Luxembourg retail banking revenue pools: Methodology and scope

The assessment of the Luxembourg retail banking revenue pools is part of a larger study looking at the eleven largest European economies by GDP. Overall, the focus lies on four key product groups that are relevant for an average household: everyday banking, savings and investments, consumer loans and mortgage loans (see figure 1).

To define the revenue pools of these four product groups, our model estimates the total market volume and fees/margins of each specific product. Future revenue pools are estimated based on various assumptions on the evolution of market volumes and margins. Our analysis relies on numerous publicly available sources such as the ECB, Eurostat, Statec, BCL, the Ministry of Housing as well as zeb data on market benchmarks, project insights and expert views.

In a subsequent step we are using a variety of socio-demographic and market data (e.g. purchasing power, unemployment rate, relative real-estate prices and growth rates) to break down the revenue pools to municipality level. However, this drill-down will not be tackled within this article.

Luxembourg retail banking market: Revenue pool evolution

The evolution of the entire Luxembourg market by itself provides only few relevant insights. In fact, between 2010 and today, the market has decreased in total by a magnitude of around 5%, whereas by 2025 the level will be back to just slightly above that of 2010.

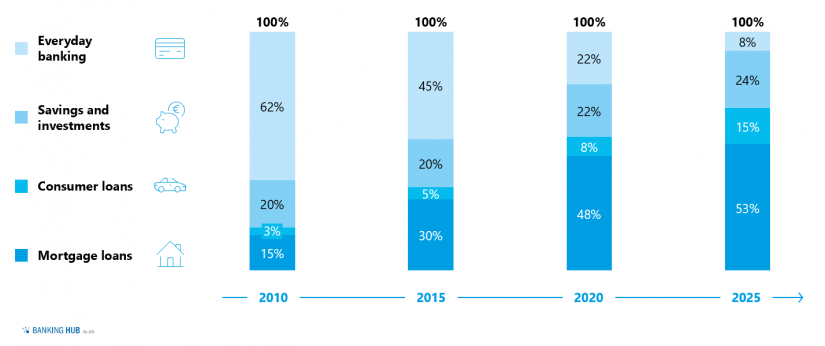

Therefore, the development of the shares of the four defined key product groups is of much greater relevance. In Luxembourg, the trend is very similar to the general European average, i.e. revenues from everyday banking products are significantly decreasing, whereas revenues from loans, particularly mortgages, are increasing above average levels. More precisely, for Luxembourg we could even talk about a pivoting of the industry. While everyday banking represented a little more than 60% of the Luxembourg retail banking revenue pool in 2010, we expect this share to drop below 10% in 2025. For mortgage loans, the development goes in the opposite direction – from about 15% in 2010, the share is expected to increase beyond the 50% threshold in 2025 (see figure 2).

In the following paragraphs, we will dive deeper into the figures within each product group and present potential drivers for these developments.

1. Everyday banking

The everyday banking segment has faced deteriorating revenues for the past ten years, even though the number of accounts and particularly credit cards has been steadily increasing. The massive shrinkage of this revenue pool is, however, due to the negative interest rates putting overnight deposits heavily under pressure. Consequently, the whole industry will start losing money on overnight deposits from 2022 on at the latest. This evolution is even more impressive when looking at the big picture, in the sense that revenues from overnight deposits represented around 50% of the entire retail banking revenue pool back in 2010 and will have a negative contribution of more than 5% in 2025. Considering that the volume of overnight deposits of Luxembourg households had already been increasing in pre-Covid times, the current development suggests a strong call for action for banks to ensure the sustainability of their business model. In the next chapter we will discuss some approaches to tackling this issue.

Finally, it is worth mentioning that revenues from overdraft loans benefit from relatively stable margins and therefore, combined with steadily increasing volumes, represent a significant revenue pool for banks.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

2. Savings and investments

The overall evolution of the savings and investments revenue pool is somewhat misleading as it suggests a rather sluggish increase from 20% in 2020 to only 24% in 2025. However, this evolution is also heavily influenced by negative interest rates that apply to the bank. In other words, deposits with maturity have been a loss driven business for many years while the savings deposits business will tend towards zero by 2025 (assuming negative interest rates continue to be applied).

