State of the banking industry

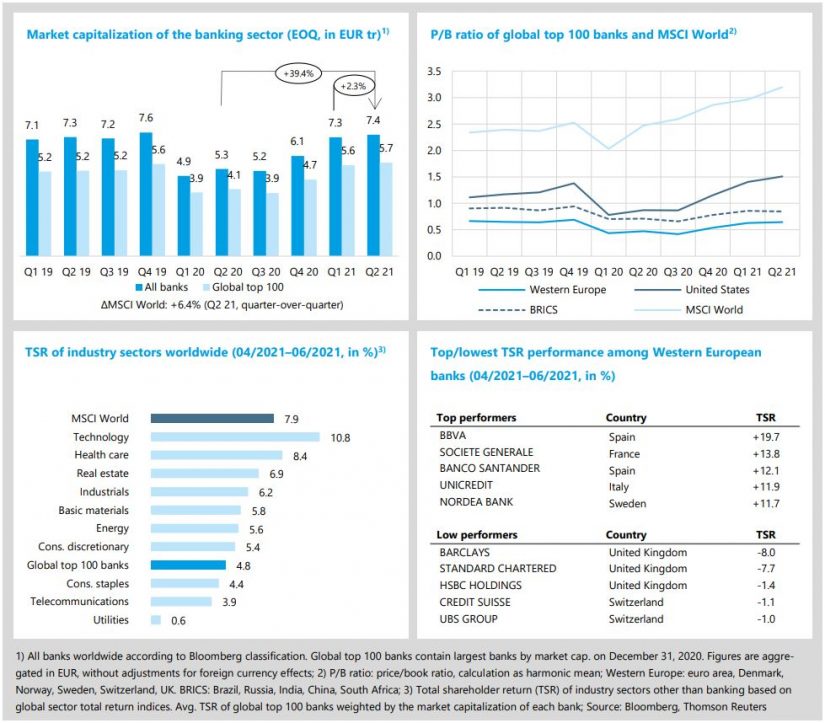

- After an outstanding first quarter, global top 100 banks were not able to keep up with the strong overall capital market performance in Q2 2021 – TSR +4.8% vs. MSCI World +7.9% QoQ.

- Looking at the first half of 2021, however, the top 100 banks are the clear winners and outperformed the market with +22.7% YTD (MSCI World: +13.3% YTD).

Global capital markets seem to have overcome the pandemic and confirmed the positive trend of the first months of the year while achieving new heights in Q2 2021 (MSCI World market capitalization +6.4% QoQ, TSR +7.9% QoQ). Global top 100 banks were not able to keep up with the overall market development but continued to perform well (market capitalization +3.0% QoQ, TSR +4.8% QoQ). Looking at the first half of 2021, however, the top 100 banks are the clear winners among all industries and outperformed the market with a TSR of +22.7% YTD (MSCI World: +13.3% YTD).

- The banking sector’s market capitalization continued to rise in Q2 (+2.3% QoQ) and improved by +21.2% over the first half of 2021 to EUR 7.4 tr. The market cap of global top 100 banks is up by +22.0% YTD, reaching a new all-time high of EUR 5.7 tr.

- Average P/B ratios of the global banking sector climbed further. However, the gap between U.S. and Western European banks continued to widen. While average P/B ratios of Western European banks only improved slightly by +0.02x, the U.S. banks’ valuation increased by +0.10x to 1.51, now 2.3 times the Western European value of 0.65x.

- In the second quarter of the year, U.S. banks again showed a strong TSR of +8.2%. Western European banks’ good performance was slowed down a bit at the end of Q2 due to renewed COVID-19 worries in the UK (TSR +4.5% QoQ).

- UK banks dominated the Western European low performers as increasing cases of a more contagious COVID-19 delta variant in the UK affected banks’ share prices. BBVA is the Western European top performer and continued its strong development that began in Q3 2020. A positive and sustained operating trend by the bank has pushed the stock price up by +123% since October 2020.

