Definition

RegTech is an amalgamation of “regulatory” and “technology”. RegTech companies use new technologies to support efficient regulatory management from an IT perspective within the entire (IT) banking architecture. RegTech services enable the agility and speed that is required for implementing the flood of regulations in an efficient way and use standardized approaches to address the specifics of different data sets. In doing so, RegTech companies make use of innovative technologies such as big data and data visualization techniques, cloud based services, block chain technologies, as well as artificial intelligence elements.

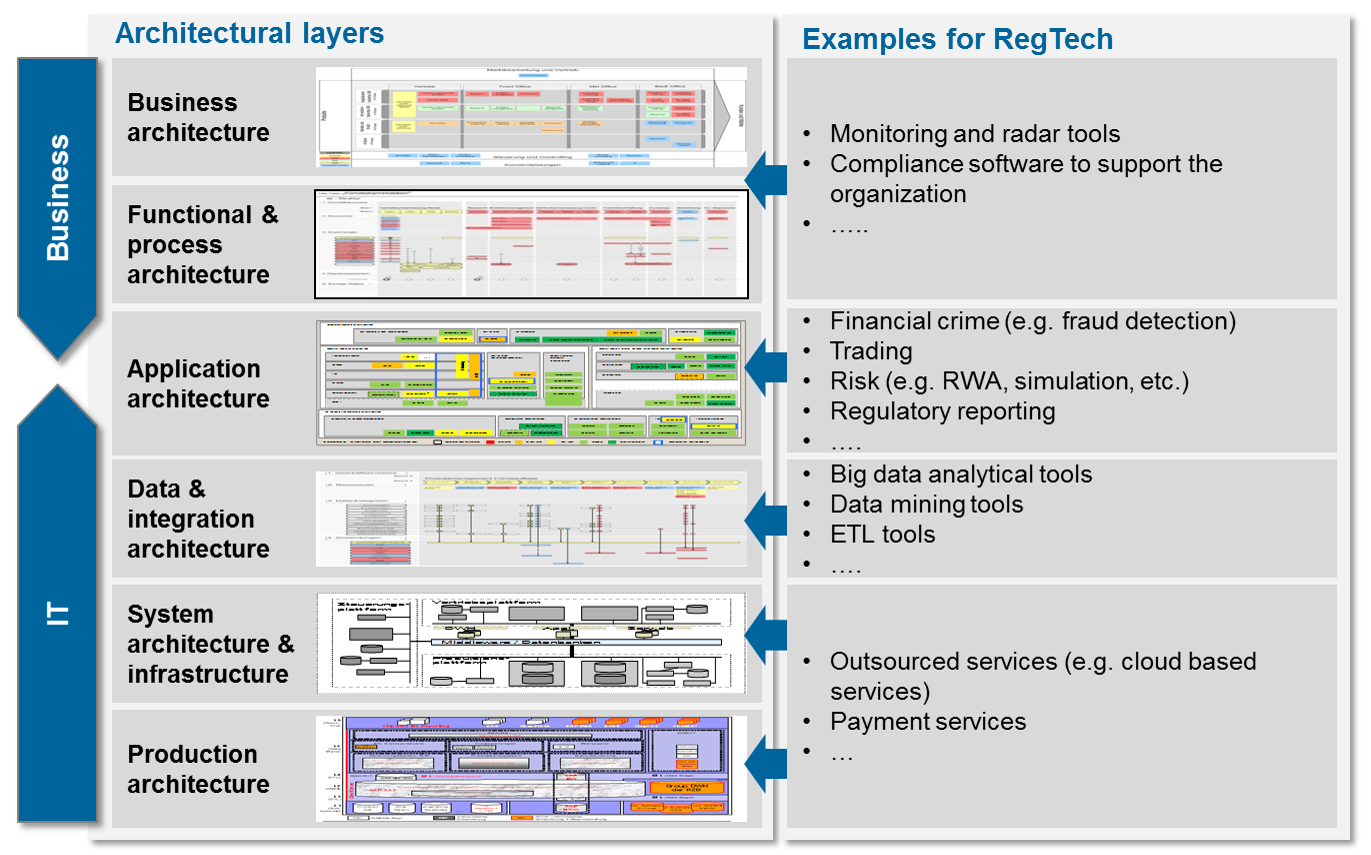

There are many use cases where RegTech companies dedicate their services to banks’ business as well as IT architecture (see Figure 1). However, technologies that relate to the business and functional/process perspective, e.g. monitoring tools for managing the large amount of new regulatory initiatives (e.g. zeb.regulatory.information), also have to be considered as RegTech components.

Where does RegTech come from?

Banks are currently facing the specific challenge to manage the flood of new regulatory initiatives which have constantly increased within the last 10 years. Currently, the most complex regulatory driven initiatives are BCBS # 239, SREP, AnaCredit, IFRS 9 and “Basel IV”, which make the achievement of regulatory efficiency a main management topic of interest for nearly every European bank.

Therefore, international finance institutions such as the Institute of International Finance (IIF) and the Financial Conduct Authority (FCA), have intensified their discussions on the currently developing RegTech industry. However, the conclusions drawn from ongoing RegTech discussions are contrary: Some experts argue that the RegTech market is a promising field as RegTech companies offer efficient IT solutions for a stricter regulatory environment. Others view the future development of the RegTech market with a critical eye since standardized IT approaches are difficult to implement within the banking industry due to the huge differences among banks’ IT architectures and national regulatory reporting requirements in addition to Europe-wide regulation.

Are RegTech companies effectively addressing banks’ current issues in regulatory management?

Today, many banks have a large number of legacy systems in their IT architectures with various overlapping source systems. Furthermore, most of the banks have serious difficulties in implementing an integrated finance and risk architecture. Additional challenges arise from the different capabilities, interfaces and life cycles of technology.

