New challenges for operating models in the asset management industry?

Margin pressure, regulatory requirements, sustainability and digitalization are challenges that asset managers have been facing for years now. They are well-known and require no additional explanation here. The coronavirus pandemic has further accelerated the need to adapt to some of these challenges – with digitalization being at the forefront.

However, their implications for the operating model in the asset management industry are varied and can even lead to competitive advantages. In practice, operating models are set up differently as they depend on the individual business model and on a company’s specificities such as geographical exposure, asset class focus and size in terms of AUM.

Potential cross-asset synergies and shared functions have to be identified and considered to ensure an efficient servicing of various asset classes in a fast-evolving product environment.

In this respect, the traditional FO-MO-BO structure described in the following section is often adhered to by those asset managers that offer many asset classes, as cross-asset functions can easily be consolidated in a common middle office.

Operating models in the asset management industry: status quo analysis

Operating models run by asset managers can be split into the following three categories:

- Traditional: front office (FO) – middle office (MO) – back office (BO)

- Lean: FO – BO

- Outsourced: FO – outsourced MO/BO

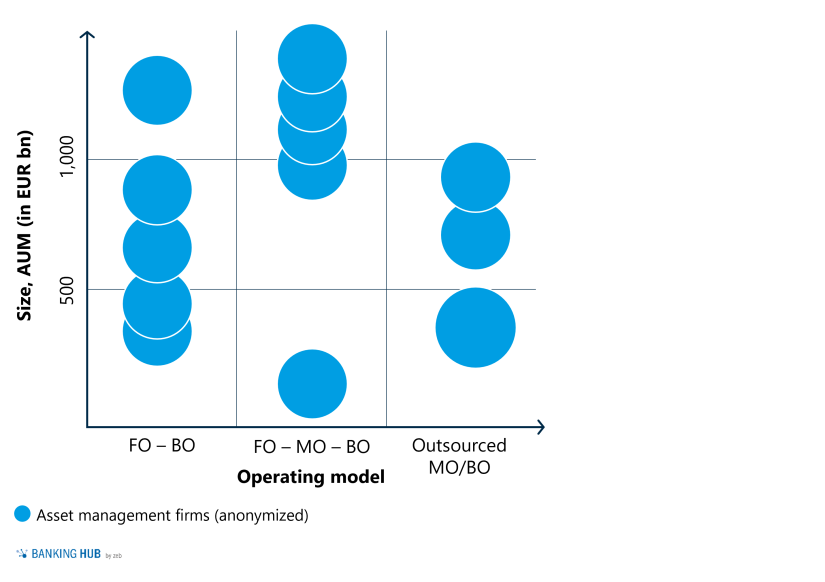

Before going into more detail about the specifics of each model, it is interesting to look at various players from global to local and compare their strategic orientation. Figure 1 shows that the set-up of the operating model does not necessarily depend on the volume of AUM:

- Leading players with AUM above EUR 1,000 bn tend to run their operating model in a traditional FO-MO-BO structure.

- Mid-market players that are managing assets between EUR 500 bn and EUR 1,000 bn have no clear focus. In this cluster, 50% of the asset management firms included in this study have a lean FO-BO structure, whereas the other 50% tend to outsource their functions to a third-party provider such as Statestreet, Caceis, Universal or HSBC INKA.

- Small players, with AUM below EUR 500 bn, tend to have all sorts of set-ups – from lean to traditional to outsourced. In this context, outsourcing strongly depends on the strategic rationale and size. Only mid- to large-sized asset management firms tend to outsource their middle offices as such services can easily be scaled with rising AUM, thus reducing unit costs. Smaller players rather outsource the back-office functions to an asset servicing company in order to focus exclusively on the core business of asset and/or portfolio management.

Front-back office vs. front-middle-back office: What are the differences?

Traditional operating model structure

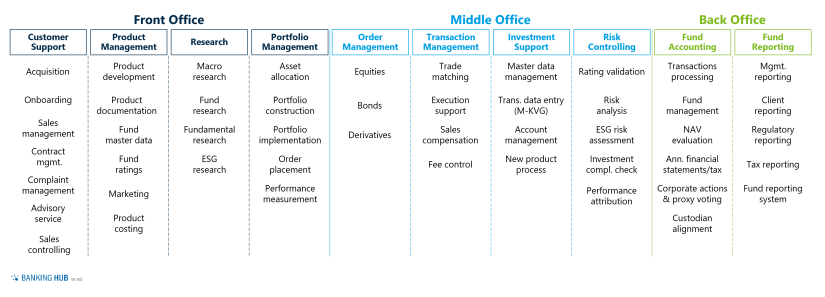

According to the traditional operating model, the value chain of an asset manager is split into three independent organizational units with each one having its dedicated responsibility and cost center.