Economic environment and key banking drivers

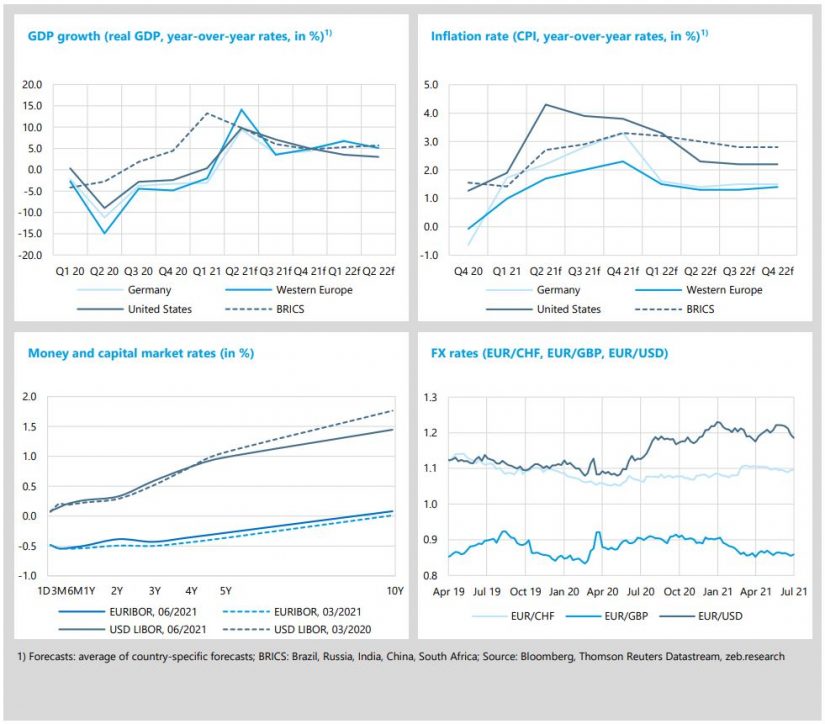

- In line with falling infection rates, progressing vaccinations and a corresponding reopening of the economy, economic growth is picking up in the U.S. and Western Europe.

- Accelerating growth will further push price levels in 2021 but major central banks signaled no concerns about persistent and high inflation rates and decided to maintain their current monetary policy.