From the process perspective, a complete standardization is a huge ambition since the massive flood of regulatory initiatives very often leads to short-term interim solutions. That is why a harmonization of group wide data definitions, e.g. a business information model, is not available in many banks. Based on this status quo, every required change leads to immense costs, which is one of the main reasons why many banks have established short-term workaround solutions.

Furthermore, there are several software and data solution providers in the market that do already support banks in mitigating the regulatory flood and improving the processing and delivery of data and reports to the relevant authorities. Thus, the replacement of old solutions as well as the integration of new solutions based on new data formats and technologies represent enormous obstacles for the RegTech market. Insufficient collaborations between banks make it even more difficult for RegTech companies to offer standardized solutions for an entire industry. Therefore, regulatory efficiency cannot be achieved as easily as promised by RegTech companies.

Nevertheless, there are opportunities to provide IT solutions in isolated areas (e.g. fraud detection, risk assessment, etc.). But very often, in those isolated areas, excellent and modern software components are already available.

RegTech companies can be a vehicle for all regulatory technologies in banks due to the various interesting ideas, but existing long-term regulatory software components also have to be considered. Therefore, it is important to highlight the relevance of the RegTech companies in order to increase the general awareness of the need for sufficient long-term software solutions in banks.

Thus, the overall challenge for banks is not in implementing the newest RegTech offers as a standalone service and thereby achieving regulatory efficiency with regard to one particular regulatory initiative. Instead, RegTech companies should support banks’ overall journeys to improve regulatory efficiency throughout their entire organization. However, this requires the completion of some prerequisite activities. These include:

- the simplification of the business and IT architecture by establishing a common target picture (see also BankingHub article on Regulatory Roadmap),

- the harmonization of data and facilitating of a common understanding of data taxonomies throughout the bank (see also ERF/ BIRD for an initiative driven by authorities),

- the establishment of a group wide integrated finance and risk architecture,

- the implementation of data governance and the improvement of data quality,

- the automation of processes to reduce workarounds.

