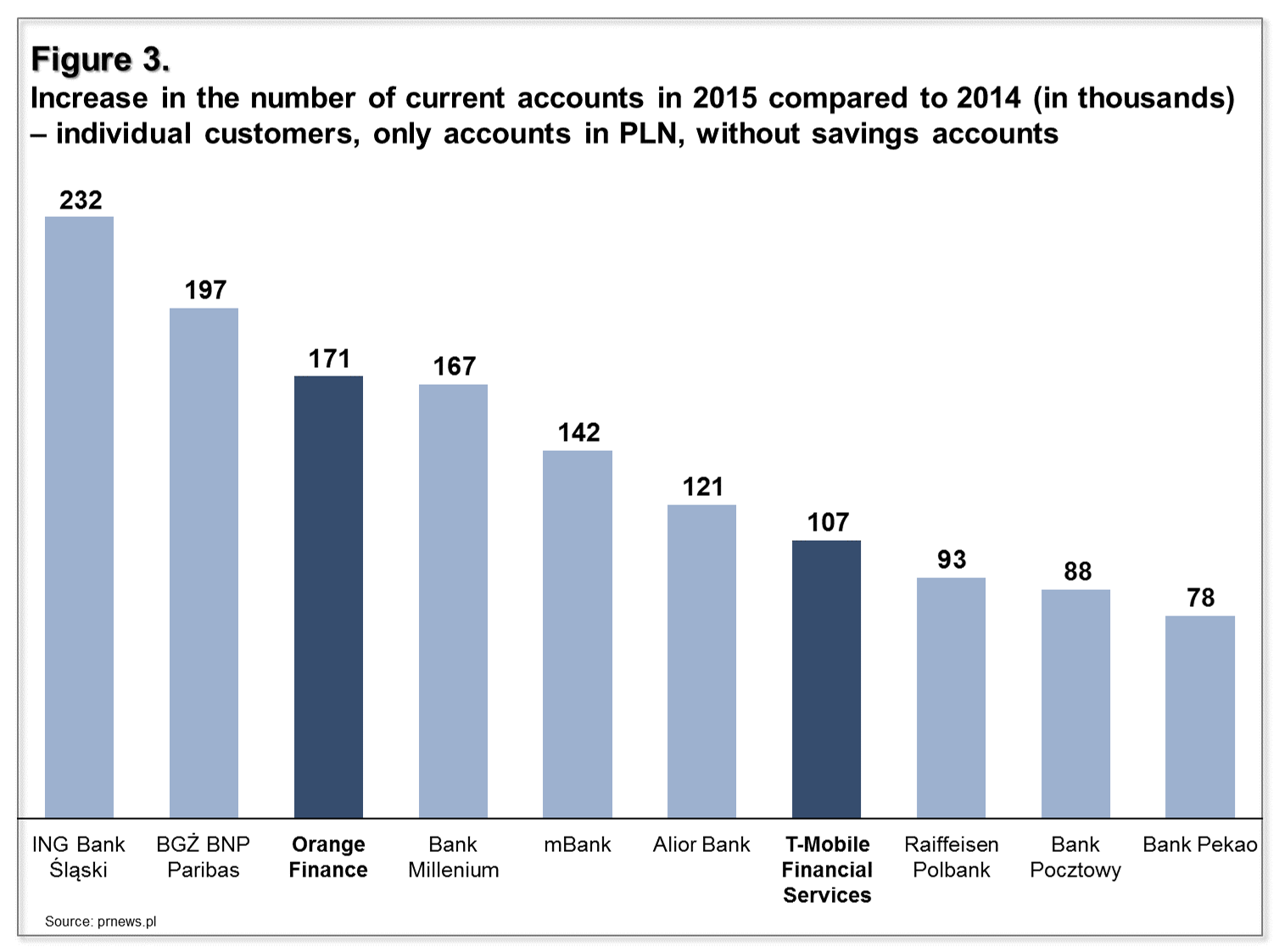

Although the acquisition of clients progresses slower than originally assumed, the increased number of current accounts was highly significant compared to other banks in Poland. Orange Finanse took the third and T-Mobile Financial Services the seventh place among the fastest growing Polish banks (see Figure 3).

