A market facing significant upheaval

With its strict bank secrecy rules and a business-friendly administration, Luxembourg has long been an important financial center especially for European offshore private banking. With the end of bank secrecy, increasing competition from other financial centers and the slack in global growth, private banking in Luxembourg seemed to reach an impasse.

Positive development over the last years

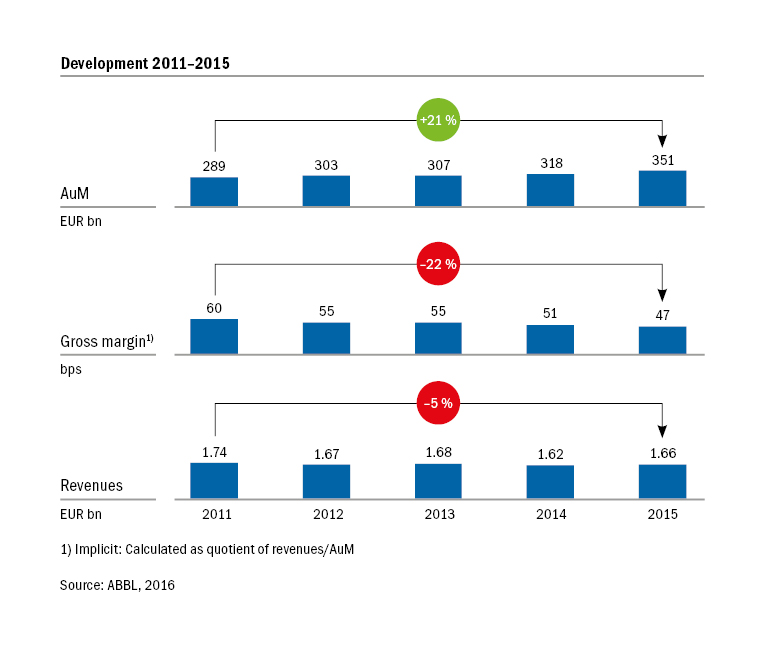

Although regulations lead to a noticeable withdrawal of deposits by affluent clients over the past few years, the market has grown once again. Luxembourg was able to use its structural advantages, for example its strong footprint in asset management, its EU access and high political stability to attract assets from wealthy clients (UHNWIs) worldwide. From 2011 to 2015, an increase in AuM by approximately 5% p.a. and a total AuM increase by 21% can be observed, which is comparable to neighboring countries such as Germany and Switzerland. This shift, however, comes at a price: The positive development of AuM is accompanied by a significant erosion of gross margins by approximately 22% from 2011 to 2015, which is typical for the upper wealth segments. Considering both effects, total market revenues have slightly decreased over the period of observation (cf. Figure 1).

Private Banking in Luxembourg—quo vadis?