Furthermore, simplification should be seen by all relevant stakeholders as a sustainable strategic asset for a bank’s future so that the developed standards and the targeted sustainability are incorporated in business action and thought.

Recently, several banks have initiated regulatory programs and the implementation of BCBS # 239 for example has intensified this development even more. However, it has to be emphasized that the journey is a long-term ambition and execution requires not only a strict program management but also perseverance.

As soon as those activities have led to a significant simplification, some new smart technologies may be implemented and could have the potential to significantly reduce banks’ costs for specific compliance issues or improve a bank’s capability to use big data.

Summary

RegTech is a new buzzword which stands for existing as well as new and upcoming IT solutions in the area of regulatory and compliance management. RegTech initiatives stress the importance of regulatory technologies in banks and for this reason can help develop better IT solutions for the future.

However, RegTech services alone will not be able to improve regulatory efficiency within banks. The financial industry will only be able to benefit from RegTech companies’ innovative, smart and technology-based solutions after today’s business and IT architecture within banks has been significantly simplified.

Therefore, the success of RegTech solutions very much depends on the capability of banks to change their target operating model. In summary, “Financial institutions have a primary responsibility for supporting RegTech development, most importantly by creating IT and risk infrastructures that are capable of integrating these new solutions”[1].

[1] Regtech in Financial Services: Solutions for Compliance and Reporting; Institute of International Finance (March 2016), p. 2, https://www.iif.com/node/9994

9 responses to “RegTech”

Cleveroad

Great diagram!

About regulatory efficiency you should see info about startups Perfios and ComplyAdvantage.

David Jonesу

Many Fintech companies today spend many resources and management focus on compliance, and virtually all of it (with the notable exception of the legal work) is done in-house. The main reason for that is that for many of these companies, the business use-case is innovative in a way that’s not immediately covered by external providers. Regtech could theoretically help these startups carry some of that load.

Trading Bitcoin

So, it could be a good answer for regulatory efficiency?

I think maybe.

AI Healthcare

“AI is changing it all, making things easier for us. It changes the way we interact, consume information, obtain goods and services. It does what humans do, but more efficiently, quickly, and at a lower cost. How? Let’s figure out the big picture.

Artificial Intelligence, abbreviated as AI, is not one technology, but rather an umbrella term for a branch of computer science. This branch is dedicated to complex algorithms and software able to perform human-like tasks: speech and text recognition, data analysis, learning, problem-solving.

Through the analysis of complicated data and its recurrent patterns recognition, AI-powered technologies can approximate conclusions without direct human input.

AI is quite a broad field. As that field has progressed, several types of AI have emerged. The main applications of AI are machine learning, deep learning, natural language processing, image processing, and speech recognition.

Artificial intelligence can be used across all manner of industries, ripe for AI disruption. The healthcare ecosystem is no exception. AI powers healthcare by the availability of structured patient data from various databases and the rapid progress of these data analytics techniques.

Armed with AI innovative technologies, doctors can make more precise diagnoses and improve treatment plans with better predictions. Moreover, AI becomes increasingly applied in medicine development, patient monitoring, and care. As a result of AI’s ability to deal with the growing database of detailed patient data, the whole healthcare industry is shifting towards preventive rather than reactionary level. Here we researched the recent advancement to answer the question: what are examples of artificial intelligence in healthcare?

Anna

Very nice and well researched – thank you!

Dmitry

I think this is one of the most significant

info for me. And I am glad reading your article.

Alan Carver

Can anyone please tell me about any software development company that follows RegTech at the moment?

Ivory Howard

I didn’t have any expectations concerning that title, but the more I was astonished. The author did a great job. I spent a few minutes reading and checking the facts. Everything is very clear and understandable. I like posts that fill in your knowledge gaps. This one is of the sort.

AllRighted

Therefore, international finance institutions such as the Institute of International Finance (IIF) and the Financial Conduct Authority (FCA), have intensified their discussions on the currently developing RegTech industry. However, the conclusions drawn from ongoing RegTech discussions are contrary.