The market for ESG investment solutions

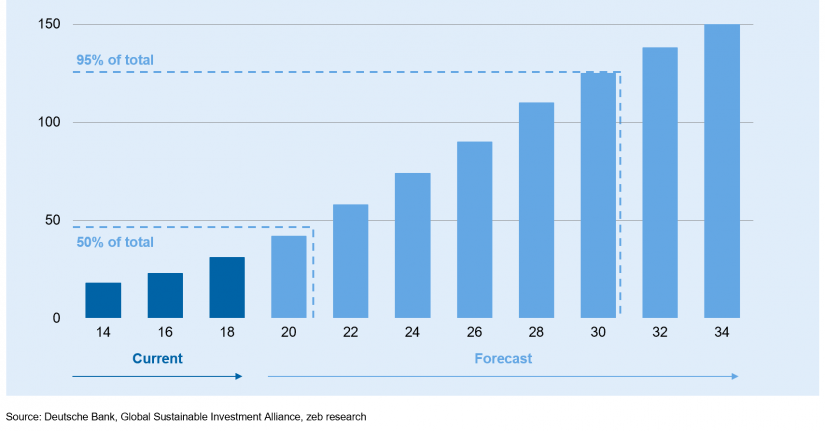

According to the latest research from the Global Sustainable Investment Alliance[1], the network of sustainable investments organizations from around the world, at the start of 2018 more than USD 30 trillion of total assets under management already factored in ESG principles. In addition, according to a forecast published by Deutsche Bank[2], ESG investments are expected to further grow and to pass the USD 100 trillion mark by 2030 (figure 1).

While the numbers may have some limitations due to different interpretations of ESG criteria, research from the Global Sustainable Investment Alliance based on biannual data consolidated by Eurosif[3] estimates that ESG investments account for approx. USD 14 trillion corresponding to slightly less than half of total assets managed in Europe.

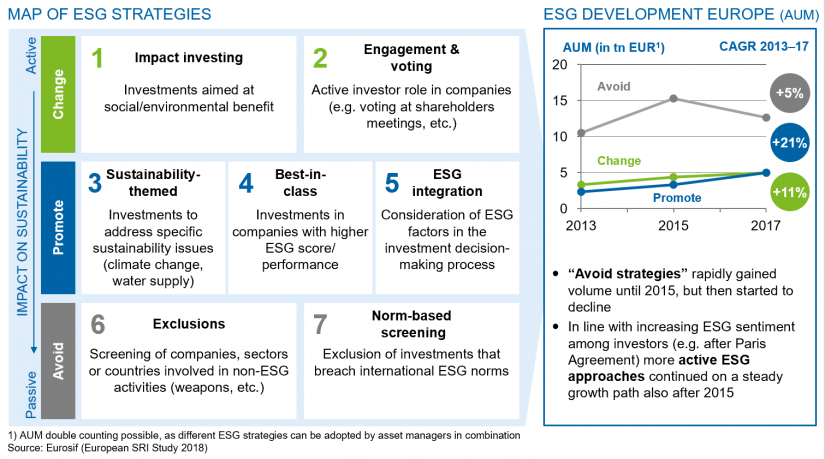

Multiple ESG-related investment approaches are available for selection by asset managers, also in combination, and even though the market players have not settled on standard methodologies yet, ESG strategies can generally be clustered according to more active or passive ESG impact (figure 2).

Potential strategies range from passive approaches such as exclusion or norm-based screening, where certain assets/securities from the investment universe are avoided depending on, respectively, their reference sectors or non-compliance with ESG norms, to intermediate and more sophisticated solutions such as best-in-class or ESG integration approaches that evaluate how investments promote global sustainability, and finally to active approaches, e.g. impact investing, where investments have a direct impact on ESG goals.

While passive approaches (due to their simpler and more immediate application) were the first to quickly gain volume in the market, in line with increasing public ESG sentiment (e.g. after the Paris Agreement), since 2015 investors’ preference has started to shift to more active ESG approaches, while investments in exclusion and negative screening approaches have declined.

As the investors’ interest in sustainable investments is growing, the market for sustainable investment solutions is rapidly expanding. According to a report from Morningstar[4], the number of sustainable mutual funds and ETFs in Europe has grown to exceed 2,200 investment funds either committed to using ESG criteria in the selection of securities or aimed at delivering a direct positive ESG impact.