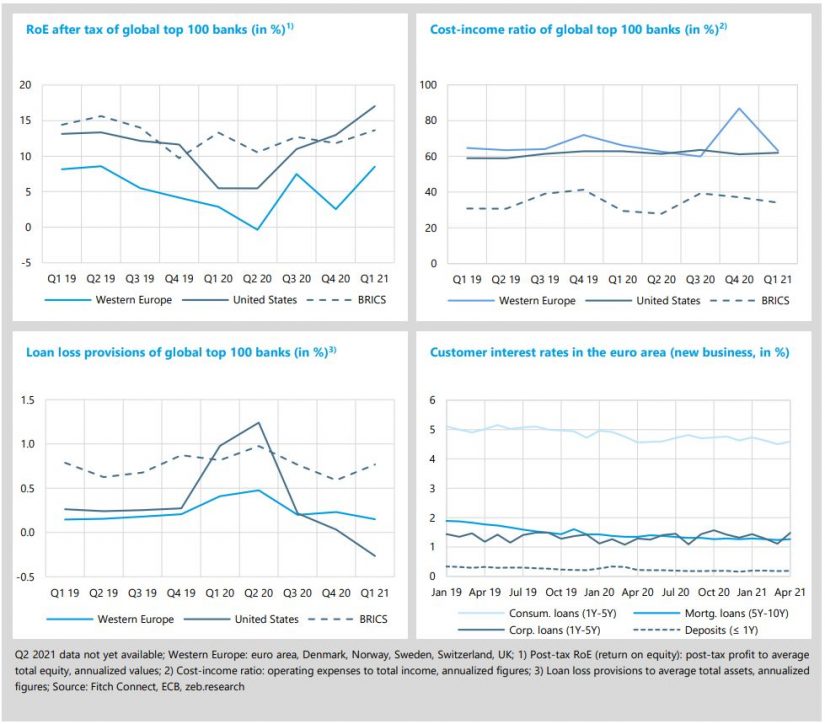

- Global top 100 banks surprised analysts with strong Q1 results and improved profitability across all regions – RoE of U.S. banks 17.0% (+11.5%p YoY), BRICS banks 13.6% (+0.3%p YoY) and Western European banks 8.5% (+5.6%p YoY).

In line with falling infection rates, progressing vaccinations and a corresponding reopening of the economy, economic growth is picking up in U.S. and Western Europe. Accelerating growth will further push price levels and especially in the U.S., inflation forecasts are expected to reach +4.3% and are likely to remain elevated above 2.0% over 2022. Major central banks signaled no concerns about persistent and high inflation rates and decided to maintain their monetary policy for the near future, but interest rate hikes by the U.S Fed could be possible by the end of 2023.

- In Q1 2021, the third wave of the COVID-19 pandemic kept Western Europe in recession (real GDP growth -2.0% YoY). With relaxing containment measures, however, the economic recovery in Western Europe is expected to speed up in Q2, with a growth of +14.1% YoY, and will likely continue through the remainder of the year. Following moderate economic growth in Q1 2021 (+0.4%), U.S. real GDP growth is expected to rise by +9.8 % in Q2.

- Inflation in Western Europe and Germany is forecast to peak in Q4 2021 (Western Europe: +2.3%, Germany: +3.3%). However, these developments should only be temporary, and inflation is expected to be moderate again for 2022.

- The euro area yield curve remained nearly unchanged as the ECB communicated its intention to consistently keep rates low and to continue its pandemic policy measures at least until the end of Q1 2022. U.S. Fed projections of at least one rate hike by the end of 2023 reduced the pressure on long-term yields and the USD LIBOR curve flattened compared to Q1 2021.

- In Q2 2021, the euro continued its upward trend against the U.S. dollar but since June, the EUR/USD exchange rate has fallen in line with growing divergences in monetary policy between U.S. Fed and ECB.

In the first quarter of 2021, global banks surprised analysts with strong results and profitability improved across all regions – RoE of U.S. banks: 17.0% (+11.5%p YoY), BRICS banks: 13.6% (+0.3%p YoY) and Western European banks: 8.5% (+5.6%p YoY). Amid an improving economy, most of the Western European and U.S. banks exceeded analysts’ expectations, thanks to higher revenues from trading activities, rising bond yields and lower loan loss provisions. However, it remains to be seen whether banks will be able keep up these positive results until the end of the year.

- In Q1 2021, profitability of U.S. banks improved for the third time in a row and even surpassed BRICS banks’ RoE. U.S. banks’ revenues surged compared to previous quarters (+42% QoQ, +213% YoY), in part benefiting from a significant release of reserves for credit losses.

- Western European banks showed solid revenue growth (+3.1% YoY) in line with a lower cost base (-1.7% YoY). As a result, the average cost-income ratios of Western European banks improved to 63.1% (-3.0%p YoY). Eurozone banks were also able to benefit from the ECBs’ targeted longer-term refinancing operations which stabilized banks’ Q1 net interest income (see our special topic for details).

- Western European banks have stopped increasing risk provisions in Q1 2021 and LLPs decreased slightly by -0.08%p QoQ to 0.15%, the lowest value for two years. U.S. banks’ LLPs even turned negative to -0.26% and several large U.S. banks expect reserves to shrink further in the coming quarters as remaining economic uncertainties continue to improve.

- Euro area rates for consumer and corporate loans decreased slightly in the first three months of 2021, as loan demand was impacted by stricter containment measures, but already increased again in April.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic: TLTRO – a welcome booster for profits and growth?

