Current market environment in asset management

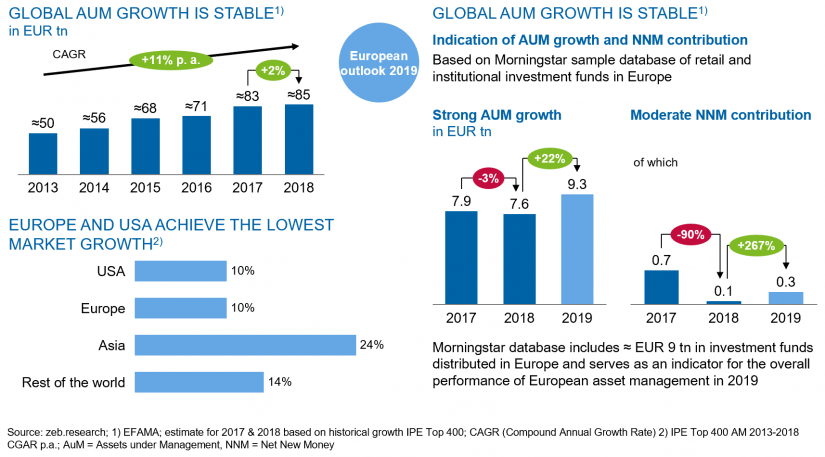

Two components drive growth in asset management: the market performance and the inflow of net new money. Even though the latter has been stable and is expected to maintain a positive trend in the future—due to global trends (such as the rise in the general standard of living, the worldwide expansion of the middle and upper classes and the growing need for private retirement provisions)—it has a much smaller influence on the annual development of the industry, historically accounting for just over one-third of total industry growth.

In contrast, the market performance plays a significantly larger role accounting for two-thirds of the industry’s overall growth. In this respect, 2018 was a record year:

for the first time since 2008 the stock markets collapsed at the end of the year, most of them closing with a loss. Even the bond markets provided little or no compensation due to the widespread low interest rate environment. Since market performance usually also has a linear spillover effect on net new money inflows (i.e. investors tend to be cautious with new money investments in consolidating markets and vice versa), the industry grew only slightly in 2018 and even shrank in some areas and countries. Global growth from 2017 to 2018 was only 2%, as shown in figure 1.

The indication for 2019, on the other hand, is very positive, especially in view of the market development observed in the second half of the year: based on the development of investment funds distributed in Europe, which are contained in the Morningstar database that represents a significant section of the European asset management industry, we anticipate strong growth in assets under management (AuM +22%) and a tripling of net new money (NNM +267%) compared to 2018 across the European market.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Asset management caugt in the cost trap: More cost discipline necessary to compensate for the decline in earnings

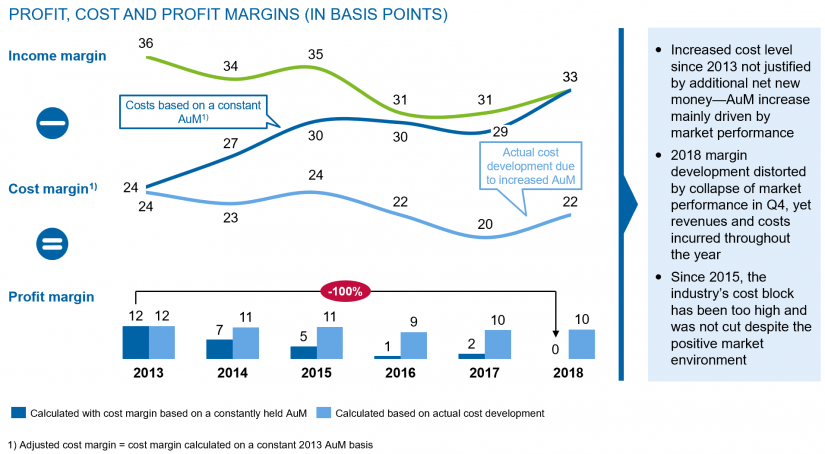

In our zeb.asset management study, we analyze about 50 of the largest asset managers with a high European market footprint. We have already demonstrated in the past year that the industry’s growing earnings pressure and slow cost-saving measures were more than offset by the strong market performance, thus keeping the industry’s profit margin relatively stable.

The effect of the performance slump in Q3 2018 translates to an increase in revenue and cost margins in 2018, which could initially lead to the erroneous conclusion that the revenue and cost situation had improved. It should be noted, however, that between the beginning of the year and Q3 2018, the bulk of revenues and costs were incurred in a positive market environment and that the rising margin effect, arithmetically speaking, only resulted from the sudden plummeting market figures (and thus AuM[1] decline) at year end.

Only keeping the AuM constant when calculating the cost margin, as seen in figure 2, reveals the weakness of the industry and illustrates that theoretically the profit margin has already shrunk to zero.

Despite the very friendly market environment in 2019, there are several reasons why the asset management industry will not be able to return to the old days of high margins, especially regard to the revenues:

- Passive strategies are up to 90% cheaper than active strategies, which puts them under considerable price pressure. Passive strategies continue to enjoy increasing popularity among all investor groups with correspondingly high growth rates.

- We have observed a decline in profit margins across all asset classes in both retail and institutional business—not only due to “passive pressure” caused by the majority of active strategies underperforming their passive benchmark, but also due to increasing regulatory-driven transparency requirements.

- In addition, regulatory and consumer protection organizations (currently mainly the British FCA and ESMA) critically monitor the market and increasingly call on suppliers to offer “fair prices”.

In order to maintain the attractiveness of the asset management industry, companies are therefore forced to tighten their cost discipline—a rather daunting task given the actual cost development of recent years and especially in 2018.