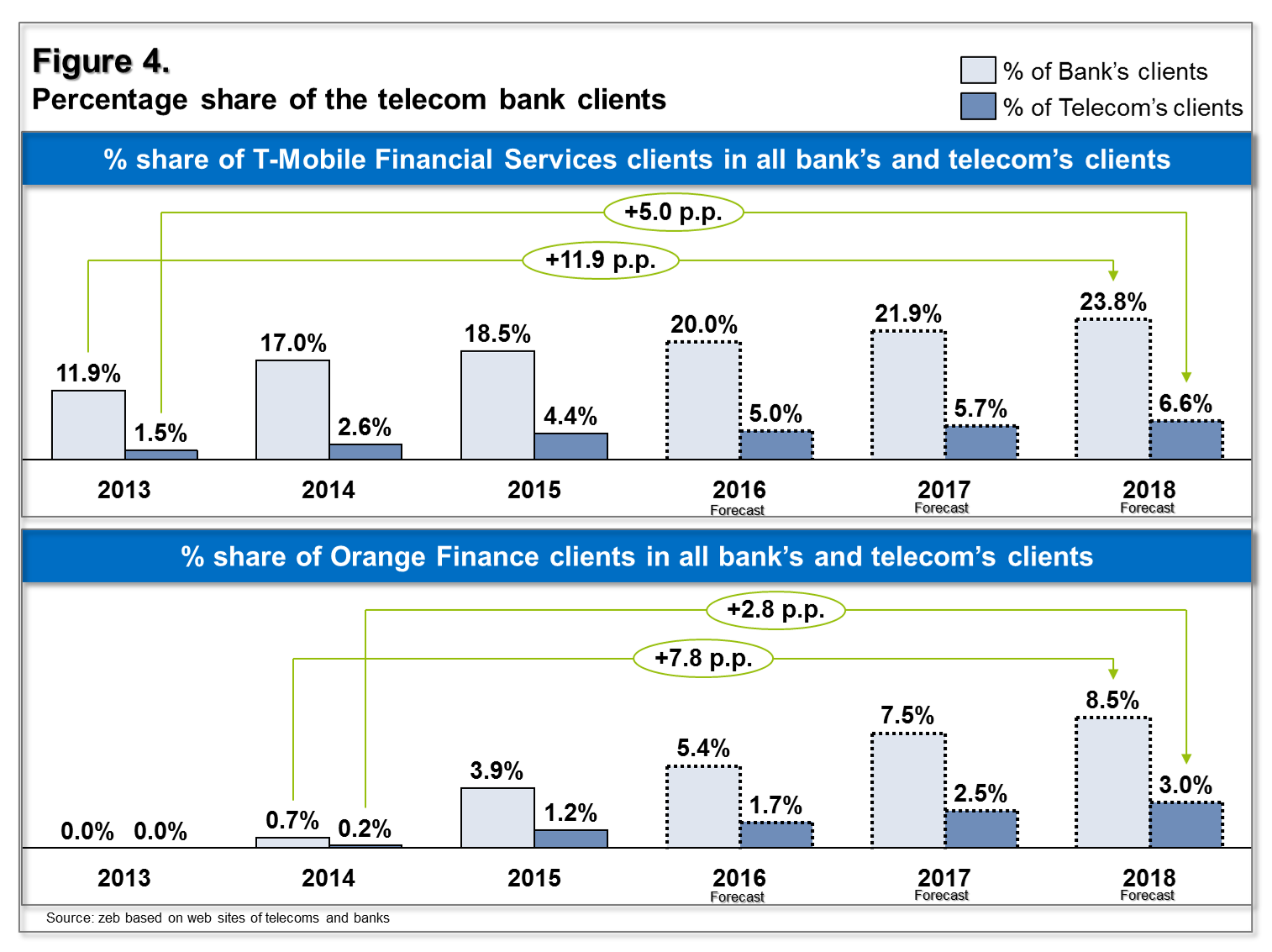

What is more, the retail client base of telecom banks was growing much faster than the client base of banks only or telecom only. Clients using both banking and telecommunications services represent the fastest growing group within the total retail client base. The trend is likely to continue allowing telecom banks to grow and increase their market shares faster than within traditional banking-only or telecom-only businesses (see Figure 4).