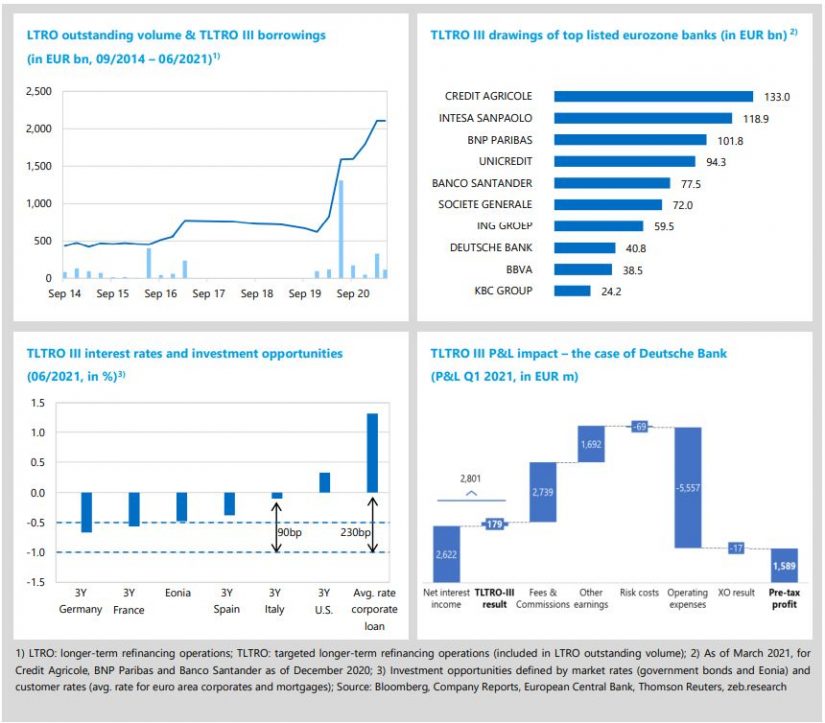

- TLTRO III is currently “en vogue” among eurozone banks as the ECB announced in December 2020 that it would extend it by three additional bidding points.

- The ECB program offers very attractive refinancing conditions for banks to maintain favorable debt financing conditions for the real economy and to counter adverse COVID-19 effects.

- The extensive use of TLTRO III can explain large shares of eurozone banks’ balance sheet growth and can help to stabilize net interest income – unfortunately, only a pleasant and temporary side effect of the ECB’s low-interest policy.

TLTRO III is currently “en vogue” among eurozone banks as the ECB announced in December 2020 that it would extend its current targeted longer-term refinancing operations (TLTRO) by three additional bidding points in the ongoing third series. This ECB program offers very attractive refinancing conditions for banks to maintain favorable debt financing conditions for the real economy as well as to counter adverse COVID-19 effects on the bank lending channel. But what are the actual effects on loan origination, balance sheet volumes and profits of Europe’s top listed banks participating in the program?

TLTRO was originally launched by the ECB as a non-standard funding measure in 2014. The application for these operations is possible for all banks of the euro area and the individual durations are up to three years. While participating banks receive their TLTRO funds upfront, the final borrowing “costs”, however, are determined after examination of a specifically defined lending performance. If a bank improves its net lending compared to a pre-defined reference period, and thus reaches its threshold, the funding rate is set to the attractive deposit facility rate (currently at -0.5%). If the institution does not reach its benchmark, the less favorable rate for main refinancing operations (currently at 0.0%) is applied. The total amount that banks can borrow is limited by the volume of their loans to non-financial corporations and households, i.e. 50% of participating banks’ eligible loans outstanding.[1]

These conditions were made even more attractive during the program. In the course of the third series of TLTRO (TLTRO III), established in September 2019, the net lending benchmark was capped to 0% and further discounts on the refinancing rate were offered. From June 2020 to June 2021, the ECB introduced the so-called special interest rate period, where funding rates are reduced by another -50 bps regardless of whether the benchmark is reached or not – i.e. the maximum achievable funding rate is set to a level of -1.0% (in case of benchmark reached) or -0.5% (in case of benchmark missed). In December 2020, TLTRO III was extended by three additional bidding periods (TLTRO-III.8-10) for 2021, in combination with a prolonged period of the very attractive funding rates until June 2022. Furthermore, the global limit of banks’ TLTRO funds has been increased to 55%.