Escaping the cost trap: no news, but new tools and methods

The industry has been discussing various cost reduction measures for years. At the same time, however, year-end results reveal a persistent lack of consistent implementation.

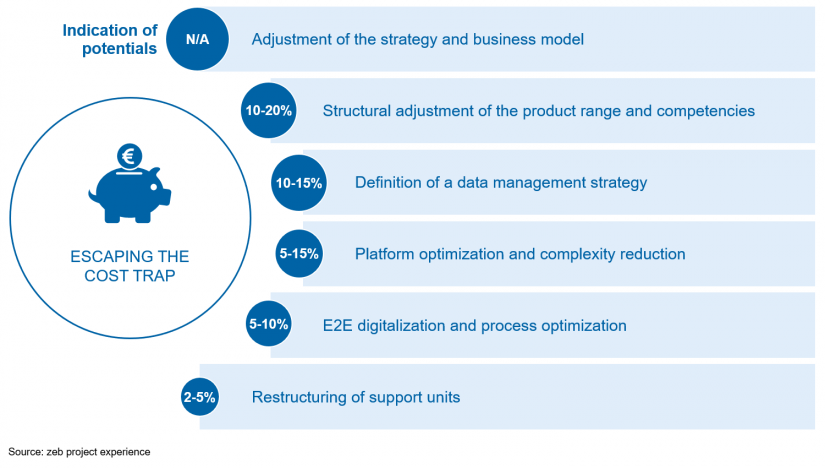

Figure 3 summarizes what we consider to be the six most effective levers for sustainable cost optimization in asset management with an indication of potential. The first two levers relate to the business model and the efficient sharpening of the asset manager’s original unique selling proposition, while the bottom four relate to the operating model and the systematic digitalization of operational processes. Given the rapid pace of technological development, it is imperative to continuously sequence the corresponding internal measures.

Figure 3: Levers for sustainable cost optimization in asset management with an indication of potential

Figure 3: Levers for sustainable cost optimization in asset management with an indication of potentialAdjustment of the strategy and business model

Many managers find it difficult to part with unprofitable areas or to withdraw from unprofitable markets. They often shy away from the associated loss of income or fear overarching negative effects (e.g. on more extensive, group-wide customer commitments). However, depending on business complexity, especially streamlining non-core activities can be an enormous lever to reduce costs. Concrete measures could include, for example:

- selling below average-margin business lines or business lines that fall short of a critical size (e.g. fund servicing or ETF business, if it is too small) and, if necessary, substituting them through cooperations

- devising a strategy to exit unprofitable markets (sale, reduction of sales and marketing)

Structural adjustment of the product range and competencies

While regular adjustment and development of the product and service offering is standard practice in other industries, asset managers often tend to stick too long to strategies once launched but which, from an economic point of view, prove unprofitable. In this context, streamlining in particular offers scope for systematic innovation management and at the same time enormous cost-saving potential. Concrete measures could include, for example:

- systematically reviewing the investment competencies and the product offering in terms of profitability, critical size and relevance (trends, future growth potential)

- discontinuing or merging suboptimal/non-competitive funds/mandates and the corresponding resources and transferring assets/clients to relevant/similar strategies/funds where possible

Definition of a data management strategy

Every asset manager’s activities are based on data that not only determine the business operations, but also the actual development of investment strategies and thus the generation of investor returns. A future-oriented application of machine learning and artificial intelligence is only feasible with a well-established data management system. Effective and, due to the constantly increasing data volume, cost-efficient data management is therefore essential and should be continuously updated. Concrete measures could include, for example:

- defining a group-wide data governance

- enforcing high data quality and introducing the golden-source principle: massive reduction of complexity and costs—often combined with corresponding consolidation/rationalization of the system landscape

- reviewing and optimizing data providers

Platform optimization and complexity reduction

The increasing automation and digitalization of various business processes over the last few years have led many asset managers to build up a digital jumble with a multitude of isolated applications and/or to shy away from replacing outdated proprietary developments with standard software available on the market. At the same time, however, regularly modernizing the system landscape and consistent centralization beyond political hurdles holds enormous cost-saving potential. In this context, the following approaches, for example, should be considered:

- simplifying existing platforms or modernizing the system landscape along the strategy and business logic, also using SaaS, cloud-based solutions and third-party providers

- centralizing middle-office activities, selective outsourcing, optimizing manual support activities (e.g. order management)—with simultaneous process automation

E2E digitalization and process optimization

The continuous development of technical possibilities also results in new process optimizations. A systematic sequencing of activities thus holds cost reduction potential at any time in every department, for example:

- E2E digitalization and E2E process automation, process simplification/standardization—e.g. workflow solutions in customer onboarding (increasing speed, reducing costs and operational risks)

- automation of repetitive, rule-based activities with high frequency / high volume via robotics (RPA)—e.g. collateral reporting, pre-trade compliance checks or reconciliation of securities data

Restructuring of support units in asset management

In recent years, many asset managers have already taken an active role in this area, therefore we estimate the potential at 2–5% to be relatively low, but nevertheless believe that regular reviews are worthwhile. What might have made sense 2–3 years ago may now, under changed market conditions, hold optimization potential. Touch points could be, for example:

- optimizing/centralizing support units such as marketing or HR

- outsourcing or offshoring basic back-office functions (e.g. fund reporting)

- rationalizing the ManCo set up (or outsourcing, if not of strategic relevance)

Many asset managers have already implemented extensive cost reduction programs over the last 3 years. Given the enormous pressure on earnings within the industry, however, efforts are far from sufficient to halt the decline in profit margins on a sustainable basis. Only those who, like sportsmen, constantly and persistently strive for optimization will be able to keep up in the future under the intensifying competitive conditions of the asset management industry. As partners for change, zeb is happy to support you. Get in touch!

[1] AuM = Assets under Management