From these developments, we can deduct that revenues from securities in Luxembourg retail banking market must have increased significantly in proportion, but also in absolute value. While overall margins decreased in an initial post-MiFID II phase and have since rather stagnated, the rise in volume is the driving factor here. The evolution of stock markets is probably the most important volume driver (around 47% of the investments of Luxembourg households are in shares and other equity), and even though a changing attitude towards investing has pushed retail investors to start placing their money, we believe that there is still plenty of potential.

Our estimation of the wealth structure in Luxembourg shows that only 11% of total wealth is held in securities whereas around 18% is held in deposits and, unsurprisingly, 56% in real estate (the remaining part being participations and insurance). In the next chapter, we will outline some approaches how retail banks can transform high shares of deposits to ultimately improve revenues in the investments area.

3. Consumer loans

Despite the low interest rate environment that banks have been navigating since the 2008 financial crisis, loans still account for a large portion of retail banking revenues. More specifically, the subcategory of consumer loans has constantly increased in recent years and will become even more important in the future, representing 15% of the retail banking revenue pool in 2025.

Looking at the details, we observe that margins have actually been relatively stable over the past few years in the Luxembourg retail banking market, while the overall volume of consumer loans increased by over 120% between 2010 and 2019. Generally, consumer loans are used to bridge temporary financing needs such as the purchase of a car (directly or through leasing), education (student loans) or other personal needs (e.g. home renovation, vacation). Acceptance of borrowing smaller amounts of money has increased in recent years owing to the omnipresence of attractive financing offers.

Indeed, the emergence of online loan brokers, point-of-sale buy-now-pay-later services as well as private leasing solutions offered by car dealers, leasing companies and banks has driven this trend. As an example, leasing was dominated by leasing companies (such as LeasePlan, Arval etc.) for years, but private leasing services by banks have started to emerge as they identified the business opportunities of this profitable segment. Moreover, the increasing attractiveness of financing conditions for retail clients is certainly another volume driver.

4. Mortgage loans

Mortgage loans have turned into the key driver of retail banking revenues in Luxembourg. In the last ten years, revenues generated through mortgages grew constantly at a high rate and will make up more than 50% of all retail banking revenues in Luxembourg by 2025. The root cause of this evolution is certainly linked to the surge of real estate prices in Luxembourg, driven by an underlying structural gap between supply and demand (we will not provide further details on this issue as this would go far beyond the scope of this study). Indeed, according to the BCL, between 2010 and 2019 the average mortgage volume per Luxembourg citizen increased by more than 90%, and it will certainly follow the same path in the years to come.

In the next chapter, we will a closer look at how mortgage pricing can be aligned with customers’ individual willingness to pay.

Selected key profitability levers

While numerous approaches could be used to adapt the business model to this new situation in the Luxembourg retail banking market and ultimately improve profitability (e.g. optimized omnichannel services, increased self-servicing through mobile banking efficiency, digitization of processes for mortgage loans, etc.), we would like to focus on the securities and mortgage business.

1. Securities business

As described in the previous section, Luxembourg citizens still hold a considerable proportion of their wealth in the form of bank deposits (18%). The BCL confirms this trend by observing that between April 2020 and April 2021, deposits from Luxembourg households increased by EUR 1.739 billion (or 4.1%).

According to our project experience and different customer surveys in the Luxembourgish as well as other European retail banking markets, there are four main categories of reasons why people are not investing their available cash or not investing more of it:

- Financial education, e.g. lack of financial knowledge, complexity of financial markets and unawareness of concepts such as compound interest or dollar-cost averaging

- Inconvenience issues linked to the user experience, information gap or time restrictions as well as perception of high fees or insufficient savings

- Absence of an appealing offer, e.g. offer does not match individual needs, goals, lifecycle phase, or only (apparently) complex products are available

- Psychological reasons, e.g. risk/loss aversion, lack of trust toward the banks and lack of emotional connection to the investments

Different solutions to overcoming these blockers from the sales perspective are available. With a view to efficiency, however, the options need to be chosen according to the targeted customer group, the desired magnitude of impact as well as the considered time horizon. In fact, approaches like fractional investing, gamification of the investment process, low minimum fees and robo-advisory might be suitable initiatives to target millennials, tech-savvy customers as well as HENRYs (High Earners, Not Rich Yet), but they won’t be as relevant for baby boomers or female investors, who would value goal-based investment services, advanced training material and the use of less technical vocabulary.

