LCR: Take three

In addition to the requirement to report the LCR templates to supervisory authorities, the Commission decided to gradually introduce a mandatory minimum LCR, which had been continuously increased from 60% in 2015 to 100% as of 2018. The LCR requirements apply for all European banks independent of their size.

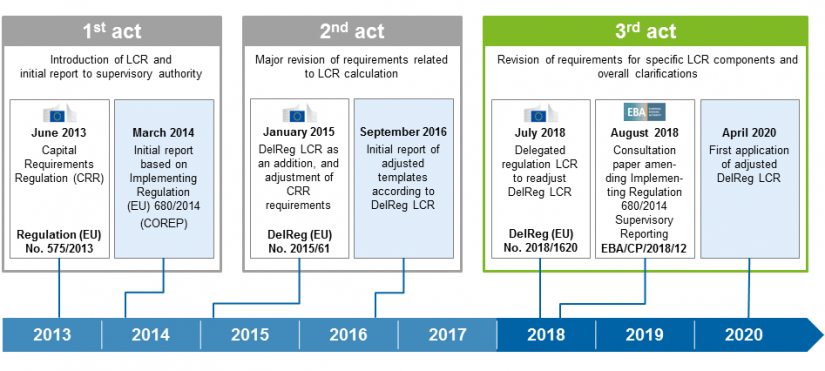

Although the original LCR according to CRR was already reported for the first time in March 2014 and completely revised with the DelReg LCR introduction (initial application) in September 2016 (cf. Article on LCR according to DelReg), the European Commission decided on the second adjustment of the LCR on July 13, 2018. According to the European Commission, the main objective of this initiative is to improve the alignment of liquidity requirements with international standards and to enable a more efficient liquidity management for financial institutions. The DelReg LCR amendment was based on DelReg (EU) 2018/1620, published on October 30, 2018 in the Official Journal of the European Union and came into force on November 19, 2018. The initial application of the amended DelReg LCR was set to April 30, 2020[1]. To illustrate the adjusted requirements for computing and reporting the LCR, the European Banking Authority (EBA) published a consultation paper amending the Implementing Regulation (EU) 680/2014 in August 2018. This contains the LCRs template specifications in accordance with the amended DelReg.[2]

DelReg LCR – impact depends on the institution’s complexity

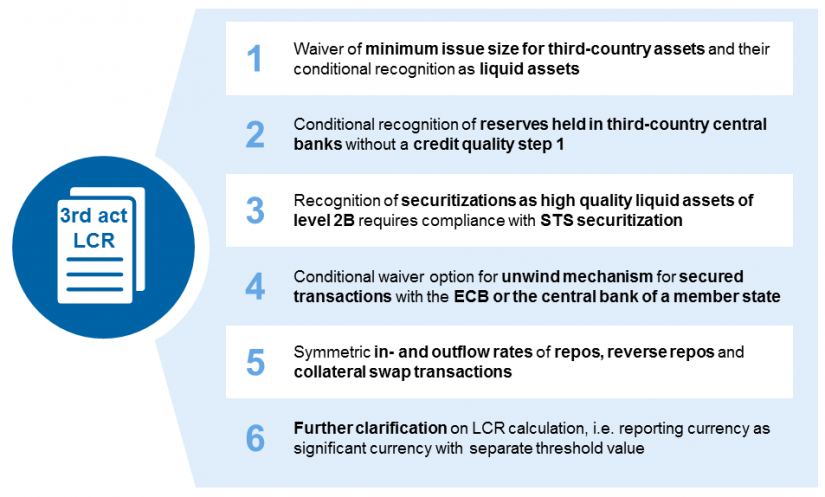

The DelReg amendments proposed by the European Banking Authority (EBA) and approved by the European Commission comprise six key topics, which are shown in Figure 2 and described in the following:

- Waiver of the minimum issue size for third-country assets and their conditional recognition as liquid assets up to the volume of stressed net liquidity outflows that are denominated in the same currency as the assets

- Reserves held in third-country central banks without a credit assessment of credit quality step 1 may, under certain circumstances, be treated as Level 1 liquid assets. The recognition is limited to the amount of stressed net liquidity outflows that are denominated in the same currency as the reserves

- Securitizations are only recognized as high quality liquid assets of Level 2B if they fulfill both the existing DelReg LCR requirements and those for simple, transparent and standardized (STS) securitizations according to the European Regulation 2017/2402

- Competent regulators have a waiver option to exclude secured transactions with the European Central Bank (ECB) or the central bank of a member state from the unwind mechanism if they have a maturity of 30 days or less and include a high quality liquid asset (HQLA) component. The exclusion is made on a case-by-case basis and under defined criteria. Collaterals received as a part of a derivatives transaction should no longer be generally considered in the unwind mechanism, irrespective of the explicit permission from regulators