Sustainable derivatives are also gaining traction. It started in 2018, when Nasdaq launched a first set of ESG futures based on the Nasdaq ESG index using a combination of norm-based screening and exclusion strategies, which was rapidly followed by Eurex launching ESG futures on STOXX ESG indexes at the beginning of 2019. Market interest in such products is confirmed by the number of contracts traded, which as of September 2019 passed 1m units for the Nasdaq futures and approached 800k. units for Eurex futures. Eurex went a step further in new sustainable product development by adding ESG options on a STOXX ESG Index to its product range at the end of 2019, while in parallel CME and ICE also introduced new ESG futures based on best-in-class indexes.

Existing barriers to ESG investing

Despite the strongly growing interest in sustainable investment solutions, the market is still characterized by a degree of uncertainty and barriers to entry as European regulators are working on a set of legislative papers to establish a level playing field for all market players.

One of the biggest challenges the sector is still facing is the lack of a common taxonomyto define the perimeter and the minimum requirements for sustainable activities. There is for instance an ongoing debate on what activity to consider “green” (e.g. nuclear power plants) and what investment falls into the ESG scope. A second barrier to a wider adoption of ESG investments is the lack of a common standard for ESG disclosures. For example, when disclosing information on their ESG performance, companies can choose what criteria to follow and whether to have their reporting audited by a third party. This lack of common rules resulted in unbalanced reporting of ESG risks and performance and, in the worst cases, in greenwashing, i.e. making unsubstantiated or misleading claims regarding the sustainability benefits of an investment product.

In addition, even though many traditional (MSCI, Refinitiv, etc.) or specialized (RobecoSAM, Sustainalytics, etc.) ESG financial data providers have developed a specific offering to equip investors with up-to-date ESG data and ESG ratings, the quality and the comparability of available ESG information is still not sufficient across asset classes and markets, dissuading many investors from increasing their ESG exposure or from entering the market at all. As reflected in a recent study by BNP[5], approximately 66% of interviewed asset owners and asset managers quote data-related issues as the biggest barrier to a greater adoption of ESG across their portfolios.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Expected future developments in the EU market

To better regulate the market for sustainable investments and promote the goals set in the Paris Agreement, the EU has laid out an Action Plan[6] in 2018 to reorient capital flows towards sustainable investments. As part of this Action Plan, various regulatory interventions are expected, e.g.:

- A regulation on mandatory sustainability disclosures, requiring investment firms to disclose how they have considered sustainability issues and risks in their investment decision process and the impact of their investments on society

- A regulation introducing EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks and establishing a clear set of minimum requirements to be met by index administrators in order to be allowed to use those labels when marketing their indexes

- A new common taxonomy to label sustainable activities and investments

- New amendments to the MiFID II directive by ESMA, in particular in the areas of suitability requirements and product governance

According to current legislative planning, the entry into force of the above regulations will follow a scattered approach. Subject to exceptions, the benchmark regulation is expected to enter into force in 2020 and achieve full application in 2021 together with the disclosure regulation and new amendments to MiFID II. Regulation on taxonomy will instead likely be introduced in 2022, allowing more time for authorities to agree on what a “green” investment is and to find consensus on technical rules.

ESG investments: The implications for financial institutions

The rise of ESG factors in the global economy has inevitable implications on the European financial industry. While EU authorities are shaping the new ESG regulatory framework, financial institutions are already facing demands for more active ESG solutions by their stakeholders (institutional investors, rating agencies, clients), regardless of the expected introduction of new directives in the upcoming months.

How can financial institutions respond to such a call for action?

First, they should start to assess the implications that ESG factors may have on their business model and core operations in order to map and prioritize the key functions to be addressed (e.g. investment processes, product governance, risk controls, etc.) based on already publicly available regulatory guidelines and market trends.

Secondly, financial institutions should define a strategy and an ambition level for their transition to an “ESG-ready” organization. If all financial institutions will need to comply with new minimum regulatory requirements, certain players may choose to adapt their business and operations more aggressively, e.g. by adapting their product shelf to ESG solutions, integrating ESG factors into their investment processes, etc., in order to position themselves on the market as ESG pioneers and attract new clients or investors.

Lastly, institutions should develop an action plan with concreate measures and milestones to improve their ESG footprint, in line with the defined strategy and ambition level.

The rapid expansion of ESG consciousness among regulators, governments and the public is a phenomenon that can no longer be ignored by financial institutions. The time for action has come—institutions now have to decide which direction to take.

One response to “ESG investing: the rise of a new standard”

Pingback: ESG Treiber, Regulierungskritik und vieles mehr - Responsible Investment Research Blog