The FO is responsible for client-related tasks from acquisition, customer support up to product management and portfolio management. In this business unit, closeness to the client is required due to the continuous exchange with the client advisor, e.g. during the onboarding process, the portfolio review or with regard to investments.

The relationship manager is responsible for identifying the client’s needs, whereas the portfolio manager makes sure that these are reflected in the products.

The MO acts as support to the FO and takes over all non-client-related tasks. This set-up is considered to be efficient since portfolio managers in the FO have higher salaries than the MO staff, which explains why they should focus primarily on client acquisition, servicing and portfolio management rather than executing administrative and supportive tasks.

Historically, a MO was established due to a heterogeneous system landscape in the FO and BO. Indeed, portfolio management systems, where the front staff entered orders, were often very different from the systems used in the BO for reconciliation, accounting and reporting purposes. The raison d’être of the MO was to ensure the transfer of orders initiated by the FO to the BO by manually entering them into BO systems (this is today often resolved with APIs).

Previously, the MO handled the paper-based transfer of these orders to the BO. Nowadays, the MO not only acts as an intermediary for communication and order handling between front and back office, but also hosts technical functions that require specific expertise such as risk management. These functions are required for each asset class and therefore a common middle office is key to ensure the realization of cost synergies for similar processes.

In terms of market developments, major AM players are starting to consolidate functions related to their current key challenges, i.e. ESG and data management. Their high importance and multivariate impact along the value chain explain why they should be anchored in one single place.

Deep-dive: ESG

The consideration of ESG factors along the value chain is a complex and lengthy process that concerns almost all business units: from the integration of ESG into the company strategy to the adjustment of investment policies and risk measurement up to a refined customer and regulatory reporting. The impact is far-reaching and integration needs to be defined and monitored accordingly.

To ensure a clear positioning towards the market, the clients and the regulator, the entire ESG governance needs to be run from one single unit that acts as coordinator and makes sure that the company heads in the same direction. The independence of the three value chain clusters ensures that the MO coordinates the ESG implementation and governance independently for the entire company.

Finally, at the heart of a consistent ESG strategy lies data – needed e.g. to finance ESG investments or to monitor risk KPIs. In this respect, data management needs to be adjusted accordingly to integrate new ESG-specific data sources and KPIs.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Deep-dive: data management

Asset managers are more than ever relying on qualitative and real-time data to make optimal decisions, e.g. to evaluate and rebalance their portfolios. This is even more true when the data is less structured, which is the case for illiquid asset classes such as infrastructure or real estate.

Similar to ESG, data management needs to be anchored within the organization in the center of the value chain with close access to ESG, portfolio management and operations. The consolidated data management within the MO acts as coordinator and prevents that different, sometimes redundant data sources are used and analyzed differently in various business units. The independence of the MO is important to drive the right decisions and conduct a clear company strategy.

Lean operating model structure

In terms of functions, the lean FO-BO structure does not differ from the traditional set-up. However, the rationale is changing. Functions that were, in a traditional model, executed by the MO are either located in the FO or BO; i.e. the FO also takes over supportive and administrative tasks. They are performed by portfolio and relationship managers or dispatched to their team assistants within the FO depending on the set-up.

The order and transaction management as well as investment support and risk management are service-oriented functions that require technical expertise which is normally not available in the FO. Their thematic fit to fund accounting and reporting suggest that they are consolidated within the BO to form one single business unit focusing on the rather “technical” part of the value chain. These functions illustrate well that both FO and BO follow a very different approach, the first being client-oriented, the second service-oriented. In practice, this hard boundary often results in some administrative and supportive activities that do not fit into one of these two organizational units. A clear process governance including the definition of ownership is key in a lean set-up to ensure a smooth border between FO and BO.

Frequently, a smooth front-to-back software allows staff to enter and execute orders directly in one single software. This straight-through processing significantly decreases license costs while resulting in a faster time-to-market and reducing operational risks as orders are entered manually only once. The closeness of relationship managers to portfolio managers and the trading desk may, depending on the set-up, optimize market time and increase client centricity.

In a lean structure, overarching functions such as the above-mentioned ESG or data management are often spread along the value chain. They are located in each relevant business unit (“in silos”) which of course promotes closeness and a lower time to market, but makes the coordination and harmonization of processes and procedures much more difficult.

Outlook and key takeaways on operating models in the asset management industry

In order to optimize their operational set-up and ensure future readiness, asset managers need to analyze their value chain precisely and identify the best-fitting model based on strategic targets (e.g. geographical expansion, cost reduction programs, outsourcing) and their status quo processes.

There is no one-size-fits-all set-up. An individually tailored solution is necessary for each asset manager. zeb has gathered valuable experience in relevant projects over the years from design to implementation in areas such as process optimization, outsourcing of business units as well as the setting up of functions within the MO and BO and can therefore be a competent partner for your transformation.