- In- and outflow rates of repurchase agreements (repos), reverse repos and collateral swaps will be fully in line with the approach of the Basel Committee. In particular, cash outflows are no longer determined based on the liquidity value of the underlying collateral, but based on the prolongation rate of the transaction. This leads to a symmetrical use of the in- and outflow rates

- With the DelReg LCR amendment, the EBA and the European Commission also aim at codifying the clarifications already known from EBA Q&As as well as new clarifications. This applies to the following issues, in particular:

- Introduction of a separate reporting of transactions in the reporting currency as a significant currency

- Clarification that uncommitted collaterals deposited in a pool are eligible as HQLA dependent on their quality (e.g. GC Pooling)

- The market value of CIU shares as well as the calculated haircut have to be validated by an external auditor at least annually. Validation may be conducted by a fund provider or by the institution holding the CIU

- Amendment of the general clause to cover all outflows from all other liabilities and open commitments that are not further specified in the DelReg LCR and specification of the treatment of other open commitments towards non-financial clients. Other open commitments towards non-financial clients—if they exceed the inflows from non-financial clients calculated in accordance with Article 32 3(a) of the DelReg LCR—have to be recorded as outflows at 100% of the exceeding amount

- Inflows from securities with maturity within the next 30 calendar days are to be recorded at 100%

The amendments of the DelReg LCR will probably have a significant impact on international large-cap banks, whereas smaller institutions, which solely act on the European market and have a rather simple liquidity buffer structure, might only face minor adjustments.

No significant foreign currency reporting, however, separate reporting of transactions in the reporting currency possible

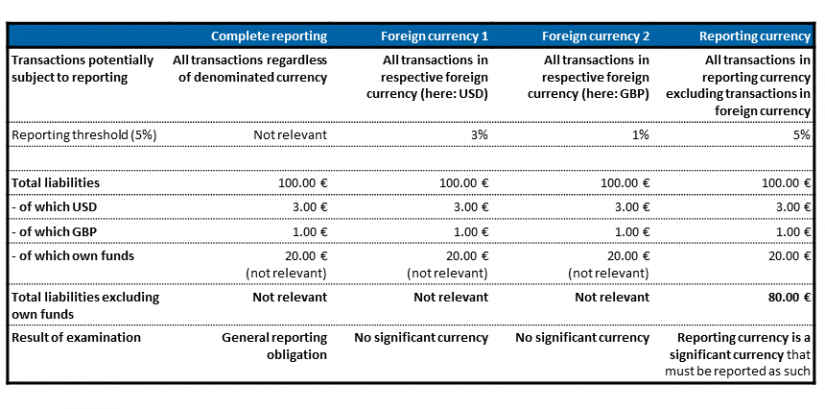

One of the most significant adjustments of the DelReg LCR is the introduction of a mandatory reporting of transactions using the reporting currency as a significant currency. This amendment applies if the liabilities in a currency other than the reporting currency equal or exceed 5% of total liabilities, excluding regulatory capital and off-balance-sheet items. The divergence in the thresholds for the reporting requirement of transactions in the reporting currency and for those in the foreign currencies appears ambiguous at first sight. Figure 3 demonstrates the differences in calculation:

While the institution is not required to separately report USD (3% of total liabilities) or GBP (1% of total liabilities), it is required to separately report transactions in the reporting currency, since USD and GBP in total represent 5% of total liabilities less regulatory capital[3].

However, the deviation in the calculation of the reporting threshold in significant currencies should be considered in the context of the CRR revision. The latest CRR II draft of May 20, 2018 specifies the new threshold calculation—total liabilities without consideration of regulatory capital and off-balance-sheet items—also for the correct application of the foreign currency reporting requirement and will thus ensure a harmonization of reporting thresholds once CRR II has been introduced. However, until the introduction of CRR II, an institution is not obliged to report significant foreign currencies, even if separate reporting of transactions in the reporting currency is requested.

Still no mandatory minimum quota for foreign currency LCR

Although the EBA clearly indicates in its report on liquidity ratios dated October 4, 2018 that many banks currently experience significant currency mismatches between liquid assets and net liquidity outflows and that this leads to increased risks in stress scenarios, the DelReg LCR amendment still does not introduce a foreign currency LCR. The institutions are still required to calculate and monitor LCR in significant currencies only.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Changes in reporting templates lead to noticable efforts for all institutions—significant changes in content only for large institutions