However, our project experience in numerous European banks shows that one particular initiative proves to bring consistent results across all major bank types and customer segments when it comes to increasing investment volume: dedicated training and coaching of the salesforce combined with analytical support.

Firstly, salesforce training focuses on enabling relationship managers to better sell to their clients. A typical training program is conducted over 4 to 8 weeks, includes sessions on client acquisition, sales, negotiation, as well as products (e.g. ETFs, stocks, insurance, negative interest rate fee, fund saving, etc.) and concludes with individual coaching sessions. With the help of professional trainers and coaching, impressive results can be achieved – project experience shows an average increase of custody account openings by +228%, of fund contracts by 1,300% and security sales by +108% over a one-year period at a particular bank. This initiative can be considered an efficient quick win as it is typically implemented within a relatively short project duration and limited budget, providing an immediate increase of investment revenues to the bank.

Secondly, data analytics should be used as an enabler to better understand the client and ultimately identify “low-hanging fruits”, i.e. clients with a higher tendency to invest. While data analytics can be defined as an advanced CRM tool with ongoing data screening and learning algorithms, a simplified analysis of available static data sets can also do the job in the first run. In both cases, different triggers would need to be considered, e.g. high cash share, recent transactions, salary or job change, upcoming inheritance, past investment behavior as well as interests, that feed the analysis on a regular basis thus providing additional valuable insights to the relationship managers on how to approach the client with the right solution at the right time.

2. Mortgage business

As the Luxembourg real estate and mortgage markets are rising at an unprecedent pace, the volume component is not an issue for banks, as described above. Therefore, our focus is on the pricing of mortgages, which in the end also impacts the acquired volume for the bank.

We have seen that the lending business (particularly mortgages) is the dominant source of income for retail banking in Luxembourg, accounting for over 50% of total income – despite the fact that new business margins have settled at a fairly low level and that it has become much easier to compare terms and conditions at different banks through comparison platforms or simulators. In addition, it is even more surprising that the further development of credit pricing is still overshadowed by pricing measures in the environment of current accounts and securities.

A pragmatic solution to optimize mortgage pricing is offered by a differentiated derivation and control of individual margins, which can be integrated either as a comparative or suggested price, or directly into preliminary costing. The main idea of such a “client-specific pricing” approach is to develop assumptions as to which customer, product and competitive characteristics are responsible for different gross/net margins and to analyze them by relying on proven statistical methods (typically multiple linear regression). In other words, potential margin drivers such as loan size, type (new business vs. prolongation), complexity, client risk profile, age, income or client relationship duration are statistically tested and used to define the client’s individual willingness to pay and, as a consequence, the individual interest rate.

Project experience shows significant potential for markups, especially for clients with lower volumes, longer bank relationships and loans with additional flexibility options. Numerous pricing projects across European banks suggest that an increase of new business margins by 5 to 10 basis points is possible. Of course, the result of such an initiative is not only to increase margins but also to lower the number of lost deals, as each client is offered the right price they are actually willing to pay. Key factors of successful client-specific pricing include:

- Adjustment of the loan terms table/calculation logic so that the desired effects are “priced in” via appropriate surcharges or discounts

- Use of the existing technical options in the pre-calculation modules (of the respective core banking system)

- Integration of the new pricing logic into an overall concept and user-friendly pricing tools to support sales teams

- Regular measurement of price enforcement in active business and use of the results as an important agenda item for sales dialogs

Luxembourg retail banking market: Key takeaways

The revenue situation in the Luxembourg retail banking market has undergone massive changes in recent years. The future remains challenging, especially in view of changing customer behavior and preferences as well as the low interest rate environment that will certainly continue to prevail in the coming years. It remains to be seen to what extent banks in Luxembourg will charge negative interest rates or fees on their customers’ deposits in the future.

To remain profitable in the long run, local players need to adapt their approach to the new reality and take targeted measures – for example, converting the deposit surplus into profitable business.