By now, eligible banks have made extensive use of the TLTROs, pushing the total outstanding volume of the ECB’s LTRO (including TLTRO) borrowings to more than EUR 2,100 bn at the end of June 2021. In the latest tranche (TLTRO-III.8) in June 2021, the ECB allotted roughly EUR 110 bn of funding for banks. The most pronounced uptake in TLTRO III drawings, however, took place in June 2020 with total borrowings exceeding EUR 1,300 bn relating to ECB’s established special interest rate period. Among the top 10 listed eurozone banks, especially G-SIBs from Western and Southern Europe are among the biggest borrowers. As of March 2021, the French Crédit Agricole showed a total borrowing amount of EUR 133 bn, followed by Intesa Sanpaolo with EUR 119 bn and BNP Paribas with around EUR 101 bn. Over 2020, the considered top listed banks of the euro area utilized around EUR 650 bn of TLTRO III – nearly 40% of the total drawings in 2020 (EUR 1,650 bn). Compared to the increase in these banks’ total assets, the TLTRO III utilizations could explain, on average, up to 60% of their entire balance sheet growth in 2020 of +8.6% YoY. This points to the fact that European banks seem very confident about reaching their lending threshold and benefiting from strongly discounted interest rates. As most banks’ individual borrowing limits are not reached, TLTRO volume is expected to increase even more due to the remaining operations of the program.

A very simple comparison with other investment opportunities underlines the attractiveness of the TLTRO III program for participating banks. First of all, a targeted funding rate of -1.0% can at least realize a +50 bps spread, if excess funds are deposited at the ECB facility rate of -0.5%, thus providing a significant and risk-free contribution to banks’ net interest income (NII). For Southern European banks, for example, TLTROs can be even more beneficial compared to the negative interest rates of a corresponding government bond – e.g. +90 bps spread vs. a 3-year Italian bond. Finally, compared to the interest rate charged for an average euro area corporate loan, a remarkably high spread of approx. +230 bps appears to be realizable. Analyzing banks’ Q1 2021 reports illustrates how TLTRO III funds can help to support results. For instance, the Q1 results of Deutsche Bank show that TLTRO III funds increased the bank’s NII by +6.4% (i.e. EUR 179 m), which finally led to +11% in pre-tax profit. Another example is ING Group, where TLTRO III contributed to the NII with +6.6% (i.e. EUR 233 m) in Q1 2021 or even +16% to pre-tax profit.

Bank analyst forecasts even predict an average rise of around 8% in pre-tax profits for participating eurozone banks by 2022. However, the total effect is still uncertain and will not affect all banks in the same way. Especially banks with a limited deposit business could benefit the most from the TLTRO as well as banks operating in countries with a strong loan demand or more attractive investment opportunities (like e.g. Italy, Spain or France).

Regarding concerns that TLTRO-induced liquidity could lower banks’ credit standards and increase balance sheet risks, it is worth mentioning that empirical studies could not find an effect on systematic and excessive risk-taking. Therefore, banks seem to make use of the funds prudently, increased their loan supply to the real economy and do not take disproportionate risk positions on their balance sheets.[2]

As part of the ECB’s expansive monetary policy, TLTRO has successfully supported the major objective to increase market liquidity and to stabilize (net) lending for the economy. For eurozone banks, the additional income from the program is, of course, a significant but only temporary side effect. The overall negative impact on banks’ P&L of the ECB’s low interest rate policy, however, cannot be compensated and will persist beyond 2022.