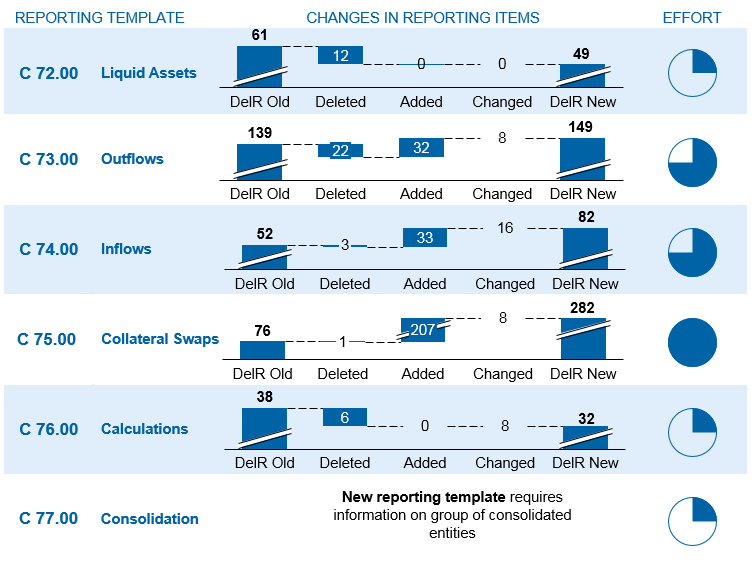

The EBA ITS draft amending Implementing Regulation (EU) No. 680/2014 contains new and amended templates resulting from the amended DelReg LCR. Figure 4 shows the changes in the individual templates and gives an indication of technical implementation efforts.

Figure 4: Overview of changes and indication of implementation efforts due to new LCR reporting templates

Figure 4: Overview of changes and indication of implementation efforts due to new LCR reporting templatesThe most significant amendments of each reporting template are briefly described below:

- C72.00 Liquid Assets

- Reduction of items that have to be reported in the memorandum items

- C73.00 Outflows

- Separate reporting of secured funding transactions for which collaterals fulfill operational requirements for liquid assets

- Additional recording of excess operational deposits and analog weighting to the non-operational deposits

- Extension of reporting requirements for memorandum items with information on certain secured funding transactions with central banks, as these may be waived from the application of the unwinding mechanism (waiver option)

- C 74.00 Inflows

- Separate reporting of secured funding transactions for which collaterals fulfill operational requirements for liquid assets

- Separate recording of secured funding transactions with central banks or other counterparties, to ensure an exemption from the application of the unwind mechanism

- Extension of reporting requirements for memorandum items with information on certain secured funding transactions with central banks, as these may be exempted from the application of the unwind mechanism (waiver option)

- C 75.00 Collateral Swaps

- Separate reporting of collateral swaps for which collaterals fulfill operational requirements for liquid assets

- Separate recording of collateral swaps with central banks or other counterparties, to ensure an exemption from the application of the unwind mechanism

- Extension of reporting requirements in the memorandum items, e.g. in order to ensure the application of the unwind mechanism

- C 76.00 Calculation

- Extensive template redesign

- Removal of the calculation of excess liquid assets in different HQLA categories, among others

- C 77.00 Consolidation

- Introduction of a new template which includes information on consolidated group units for calculating, supervising and reporting LCR

Challenges and recommendations for financial institutions

The EU Commission and the EBA have given the following reasons for amending the DelReg LCR: better alignment with international standards, a more efficient liquidity management by credit institutions, reduction of information asymmetries between supervision and banks and facilitation of cross-border supervision. In our view, the alignment with the BCBS international standards reduces the effort for internationally operating institutions, but it remains questionable whether this alignment enables a more efficient liquidity management.

In its comments on the first draft of the DelReg LCR amendment, the German Banking Industry Committee[4] welcomes in particular the symmetrical treatment of inflows and outflows in certain transactions. Nevertheless, the industry criticizes the increased complexity as well as the lacking clarification of various requirements and demands size-related exemptions, which are not taken into consideration in the current DelReg LCR revision. The German Banking Industry Committee requests the removal of exceptional circumstances for the waiver option with regard to the unwind mechanism in Article 17 (4) (b), as it fears a considerable discretionary power that might lead to the distortion of competition. In addition, the Committee proposes that STS securitizations with the highest credit rating and a minimum issue size of 250 million EUR should be treated as Level 2A assets.

Overall, we expect a rather minor impact on the LCR for the majority of financial institutions. However, the situation differs for international large-cap institutions with substantial exposures in third countries outside of the EU and with extensive activities in the field of secured funding and capital markets. This should lead to noticeable simplifications in terms of eligibility of third-county assets in central banks as well as the facilitation of secured funding and collateral swap transactions. Nonetheless, the implementation effort should not be underestimated. Automated technical solutions must be urgently adapted in view of the upcoming initial reporting in April 2020 to enable the assessment of individual effects and to allow for sufficient time for management operations. In this context, we also recommend to perform a fundamental gap analysis of existing implementations.