Due to the fact that the banking market in Poland is more competitive than the telecommunication market with a higher number of client bases of smaller players acquired by telecom banks, they constitute a higher share of overall banking clients than the share of overall telecom clients. This makes the entire business more important for banks than for telecoms in terms of gaining market share. In 2015, customers of T-Mobile Financial Services constituted a large share of 18.5% in the number of the bank’s retail clients, and 4.4% in the telecom’s clients. In 2015, the share of Orange Finanse customers was almost 4% in the bank’s clients, and 1.2% in the telecom’s clients.

Despite the fact that initially assumed plans will rather not be achieved, it is clear that telecom ventures allowed both banks and telecoms to grow their clients’ bases much faster than their traditional business. In fact, plans could be too ambitious, but compared to the market, the achieved results were very good which is why neither banks nor telecoms are considering to withdraw from such partnerships for now. According to T-Mobile Poland CEO, the telecom operator wants to still focus on banking[1]. In addition, the percentage of customers considering T-Mobile Financial Services as the main bank is increasing[2].

Striving for revenues—will customer acquisition costs be compensated by increased revenues?

Having analyzed the number of retail clients of telecom banks, the question remains how successful these banks are in making their client base profitable. Looking closer at telecom banks reporting, fast growing customer numbers are clearly observable, but unfortunately these banks are not reporting revenue figures separately. According to zeb’s estimations, telecom banks currently contribute to no more than 5% of total retail revenues of the banks they cooperate with. Taking the assumption that growth of the customer base can be achieved also in years to come and both banks will at least achieve average profitability per client on the level of the cooperating banks retail business, their share in total retail revenues of cooperating banks would be between 10% and 20%.

Increasing revenue per client means that telecom banks have another challenge to overcome—they need to increase the activity of existing clients. Some of these activities already started with both telecom banks currently offering a wide range of promotions. For instance, T-Mobile Financial Services has introduced the new current account with cash back offered only to active clients. Moreover, the bank has increased their fees significantly, which affected the clients that are not active. Orange Finanse has also developed its product offer and introduced cash loans in Orange shops. To further activate the customers, they have developed a package offer with a discount on the monthly subscription for telecommunication services.

Although a sustainable business model of telecom bank has not been proven yet, strategic alliances are being extended to other markets

The above mentioned examples from Poland after two years do not deliver an obvious answer how the alliances are going to evolve in the future. Although both were very successful in client acquisition (despite being below initial plans), the profitability of acquired clients has not been achieved yet. Telecom banks are still working on extending their local presence and are trying to increase the activity of existing clients through a unique product offer as well as further raising awareness among potential clients using new distribution channels.

There are different ways alliances can develop in the years to come. Telecoms might emerge as independent banking services providers applying for their own license and at the same time entering a war with banks (already happened in case of Plus Bank, one of three telecom banks in Poland). The scenario could be feasible only in case telecom banks could achieve a very high profitability based on clients acquired from channels of telecom operators thereby incentivizing the telecom operator to work independently.

The second scenario could be that banks withdraw from alliances in case of insufficient profits. Either insufficient profitability of telecom banks customers or disputable profit distribution between involved parties might lead banks to focus on their traditional channels.

Finally, the status quo scenario could continue with banks becoming long-term partners for telecoms to share moderate profits. Such a setup would allow both banks and telecoms to share their know-how and decrease the risk of telecom operators entering business independently. Based on the short history of Polish telecom banks and other international examples, this scenario is most likely to be established on the market.

The proof supporting the status quo scenario already came with telecom banks ventures being extended. Alior Bank extended its strategic alliance with the global telecommunications operator by entering Romania, one of the largest economies in CEE with a high growth potential for banking services and dynamic growth of smartphones, which is the first step towards the bank’s expansion on foreign markets. In August 2015, Alior Bank signed an agreement with the Romanian operator Telekom Romania Mobile Communications from Deutsche Telekom Group. The purpose of the initiative is to create a branch of the bank in Romania, which will operate according to a model similar to the current cooperation between Alior Bank and T-Mobile Poland.