Fully automated and fully digital target picture

Today, asset managers could operate almost completely automated and digitalized – in theory, human action and interaction are hardly necessary anymore. This is particularly evident when looking at numerous young, highly digitalized challengers, from Tungsten Capital Management to Upvest.

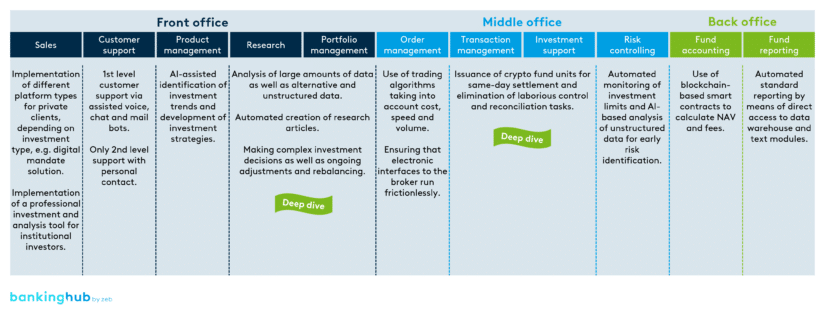

Figure 1 shows exemplary use cases along the value chain. For instance, it is possible to run platform-based customer service almost completely by the means of artificial intelligence (AI) based voice, chat and mail bots or to automate investor reporting via direct access to the central data warehouse and a corresponding text module program. However, the largest and most disruptive fields of action are found in research and portfolio management, or in transaction management and investment support.

In research and portfolio management, the use of AI offers enormous disruption potential:

- AI makes it possible to automatically analyze balance sheet data and detect patterns in time series data that would have escaped the human mind. Based on this, market forecasts and recommendations for action can then be derived.

- In addition, natural language processing (NLP) can be used to perform cross-media sentiment analyses, while artificial neural networks (ANN) can evaluate unstructured data. As an example, analyses of various satellite images serve to estimate oil reserves and anticipate future price developments.

- Furthermore, extensive research can be automatically summarized into articles by means of AI – this only requires access to corresponding databases as well as qualitative input in the form of a few bullet points.

- In addition to analyzing large or alternative data sets, AI is also capable of making investment decisions, taking into account an almost unlimited amount of data as well as constraints such as Value at Risk (VaR) or ESG ratings.

- However, the biggest advantage of AI over traditional data processing programs is that AI algorithms are continuously monitored for effectiveness and further developed. A practical application example would be the combination of AI and robo-advisory – the initially selected portfolio composition would not be fixed but could be automated and continuously adjusted according to the selected investment preferences.

The second largest field of action is the use of distributed ledger technology (DLT) in transaction management and investment support:

- DLT allows blockchain-based order routing between buyer and seller to complete transactions at any time without the need for various intermediaries.

- The settlement of the traded digital assets is carried out in real time, thus offering speed advantages compared to the usual settlement time on the capital market of up to two days.

- Settlement is fully automated via a blockchain, so that especially manual processes in clearing and settlement of conventional securities trading become obsolete.

- Every transaction is automatically recorded, validated and stored on the blockchain – DLT guarantees a complete, unalterable record of transaction data.

Obstacles for a fully automated and fully digital operating model

Theoretically, operating a fully digital asset manager is possible – but what is the situation in practice?

Regulatory requirements, technologies that are not yet fully mature as well as integration efforts and customer expectations do not yet allow fully digital operation today.

- German legislation imposes strict requirements and due diligence on portfolio management – currently, digital solutions are not yet considered. In particular, self-learning solutions, whose decisions can be explained ex post but not actively controlled, however, digital “helpers”do not have any space in the regulatory space as of now.

- On top of that, there are various technological barriers. The integration of all accumulating data from different sources into a uniform data pool still poses considerable difficulties. Integrating different application systems such as the CRM tool and trading systems requires the interaction of many providers. Finally, advancing digitalization is also leading to higher demands on cyber security.

- Lastly, it should be noted that asset management is a “people business”. Digital operating models, especially in the management of capital assets, are usually met with a certain degree of skepticism. In addition, maintaining client relationships is an integral part of asset management, especially in institutional investing – an aspect that would come into question when applying a fully digital operating model.

In addition to these obstacles, established asset managers embarking on the journey to a fully digital operating model face transformation efforts that should not be underestimated. Apart from significant investments in infrastructure, data management and technologies, these also include the implementation of automation and digitalization projects as well as upstream standardization across the entire operation – tasks that require corresponding human resources, sufficient expertise and, above all, the willingness to embrace change.

Cornerstones of Target Operating Model 4.0

The fully digital target picture currently seems difficult to achieve – but what can asset managers already do today to lay the foundation for an automated and digitalized operating model?