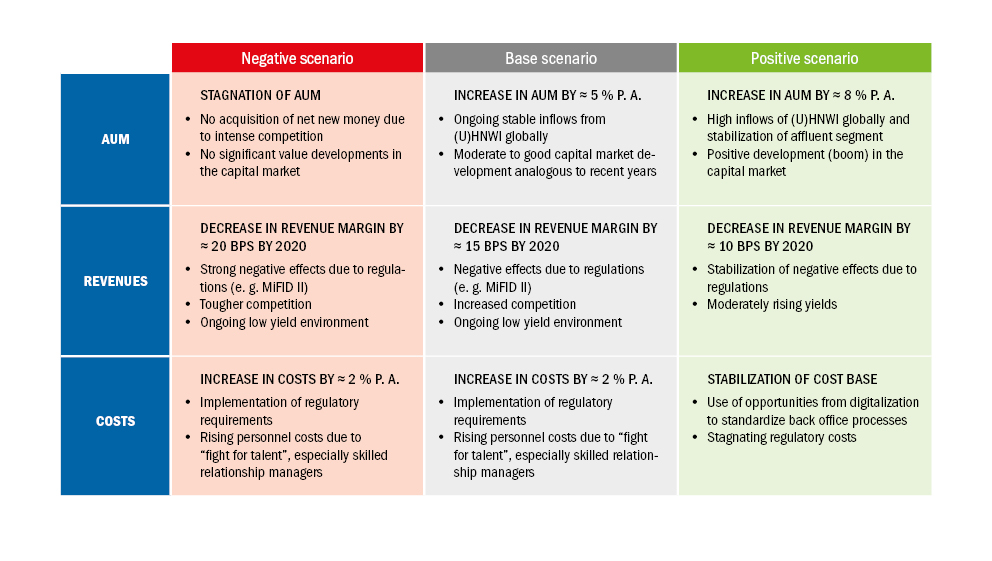

It is evident that an unfavorable development of AuM would have a severe impact on the development of profits. Thus, to better understand and assess the development of revenues, costs and profits of Luxembourg private banks, we examined publicly available data of eight banks. These eight institutions account for about 33% of the Luxembourg AuM. Although the sample certainly suffers from some sort of “survivor bias”, making forecasts potentially too optimistic, it provides useful insights into the situation of individual institutions and the market. In order to forecast the impact on the future financial situation of our sample banks in 2020, a scenario analysis comprising three possible scenarios was conducted (cf. Figure 2):

- “Negative scenario”: Unfavorable development of both macroeconomic and business-specific factors

- “Base scenario”: Continuation of current trends

- “Positive scenario”: Favorable development of both macroeconomic and business-specific factors

The analysis shows that only in the “positive scenario”, which is based on extremely optimistic to roseate assumptions, the examined sample banks are able to expand their profitability: Their average net profit margin increases from 28 bps in 2015 to 41 bps in 2020 (cf. Figure 2). Even if the current trend of recent years persists (i.e. in the “base scenario”), the AuM-weighted net profit margin will decrease to 23 bps by 2020. In this scenario, only four out of eight banks will obtain a net profit margin of more than 20 bps. The deterioration of gross margins as well as the steady increase in overall costs outweigh the positive effect of AuM growth. This shows that purely relying on continuous growth in AuM without taking appropriate actions to address margins and costs is not enough. Under the “negative scenario”, average net profit margins (weighted by AuM) will shrink from 28 bps in 2015 to only 1 bp in 2020, which is considerably below a critical threshold of 20 bps from an investor’s perspective.

New challenges ahead

There are at least four major challenges that private banking in Luxembourg is currently facing:

- Realigning strategy and generating a clear USP: As most Luxembourg banks are shifting towards upper segments of wealth management, competition for this small but very wealthy portion of clients is increasing dramatically. At the same time, the relatively low-risk “mass” private banking business is dissolving. With strong competition focusing on a small segment of ultra-wealthy clients, clear differentiation will be required to retain market share

- Fulfilling changing client needs: In addition, these structural changes in the client portfolio, all private banking and also wealth management clients are quickly adopting new technologies and demanding a new form of “digital proximity” of their banks. Price, products and performance are still important as essential “hygiene factors”, but digital aspects are now turning into the core drivers for customer satisfaction. Digitally savvy clients, especially the younger generation, expect the supplementation of traditional services by digital channels and tools (e.g. in advisory services) as well as consistent end-to-end customer journeys

- Monitoring and following digital trends: Digital trends such as robo-advice are becoming more attractive to clients and the combined approach of personal advice and automated investment decisions (hybrid model) has the chance to capture market share beyond the affluent segment

- Keeping an eye on profitability: Within the next few years, even more pressure will be placed on profitability both because of intense competition and the investment required for regulatory compliance and digital transformation. Thus, cost management is and will remain a top priority for the time being

To sum up, Luxembourg private banks indeed seem to be approaching tougher times. Consistent decision making and fast implementation will be essential for their future success.

Three strategic options

Private banks or private banking divisions in Luxembourg have different options to react to the challenges ahead depending on their goals. If they want to be successful in international wealth management, they need to establish and emphasize a clear wealth management USP with all corresponding business model adaptations, such as the right branding, a tailored solution offering and “high-end” relationship managers on a par with their wealthy clients. Besides, Luxembourg private banks have the opportunity to leverage their existing infrastructure and position Luxembourg as an EU hub for digital private banking in the affluent segment while re-diversifying their client portfolio at the same time and thus reducing concentration risk. From a group perspective, Luxembourg can play a vital role in operating model simplification as one of a limited number of booking centers across the globe as it combines a comprehensive technical infrastructure and a skilled back office workforce. Aside from these advantages, the coverage of several time zones, high data protection standards and a multilingual environment are additional strong arguments for Luxembourg.