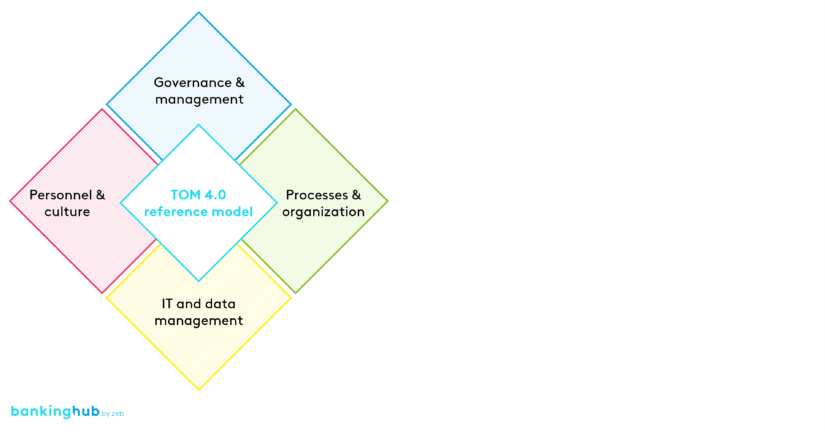

The zeb reference model of Target Operating Model 4.0 shown in Figure 2 illustrates the key fields of action.

First, IT and data management must be carefully reconsidered, including:

- Formulating a clear IT and data strategy

- Establishing a harmonized governance framework with responsibilities, processes, rules and standards

- Defining data quality standards and ongoing quality monitoring

- Ensuring the comprehensive harmonization and E2E integration of the IT system landscape, including the creation of a “golden source” for all ensuing data

Furthermore, the processes and the organization must be adapted to the new IT and data landscape and must be E2E-linked, too. Through IT as well as organizational E2E linkage, manual interfaces between different systems and process steps are to be eliminated and the focus of daily work is to shift to value-adding activities.

In the course of restructuring IT and organizational processes, it is also crucial to rethink the company-wide governance and management model and adapt it to new circumstances. This is partly due to the fact that today’s organizational structures and reporting channels are usually in contrast to E2E-linked processes. In addition, existing performance indicators are usually not suitable for a digital work environment or new work content and priorities.

The last building block of the zeb reference model is personnel and culture. It is essential to promote employee development so that they are willing and able to adopt new, digital ways of working, and to recruit new employees with sufficient specialist and IT expertise so that the operating model can be continuously enhanced. Previous approaches, including, for example, a poorly developed error culture, can also lead to opportunities not being taken and must therefore also be scrutinized.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Deep dive: the E2E-linked organization in asset management

The E2E linking of processes is a central cornerstone of all digitalization and automation ambitions in asset management – but the work structures or priorities from sales unit to back office differ considerably. So how does E2E linking work?

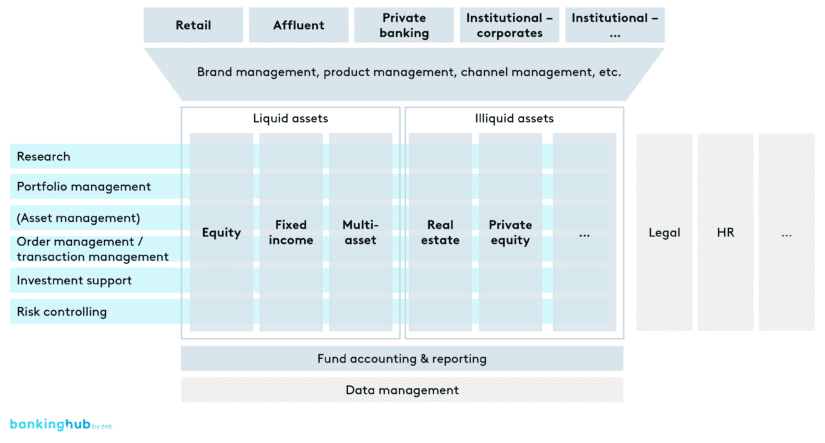

Basically, it is a good idea to divide the sales department according to customer groups – retail customers have different needs than affluent and private banking clients, and corporate investors have different needs than insurance companies. This ensures that the various sales units can specialize in their customer groups and broaden their network in the target group. The various sales units have uniform interfaces with brand and product management. Brand and product management processes the information collected and passes on impulses to product management, research, and portfolio management.

Furthermore, it is recommended to divide the front and middle office units according to asset classes. The requirements for portfolio managers and their skill sets differ depending on the asset class, and so do the ways of carrying out transactions. Liquid assets are generally traded in a standardized manner on the stock exchange, while trading in illiquid assets is subject to complex due diligence and negotiation processes. The processes in the individual asset class streams should be standardized as much as possible and have a common interface with fund accounting and fund reporting. This ensures that information can be passed on to the accounting department in a standardized manner.

In addition to the classic activities along the value chain, it is possible to create an overarching data management unit with central responsibility for company-wide data integration, ensuring data completeness, quality and up-to-dateness, and systematically identifying opportunities for further data use.

It should be noted, however, that the structure of the organization should be based on the strategic orientation of the company – for example, the sales department can also be divided by region and production by product type.

As the example of the Quelle Group shows, companies must not rest on the laurels of their current success and miss fundamental trends such as digitalization. Change takes time – that’s why companies need to start gradually working toward a long-term digital target picture today.